December 11, Colombo (LNW): The government has announced a revamped financial support initiative aimed at helping micro, small and medium-sized enterprises regain their footing after the recent wave of natural disasters.

The new facility, titled RE–MSME PLUS, brings together several existing state-backed lending programmes—previously known as SMILE-III, E-FRIEND-II and RE-MSME—into a single, more flexible scheme intended to fast-track recovery and encourage investment.

According to officials, Cabinet approval has been granted to launch the upgraded scheme early next year. The authorities expect that roughly 130,000 business owners will benefit from a mix of rapid-release financial assistance and longer-term concessional support.

The initiative is designed not only to offer relief but also to strengthen the resilience of small-scale industries that form the backbone of the local economy.

Under the planned arrangement, eligible enterprises will have access to government-funded loans at an annual interest rate of just 3 per cent over a three-year period. The scheme will also include a grace period of up to six months, with borrowing limits set at Rs. 250,000 for micro-level ventures and Rs. 1 million for small and medium-scale businesses.

Officials say these terms are meant to ease cash-flow pressures and give affected entrepreneurs enough breathing space to rebuild operations.

Cabinet has also endorsed the continuation of the RE–MSME – Disaster Relief programme, with the President—acting in his role as Minister of Finance—greenlighting both initiatives. Authorities hope the combined effort will accelerate recovery in sectors hit hardest by the recent adverse weather, while encouraging businesses to adopt more sustainable and disaster-resilient practices in the long run.

Government Unveils Fresh Credit Lifeline for MSMEs Hit by Recent Disasters

UN Rallies Global Support for Sri Lanka’s Post-Cyclone Rebuilding Drive

December 11, Colombo (LNW): The United Nations has launched a fresh appeal to bolster Sri Lanka’s post-cyclone recovery, aiming to gather roughly US$35 million over the next few months to help restore essential services and support affected communities.

At a briefing in Colombo on Thursday, the UN’s top representative in the country, Marc-André Franche, explained that the organisation had worked closely with the Disaster Management Centre to map out urgent needs across seven key areas, following the havoc wrought by Cyclone Ditwah. Roads, housing, health services and livelihoods are among the sectors identified for swift assistance.

Franche stressed that the Sri Lankan government remains at the forefront of the relief operation, with the UN and a network of local and international partners stepping in to reinforce national efforts where required.

He also revealed that contributions totalling nearly US$10 million have already come through from a group of supporting nations, including Australia, Canada, members of the European Union, Switzerland, the United Kingdom and the United States. According to him, a further US$26 million will be sought through a coordinated push designed to ensure that aid reaches the most vulnerable communities efficiently.

In addition to immediate relief, Franche hinted that the UN hopes this funding drive will help Sri Lanka build greater resilience against future climate-driven disasters, noting that the scale of destruction caused by Cyclone Ditwah underscores the urgency of long-term preparedness.

Health Authorities Warn of Eye Infection Risk in Flood-Affected Areas

December 11, Colombo (LNW): The Health Promotion Bureau has issued a warning that eye infections, particularly conjunctivitis, could spread more easily in the wake of recent floods due to overcrowding in temporary shelters and public spaces.

Officials stressed the importance of good hygiene to protect against infection and limit transmission. Conjunctivitis, commonly known as sore eyes, is highly contagious and can be passed through direct contact, shared items, or contaminated surfaces. Typical symptoms include redness, swelling, itching, excessive tearing or discharge, light sensitivity, and crusting around the eyes.

The Bureau advised the public to adopt the following precautions:

– Wash hands thoroughly and regularly with soap and water

– Disinfect frequently touched surfaces

– Cover coughs and sneezes

– Clean contact lenses carefully and avoid using unclean lenses

– Seek medical attention if symptoms persist beyond a week

Authorities also warned against rubbing the eyes or sharing personal items such as towels, pillows, or eye drops, as these practices greatly increase the risk of spreading infection.

Members of the public were urged to share this advisory widely to help prevent further outbreaks in communities still recovering from the floods.

Sri Lanka Moves to Streamline Tax System and Boost Revenue

December 11, Colombo (LNW): Sri Lanka’s Finance Ministry and the Inland Revenue Department have convened a high-level meeting to discuss measures aimed at expanding the tax base, simplifying the filing process, and cutting red tape, according to an official statement from the ministry.

The session was led by Deputy Minister of Economic Development, Nishantha Jayaweera, and attended by Inland Revenue Commissioner General Rukdevi Fernando alongside senior department officials.

