By: Staff Writer

October 04, Colombo (LNW): The Colombo Lotus Tower Management Company (CLTMC) has reported a 31% surge in revenue within a year since the new management team took charge, marking a major turnaround for one of Sri Lanka’s landmark attractions.

Speaking at a media briefing, CLTMC Chairman Shirantha Peries and CEO Dr. Chamaru de Alwis said the company recorded Rs. 1.43 billion in revenue for the eight months ending August 2025, compared to the same period in 2024. Gross profit climbed 77% to Rs. 786.9 million, while profit before tax soared 192% to Rs. 539.9 million, reflecting improved efficiency and strict financial discipline.

“This strong performance reflects disciplined management, prudent decision-making, and effective cost controls,” Peries said, adding that the team remains focused on enhancing visitor experience and operational excellence at South Asia’s tallest self-supported structure.

Since taking over in October 2024, the new management comprising over 120 professionals has prioritised safety, service quality, and profitability. The leadership acted swiftly after a tragic incident last year to reinforce safety protocols, including installing steel mesh barriers, expanding CCTV surveillance, and increasing security staff across key zones.

A key milestone has been digital transformation, including a fully digital ticketing platform replacing manual systems, ensuring transparency and convenience. A smart parking solution with real-time monitoring is set for launch within two months.

The management has also pursued legal action to safeguard the Tower’s commercial rights and introduced measures to lease underutilised spaces, enhancing income streams. “Every square foot counts as a potential investment,” said Dr. de Alwis, noting that the Tower is evolving into a vibrant hub for leisure, technology, and business.

Looking ahead, CLTMC is preparing several high-profile projects. These include a Rs. 100 million Aquarium Café venture, Sri Lanka’s first bungee jump attraction expected to be the world’s highest tower-based jump and the repositioning of luxury suites on the 28th floor as premium accommodation for high-end visitors.

Additionally, a 42,000 sq. ft. warehouse redevelopment is under discussion with multinational investors, potentially attracting new foreign direct investment.

Peries said the management remains committed to building Lotus Tower into South Asia’s premier hub for education, technology, and entertainment, ensuring it continues to serve as a national asset that delivers both financial value and world-class experiences

Lotus Tower Boosts Revenue 31% under New Management

Sri Lanka Faces Rising Debt Burden from Growth-Linked Bond Triggers

By: Staff Writer

October 04, Colombo (LNW): Sri Lanka’s recent sovereign debt restructuring carries significant upside risks—if the economy outperforms expectations, the nation may be locked into additional payments of US$150 million to US$270 million annually from 2028 through 2038, according to a new IMF working paper on “Sri Lanka’s Sovereign Debt Restructuring: Lessons from Complex Processes.”

The root of this exposure lies in macro-linked or state-contingent bonds (SCDIs) issued during the restructuring process. These instruments tie future debt payments to the country’s economic performance. In Sri Lanka’s case, triggering events depend on achieving minimum thresholds for dollar-denominated GDP and cumulative real growth over multiple years. Once triggered, higher payments become a fixed featureregardless of whether performance weakens later.

Specifically, the IMF report outlines that three scenario triggers are in play: if Sri Lanka’s average USD GDP between 2025 and 2027 exceeds thresholds of US$94 billion, US$99 billion, or US$107 billion, and if real GDP growth cumulatively over 2024-27 surpasses 11.5 percent, then the higher payment tier will be activated permanently (for a decade).

The IMF underscores that while state-contingent debt terms are designed to share upside gains with creditors and mitigate risk under volatility, they also introduce complex new vulnerabilities. Once payments ratchet upward post-2028, they cannot be easily reversed—even in an economic downturn. Moreover, these instruments carry political risk: if higher payouts are perceived as socially unfair, they may become contentious domestically.

Although the IMF itself does not draft the detailed design of such bonds, the Fund plays a central role in assessing whether they are consistent with debt sustainability goals. Its evaluation framework (the Sovereign Risk and Debt Sustainability Framework, or SRDSF) uses large-scale simulations to test whether such arrangements would increase the likelihood of breaching key debt or financing targets under adverse or extreme scenarios.

