December 14, Colombo (LNW): A few showers may occur in Northern, North-Central, Eastern, Uva and Central provinces, the Department of Meteorology said in its daily weather forecast today (14).

Showers or thundershowers may occur at several places in the other areas of the island after 1.00 p.m.

Fairly strong winds of about (30-40) kmph can be expected at times over Eastern slopes of the central hills, Northern, North-central and North-western provinces and in Trincomalee, Hambantota and Monaragala districts.

Misty conditions can be expected at some places in Sabaragamuwa, Central provinces and in Galle and Matara districts during the early hours of the morning.

The general public is kindly requested to take adequate precautions to minimise damages caused by temporary localised strong winds and lightning during thundershowers.

Marine Weather:

Condition of Rain:

Showers will occur at several places in the sea areas off the coast extending from Puttalam to Pottuvil via Mannar, Kankasanthurai and Trincomalee. Showers or thundershowers may occur at a few places in the other sea areas around the island during the evening or night.

Winds:

Winds will be north-easterly. Wind speed will be (30-40) kmph. Wind speed can increase up to (50-55) kmph at times in the sea areas off the coast extending from Colombo to Trincomalee via Puttalam and Kankasanthurai and from Hambantota to Pottuvil.

State of Sea:

The sea areas off the coast extending from Colombo to Trincomalee via Puttalam and Kankasanthurai and from Hambantota to Pottuvil will be rough at times. The other sea areas around the island will be moderate.

Temporarily strong gusty winds and very rough seas can be expected during thundershowers.

Showery conditions to continue further: Strong winds expected (Dec 14)

Valuing the Coast: Test of Sri Lanka’s Conservation Resolve

By: Staff Writer

Sri Lanka has taken a symbolic yet potentially transformative step toward strengthening coastal and marine conservation with Cabinet approval for a new Global Environment Facility (GEF)–funded initiative that seeks to quantify the economic value of the country’s natural marine assets.

The four-year project, backed by a US$ 2.66 million grant, aims to integrate the natural capital value of coastal and marine ecosystems into national development planning in an area long neglected despite Sri Lanka’s island geography and climate vulnerability.

The project, titled “Integration of the Natural Capital Value of the Coastal and Marine Ecosystems in Sri Lanka with the Sustainable Development Plans,” will be implemented in selected coastal districts including Galle, Mannar, Puttalam and Trincomalee. It has been jointly designed by the Ministry of Environment and the International Union for Conservation of Nature (IUCN), with Cabinet also approving the signing of a formal implementation agreement between the two parties.

At its core, the initiative seeks to address a critical policy gap. While many countries now assign measurable economic values to ecosystems such as mangroves, coral reefs, lagoons and seagrass beds, Sri Lanka has largely relied on qualitative assessments.

As Cabinet Spokesman and Minister Dr. Nalinda Jayatissa acknowledged, this has limited the ability of policymakers to fully factor environmental costs and benefits into infrastructure, tourism, fisheries and urban development decisions.

The current Government, now completing roughly one year in office, has repeatedly pledged to place environmental sustainability at the centre of economic recovery.

This project reflects a growing recognition that conservation is not merely an ecological concern but a fiscal and developmental one. Healthy coastal ecosystems reduce disaster risks, support fisheries-based livelihoods, protect shorelines from erosion and contribute significantly to tourism revenues benefits that often remain invisible in traditional budgeting processes.

However, the initiative also highlights the Government’s capacity constraints. The reliance on donor funding and international technical partners underscores the limited domestic institutional ability to conduct large-scale natural capital accounting independently.

Over the past year, progress on broader coastal protection measures such as controlling illegal sand mining, unregulated coastal construction and marine pollution has been uneven, constrained by weak enforcement and overlapping institutional mandates.

Climate change has further raised the stakes. Rising sea levels, coral bleaching and intensified coastal flooding are already affecting vulnerable districts, making the integration of ecosystem values into development planning increasingly urgent.

