This article outlines why central bank policy statements nowadays are nothing but turning wrong pages of the monetary books relating to the present policy stance around the world and why the world needs new practical mandates-based policy books for central banks in the interest of the general public living in the digital civilization.

Background of present monetary policy stance – US, UK and EU

At the dawn of the new year, three major central banks, i.e., US Federal Reserve (Fed), the Bank of England (BoE) and the European Central Bank (ECB), decided in January 2024 to maintain their restrictive monetary policy stances at present levels. This comprises of keeping the policy interest rates unchanged and continuation of quantitative tightening (balance sheet reduction) as has been announced. Keeping policy interest rates unchanged has been the easy and favourite policy decision made in the past 4-6 months.

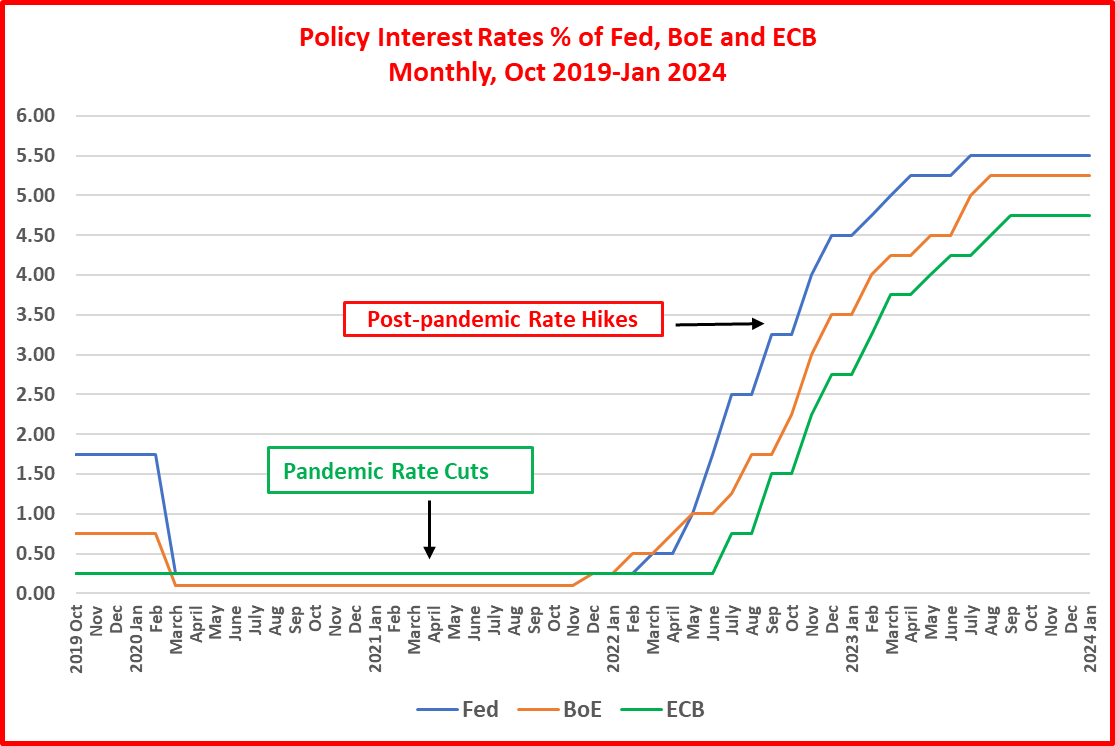

Accordingly, their policy interest rates at present are 5.25%-5.50% for the Fed, 5.25% for the BoE and 4.00%-4.75% for the ECB. This is the 4-6 months in the row of keeping policy rates unchanged. The present level is an increase of 5.25% for the Fed, 5.15 for the BoE and 4.5% for the ECB from their levels in December 2021, i.e., 0-0.25% for the Fed, 0.10% for the BOE and -0.50%-0.25% for the ECB (see the Chart below).

Their reference to the uninterrupted and competitive hikes in policy rates so far since the beginning of 2022 has been the control of inflation back at the long term target of 2% to maintain the price stability (see inflation Chart below).