In Sri Lanka’s case, the IMF judged that the arrangement meets its internal criteria: the probability of breaching debt-to-GDP or gross financing needs thresholds stays within acceptable bounds, and even in the worst 10 percent of outcomes the additional burden remains relatively modest (at most 0.4 percent of GDP). Importantly, the additional annual payments are capped at about US$250 million.

Still, the IMF cautions that no modelling can perfectly capture uncertainty, and residual risks remain. Moreover, distinctions matter: some analysts argue the new bonds are not true state-contingent debt after 2027beyond that point they function as standard fixed-coupon bonds, so future shocks may no longer modulate payments.

Sri Lanka has meanwhile posted strong recent performance: growth rebounded by approximately 5 percent in 2024, and revenue mobilization has surged, helping stabilize macro conditions.

The IMF has completed multiple reviews of its Extended Fund Facility for Sri Lanka, supporting the country’s reform agenda and debt restructuring process.

But the broader picture is one of conditional relief: while Sri Lanka may benefit from significant debt relief under its deal, it is also exposed to higher debt service if performance is strong and that exposure may persist even through downturns.

The design of SCDIs thus offers a double-edged sword: sharing gains with creditors comes at the cost of locking in future risks. As Sri Lanka moves toward restoring stability, its macro-debt trajectory remains intricately tied to both growth outcomes and the structural safeguards built into its debt instruments

IMF Applauds Sri Lanka’s Economic Recovery as Reform Programme Gains Momentum

October 04, Colombo (LNW): Sri Lanka’s economic revival continues to gain international recognition, with the International Monetary Fund (IMF) commending the island nation for the steady progress achieved under its ongoing reform agenda.

The positive assessment comes as the country moves further along its path of post-crisis recovery, supported by the IMF’s Extended Fund Facility (EFF) programme.

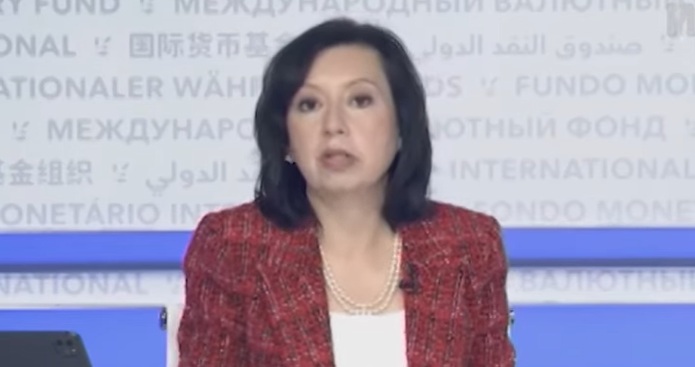

Addressing journalists in Washington on October 02, IMF Communications Director Julie Kozack highlighted Sri Lanka’s improving economic indicators, noting that the country has maintained low inflation levels, strengthened its foreign reserves, and significantly improved its revenue performance.

“The recovery has been quite robust,” Kozack observed, pointing out that the economy recorded a 5% growth rate in 2024, marking a notable turnaround after a period of severe financial turbulence. “Government revenue as a share of GDP rose to 13.5 per cent, up from just 8.2 per cent two years ago. While there’s still more to be done, this represents a remarkable step forward,” she added.

Kozack also reported that Sri Lanka’s debt restructuring efforts are nearing completion—a critical element of the broader recovery strategy. Successful restructuring has been essential to easing the country’s debt burden and restoring confidence among international creditors.

The IMF has so far disbursed a total of US$1.74 billion to Sri Lanka under the EFF agreement, with the latest tranche of US$350 million released following the completion of the programme’s Fourth Review in July this year.

An IMF delegation is currently in Sri Lanka conducting the Fifth Review, with discussions underway between the mission team and local authorities. While further details are expected at the conclusion of the mission, Kozack confirmed that overall programme performance remains strong.

She emphasised that the Sri Lankan government continues to demonstrate clear commitment to the reform agenda, which is centred on restoring macroeconomic stability, achieving debt sustainability, and implementing structural reforms aimed at fostering long-term growth.

International observers have increasingly cited Sri Lanka’s reform trajectory as a potential model for other countries facing similar economic challenges. The government’s efforts to improve fiscal discipline, modernise state institutions, and stabilise its financial system have helped to regain a measure of investor confidence and set the foundation for more inclusive and sustainable development.

