December 11, Colombo (LNW): Court of Appeal Justice K. M. Gihan Himanshu Kulatunga has formally taken his seat on the Supreme Court, following a swearing-in ceremony held yesterday morning at the Presidential Secretariat.

President Anura Kumara Dissanayake presided over the event, marking another key appointment to the nation’s apex judiciary.

The brief but dignified ceremony drew several senior officials, including the President’s Secretary, Dr Nandika Sanath Kumanayaka. Attendees noted that Justice Kulatunga’s elevation is expected to strengthen the Supreme Court’s capacity at a time when the judiciary faces a rising caseload and heightened public scrutiny.

Gihan Kulatunga Sworn In as Supreme Court Justice

Thousands Remain in Emergency Shelters After Widespread Landslides and Flooding

December 11, Colombo (LNW): The Disaster Management Centre (DMC) reports that tens of thousands of people displaced by the recent spell of landslides and severe flooding are still living in temporary accommodation.

According to the latest figures, more than 85,000 individuals from nearly 27,000 households have been moved to emergency shelters set up around the country.

In total, 873 refuge centres are now in use, many of them housed in schools, community halls, and religious institutions. Local authorities say conditions are stable but overcrowded in several districts, as continuous rain has slowed efforts to move families back to their homes or begin repairs.

Officials added that relief teams are working to ensure uninterrupted supplies of food, clean water, and essential medicines. Volunteers from civil society groups have also joined the effort, offering logistical support and helping to coordinate welfare services for vulnerable groups, including children, the elderly, and differently-abled people.

Sri Lanka Accelerates Post-Cyclone Damage Survey as Global Aid Rises

December 11, Colombo (LNW): The Ministry of Finance has begun an extensive effort to catalogue the destruction left in the wake of Cyclone Ditwah, with officials saying the initiative will help guide the country’s long-term recovery.

According to Dr Harshana Suriyapperuma, the Ministry’s Secretary, a nationwide data-gathering exercise is now under way to document losses suffered by businesses and properties. The work is being carried out in tandem with local administrative offices and a number of state bodies.

Teams have already been dispatched to the worst-hit communities to obtain detailed, on-site assessments. Dr Suriyapperuma noted that new digital tools would streamline the reporting process, allowing information to reach government planners far more swiftly than in past disaster responses.

An information platform created freely by MillenniumIT ESP—with technical backing from Microsoft—is being rolled out to support this accelerated approach. Officials said the system will form the backbone of the reconstruction strategy over the coming months.

Sri Lanka has also seen a steady inflow of support from abroad. Dr Suriyapperuma highlighted that both financial pledges and material assistance have arrived from a host of partner nations. Australia, New Zealand, the United Kingdom, the Maldives, the United States, Nepal, Switzerland, Canada, Ireland, and Korea, along with global institutions such as the World Bank, IMF, and Asian Development Bank, have reportedly signalled readiness to assist the country’s rebuilding efforts.

In the immediate aftermath of the cyclone, India and Pakistan were among the first to rush supplies, while additional relief—from food essentials to medical items—has since been delivered by the Maldives, Australia, Bangladesh, the UAE, Switzerland, and Qatar. Officials say more contributions are expected as Sri Lanka moves from emergency response to long-term rehabilitation.

Showers, thundershowers expected across Island: Public urged to exercise caution (Dec 11)

December 11, Colombo (LNW): Showers or thundershowers will occur at times in Northern, North-Central, Eastern, Central, and Uva provinces, the Department of Meteorology said in its daily weather forecast today (11).

Fairly heavy falls about 50 mm are likely at some places in Northern province.

Showers or thundershowers may occur at several places in the Western and Sabaragamuwa provinces and in Galle and Matara districts after 1.00 p.m.

Misty conditions can be expected at some places in Sabaragamuwa, Central and Southern provinces during the early hours of the morning.

The general public is kindly requested to take adequate precautions to minimise damages caused by temporary localised strong winds and lightning during thundershowers.

Marine Weather:

Condition of Rain:

Showers will occur at times in the sea areas off the coast extending from to Puttalam to Pottuvil via Mannar, Kankasanthurai and Trincomalee.