If implemented effectively, the project could strengthen climate resilience and guide smarter investments that balance growth with long-term ecological security.

Ultimately, the success of this initiative will depend on whether its findings translate into binding policy decisions rather than remaining as technical reports. For a Government under pressure to deliver tangible outcomes within a limited political timeframe, the project represents both an opportunity and a test of its commitment to safeguarding Sri Lanka’s coastal and marine heritage

From Tragedy to Technology: Sri Lanka Turns to GeoAI

By: Staff Writer

December 13, Colombo (LNW): The launch of Sri Lanka’s GeoAI for Disaster Resilience initiative reflects a growing recognition that climate-driven disasters require smarter, faster and more coordinated responses. Unveiled weeks after Cyclone Ditwah left a trail of destruction across the island, the programme represents a strategic pivot toward data-driven disaster preparedness.

Cyclone Ditwah, which displaced communities, damaged infrastructure and slowed economic recovery, exposed long-standing weaknesses in forecasting, coordination and emergency response. Against this backdrop, the new GeoAI initiative seeks to harness Artificial Intelligence and spatial data to bridge these gaps.

Speaking at the launch, project leaders emphasised that technology alone cannot prevent disasters, but it can dramatically reduce their human and economic costs. GeoAI Project Lead Dr. Novil Wijesekara said the goal is to embed intelligence into every stage of disaster management from early warning and evacuation planning to post-disaster recovery.

The programme’s design places strong emphasis on capacity-building. More than 125 university students will receive advanced training in GIS-based hazard mapping, predictive analytics and drone data interpretation. Officials say empowering young people with these skills is essential for building long-term national resilience.

University of Colombo Vice Chancellor Prof. Indika Mahesh Karunathilaka highlighted the role of youth in rebuilding the country after recent disasters. He said young Sri Lankans are already carrying much of the burden of recovery and that equipping them with advanced technological skills will strengthen national preparedness.

International cooperation is also central to the initiative. US Embassy Deputy Chief of Mission Jayne A. Howell reaffirmed Washington’s support, describing the programme as an investment in Sri Lanka’s safer future. She noted that improved early-warning systems and coordinated emergency responses benefit not only communities but also long-term development.

Government officials believe GeoAI can transform how institutions work together during crises. Digital Economy Ministry representatives stressed that integrated data platforms will improve coordination and speed up decisions when minutes can mean the difference between safety and tragedy.

As climate events intensify across South Asia, Sri Lanka’s move toward AI-powered disaster management signals a broader shift from responding after disasters strike to preparing intelligently before they do.

Outward Vision Meets Government’s Inward Politics in Sri Lanka

By: Staff Writer

December 13, Colombo (LNW): A year into the new administration, Sri Lanka’s economic trajectory reveals a widening gap between outward ambition and inward political practice. The IFC’s call for globally integrated, export-led growth has exposed uncomfortable truths about governance that remains cautious, defensive and overly focused on the past.

While macroeconomic stability has improved, the reform momentum expected by investors and businesses has failed to materialise. Policy signals remain mixed, regulatory changes unpredictable and decision-making heavily centralised. Ministers, instead of articulating a clear forward strategy, have leaned on a familiar narrative of inherited crises and external shocks an approach increasingly dismissed by the private sector as an excuse for underperformance.

IFC Regional Director Imad Fakhoury’s remarks underscored that Sri Lanka’s challenge is not a lack of opportunity but a failure of mindset. He argued that the country must rebrand itself as a green, sustainable and outward-looking economy, capable of attracting long-term investment and competing globally. This vision contrasts sharply with inward-looking tendencies that continue to shape policymaking, from hesitant trade reforms to administrative controls that stifle enterprise.

Sri Lanka’s ambition to expand exports, develop high-value tourism, scale digital services and modernise agribusiness depends on confidence and consistency—qualities investors say are missing. Even public-private partnerships, frequently promoted as essential given fiscal constraints, have progressed slowly due to bureaucratic caution and political risk aversion.