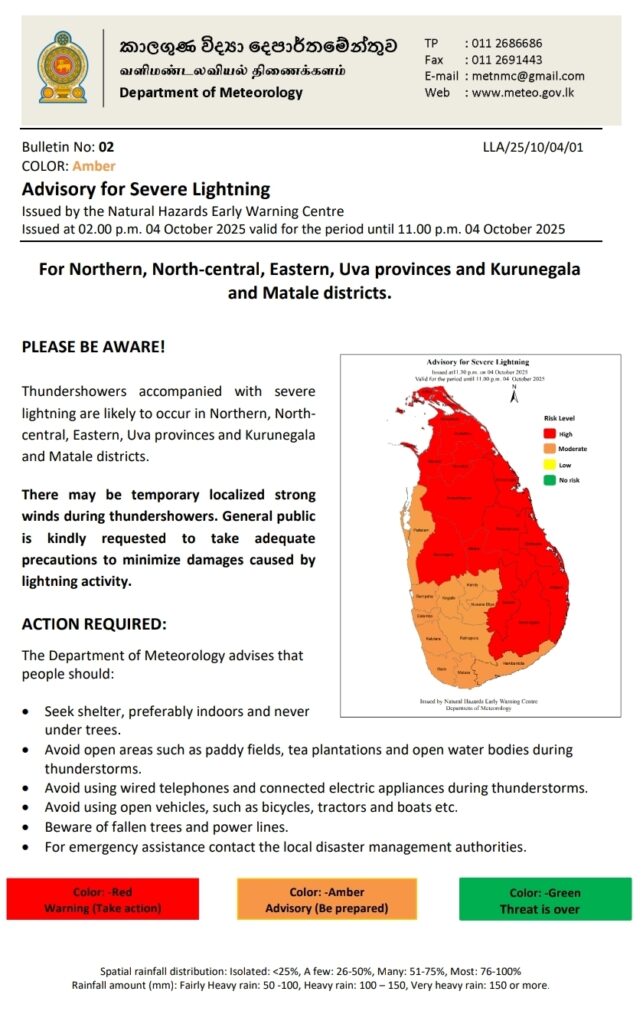

Thundershowers accompanied with severe lightning likely to occur, Dept warns

October 04, Colombo (LNW): Thundershowers accompanied with severe lightning are likely to occur in Northern, North-Central, Eastern and Uva Provinces and Kurunegala and Matale Districts, the Natural Hazards Early Warning Centre of the Department of Meteorology said in a warning statement today (04).

There may be temporary localised strong winds during thundershowers, the statement added.

The general public is urged to take adequate precautions to minimise damages caused by lightning activity.

The Department advised that people should seek shelter, preferably indoors and never under trees, avoid open areas such as paddy fields, tea plantations and open water bodies during thunderstorms, avoid using wired telephones and connected electric appliances during thunderstorms, and beware of fallen trees and power lines.

Sri Lanka Launches Landmark Asset Seizures Under New Anti-Corruption Law

October 04, Colombo (LNW): Sri Lankan authorities have launched a series of high-profile investigations targeting suspicious properties—including a hotel and several private residences—allegedly linked to public officials, under the country’s newly enacted Proceeds of Crime Act.

The move signals a significant shift in the nation’s approach to tackling corruption and illicit wealth.

Director General of the Commission to Investigate Allegations of Bribery or Corruption (CIABOC), Ranga Dissanayake, confirmed that at least four active inquiries are currently underway, with more expected to follow.

The Act, which came into force on 1 June 2025, empowers the state to seize assets that individuals cannot lawfully account for, even in the absence of a formal conviction.

“This is not like traditional criminal prosecutions where the burden is on the state to prove guilt beyond reasonable doubt,” Dissanayake said. “Here, if the state can demonstrate that an individual is in possession of property not commensurate with their declared income, it is up to the individual to establish its legitimate origin.”

Approved by Parliament earlier this year, the Proceeds of Crime Act is widely regarded as a milestone in Sri Lanka’s efforts to recover stolen public assets. The legislation enables authorities to trace, freeze, and confiscate illicit wealth through non-conviction-based procedures. It also facilitates international cooperation for locating assets stashed abroad, often through sophisticated laundering schemes.