Showers or thundershowers may occur at several places in the other sea areas around the island during the evening or night.

Winds:

Winds will be north-easterly. Wind speed will be (30-40) kmph.

Wind speed can increase up to (50-55) kmph at times in the sea areas off the coast extending from Kalutara to Trincomalee via Puttalam and Kankasanthurai.

State of Sea:

The sea areas off the coast extending from Kalutara to Trincomalee via Puttalam and Kankasanthurai will be rough at times.

The other sea areas around the island will be moderate.

Temporarily strong gusty winds and very rough seas can be expected during thundershowers.

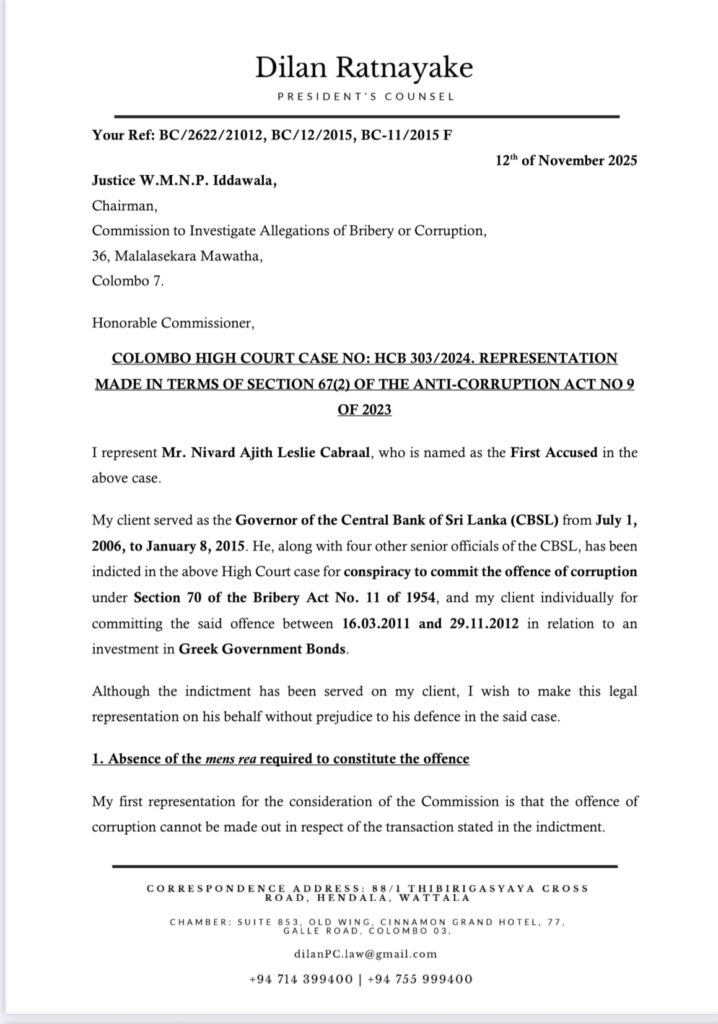

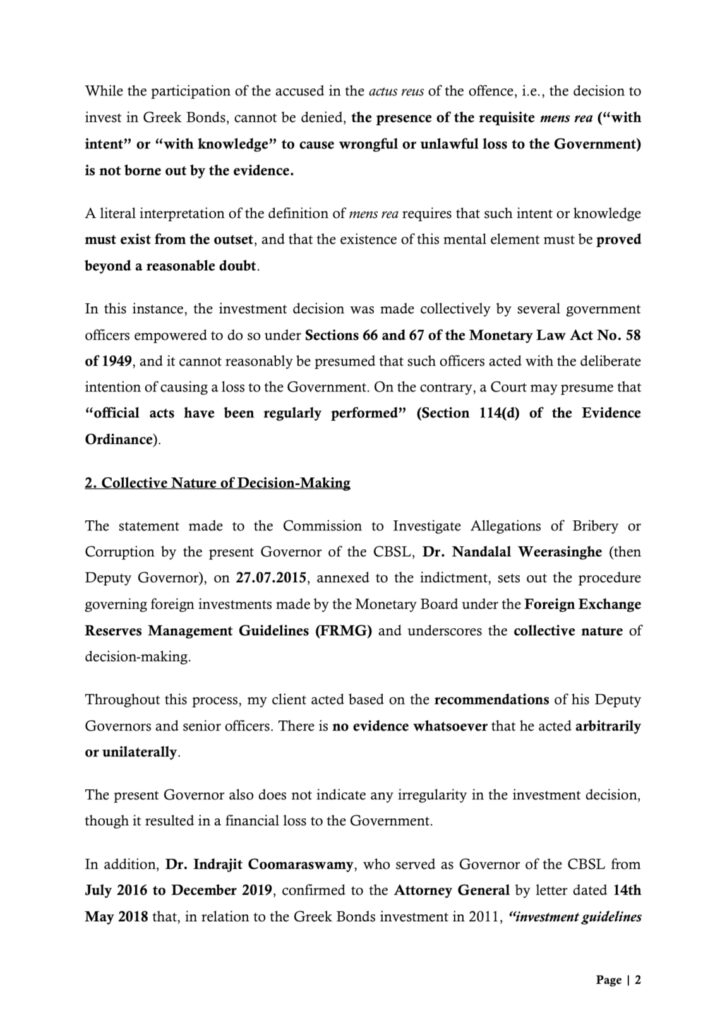

High Court Dismisses Bribery Case Against Ajith Nivard Cabraal and Three Others

December 10, Colombo (LNW): Former Governor of the Central Bank, Ajith Nivard Cabraal, has been granted conditional release in connection with the contentious Greek bond affair, while three co-accused were freed unconditionally by Colombo High Court Judge Mohammed Mihal yesterday.

The case revolves around allegations that, at a time when Greece was grappling with a severe economic crisis, senior officials at the Central Bank allegedly went ahead with the purchase of government treasury bills, reportedly resulting in losses exceeding Rs. 1.84 billion to the state. The Commission to Investigate Allegations of Bribery or Corruption (CIABOC) had originally charged Cabraal along with former Deputy Governor Dharmasena Dheerasinghe and Assistant Governors Don Vasantha Ananda Silva and M.A. Karunaratne.

In proceedings before the Colombo High Court, the indictments against Cabraal were formally considered for withdrawal under Section 67(1) of the Bribery Act. Following a request by Cabraal and a subsequent review by the Director General with CIABOC approval under Section 67(2), the court officially withdrew the charges against him under Section 67(3).