Officials were instructed to promote voluntary tax compliance and intensify public awareness campaigns to ensure taxpayers are better informed. The Deputy Minister emphasised the need to reduce obstacles in filing returns and to simplify forms wherever possible.

A key focus of the discussion was the formulation of a practical strategy for the Inland Revenue Department to achieve the government’s revised revenue targets for 2025. The 2026 budget raised the projected tax revenue for 2025 from Rs. 4,590 billion to Rs. 4,725 billion, marking a 2.9 per cent increase.

This upward revision reflects expected growth in income tax collections as well as levies on goods and services, including vehicle import duties. The income tax target was set 3.7 per cent higher at Rs. 1,210 billion, while levies on goods and services were increased by 6.5 per cent to Rs. 2,953 billion.

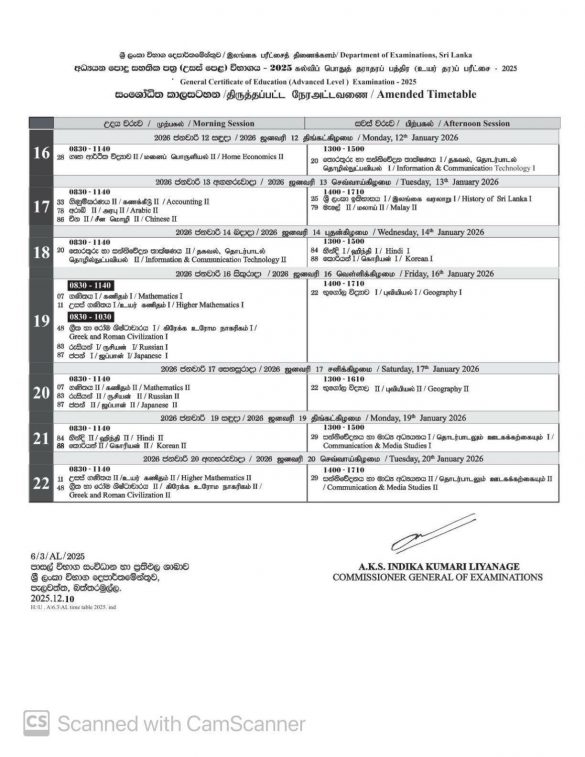

Revised A-Level Timetable Announced Following Weather Disruptions

December 11, Colombo (LNW): The Department of Examinations has unveiled a new schedule for the remaining papers of the 2025 G.C.E. Advanced Level exams, which were postponed due to severe weather affecting multiple regions of the country.

The rescheduled examinations are set to take place between January 12 and 20, 2026. The Department has issued the updated timetable alongside an official notice to ensure all candidates are informed.

The Commissioner General of Examinations confirmed that special arrangements will be made for students impacted by the recent adverse conditions. School candidates unable to sit their exams at their designated centres are urged to notify their school Principal immediately.

Principals must then inform both the Zonal Director of Education and the Commissioner of Examinations (School Examination Organisation and Results) of any disruptions.

Private candidates who face difficulties attending their scheduled centres are requested to contact the Department directly via the following:

Hotline: 1911

Telephone: 011 278 4537 / 011 278 6616 / 011 278 4208

Fax: 011 278 4422

Email: [email protected]