Dissanayake noted that investigations under the new law focus more on the assets themselves than on individuals. “It’s a powerful shift. We can now disrupt the benefits of corruption even when criminal convictions are hard to secure due to lack of witnesses or procedural delays,” he said.

Recent operations have already led to the freezing of properties believed to have been acquired through corruption, with investigators assessing documentation, income declarations, and ownership histories. In some cases, individuals holding public office are reportedly unable to provide credible explanations for the scale of their wealth.

The Director General further urged the public to come forward with information, reminding citizens that failure to report knowledge of suspicious or unexplained assets is, under the new legislation, itself a punishable offence.

Meanwhile, separate police operations targeting organised crime have resulted in the seizure of assets estimated at Rs. 4.5 billion. These include residential and commercial properties, luxury vehicles, land plots, cash holdings, jewellery, and even vessels—confiscated under the provisions of the Money Laundering Act.

Anti-corruption advocates, including Transparency International Sri Lanka (TISL), have welcomed the implementation of the Proceeds of Crime Act, calling it essential for dismantling entrenched networks of grand corruption. TISL noted that the law focuses on stripping away the financial incentives for corruption, ensuring that stolen public funds are returned to the state and, ultimately, to the people.

New Line of Inquiry Opens in Rugby Player Wasim Thajudeen Case Following Detained Politician’s Revelations

October 04, Colombo (LNW): Authorities have initiated a renewed investigation into the 2012 death of former rugby player Wasim Thajudeen, prompted by recent disclosures made during the interrogation of a detained local politician.

According to Minister Dr Nalinda Jayatissa, fresh leads have emerged as a result of questioning Sri Lanka Podujana Peramuna (SLPP) member Sampath Manamperi, who is currently being held under a 90-day detention order.

Manamperi, who was arrested in connection with a major narcotics-related case involving the seizure of two containers filled with chemicals believed to be used in the production of crystal methamphetamine (commonly known as “ice”), is reportedly cooperating with investigators.

Minister Jayatissa confirmed that new investigative pathways have opened in relation to Thajudeen’s death, a case that has remained clouded by controversy for over a decade. Originally ruled an accident, Thajudeen’s death was later reclassified as a homicide after signs of foul play emerged during earlier inquiries.

In response to accusations from the opposition that the renewed probe serves as a political vendetta against dissenting voices, the Minister dismissed such claims as speculative.

“Ongoing investigations are guided by facts and emerging evidence. Those who fear arrest may describe it as a witch-hunt, but only those with something to hide know how deeply they’re involved,” he said.

He noted that statements are still being recorded and that Manamperi has only begun to reveal key information that could shed light on past events.

“It is the duty of law enforcement to follow the trail wherever it leads. No one is being targeted without basis,” the Minister added.

The new developments have reignited public interest in the Thajudeen case, which has long symbolised concerns over impunity and political interference in high-profile criminal investigations.

Ex-President Mahinda Rajapaksa Returns Armoured Vehicle Amid Security Concerns

October 04, Colombo (LNW): A bulletproof vehicle previously allocated for the protection of former Sri Lankan President Mahinda Rajapaksa has been officially returned, following recent changes to legislation governing privileges extended to former heads of state.

According to a statement issued yesterday (03) by Rajapaksa’s media spokesperson, Attorney-at-Law Manoj Gamage, the armoured vehicle was handed back through the relevant leasing or service provider.

In addition, a secondary vehicle used by his close protection officers was also returned to the authorities.

The decision comes in the wake of the Presidents’ Entitlements (Repeal) Act, which has effectively withdrawn several benefits and official provisions previously extended to past executive presidents.

Gamage stated that the Presidential Secretariat had formally notified Rajapaksa on 24 September of the requirement to relinquish both official vehicles and the official residence still under his use.

Expressing concern over the implications of the move, Gamage remarked that the absence of adequate transport and protection infrastructure places the former President’s safety at risk.

He added that arrangements are underway to seek discussions with the Inspector General of Police, the Secretary to the Ministry of Defence, and senior defence officials to explore avenues for securing alternative protective measures.