After evaluating submissions, Judge Mihal stipulated that Cabraal could be released under specific conditions, while the remaining three defendants—Dheerasinghe, Silva, and Karunaratne—were freed without any conditions under Section 194(3) of the Code of Criminal Procedure.

The court also directed that Cabraal must pay Rs. 1,843,267,595.65 to an account designated by the Central Bank of Sri Lanka within three months. Should he fail to meet this deadline, the previously withdrawn charges will be reinstated under Section 67(5) of the Bribery Act.

The CIABOC initially filed charges in 2024, but a technical issue concerning the date of the indictments led the High Court to release the accused without formally serving the charges on May 31, 2024. The commission subsequently re-submitted the case on 21 August 2024, leading to the latest developments.

Is Sri Lanka’s national survival truly threatened?

The recent catastrophes must not be viewed as mere unfortunate incidents but as stark teaching provides evidence that the current trajectory is unsustainable

pix by Kushan Pathiraja

The 2022 economic recession, the worst since independence, serves as a stark example. The crisis was not solely a function of global shocks, but a direct consequence of ill-conceived and politically motivated policies

- The recent severe climatic disasters, leading to hundreds of casualties and an estimated economic cost of $6-7 billion

- Clear, early warnings of adverse weather were reportedly received, yet preemptive action and timely evacuation were largely absent

- Negligence of authorities to act on available data highlights a deficit in the intersection of National Security and Political Capability

- Studies show alarming migration rates among science-based graduates, turning a national strength into a foreign subsidy

Sri Lanka, the Pearl of the Indian Ocean, boasts of a history stretching back over 2,500 years, rich with cultural heritage and resilience forged through centuries, including foreign rule from 1505 to 1948. Yet, as the nation moves further from independence, a disquieting question looms: Is the national survival of Sri Lanka fundamentally threatened?