The IFC, which has invested heavily in renewable energy, logistics, agribusiness and financial inclusion, remains “bullish” on Sri Lanka’s potential. Yet this optimism is conditional. Fakhoury emphasised that policy predictability and a credible investment climate are non-negotiable if Sri Lanka hopes to convert opportunity into sustained growth.

The deeper concern highlighted by the IFC’s warning is leadership attitude. An inward gaze, coupled with an air of arrogance, has limited honest self-assessment within government. Instead of acknowledging policy failures and course-correcting, leaders have chosen to look backward.

Sri Lanka’s history shows that recovery without reform is temporary. The choice before policymakers is stark: embrace an outward-looking reset or risk turning a fragile recovery into another lost decade.

Microfinance Fallout: Rural Families battered in Ditwah Caught in Debt Cycles

By: Staff Writer

December 13, Colombo (LNW): As Sri Lanka prepares to enact the Microfinance and Credit Regulatory Authority Act 2025, an escalating crisis among vulnerable communities highlights the gravity of unregulated lending’s human toll.

In massive a scale of exposure in the aftermath of Ditwah cyclone, 2.3 million people, including 522,000 children and 263,000 older persons, were affected by floods and landslides

Microfinance loans small in size but far reaching in impact have become both a tool of survival and a gateway to indebtedness for impoverished households across the island.

The new Act, expected to replace the outdated 2016 framework, will formalise licensing and extend oversight to all moneylenders and microfinance providers.

However, the hard realities on the ground reveal why reform has become urgent. Informal and semi-formal lenders operate outside formal supervision, with no reliable data on borrower outcomes.

Parliamentary sub-committees are now gathering information in areas such as Batticaloa, Polonnaruwa and Nuwara Eliya to assess how many borrowers have defaulted and are facing financial distress.

For many rural families, microfinance debt is not financing business growth but meeting basic survival needs. Dubbed “loan traps” by activists, these cycles of borrowing to cover food, healthcare or school fees often push households deeper into poverty.

Women estimated to represent a large majority of microfinance borrowers face disproportionate stress, loss of assets, and in some tragic cases, consequences as severe as contemplated suicide due to intense collection pressure.

Advocates say unregulated interest rates and coercive recovery practices have eroded the dignity and stability of farming families and informal workers.

The effort to secure affordable credit becomes a destructive pursuit when repayments consume a disproportionate share of meagre incomes. Community leaders report that traditional safety networks have frayed under financial strain, forcing many to take multiple simultaneous loans, a known precursor to over-indebtedness.

Lenders, meanwhile, contend they face risks too: unclear legal frameworks limit their ability to assess risk consistently and maintain sustainable portfolios.

Without a credible risk assessment ecosystem, both borrowers and lenders operate in uncertainty, exacerbating financial system fragility. Formal data points on non-performing microloans remain elusive, but anecdotal evidence suggests defaults are rising in poorer districts.

Economists argue that a balance is needed stronger consumer protections combined with financial literacy and alternative income-boosting initiatives for low-income borrowers.

As Sri Lanka’s wider economy continues its uneven recovery from recent crises, policymakers are under pressure to implement measures that protect borrowers while strengthening lender governance. The new regulatory authority could be a turning point if it successfully addresses the structural drivers of microfinance distress, not just the symptoms.