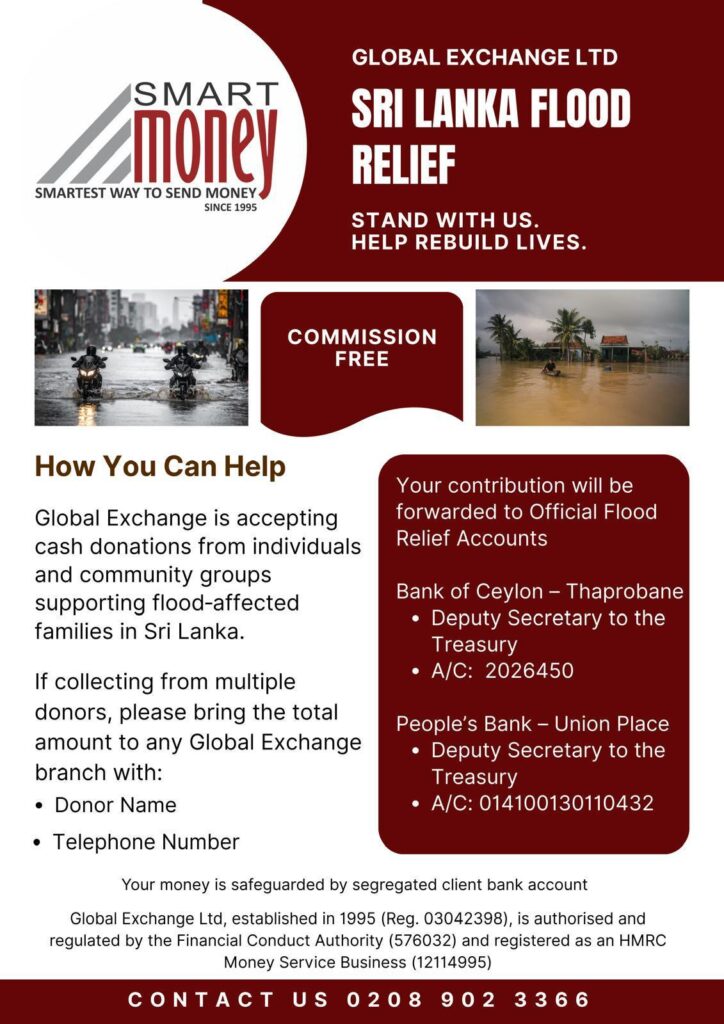

UK-Based Relief Drive Mobilises Support for Sri Lanka’s Flood Survivors

By: Isuru Parakrama

December 11, Colombo (LNW): A UK-based humanitarian initiative has been launched to support thousands of Sri Lankan families affected by the severe flooding triggered by Cyclone Ditwah, which swept across multiple districts with devastating force.

Global Exchange Ltd, a long-established money transfer service operating since 1995, has begun accepting cash donations to help fund official relief efforts in the island nation, where torrential rains, mass displacement and widespread damage have overwhelmed local authorities and communities.

The campaign, branded under the company’s Smart Money service, urges the Sri Lankan communities and the wider British public to stand in solidarity with those whose lives have been upended by the sudden onset of floods.

With entire neighbourhoods submerged, transport links paralysed and homes destroyed, the need for rapid humanitarian assistance has become increasingly urgent. In response, Global Exchange has committed to forwarding all contributions directly to designated flood-relief accounts managed by Sri Lanka’s Treasury, ensuring donations reach government-authorised emergency support channels without delay.

Donors are asked to provide only basic details—namely their name and telephone number—when handing over contributions. To encourage maximum participation, the company has waived all commission fees associated with the transfers, emphasising that every pound donated will go entirely towards relief efforts.

Funds collected through the programme will be remitted to two official government accounts: one at the Bank of Ceylon’s Thaprobane branch and another at People’s Bank in Union Place, both held under the Deputy Secretary to the Treasury.

The firm is authorised and regulated by the Financial Conduct Authority and registered as an HMRC Money Service Business, adding additional layers of oversight to reassure contributors of the legitimacy and accountability of the initiative.

With Cyclone Ditwah’s impact continuing to reverberate across Sri Lanka, the economic and social implications are becoming more visible. Flood-affected districts—many already grappling with the country’s broader economic challenges—now face extensive crop losses, damaged infrastructure and disruptions to education as schools remain closed in several regions. Families living in low-lying or marginalised communities have found themselves disproportionately affected, with the destruction of homes and livelihoods compounding existing vulnerabilities. For diaspora communities in the UK, the appeal has resonated deeply, with many maintaining close family ties to areas hardest hit by the floodwaters.

For further information or to make a donation, supporters may contact Global Exchange on 0208 902 3366.

Egg Prices Set to Remain Stable, Producers Deny Price Hike Claims Over Festive Season

December 11, Colombo (LNW): The All Ceylon Egg Producers’ Association has rejected suggestions that the cost of eggs will surge during the forthcoming festive period, insisting that such forecasts are unfounded.

R.M. Sarath Ratnayake, President of the Association, criticised what he described as “misleading rumours” circulated by a small group seeking to push for increased egg imports.

He emphasised that domestic producers are fully equipped to meet demand and can continue supplying eggs at under Rs. 45, ensuring that consumers will not face inflated prices this season.

SL’s Main River Systems Flow Steadily, Show No Signs of Flood Risk

December 11, Colombo (LNW): Sri Lanka’s main river systems are flowing steadily and show no signs of posing a flood risk, according to a hydrological assessment released at 6.30 a.m. today (11).

The latest readings indicate that all major waterways remain comfortably within their safe limits, offering reassurance to communities still anxious after recent severe weather.