The premise that national survival rests on seven crucial pillars National Economy, National Security, National Culture, National Diplomacy, National Science & Technology, National Intelligence, Data & Innovation, and National Political Capability offers a robust framework for assessment. A careful analysis of recent decades, particularly since 1977, overwhelmingly suggests a systemic decline across these pillars, largely driven by chronic political mismanagement and a destructive prioritization of personal and party interests over the national good.

The deterioration of the seven pillars: Examples of Political Mismanagement

The erosion of the nation’s foundation is evident in a recurring cycle of preventable disasters and crises, all pointing back to failures in governance:

1. National Economy and Political Incompetence

The 2022 economic recession, the worst since independence, serves as a stark example. The crisis was not solely a function of global shocks, but a direct consequence of ill-conceived and politically motivated policies.

Ill-Timed Tax Cuts: The drastic tax reductions in 2019, aimed at political favour, severely depleted government revenue, worsening the structural budget deficit. This contributed directly to the unsustainable debt burden.

The Organic Fertiliser Ban: The sudden, poorly planned shift to a nationwide ban on chemical fertilisers in 2021, despite warnings from experts, devastated the agricultural sector. Rice production plummeted by over 39%, turning the country from self-sufficiency to a need for costly imports, severely impacting National Economy and National Security (food security).

“White Elephant” Projects and Corruption: Decades of dependency on high-interest debt for non-essential or unprofitable infrastructure projects often alleged to benefit political cronies exacerbated the foreign exchange crisis. Allegations of massive corruption surrounding International Sovereign Bond payments and tax revenue manipulation further highlight a breakdown in economic governance.

2. National Security &

Intelligence Failure

The notion that National Security encompasses more than just military defence extending to education, health, and disaster management is tragically validated by recent events.

The Easter Sunday Disaster (2019): This catastrophic event, which claimed over 250 lives, was a monumental failure of National Intelligence and National Security. Multiple foreign intelligence warnings were received, but were allegedly ignored or not disseminated due to political rivalry and a breakdown of communication channels between the President and Prime Minister. This political polarisation and negligence directly enabled a terrorist attack.

The Human Cost of Climate Catastrophe: The recent severe climatic disasters, leading to hundreds of casualties and an estimated economic cost of $6-7 billion, tragically parallel the Easter Sunday failure. Clear, early warnings were reportedly received, yet preemptive action and timely evacuation were largely absent. The negligence of authorities to act on available data highlights a severe deficit in the intersection of National Security (disaster management) and National Political Capability.

3. Brain Drain and the Death

of Meritocracy

The most insidious threat to long-term national survival is the systematic degradation of the public service. Since 1977, a culture of political patronage has meant that critical public sector appointments from heads of state-owned enterprises to key regulatory bodies have been consistently awarded to incompetent political party supporters, relatives, and friends, often bypassing honest, qualified, and experienced officers.

The Impact of Incompetence: This policy of political clientelism cripples the National Science and Technology and National Intelligence, Data and Innovation pillars. When unqualified individuals head technical institutions or manage disaster response, the inevitable result is incompetence that manifests as a national crisis.

The Brain Drain Catastrophe: As a direct consequence, the brain drain, the mass exodus of highly educated and skilled professionals (doctors, engineers, finance experts, university lecturers) has reached historic levels. This loss of human capital is, as suggested, a disaster worse than any natural catastrophe, draining the intellectual engine required for innovation, recovery, and effective governance. Studies show alarming migration rates among science-based graduates, turning a national strength (free, high-quality education) into a foreign subsidy.