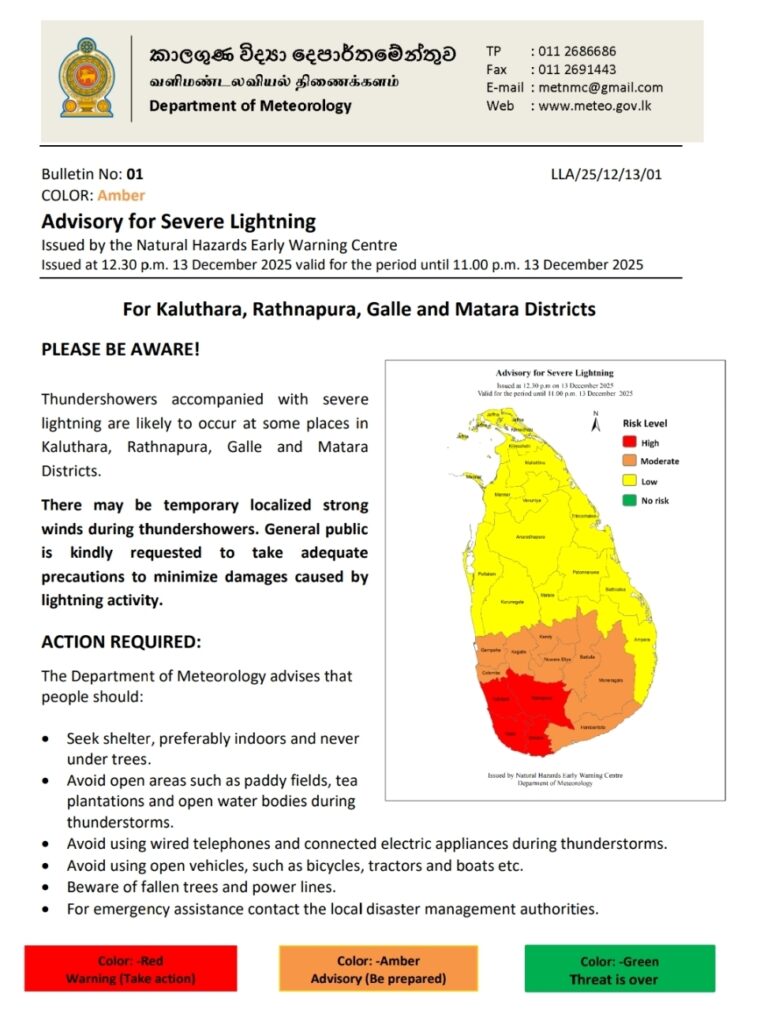

Severe lightning expected in four districts: Met Dept

December 13, Colombo (LNW): Thundershowers accompanied with severe lightning are likely to occur at some places in Kalutara, Ratnapura, Galle and Matara Districts, the Natural Hazards Early Warning Centre of the Department of Meteorology said in a warning statement.

There may be temporary localised strong winds during thundershowers.

The general public is kindly urged to take adequate precautions to minimise damages caused by lightning activity.

Many Sri Lankan Reservoirs Begin Spilling Amid Ongoing Rainfall

December 13, Colombo (LNW): The Irrigation Department has confirmed that a significant number of the country’s reservoirs are currently spilling, reflecting continued rainfall in several regions.

H.M.P.S.D. Herath, Director of Irrigation (Water Management), reported that 36 major reservoirs and more than 46 medium-sized tanks are releasing water.

In the Ampara District, three of the nine principal reservoirs have begun spilling, while all main reservoirs in Anuradhapura are at capacity. Meanwhile, three of seven in Badulla and three of four in Batticaloa are also releasing water.

Spill gates have additionally been opened at selected reservoirs in other districts: four out of ten in Hambantota, two of three in Kandy, four of ten in Kurunegala, and one of three in Monaragala. In the North and East, two of four in Polonnaruwa, three of five in Trincomalee, and one of four in Mannar are overflowing.

Herath noted that the current volume of water being released is relatively small, and the extent to which spill gates remain open will depend on forthcoming rainfall. He urged residents living downstream to stay alert and follow official updates regarding water discharges.

Importantly, the Director reassured the public that, despite the spilling, there is no immediate threat of flooding or a sudden rise in water levels in downstream areas. Authorities continue to monitor the situation closely to ensure community safety.

Almas Holdings Commits Rs. 225 Million to Flood Relief and Reconstruction

December 13, Colombo (LNW): Almas Holdings Pvt Ltd has announced a donation of Rs. 225 million to aid recovery efforts in the wake of Cyclone Ditwah, with a significant portion earmarked for the government’s ‘Rebuilding Sri Lanka’ President’s Fund.