During the past six months, inflation in these countries has been steadily falling from the peak towards 2% long term target. The latest inflation rates are 3.4% in the US (peak 9.1% in June 2022), 4% in the UK (peak 11.1% in Oct 2022) and 2.9% in the Euro Zone (peak 10.6% in Oct 2022). Therefore, markets are pricing significant policy rate cuts in 2024 and 2025 in line with fast falling inflation rates.

However, all three central banks state that,

- policy stance is sufficiently tight with policy rates at peak,

- although inflation has significantly fallen in the past six months, it has not fallen sustainably towards 2% and remains significantly elevated from the target and,

- therefore, the present restrictive policy stance needs to be kept until the confidence is fully achieved towards reduction in inflation sustainably at 2%.

Views expressed by the Fed Chairman Jerome Powell at the last press conference held on 31 January 2024 confirm above position. Three highlights are noted below.

- “Inflation has eased from its highs without a significant increase in unemployment. That is very good news. But inflation is still too high, ongoing progress in bringing it down is not assured, and the path forward is uncertain.”

- “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent. We will continue to make our decisions meeting by meeting.”

- We believe that our policy rate is likely at its peak for this tightening cycle and that, if the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year.

Accordingly, almost all central banks who follow a similar monetary policy model have tended to follow suit on same reasoning with slight changes in the language.

However, an insight into the recent monetary policy and macroeconomic environment across the globe shows that central banks operate in a global policy cartel are turning wrong pages of the policy book at this time too to justify the restrictive monetary policy stance being continued at presently levels.

Monetary policy books – Cover and inside pages

The policy book has a cover page and a large number of inside pages.

- The cover page for most central banks is designed to market its objective as the maintenance of price stability. The control of annual inflation at a pre-announced target, i.e., 2% in developed market economies (5% in Sri Lanka), is marketed as the price stability.

- The inside pages present how the monetary policy is implemented and its effects are felt on the wider economy to hang around the inflation target. Therefore, these pages present policy instruments and transmission of their impact towards the price stability/inflation target.

The spread of inside pages is so wide that central banks are able to link anything under the sun to the monetary policy and price stability. Therefore, the story of policy implementation and transmission is quite simple in theory.

- First, the policy instrument practiced by most central banks is the overnight interest rates set for their credit transactions through reserve balances of banks. Reserve balances are the conduit used for money printing and credit creation in the monetary system on a regular basis. Therefore, these overnight rates known as policy interest rates are set as policy targets for overnight interest rates on inter-bank lending that settles through bank reserve balances at central banks.

- Therefore, in a fractional reserve-based system of money creation by banks, policy interest rates and inter-bank interest rates are close substitutes. As such, the prime conduit for the transmission of the monetary policy towards the price stability is considered as the inter-bank interest rate.

- The demand side of the economy is considered as the intermediary of the transmission between the monetary policy and price stability as the policy assumes to affect prices in the economy through changes in the aggregate demand. This is expected primarily through changes in employment and wages in line with Phillip curve hypothesis. Therefore, it is the labour market that is primarily expected to assist the level of price stability preferred by central bank monetary policies. This is the reason why all central banks are generally against wage increases.

- The routes, speed and size of the policy transmission are conceptually set out in the most part of inside pages.

Global monetary cartel

Although central banks paint respective monetary policy stories towards domestic price stability and inflation control, their policy models, timing and languages emanate from a global cartel of central banks.

- First, except for the Euro zone, almost all countries have sovereign currencies and relevant monetary policies. Countries in the Euro zone have a common currency, Euro, and a common monetary policy implemented by the common central bank, ECB.

- Second, while countries have own sovereign currencies, they are highly dependent on hard currencies of few sovereign nations used to access the global economy. These hard currencies are known as reserve currencies. Nearly 83.7% of reserve currencies held by central banks in the world are US Dollar (US currency), Sterling Pounds (UK currency) and Euro. This means that the prime source of the creation of sovereign currencies is the holding of reserve currencies by respective central banks. Therefore, monetary policies of the US, UK and Euro zone together have direct implications on monetary policies of countries which hold reserve currencies. In this, the US monetary policy is a leading force as the US Dollar represents a dominant 59% of global reserves.

- Third, monetary policies operate in a global network combined with three blocks.