A Crisis of National Political Capability

The core of Sri Lanka’s struggle lies in the near total failure of its National Political Capability. The pervasive issue is that the government’s priority has consistently been the protection and consolidation of its political party and cadre, rather than the sincere safeguarding of the country. This can be seen in:

1. Protecting Cadres over Competence: The continued appointment of party loyalists to high positions, even in the face of proven incompetence and corruption allegations, demonstrates a profound failure of accountability.

2. Lack of Sincere Correction: The refusal to correct these fundamental errors sincerely to root out corruption, establish true meritocracy, and enforce the rule of law without political interference ensures that the nation is destined to repeat the cycle of human and resource disasters.

The very survival of the nation is indeed endangered when the political establishment views the state apparatus as a tool for personal and party enrichment, rather than a sacred trust to be managed with expertise and integrity.

Recommendations for the Correct Path: A Teaching Point from Catastrophe

The recent catastrophes must not be viewed as mere unfortunate incidents but as stark teaching provides evidence that the current trajectory is unsustainable. The path to correct this course requires radical, sincere, and systemic reforms across all seven pillars.

Reforming National Political Capability and Governance (The Foundation)

1. Enforce Strict Meritocracy in Public Appointments: Legislate and enforce a robust, non-political, and transparent mechanism for all senior public sector appointments (e.g., via an independent, professional Public Services Commission with mandated criteria). Political influence must be legally criminalised in the appointment process.

2. Strengthen Accountability and Anti-Corruption: Fully implement new anti-corruption laws with independence for investigative bodies. Introduce robust Campaign Finance regulations to enhance transparency and reduce the influence of ‘selected businessmen’ on political decision-making.

3. Restore the Rule of Law and Judicial Independence: Ensure the swift and non-discriminatory prosecution of public officials involved in corruption and negligence, regardless of political affiliation.

Revitalising National Economy and Science & Technology (The Engine)

1. Prioritise Export-Oriented Growth: Shift the focus from import substitution to a productive, outward-looking economy. This requires streamlining the trade and investment environment, reducing unnecessary tariffs, and attracting high-quality Foreign Direct Investment (FDI).

2. Invest in Science, Data, and Innovation: Create a compelling ecosystem to reverse the brain drain. This involves offering competitive remuneration for technical professionals in the public sector, providing R&D grants, and fostering collaborations between universities and industry. The focus must be on leveraging national data and innovation to solve structural problems, not just on generating reports.

3. Implement Responsible Fiscal Management: Establish an independent Parliamentary Budget Office and enact comprehensive Public Financial Management and Debt Management Laws to ensure non-partisan oversight of national finances, preventing a recurrence of the 2022 crisis.

Strengthening National Security (Beyond the Military)

1. Institutionalise Disaster Preparedness and Climate Resilience: Move beyond reactive disaster management. Establish a fully empowered, data-driven, and expert-led national agency responsible for climate change adaptation and disaster mitigation. This agency must have the authority and resources to mandate pre-emptive evacuations and resource allocation based on scientific warnings.

2. Ensure Intelligence and Security Coordination: De-politicise the national intelligence apparatus. Implement structural reforms that mandate clear, non-negotiable protocols for sharing critical security information across all levels of government, ensuring no future security failure is due to political infighting or negligence.

Environmental Protection and Stern Enforcement

The link between political negligence and human cost disasters is clearly visible in the area of environmental management. The increasing severity of floods, landslides, and droughts is often exacerbated by unchecked environmental degradation.

The catastrophic human and economic costs of recent natural disasters make it imperative to treat environmental crimes as a serious threat to National Security. This requires a fundamental shift in the legal and enforcement framework.

Strengthening Laws and imposing severe penalties

While Sri Lanka possesses a legal framework (e.g., the National Environmental Act (NEA), Forest Ordinance, Fauna and Flora Protection Ordinance), the enforcement is widely considered weak and often undermined by political interference.

The Principle of deterrence: Current penalties (often nominal fines) are simply viewed as a small cost of doing business by large-scale offenders. The recommended strict laws must introduce financial investigations into environmental crimes to trace the proceeds and target the financial beneficiaries, ensuring that environmental crimes are treated with the same severity as other high-level economic crimes.