The long-established investment and real estate group confirmed that the contribution would be made via its subsidiary, Almas Equities Pvt Ltd, a licensed stockbroking firm regulated by the Securities and Exchange Commission and the Colombo Stock Exchange.

On Friday, Chairman Imtiaz Buhardeen personally handed over a cheque for Rs. 100 million to President’s Secretary Dr. Nandika Sanath Kumanayake at the Presidential Secretariat. He also pledged an additional Rs. 125 million specifically to support recovery and rebuilding initiatives in the flood-hit Kandy District.

Buhardeen emphasised that Almas Holdings is committed to helping communities affected by the floods, focusing both on immediate relief and long-term rehabilitation. “We aim to provide support where it is most urgently needed and contribute to sustainable recovery,” he said.

The handover ceremony was attended by senior executives of Almas Equities and Almas Holdings, including Managing Director Shameer Buhardeen, Directors Risvi Abdul Majeed and Ruzly Shamsudeen, CEO Ifadh Marikar, and Strategic Development Consultant Thakshila Hulangamuwa.

The government-established ‘Rebuilding Sri Lanka’ Fund serves as a central mechanism to channel financial assistance for relief, rehabilitation, and reconstruction projects following natural disasters, ensuring swift and coordinated support for affected communities.

Sri Lanka Launches Groundbreaking Early Dengue Response Programme

December 13, Colombo (LNW): Dr Kapila Kannangara, Director of the National Dengue Control Unit, has urged both citizens and authorities to adopt a more proactive mindset in tackling dengue, emphasising that environmental cleanliness is a shared responsibility.

“The environment itself acts as a breeding ground for mosquitoes, so maintaining it properly is critical. Cleanliness is not just a duty of the authorities—it is the community’s responsibility too,” he explained, addressing the unveiling of the world’s first Simplified Early Action Protocol (SEAP) for dengue prevention.

Dr Kannangara also noted shortcomings in local government efforts, citing factors such as competing priorities, lack of awareness, and a tendency to underestimate the risk. “Prevention must continue alongside other recovery or relief efforts. Dengue does not wait for people to catch up,” he warned.

The SEAP initiative represents a significant move from reactive responses to anticipatory public health action. Scheduled to operate over the next two years, until June 2027, the project will initially focus on high-risk districts including Colombo, Gampaha, Kalutara, Jaffna, and Kandy.

With monsoon rains and recent events such as Cyclone Ditwah creating ideal conditions for mosquito proliferation, dengue remains a major public health concern in Sri Lanka, placing considerable strain on hospitals and medical services. By enabling early interventions, SEAP aims to reduce community vulnerability, prevent outbreaks, and save lives before case numbers escalate.

Dr Kannangara issued a stark reminder of the risks posed by delayed action: “When people are exhausted or distracted, their immunity drops. A standard dengue infection can escalate to a severe form, which can be fatal. Continuous prevention efforts are essential to avoid turning dengue into another disaster.”

This launch signals a major step forward in Sri Lanka’s fight against dengue, combining innovative strategy with community engagement to protect public health.

Public Servants to Receive One-Off Advance Allowance

December 13, Colombo (LNW): The Government has approved a temporary financial facility for public sector employees, granting them access to a special advance allowance aimed at easing short-term monetary pressures.

A circular issued by the Secretary to the Ministry of Public Administration, Aloka Bandara, confirms that eligible officers may obtain an advance of up to Rs. 4,000. The measure is intended as a limited support mechanism rather than a permanent entitlement.

However, the directive makes it clear that the benefit will not be extended to officials who have failed to meet repayment obligations on earlier special advances or designated bank loans. Only those with a satisfactory repayment record will qualify.

The advance may be drawn during the period from January 01 to February 28, 2026. Recovery of the amount will be carried out over ten equal monthly instalments, with interest applied at an annual rate of eight per cent.