Mannar’s Wind Power Dilemma: Progress or Peril?A New Frontier in Sri Lanka’s Energy Mix

By: Roger Srivasan

october 04, Colombo (LNW):

Sri Lanka’s ambitious renewable energy targets have placed Mannar Island at the heart of

a historic transformation. The Thambapavani Wind Farm, with its first 30 turbines already

operational, has been hailed as a flagship project — a step towards reducing fossil fuel

dependence, strengthening energy security, and cutting carbon emissions. Yet, beneath

this narrative of clean progress, a storm of local opposition is gathering force.

Demonstrations in Mannar reflect a profound unease: that the very project meant to

secure a greener future may be destabilising the fragile landscape and imperilling local

lives.

The Public Outcry: Floods, Wells, and Wellsprings of Distrust

Residents insist that since Phase I began, flooding has worsened dramatically. Fields lie

waterlogged for weeks, crops rot, pit latrines overflow, and drinking wells are polluted.

They argue that the turbine foundations, access roads, and cable trenches have disrupted

natural drainage, blocking water flow during the northeast monsoon. The community’s

fears are not mere speculation. In a flat, flood-prone island like Mannar, even minor

obstructions to watercourses can transform seasonal inconveniences into prolonged

disasters. Coupled with weak consultation and poor transparency, the sense of betrayal is

palpable.

Beyond Flooding: Ecology and Livelihoods at Stake

Mannar is more than a windy plain. It is a globally significant bird migration hotspot, a

mosaic of wetlands and fisheries that sustain both biodiversity and livelihoods.

Conservationists warn that turbine strings and associated roads could fragment habitats,

endanger migratory species, and degrade wetlands that naturally buffer floods. For

farmers and fishers, the stakes are immediate: disrupted land, declining yields, and altered

access to coastal resources. The promise of renewable energy feels distant when daily

survival is at risk.

The National Imperative: Energy Security and Climate Goals

Yet the counterargument is powerful. Sri Lanka imports the bulk of its fossil fuels, leaving

the economy exposed to volatile global markets. Expanding wind power on Mannar could

displace costly oil and coal, stabilise long-term energy prices, and help meet urgent

climate commitments. Wind energy is clean, renewable, and increasingly cost-effective. Its

carbon savings benefit not just Mannar but the entire nation — a collective good that

cannot be ignored.

Where the Balance Lies

The dilemma, then, is stark: local harm versus national gain. But it need not be an

either–or equation. Hydrological safeguards — frequent culverts, open channels, and

seasonal construction windows — can mitigate flooding risks. Wetland buffers and

ecological corridors can preserve biodiversity and migration pathways. Transparent

monitoring and independent audits can rebuild trust. Benefit sharing — jobs, local

electrification, and improved drainage — can ensure that Mannar’s people are not asked

to sacrifice for free. Without these safeguards, expansion would be reckless. With them,

Mannar can indeed host wind power responsibly.

The Best Interest of Sri Lanka

In the final analysis, the people of Mannar are right to raise their voices. Their fears are

grounded in real vulnerabilities and lived experience. At the same time, Sri Lanka cannot

afford to abandon its renewable energy vision.

The best interest of the nation — and Mannar — lies in conditional progress: expand only after independent verification, genuine

consultation, and visible safeguards are in place. A “fix first, then phase” approach offers a

path where energy security and community resilience move forward together.

Conclusion

Mannar’s winds are a gift of nature, capable of powering the nation for generations. But if

ignored, the same winds may also fan the flames of resentment and mistrust. The true

measure of progress is not how many turbines stand tall, but how well a nation ensures

that its people and environment stand tall alongside them.

Sri Lanka’s ambitious renewable energy targets have placed Mannar Island at the heart of

a historic transformation. The Thambapavani Wind Farm, with its first 30 turbines already

operational, has been hailed as a flagship project — a step towards reducing fossil fuel

dependence, strengthening energy security, and cutting carbon emissions. Yet, beneath

this narrative of clean progress, a storm of local opposition is gathering force.

Demonstrations in Mannar reflect a profound unease: that the very project meant to

secure a greener future may be destabilising the fragile landscape and imperilling local

lives.

The Public Outcry: Floods, Wells, and Wellsprings of Distrust

Residents insist that since Phase I began, flooding has worsened dramatically. Fields lie

waterlogged for weeks, crops rot, pit latrines overflow, and drinking wells are polluted.