By sincerely implementing genuine meritocracy, enforcing the new anti-corruption laws without fear or favour, and prosecuting environmental offenders with zero tolerance, Sri Lanka can begin to correct the fundamental flaws that continue to endanger its national survival.

Duty over self- interest

Unless the current political class makes a sincere and radical departure from the path of self-interest and party-first politics, no external power, divine or otherwise, will be able to prevent the repetition of disasters that threaten the 2,500 year legacy and, indeed, the very survival of the Sri Lankan nation. The time for genuine, national-interest-driven leadership is not tomorrow, but now.

(The writer is a battle hardened Infantry Officer who served the Sri Lanka Army for over 36 years, dedicating 20 of those to active combat. In addition to his military service, Dr Perera is a respected International Researcher and Writer, having authored more than 200 research articles and 16 books. He holds a PhD in economics and is an entrepreneur and International Analyst specialising in National Security, economics and politics. He can be reached at [email protected],

Rebuilding Sri Lanka: Integrity Must Lead Our Recovery

By Nalinda Indatissa PC

As Sri Lanka struggles to rebuild homes, livelihoods and public infrastructure after the devastating cyclone, another equally urgent task lies before us: rebuilding the economy. Physical reconstruction and economic recovery must proceed together. One without the other would leave the nation vulnerable to repeated cycles of crisis.

At the heart of economic recovery lies one essential element—trust. Whether between citizens, institutions or international investors, trust is the foundation of all business relationships. Corruption destroys this foundation. When decisions are driven not by merit but by hidden payments, approvals become unpredictable, costs are inflated, and competition is distorted. That is why individuals, companies and public bodies must never accept or offer bribes, including facilitation payments.

Global investors are acutely aware of corruption risk. They study governance standards, delays in approvals, and the hidden costs of doing business. When they observe inflated fees, opaque decisions and a system dependent on “connections,” they label the country high-risk and look elsewhere. Sri Lanka’s situation is no exception.

To restore confidence, Sri Lanka must reform its business environment boldly and urgently. Efficiency, transparency and predictability must guide every approval and every investment pathway. The country must revisit its grossly inflated BOI company incorporation charges, which deter investors long before they begin operations. Our long delays in obtaining approvals—whether for construction, investment, or trade—are crippling. A modern economy cannot function when even basic permissions require months of waiting and multiple personal interventions.

The solution lies in strong digitisation. One-stop shops for approvals, digital workflows, and online case-tracking will eliminate unnecessary human contact and vastly reduce opportunities for corruption. A comprehensive digital payment system for government transactions is also essential. Once payments are traceable, corrupt politicians and officials will find it far more difficult to move or conceal ill-gotten black money. Digitisation protects not just the investor, but the integrity of the entire public service.

Our professionals also bear responsibility. Accountants, attorneys-at-law, bankers, real estate agents and company secretaries act as gatekeepers of the financial system. They must demonstrate integrity, refuse complicity, and report suspicious transactions. When professionals turn a blind eye, the entire nation pays the price.

Government institutions, too, must lead by example. Strengthening the Bribery Commission and restoring its independence was an important first step. But institutions alone cannot cleanse a country. The baton must now pass to public sector officials, private businesses, and the general public. Every citizen must recognise that corruption is not a victimless crime—it steals from our future, our children, and our ability to rebuild after disaster.

The younger generation must be taught to reject corruption entirely. Schools should integrate ethics, civic duty and real-world lessons on the costs of corruption into their curriculum. Children must grow up understanding that the shortcuts of today become the national suffering of tomorrow.

Sri Lanka must regularly and honestly evaluate its corruption landscape. Using global indices, investor feedback, audit findings and enforcement data, the nation must measure progress—and be prepared to confront uncomfortable truths. Transparency is essential for real reform.

Today, Sri Lanka stands at a defining moment. The cyclone forced us to rebuild our physical world. Now, the challenge is to rebuild our economic and moral foundations. Our choice is clear: continue with the old path of inefficiency, inflated costs and corruption, or embrace a future grounded in integrity, efficiency and fairness.