The Hydrology and Disaster Management Division reports that the Kelani, Kalu, Mahaweli, Gin, Nilwala and Walawe basins are all registering levels well below their respective alert thresholds.

Measurements taken between 5.00 and 6.00 a.m. reflected largely stable conditions, with only a few locations recording negligible rises amounting to mere millimetres.

On the Kelani Ganga, gauges at Nagalagam Street, Hanwella, Glencourse and Kithulgala continued to show normal flows. The Kalu Ganga, while displaying slight increases at Putupaula, Ellagawa and Ratnapura, remains safely beneath any warning markers. The Gin, Nilwala and Mahaweli rivers exhibited a similar pattern, with no stations reporting concerning behaviour.

Rainfall has been relatively subdued over the past 21 hours. The highest totals—29.4 mm at Maguru Ganga and 14.7 mm at Baddegama—were modest and unlikely to affect river levels significantly.

The update, compiled by Hydrology Assistants and validated by Eng L. S. Sooriyabandara, Director of Hydrology and Disaster Management, notes that routine monitoring will continue throughout the day.

Authorities, however, emphasise that current conditions present no immediate risk of flooding, allowing residents in vulnerable areas a brief but welcome respite.

Sri Lankan Insurers Fast-Track Payouts as Cyclone Ditwah’s Toll Becomes Clear

December 11, Colombo (LNW): Insurance firms across Sri Lanka have moved quickly to ease the financial strain on those hit by Cyclone Ditwah, with authorities confirming that initial payouts for minor damages are already under way.

According to Finance Ministry Secretary Dr Harshana Suriyapperuma, the Insurance Regulatory Commission summoned all companies to coordinate a unified approach to supporting affected households and businesses.

Under this collective effort, insurers have begun processing claims relating to property losses, business disruptions, and fatalities. Where assessments allow, partial settlements are being released to help families and enterprises regain some stability while full verifications continue. Officials say the aim is to avoid bureaucratic delays and ensure that compensation reaches those in need as swiftly as possible.

Meanwhile, the government’s wider Rebuilding Sri Lanka initiative has drawn considerable backing, with nearly Rs 1.9 billion raised from local donors, the diaspora, and philanthropic organisations. The funds, according to the Presidential Media Division, will bolster ongoing recovery work ranging from emergency aid to long-term reconstruction.

Early assessments from the Ministry of Industry suggest a far-reaching blow to the productive sector. More than 3,200 enterprises—spanning large factories to small workshops—have reported varying degrees of damage. Gampaha district has recorded the highest number of affected establishments, and officials caution that current figures only reflect data already entered into the system, meaning the real scale may be considerably higher.

A fresh geospatial analysis by the United Nations Development Programme paints an even starker picture. It estimates that over 1.1 million hectares—close to a fifth of Sri Lanka’s territory—were submerged during the cyclone, impacting roughly 720,000 buildings. Infrastructure losses are equally severe, with thousands of kilometres of roads, hundreds of bridges, and extensive stretches of rail line damaged or destroyed.

With more than 600 fatalities and economic losses projected to exceed US $1.6 billion, Cyclone Ditwah stands as the country’s most devastating natural disaster since the 2004 tsunami. The UNDP’s findings indicate that more than half of those living in the flooded regions were already in precarious economic situations, suggesting that the cyclone’s aftermath could deepen inequality and prolong recovery for many communities.

Officials warn that while emergency relief is progressing, the scale of destruction means the path to normalcy will be long, demanding both sustained assistance and careful planning to prevent further hardship.

Vatican Extends Support and Sympathy to Sri Lanka After Recent Disaster

December 11, Colombo (LNW): The Vatican has expressed its deep concern for Sri Lanka in the aftermath of the recent calamity, with Pope Leo XIV assuring the country of his heartfelt solidarity.

This was disclosed yesterday (10) by the Chargé d’Affaires of the Apostolic Nunciature in Colombo, Rev Monsignor Roberto Lucchini.

According to Rev Lucchini, the Pontiff instructed him to pass on his personal condolences to all those who have lost loved ones or livelihoods.

He said the Pope had been closely following developments and wished to make clear that the people of Sri Lanka remain in his prayers during this challenging period.

Rev Lucchini added that Pope Leo encouraged the nation to persevere with courage, guided by faith and hope, as communities work towards recovering and rebuilding. He noted that the Vatican stands ready to accompany Sri Lanka spiritually and morally as it navigates the long path to restoration.