- The US monetary policy directly transmitting to countries that hold nearly 59% of reserve currencies in US Dollar.

- The US, UK and Euro monetary cluster that competes each other for maintaining interest rates differentials unaffected by respective monetary policy decisions. This cluster is augmented by other developed countries such as Canada, Australia and Switzerland who are in the periphery of the global reserve currency group.

- Developing countries that hold reserve currencies led by the US Dollar.

As the dominant reserve currency is the US Dollar, the global monetary policy network primarily centers at the US monetary policy actions.

- Fourth, the global conduit of policy transmission is the short-term international capital flows that depend on interest rate differentials between domestic currency and reserve currencies and sovereign risks.

- Fifth, a network of money dealers operates on betting of likely monetary policy path and decisions, i.e., policy interest rates across the world, and trading money for speculative profit by moving markets. They are not bothered on any stability theories other than maximization of speculative profit through insider techniques. For this purpose, they study and interpret policy statements to the letter and spirit to figure out the phase of the monetary policy actions and the size. In fact, they drive monetary policies too as central banks take market trends and developments as early guiding signals.

In this context, policy books of the developing countries are only monetary theory books with fictitious cover and inside pages because the monetary policies they practice are primarily aimed at foreign capital inflow at the edge of US interest rates to maintain foreign currency reserves for the management of the exchange rate stability and balance of payment. Therefore, their policy books with the price stability cover is only a public deception as monetary policy in these countries is nothing but day-to-day money printing to stabilize reserve balances and inter-bank lending operations. The policy transmission beyond is only an untested hypothesis, given the low development of financial system and markets.

Rate cut quandary at present

At the beginning of the rates hike cycle to fight rising inflationary pressures, the expectation of central banks was the resulting rise in unemployment and reduced wage income with significant economic slow-downs. This is usual policy transmission believed by monetarists in line with Phillip curve version of the relationship between inflation, unemployment and aggregate demand.

Therefore, central banks and markets have been in continuous talks on whether the present cycle of significant monetary tightening would result in soft landing or hard landing outcome with inflation down back to targets over time. The soft landing means getting inflation down with a moderate increase in unemployment without a recession. Hard landing means getting inflation down with a significant increase in unemployment with a recession.

Therefore, central banks and markets speculated various modes of landing depending on their beliefs and understanding of monetary policy transmission where nobody had any suspicion over the adverse impact of monetary tightening expected on employment and growth. In fact, most favored such adverse outcomes as compared to unfavoured impact of inflation on all people.

For example, the Fed Chairman Gerome Powell at the hearing of Senate Banking and Finance Committee held on 07 March 2023 responded that the envisaged loss of employment about 2 mn to a higher unemployment rate of 4.4% (compared to 3.4% at the time) consequent to the monetary tightening would be justified socially as, not 2 mn prople loosing employment, but all citizens would suffer from presently spreading high inflation. Therefore, some members of the Committee labeled the Fed Chairman as a cruel person. Further, at the monetary policy press conference held on 15 June 2022 he stated that unemployment risen to 4.5% to get the inflation back down to 2% would still be a strong and favorable outcome, given the historically low unemployment rate of 3.7% at that time.

However, economic growth, labour markets, employment and wage growth have become stronger without any signs of deterioration despite the significant monetary tightening during the past two years. Therefore, central banks believe that the prevailing conditions of strong economy are hidden signs of continuously underlying inflationary pressures that could be escalated if the monetary policies are prematurely relaxed with rate cuts. That is the reason why central banks around the world state that inflation has not fallen sustainably at longer term targets.

If so, the stronger economy despite the significant monetary tightening during the past two years is strong evidence for non-existence of the policy transmission at this time as elaborated in inside pages of the policy book. The stronger economy at present is a result of three main factors.

- First, monetary tightening commenced in the middle of reopening of economies from the pandemic. Therefore, the recovery of global supply chains at a gradual phase has expanded the production capacity and growth without any slow-downs caused by highly restrictive monetary conditions. This recovery helped a steady decline in unemployment and steady growth in wages.

- Second, new IT inspired and innovated by the pandemic response has improved the productivity across the world.

