By: Isuru Parakrama

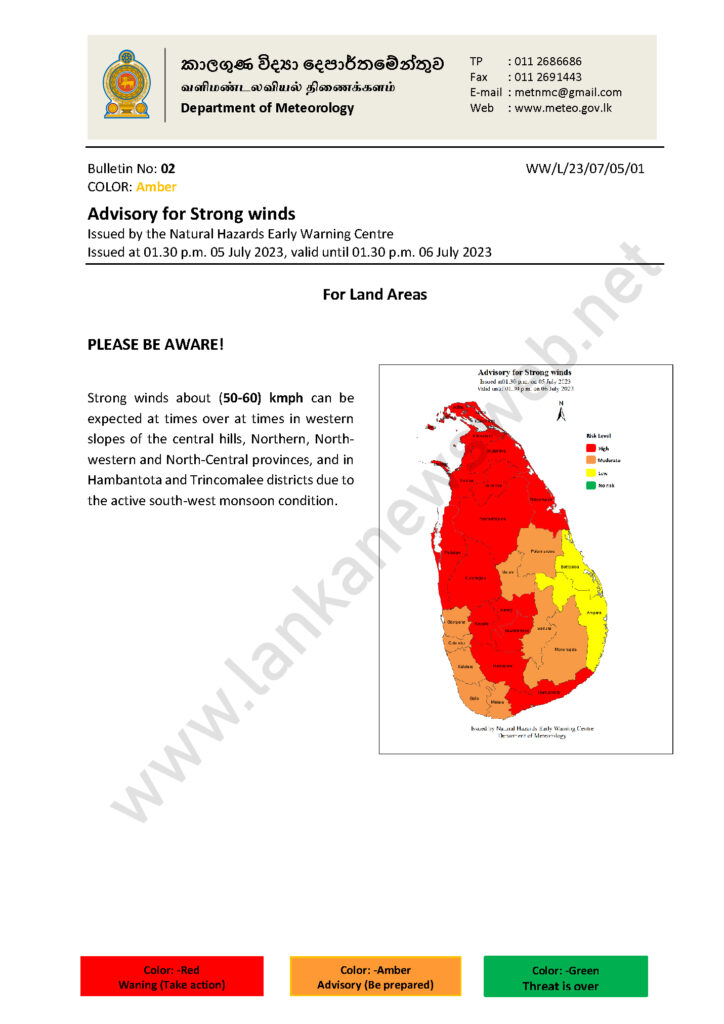

Colombo (LNW): Strong winds about 50-60 kmph can be expected at times over the western slopes of the central hills, Northern, North-Western and North-Central provinces, and in Hambantota and Trincomalee districts due to the active south-west monsoon condition, announced the Natural Hazards Early Warning Centre of the Department of Meteorology in an advisory statement today (06).

Meanwhile, prevailing heavy showers and strong winds over the south western part of the island is expected to reduce from today, whilst showers will occur at times in Western and Sabaragamuwa provinces and in Kandy, Nuwara-Eliya, Galle and Matara districts, the Dept said in its daily weather forecast.

Several spells of showers will occur in the North-Western province and in Matale and Anuradhapura districts, it added.

Marine Weather:

| Condition of Rain: |

| Showers or thundershowers will occur at times in the sea areas off the coast extending from Puttalam to Hambantota via Colombo and Galle. A few showers will occur in the other sea areas around the island. |

| Winds: |

| Winds will be south-westerly and speed will be (25-35) kmph. Wind speed may increase up to (50-60) kmph at times in the sea areasoff the coast extending from Trincomalee to Puttalam via Kankasanthurai and Mannar and sea areasoff the coast extending from Hambanthota to Pottuvil. Wind speed may increase up to (45-50) kmph at times in the sea areasoff the coast extending from Puttalam to Hambanthota via Colombo and Galle. |

| State of Sea: |

| The sea areasoff the coast extending fromTrincomalee to Puttalam via Kankasanthurai and Mannar and sea areasoff the coast extending from Hambanthota to Pottuvil will be rough at times. Sea areasoff the coast extending from Puttalam to Hambanthota via Colombo and Galle will be fairly rough. Other sea areas around the island will be moderate. Increase of swell waves (about 2.5 – 3.0 m) can be expected in the sea areasoff the coast extending from Mannar to Pottuvil via Puttalam, Colombo, Galle and Hambanthota. Temporarily strong gusty winds and very rough seas can be expected during thundershowers. |