By: Staff Writer

January 01, Colombo (LNW): Sri Lanka will reduce the threshold to change a cascading Social Security Contribution Levy from 120 million to rupees 60 million, a government statement said.

The draft bill to amend the Social Security Contribution Levy Act No.25 of 2022 was approved by Cabinet of ministers recently.

The Cabinet also approved to amend the Value Added Tax Act No. 14 of 2002, reducing the threshold to charge the tax from 60 million rupees from 80 million rupees of revenues per year.

Both actions will widen the businesses from which the tax is charged.From January 1, 2024, value added tax is to be raised from 15 percent to 18 percent. A comprehensive list of exemptions has not been made public yet.

However, certain individuals are circulating misconceptions about this measure. There are claims that life will become challenging from 1 January, and families will face substantial expenses due to the tax revision.

It is important to clarify that while there will be some additional expenses resulting from the tax reform, they may not be as significant as some are suggesting.

Additionally, the Government is actively taking measures to alleviate the burden on the public by eliminating other taxes imposed on goods and services subject to VAT and making appropriate tax adjustments.

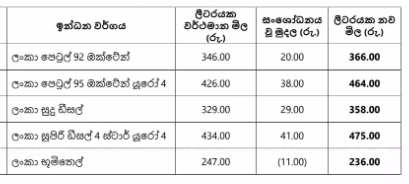

For instance, currently, port and airport taxes are levied on specific imported goods. To mitigate the impact of the VAT increase, positive measures are being implemented, including the removal of port and airport taxes on these goods, with only VAT being maintained.

Ministry of Finance, Tax Policy Adviser Thanuja Perera said that the Government is diligently addressing the impact of the Value Added Tax (VAT) revision. This involves the elimination of additional taxes on goods and services under VAT and implementing necessary tax adjustments.

It was highlighted that even individuals with expertise in economics are circulating a misconception, suggesting that family monthly expenses will increase by an additional Rs. 40,000 post the VAT implementation on 1 January.

Moreover, it was emphasised that nearly 90 types of items, including educational services, electricity, health, medicine, passenger transportation, as well as all vegetables and fruits, are exempt from VAT. Additionally, VAT does not apply to 65 types of items subject to the Special Commodity Levy.

Perera said the VAT was initially introduced in Sri Lanka through Act No. 14 of 2002, marking two decades since its inception. Originally set at two rates, it was later revised to three rates.

The VAT rate underwent various changes and was reduced to 8% in 2019, resulting in a significant decline in State income. Subsequently, it was raised to 15%.

The VAT Amendment Act, presented to Parliament last month, further increases the VAT rate from 15% to 18%, effective 1 January 2024. It is challenging for us to continue relying on concessions.

It must be emphasised that this tax amendment has been implemented to address the crucial matter of increasing State income.

Several vital tax reforms have been implemented in the past, including adjustments to the VAT registration limit. From 2019, the limit stood at Rs. 15 million, increased to Rs. 300 million on 1 January 2020, rendering many VAT-registered files inactive.

However, the limit was later reduced to Rs. 80 million and, as per the recent amendment, lowered to Rs. 60 million from 1 January 2024.

Additionally, the new amendment eliminates numerous tax exemptions, aiming to recover substantial revenue lost by the Government.