- Third, new labour force and employment structure based on work from home arrangement and new time management systems has helped stronger labor markets and productivity enhancement inducing economic growth with lower unemployment.

Therefore, monetary tightening at such a magnitude is seen a severe policy mistake as high inflationary pressures reported in the second half of 2021 was a result of the historic supply side contraction consequent to the pandemic disruption of global supply chains.

Therefore, global inflationary pressures have been a transitory phenomenon which did not require such a magnitude of monetary tightening across the globe. However, although central banks initially believed this transitory version of inflation, later they happened to give up it and believe inflationary pressures of permanent nature influenced by old monetarists.

It now shows that inflation has started falling on the consumer price index base effect as supply chains and employment have been recovering gradually with the ease of pandemic restrictions. The delayed reopening of China from the pandemic also kept inflationary pressures elevated as China was a major exporter of low prices and low inflation in the world.

Therefore, it is clear that the monetary tightening that has been contagious across the globe at an unexpected rate and speed during the past two years is a macroeconomically flawed decision of central banks. Such flawed decisions are ample in the global monetary history. The best instance is the rapid monetary tightening by the Fed during 2018-19 period causing an unwarranted wave of global tightening and economic slow-downs. The present Fed Chairman accepted it as a policy mistake and promised not to repeat it this time. However, the fact that consequences of such policy mistakes to living standards around the world are not rectifiable and reimbursable is a serious policy governance issue at the global front.

Consequences of present global wave of monetary tightening

It is not disputed of the appropriateness of the ultra loose monetary policies implemented by central banks to deal with macroeconomic uncertainties of the global pandemic in 2020 and 2021. It is observed that economists and policymakers never had any idea of macroeconomic implications of the pandemics and policies required to deal with them.

Therefore, the only option available to governments in the pandemic was to spend for the welfare of the public, households and businesses. This was immensely aided by new money created by central banks (i.e., Fed balance sheet increased by nearly 110%) at interest rates close to zero mostly similar to what they did during the global financial crisis 2007/09. Therefore, central banks interpreted the monetary relaxation at this time as the policy stance taken to prevent disturbances to financial stability. Therefore, no monetarists raised concerns over possible inflationary pressures of such spending through money creation, given the need to help come out of the humanitarian crisis caused by the pandemic at all costs.

However, the prematurely tightening of monetary policies before getting the supply side resettled sent shock waves across the countries and global economy. These are the policy created shocks that are not second to lockdown policies followed by governments in respect of the pandemic. Some of these shocks are listed below.

- The increase in the cost of production via high interest rates adding to permanent pressures on inflation.

- The public debt service difficulties due to high interest rates and emergence of debt unsustainability concepts.

- Wide-spread bankruptcies of businesses and households due to high interest rates, debt rollovers and debt service difficulties.

- Bankruptcies of less developed countries due to high global interest rates, disrupted access to foreign capital for the rollover of debt, resulting currency crises and debt default. Sri Lanka, Zambia, Ghana and Ethiopia are the frontline defaulters of this global wave while many countries such as Pakistan struggle in the periphery of the default path.

- New round of global poverty across the world.

However, central banks continue to turn pages of their policy books to support the continuation of restrictive monetary policies despite these consequences.

The IMF also supports such restrictive stances of the old monetarists. According to recent media reports (02 February 2024), the IMF Managing Director has stated that “the IMF sees a greater risk to the global economy if central banks start cutting interest rates too soon than if they move “slightly” too late.” Further, its first Deputy Managing Director stated at the World Economic Forum 2023 that markets cutting interest rates in expectation of near-term policy rates cuts would be a risk to the control of inflationary pressures by monetary policies. Therefore, the IMF also is a shadow player behind policy books of central banks to endanger the growth of the world economy.

In contrast, some Fed officials commented towards the end of last year that further policy rates hikes would not be necessary to bring inflation back down to 2% target if markets adjusted interest rates upward. Market analysts commented on this as an official attempt to outsource the Fed’s job to markets.

Therefore, price stability focused policy books of central banks are highly controversial texts that even frontline economists would not be able to establish their benefits to the people and human development of the present world.