If we choose the latter—and commit to it wholeheartedly—Sri Lanka can rise stronger, cleaner and more resilient than ever before.

Rebuild Fund Committee Faces Conflict-of-Interest Firestorm

Sri Lanka’s newly established Rebuilding Sri Lanka Fund created to channel donations and reconstruction financing in the aftermath of nationwide devastation has become embroiled in a governance and ethics controversy within days of its formation.

Civil society organisations, including the Law and Society Trust, say the 11-member Management Committee raises serious questions about inclusivity, transparency, legality, oversight structures and potential conflicts of interest.

The committee is entirely male, dominated by leading figures from Sri Lanka’s top blue-chip companies, alongside a handful of government officials.

Four of the six non-corporate seats are direct presidential appointments, prompting accusations that the process lacked transparency and violated the administration’s own pledge of gender balance, citizen involvement and political diversity.

Critics argue the appointment structure effectively outsources national reconstruction to a Colombo-centred corporate elite at a moment when the country requires broad community consultation, technical expertise and humanitarian representation.

With no women, no regional voices and no disaster-response specialists at the table, activists warn that the Fund’s direction risks being shaped by commercial interests rather than national priorities.

Concerns intensify when examining the Fund’s powers and governance model. The Management Committee is authorised not just to mobilise donations, but to prioritise projects, allocate money, and disburse funds for relief and long-term reconstruction.

This broad mandate places billions of rupees in the hands of business leaders who simultaneously head for-profit entities likely to compete for reconstruction contracts. No legal safeguards or conflict-of-interest declarations have been publicly disclosed.

The government has not clarified whether the Fund is established under a dedicated Act, Gazette, trust deed or emergency regulation leaving the legal structure and accountability mechanisms opaque. Nor has it released financial projections, though senior officials have indicated the Fund is expected to reach tens of billions of rupees in donations and foreign contributions.

Oversight responsibilities rest nominally with the National Disaster Management Council, but its supervisory power remains undefined. There is no publicly-available framework outlining reporting requirements, procurement rules, auditing procedures or parliamentary oversight. Civil society groups warn that without such checks and balances, awarding tenders to companies represented on the committee becomes a real risk.

This controversy comes on the heels of several recent all-male task force appointments, including the Clean Sri Lanka Presidential Task Force and the Archaeological Advisory Committee, raising broader fears of institutional regression at a time when public trust is fragile.

Analysts note that disaster-reconstruction governance is “deeply political,” requiring gender balance, minority representation, humanitarian experience and environmental expertise. By contrast, critics say the current committee risks steering reconstruction towards the interests of “Sri Lanka Inc.” rather than the affected communities.

Civil society groups are now calling on the government to reconstitute the committee, create a legally-grounded mandate, and establish strong transparency measures to ensure recovery spending is fair, equitable, and free from political or corporate interference.

Port City Struggles and Strengths Shape Sri Lanka’s FDI Future

Colombo Port City’s long-promised transformation into Sri Lanka’s first purpose-built services export zone is beginning to take measurable shape, with project officials reporting US$1.3 billion in foreign direct investment (FDI) already secured and a sizeable pipeline under negotiation.

However , behind the upbeat messaging lies a complex mix of fiscal incentives, risk-management mechanisms and early-stage operational challenges that will determine how far the project can influence the wider economy.

Speaking at the Sri Lanka Economic Summit organised by the Ceylon Chamber of Commerce, CHEC Port City Colombo Deputy Managing Director Thulci Aluwihare outlined how China Harbour

Engineering Company’s three-decade presence has evolved from traditional infrastructure contracting into long-term urban development.

The project, originally envisioned as a reclaimed waterfront real-estate venture, was re-cast midway into a strategic services export zone, addressing a major policy gap given that services represent nearly 60% of Sri Lanka’s GDP but previously lacked a dedicated hub.

CHEC has invested US$1.3 billion in land reclamation and infrastructure, with another US$250 million earmarked for Phase Two.

The project has already secured investors for six plots of landalso totalling around US$1.3 billion in commitments while negotiations with another six potential investors could yield a further US$600–850 million over the next three to four years.