They argue that the turbine foundations, access roads, and cable trenches have disrupted

natural drainage, blocking water flow during the northeast monsoon. The community’s

fears are not mere speculation. In a flat, flood-prone island like Mannar, even minor

obstructions to watercourses can transform seasonal inconveniences into prolonged

disasters. Coupled with weak consultation and poor transparency, the sense of betrayal is

palpable.

Beyond Flooding: Ecology and Livelihoods at Stake

Mannar is more than a windy plain. It is a globally significant bird migration hotspot, a

mosaic of wetlands and fisheries that sustain both biodiversity and livelihoods.

Conservationists warn that turbine strings and associated roads could fragment habitats,

endanger migratory species, and degrade wetlands that naturally buffer floods. For

farmers and fishers, the stakes are immediate: disrupted land, declining yields, and altered

access to coastal resources. The promise of renewable energy feels distant when daily

survival is at risk.

The National Imperative: Energy Security and Climate Goals

Yet the counterargument is powerful. Sri Lanka imports the bulk of its fossil fuels, leaving

the economy exposed to volatile global markets. Expanding wind power on Mannar could

displace costly oil and coal, stabilise long-term energy prices, and help meet urgent

climate commitments. Wind energy is clean, renewable, and increasingly cost-effective. Its

carbon savings benefit not just Mannar but the entire nation — a collective good that

cannot be ignored.

Where the Balance Lies

The dilemma, then, is stark: local harm versus national gain. But it need not be an

either–or equation. Hydrological safeguards — frequent culverts, open channels, and

seasonal construction windows — can mitigate flooding risks. Wetland buffers and

ecological corridors can preserve biodiversity and migration pathways. Transparent

monitoring and independent audits can rebuild trust. Benefit sharing — jobs, local

electrification, and improved drainage — can ensure that Mannar’s people are not asked

to sacrifice for free. Without these safeguards, expansion would be reckless. With them,

Mannar can indeed host wind power responsibly.

The Best Interest of Sri Lanka

In the final analysis, the people of Mannar are right to raise their voices. Their fears are

grounded in real vulnerabilities and lived experience. At the same time, Sri Lanka cannot

afford to abandon its renewable energy vision.

The best interest of the nation — and Mannar — lies in conditional progress: expand only after independent verification, genuine

consultation, and visible safeguards are in place. A “fix first, then phase” approach offers a

path where energy security and community resilience move forward together.

Conclusion

Mannar’s winds are a gift of nature, capable of powering the nation for generations. But if

ignored, the same winds may also fan the flames of resentment and mistrust. The true

measure of progress is not how many turbines stand tall, but how well a nation ensures

that its people and environment stand tall alongside them.

Banks Must Stop Exploiting Credit Card Users: CBSL Cannot Sit Idle

By Adolf

Sri Lankan credit card users are being taken for a ride. While banks and card companies boast about convenience, security, and global acceptance, the reality is starkly different: exorbitant fees, opaque charges, and outright exploitation. Overseas transactions are where the abuse is most glaring, and among the worst offenders is American Express (Amex), which consistently imposes punishing markups and foreign transaction fees far beyond what other cards charge.

Credit card holders pay hidden costs at every step. Foreign exchange conversion fees, service charges, and even stamp duties pile on top of already high interest rates. These fees are often poorly explained—or not disclosed at all—until the user sees the shockingly inflated statement. A simple purchase abroad can end up costing hundreds or even thousands of rupees more than anticipated. And yet, banks continue to profit while consumers bear the brunt.

Adding insult to injury, many local merchants continue to pass on their card processing costs to consumers through extra surcharges of 2.5%–3%, despite clear directives from the Central Bank of Sri Lanka (CBSL) prohibiting this practice. These surcharges violate merchant agreements and exploit customers who may not even realize they are being overcharged. CBSL has warned against this, yet enforcement remains weak, and violations persist unchecked.

CBSL has introduced regulations on financial consumer protection, emphasizing transparency and fair treatment. But statements alone do not protect consumers. Banks continue to impose hefty international fees, and card issuers like Amex, which dominate the high-end credit card segment, profit massively from overseas transactions while offering little real value in return. It is a system rigged against ordinary Sri Lankans.