Sri Lankan monetary tightening page- A dump outlier

Sri Lankan economy confronted a full scale of crisis on all fronts, public debt, foreign currency, disruption and contraction of supply chains and bank credit crunch. While this was originated by the pandemic, it continued with the political crisis leading to significant uncertainties and hyper inflationary pressures.

However, the central bank interpreted hyper inflationary pressures as a direct result of money printing during the pandemic. Therefore, it followed a hyper monetary tightening through policy rates increased by 10.5% to 16.5% pushing yield rates of auctions of government securities from 7%-8% to historic highs of 30%-33% (see Chart below). In addition, government foreign debt was deflated with a total debt (domestic and foreign) restructuring proposal as a part of the monetary solution to the country’s economic crisis. Therefore, the whole economy was devastated causing long-term structural problems to the economy and living standards. Despite the ambitious monetary policy pages frequently turned by the central bank, more than two years have elapsed without any sign of sustainable recovery of the economy and living standards.

The monetary tightening commenced in April 2022 to forestall inflation rising towards 30%. However, inflation peaked at 69.8% in September 2022 unexpectedly due to market uncertainties created by the political crisis and debt default-based monetary tightening. Therefore, with thee political crisis eased gradually, inflation started falling fast to 35.5% in April 2023 which further fell to 1.3% in September 2023. Therefore, the central bank commenced policy rates cutting cycle in May 2023 when the reported inflation was 35.5% in April compared to the official inflation target of 5% where the index base effect was dominant on reduced price pressures due to the fast recovery of civil society and markets from the political crisis.

This shows that the pages of the policy book turned by the central bank was completely wrong for hyper monetary tightening as hyper inflationary pressures were transient effects of the political crisis cum pandemic. If inflationary pressures of this magnitude exist in the country due to money-driven demand, it would take many years to get it down back to the pre-pandemic levels. Therefore, consequences of the monetary policy mistake at this time will last for at least a decade before commencing a path of recovery.

No trust in the policy model

Policy interest rates-based monetary policy models presently followed by central banks have fundamental design problems that cast doubt on their stated role in public interest.

- First, reserve balances and inter-bank lending constitute a negligible quantum of the monetary and financial system. For example, total reserves, i.e., the sum of reserve balances and fiat currencies, are mostly 2%-6% of bank money/credit created in countries. Therefore, changes in policy interest rates cannot have such a wide transmission across the economy where credit creation is largely determined by other risk factors.

- Second, the policy transmission depends on interest sensitivity of economic activities. However, other than theoretical interpretations, central banks have no idea of the connection between interest sensitivity and price stability. Therefore, inflation analysis used by central banks is nothing but identification of relative price movements of the commodity basket in the consumer price index underlying the inflation calculation. However, inflation in the monetary policy theory is a macroeconomic phenomenon connected with excess demand fueled by the high monetary expansion in the economy. Therefore, it is frustrating that central banks do not have analytical tools to asses the policy effectiveness on the inflation control and price stability other than standalone, micro commodity analysis.

- Third, many developing countries such as Sri Lanka do not have financial markets and inclusion that can pass effects of policy interest rates and reserve balances across businesses and households throughout the country to affect the demand side of the economy and prices in general. Therefore, turning policy pages in these countries similar to what the Fed does in the US economy with highly developed markets has no practical relevance. Therefore, monetary policy in these countries in the present model is only another bureaucracy. The best example is the super tight monetary policy implemented by Sri Lankan authorities in 2022 and 2023 pushing yields of government securities to 30% aimed at inflation control despite the collapsing economy due to the pandemic plus political crisis of the history. It is surprising how the central bank commenced cutting policy rates in May 2023 at the time of inflation reported around 30%.

- Fourth, in modern economies operating on money, disparities in wealth and income are directly connected with the disparity in the distribution of credit and financial services across the economic sectors and market participants where the central banks are the core of the distribution system. However, central banks resort to trickle down effects of inter-bank market and reserve balances across all segments of production, utilization and wealth creation. Therefore, present monetary policies do not have a role in a socially fair process of human development in the present generation as they are only wholesale money printing businesses at arbitrary rates.

