By: Staff Writer

Colombo (LNW): Sri Lanka’s merchandise trade deficit widened in July 2023 due to the combined impact of relatively low export earnings and high import expenditure, compared to July 2022, Central Bank announced.

However, cumulative trade deficit during January-July 2023 remained significantly low, compared to the corresponding period in 2022.

The deficit in the merchandise trade account increased in July 2023 to US dollars 367 million, compared to US dollars 122 million recorded in July 2022.

The trade account during January to July 2023 narrowed to US dollars 2,657 million from US dollars 3,628 million recorded over the same period in 2022, driven by lower imports, CB divulged.

Earnings from merchandise exports declined by 12.4 per cent in July 2023, over the corresponding month in 2022, to US dollars 1,020 million.

The decline in earnings from industrial exports, including garments, associated with slowing external demand mainly contributed to this contraction in export earnings in July 2023, compared to a year earlier.

However, earnings from exports in July 2023 increased compared to June 2023. Cumulative export earnings during January to July 2023 also declined by 10.3 per cent over the same period in the last year, amounting to US dollars 6,891 million, CB disclosed

Workers’ remittances increased notably to US dollars 541 million in July 2023 in comparison to US dollars 279 million in July 2022.

Meanwhile, based on provisional data, total departures for foreign employment during January to July 2023 and departures in July 2023 amounted to 171,015 and 24,578, respectively. Total annual departures for foreign employment in 2022 was 311,056.

Tourist arrivals increased to 143,039 in July 2023, compared to 100,388 arrivals recorded in June 2023.

Meanwhile, the cumulative tourist arrivals during January-July 2023 amounted to 767,913, compared to 458,670 arrivals recorded during the corresponding period in 2022.

Earnings from tourism in July 2023 were estimated at US dollars 219 million, in comparison to US dollars 123 million in the previous month and US dollars 85 million in the corresponding month in the previous year.

Consequently, earnings from tourism during January-July 2023 amounted to US dollars 1,094 million, compared to US dollars 765 million in corresponding period in 2022.

India, Russia, the United Kingdom, Germany, and France were the main source countries for tourist arrivals during this period.

Foreign investment in the government securities market recorded a net outflow of US dollars 38 million in July 2023 despite a cumulative net inflow of US dollars 388 million during January to July2023.

Meanwhile, foreign inflows to the Colombo Stock Exchange (CSE), including both primary and secondary market transactions, recorded a net inflow of US dollars 9 million during January-July 2023.

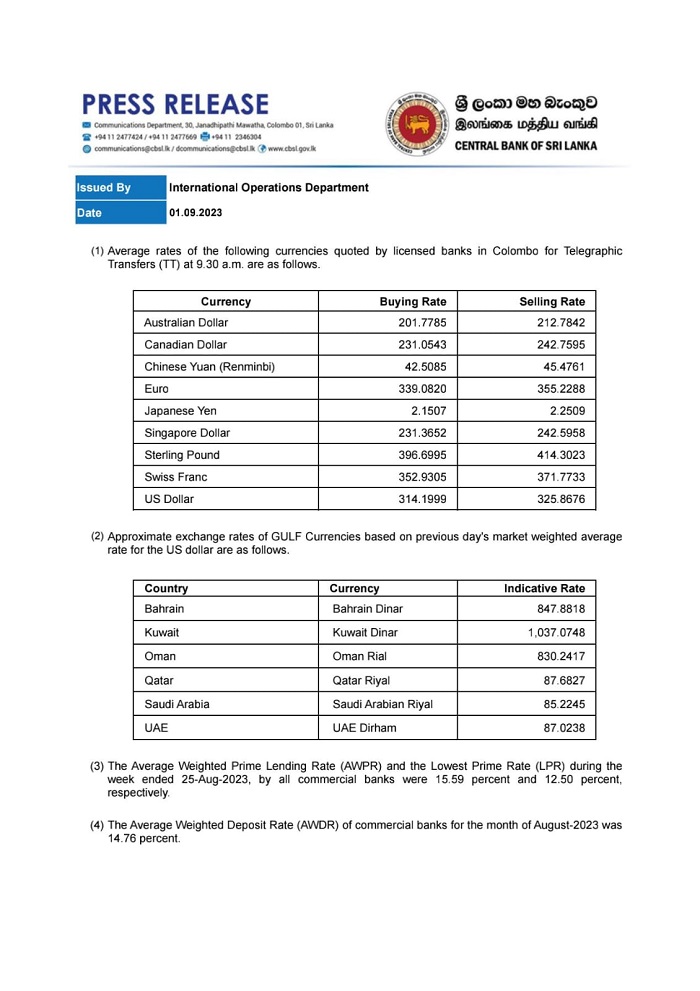

Gross official reserves increased to US dollars 3.8 billion by end July 2023, compared to US dollars 1.8 billion recorded as at end July 2022.

Central Bank supplied US dollars 13 million to the domestic foreign exchange market on net basis during the month. Overall, It has purchased more than US dollars 2.0 billion, on gross basis, during January-July 2023.