What is required is decisive, forceful action. CBSL must cap foreign transaction fees, mandate complete transparency on all charges, and penalize banks and merchants who flout the rules. Consumers must be empowered to challenge exploitative practices without fear or bureaucratic delay. Anything less leaves the door open for continued abuse.

Credit cards are meant to be a tool for convenience, mobility, and access to global commerce. Instead, they have become a vehicle for banks and card companies to extract hidden revenue from unsuspecting customers. The time for gentle warnings and regulations on paper is over. CBSL must step up and protect Sri Lankan consumers from being exploited by powerful financial institutions, including the likes of Amex. The bottom line is simple: banks cannot be allowed to treat cardholders as cash cows while regulators remain passive. The financial system’s credibility and public trust are at stake. CBSL must act now, decisively and visibly, or risk being complicit in this exploitation. Ordinary Sri Lankans deserve fair treatment, transparency, and protection—not an endless drain on their wallets every time they swipe their cards abroad

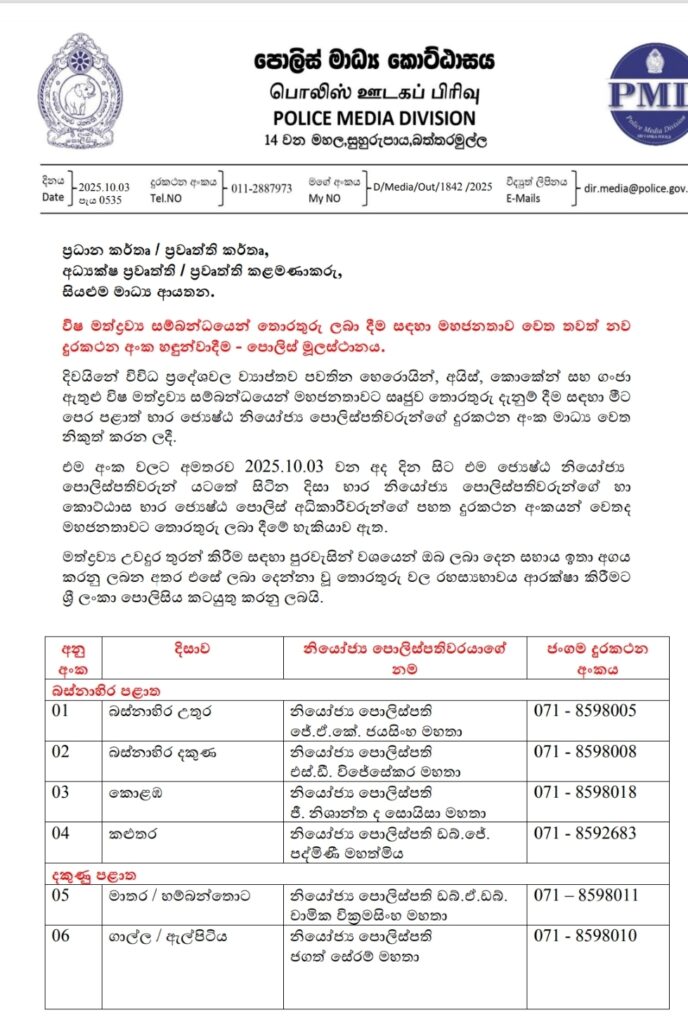

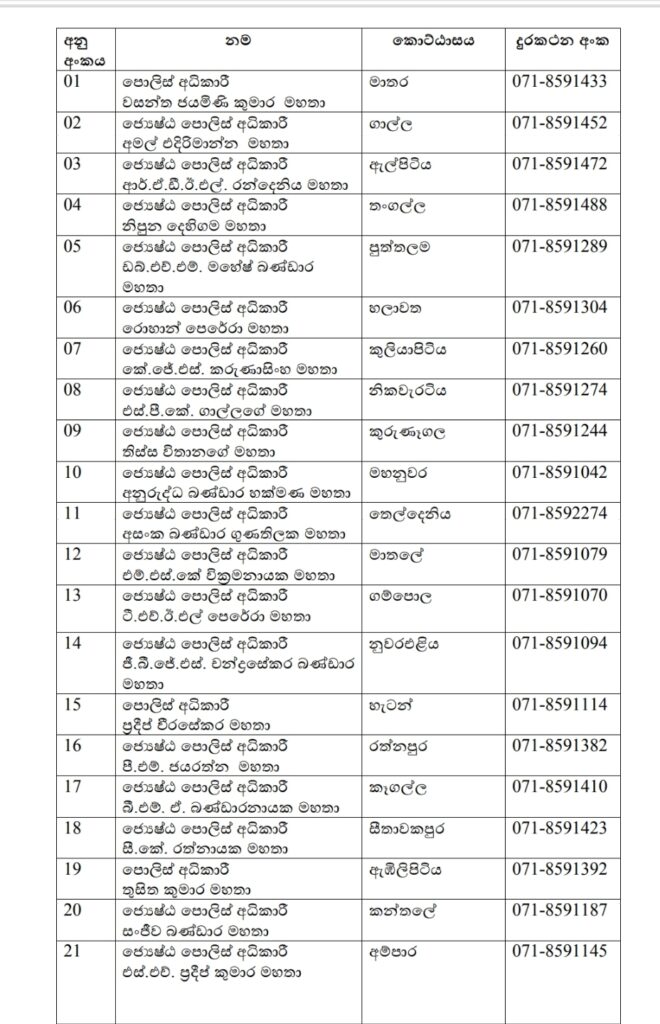

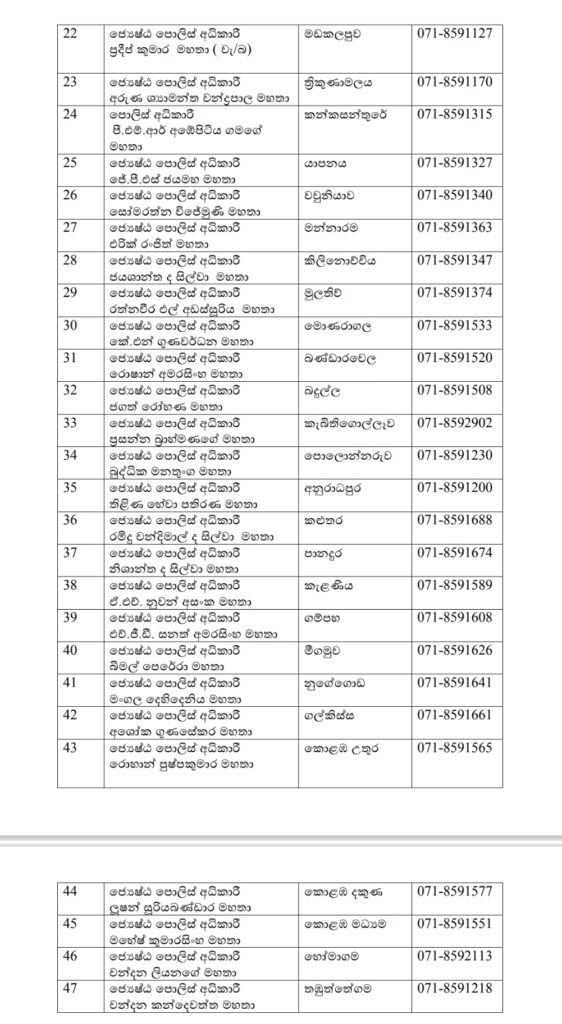

Police Launch New Hotlines for Public to Report Drug-Related Activity

October 04, Colombo (LNW): Sri Lankan police have introduced a set of new telephone hotlines aimed at strengthening the national crackdown on illegal narcotics.

Announced yesterday (03), the initiative allows members of the public to directly share information on drug-related activity with senior law enforcement officials across the island.

The public can now report incidents involving substances such as heroin, crystal methamphetamine (commonly known as ‘ice’), cocaine, cannabis, and other illicit drugs via specially designated contact numbers.

These lines will connect callers directly to the offices of Senior Deputy Inspectors General (SDIGs) overseeing regional police ranges, as well as Senior Superintendents of Police (SSPs) responsible for divisional command.

Authorities have urged citizens to use the hotlines responsibly and in good faith, noting that community cooperation is vital to tackling the spread of narcotics.