- Fifth, the step-wise manner in which policy rates are changed and other instruments are added in cycles of several years indicates that central banks themselves are not aware of the real policy transmission. For example, present policy rates cycle is nearly 25 months long and no central bank is aware of when it ends or dials back. One page of the policy book is about the tightening cycle of few years followed by a relaxing cycle of several years. To hide their unawareness of the policy adequacy and transmission, they say that the policy is highly data dependent and they wait for more data to move gradually on a meeting-by-meeting approach. The state money-based monetary policy is now about 100 years old in the world while central banks are still unaware of its capacity and effectiveness in respective countries other than what is predicted in the tribal monetary theory.

Need for a new monetary book

- Present monetary policy book has been designed on the relationship between money, production and prices in tribal currency societies. Therefore, the book predicts the increase in general prices or inflation as the direct result of the increase in the money stock where the demand side and supply side of the economy are separated with significant time lags. Therefore, central banks are given the mandate to control inflation or preserve the price stability through regulating the money stock. This is the core of the policy book.

- However, this is a meaningless hypothesis in modern monetary economies with the majority of money being digital money created by private banks in their books whereas the demand side and supply side are integrated by digital money and markets without long lags. Therefore, the old monetary book is outdated in the modern macroeconomic environment. Accordingly, the price stability-based monetary policy book is only an old faith which has no role in modern digital monetary economies.

- Therefore, mandates given by statues to central banks to preserve the stability of prices and economies and maximize employment and real incomes are unachievable, theoretical stuffs. That is why such stable economies are not found in the world despite long aged central banks. Therefore, the public never can trust monetary books of central banks. For example, the mandate of the Fed is the price stability, maximum employment and moderate long-term interest rates. However, the Fed always turns the pages for price stability with 2% inflation measured from personal consumption expenditure and has no idea of other two duties. All three duties in the mandate are highly theoretical macroeconomic concepts that can be interpreted in many alternative ways. For example, the Fed states that 2% inflation balances the price stability and maximum employment.

- As the price stability is central bank mandate, whenever prices tend to change substantially in economies, central banks tend to change policy interest rates and monetary conditions as set out in their policy books, irrespective of specific factors behind such price changes whether they are demand side or supply side or external shocks. What they state is that the price stability is their mandate with interest rate as the policy instrument available to discharge the mandate.

- For example, At a recent US Senate hearing, when a Senator queried the rationale of monetary tightening at the time of supply-side driven inflationary pressures at present, the Fed Chairman responded that the price stability was the mandate given by the Congress to the Fed with the interest rate as the policy instrument and, therefore, the Fed had no option but to raise interest rates to comply with its mandate. Parallelly, governments also finger at independent central banks for any inflationary pressures to wash their hands from inflationary concerns while central banks blame governments for fiscal deficit as the bottleneck that prevents them from preserving the price stability. Therefore, the world does not need economic theories to prove the irrationally of price stability mandates given to central banks.

- However, the monetary policy is blessed with a wide array of instruments that can be suitably mixed up to deal with both demand side and supply side in coordination with government fiscal and other social policies depending on development needs and priorities of the countries. Therefore, the present monetary policy books suffer from fundamental design problems as they are based on a single instrument of overnight inter-bank interest rates and resulting market mechanism. This is due to the lack of knowledge on modern macroeconomic management subject. Therefore, governments must resolve this monetary design problem without delay if they are interested in further human development in modern economies.

- If the policy resolution is difficult, the alternative is to find practical mandates. The primary nature of operations of present central banks shows that they only can stabilize the credit and banking system through a regular system of printing and lending of reserves to banks to support the general public trust in the state monetary system. This is the monetary book actually practiced by central banks in real world although they often turn pages of price stability covered books to show the public that they undertake money printing while preserving the price stability despite the fact that no country in the world enjoys the price stability. However, pages of books are turned like those of monetary theology.

- Therefore, it is duty of lawmakers to ensure that central banks are entrusted with realistic mandates if they are really interested in a new round of human development in modern digital civilization. Otherwise, state trust-based money and central banking will be extinct in few decades to come as they continue to operate bureaucratically on the tribal faith of sovereign currency systems.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures. All are personal views of the author based on his research in the subject of Economics.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 12 Economics and Banking Books and a large number of articles published.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

Source: Economy Forward