The final outcome, however, depends heavily on macroeconomic stability and investor sentiment toward Sri Lanka’s risk profile.

To secure investment flows, Port City Colombo pushed for a fiscal package acceptable to both the Government and the IMF, eventually winning key concessions such as 10–15-year corporate income tax holidays, duty-free imports for construction, exemptions from border taxes, and cost reductions estimated at 20–25% for developers.

These incentives have sparked debate, especially under an IMF programme typically discouraging tax holidays, but Aluwihare argues they are essential to offset Sri Lanka’s weak competitiveness indicators.

Beyond tax measures, the project’s most transformative provisions are non-fiscal incentives designed to shield investors from currency risk and restrictive capital controls—two longstanding obstacles to FDI inflows.

Port City transactions can be carried out in 16 designated foreign currencies, with the Sri Lankan rupee not recognised as legal tender within the zone, effectively providing a hedge against exchange-rate volatility.

The zone also guarantees full capital mobility, 100% foreign employment options and long-term visas.

Despite this progress, implementation difficulties persist. Infrastructure completion has lagged, forcing 155 licensed companies to operate outside the Port City premises using interim arrangements. Even so, nearly 500,000 square feet of commercial space has already been utilised, signalling rising market confidence.

Notably, the project has revived momentum in Colombo’s broader real-estate sector, which had been weakened by the economic crisis.

As Port City approaches operational readiness, its ability to convert its investment pipeline into sustained FDI inflows will be crucial not only for its success but for Sri Lanka’s wider economic recovery strategy.

Moody’s Highlights Sri Lanka’s Weak Climate Resilience and Fiscal Limits

Sri Lanka’s vulnerability to climate-driven economic shocks has been cast into sharp focus as Moody’s Investors

Service warns that the island is likely to absorb the region’s heaviest credit impact from the destructive cyclones and torrential rains that have swept across South and Southeast Asia since mid-November.

The agency said that despite several countries sharing similar physical exposure to climate risks, Sri Lanka’s weak fiscal space and limited resilience mechanisms leave it uniquely exposed.

Moody’s underscores the growing structural challenge facing the region: the absence of adequate natural catastrophe insurance coverage.

With climate disasters intensifying, countries without protection mechanisms face higher reconstruction costs, heavier debt burdens and prolonged economic dislocation. Sri Lanka, already grappling with a debt crisis and fragile public finances, is among the least equipped to absorb these shocks.

Unlike Indonesia, the Philippines or Vietnam all of which Moody’s categorises as having stronger fiscal positions and greater policy flexibility Sri Lanka’s constrained budget leaves little room for emergency response or long-term climate adaptation.

The agency warns that this combination of high exposure and low capacity significantly magnifies the current disaster’s credit implications.

Governance strength, another factor Moody’s uses to assess resilience, also plays a key role. Sri Lanka and Vietnam both carry governance issuer profile scores of 4, signalling heightened vulnerability to institutional weaknesses that can slow recovery and worsen fiscal outcomes. Effective governance, Moody’s notes, is often associated with better climate-risk mitigation and faster disaster response.

Sri Lanka’s recent climate crisis comes on the heels of what Moody’s previously described as a “fragile but progressing” macroeconomic recovery. Tourism inflows, remittances and expectations of a current account surplus through 2025 had supported cautious optimism.

Yet the country’s persistent structural weaknesses including its narrow tax base and heavy reliance on external financing mean that any shock can rapidly erode stability.

Cyclone Ditwah has already added new fiscal pressures, leading the Government to request around US$200 million in emergency support under the IMF’s Rapid Financing Instrument. The Fifth Review of the IMF’s Extended Fund Facility, expected to unlock an additional US$347 million in December, has now been postponed to early 2026 as both sides reassess the post-disaster fiscal landscape.

Moody’s latest warning reinforces a broader message: Sri Lanka must accelerate efforts to strengthen climate resilience, expand disaster insurance coverage and deepen institutional reforms. Without these measures, each new climate event risks pushing the country back into instability, undermining both its economic recovery and its long-term creditworthiness.