- Bangladesh PM Sheikh Hasina seeks Sri Lanka’s support for repatriation of forcibly displaced Myanmar nationals, Rohingyas, to their ancestral lands in the Rakhine state of Myanmar: support sought when Foreign Minister Ali Sabry paid a courtesy call on her.

- Institute of Builders President Dr. Rohan Karunarathna says it’s “pathetic” for Govt to say the industry will have no work over the next 2 years: likens it to disruption caused by the ban on chemical fertiliser: claims over 600,000 persons have already been laid off: says it’s amusing how Govt anticipates these persons to survive on Rs.5,000 a month, after earning up to Rs.70,000.

- State Finance Minister Ranjith Siyambalapitiya says travellers won’t be permitted to bring gold jewellery exceeding 22 karat gauge without approval of the Controller of Import & Exports: also says this decision will stop smuggling: claims smugglers illegally bring at least 50kg of gold per day, leading to a loss of USD 30 mn of forex per month.

- Commissioner General of Examinations reports 231,982 candidates who sat the GCE (O/L) exam in 2021 have qualified for GCE (A/L): 10,863 have obtained As in all subjects: results of 498 candidates temporarily suspended.

- Former CB Governor Ajith Nivard Cabraal says ISB payment of USD 500 mn on 18th January 2022 was a Parliament-approved and budgeted debt repayment for 2022: also says such payment can’t be legally stopped by him: queries whether those who urged Sri Lanka to default are now taking responsibility for the serious repercussions that are following the default.

- Analyst Kusal Perera predicts over 30% of school children numbering about 1.4 mn will drop out of school in the beginning of next year due to their families being unable to have even 2 meals a day: attributes situation to Sri Lanka carrying out conditions laid down by the IMF.

- SJB MP Buddhika Pathirana alleges a large sum of money is earned by 2 political parties within the Govt by giving liquor licences to supermarkets: claims the alleged racket is carried out by a few officials at the Finance Ministry & Excise Dept.

- TNA MP Sumanthiran says Budget does not present a way out of the economic crisis: expresses concern that it allocates heavily towards defence: also says TNA refrained from voting against because the President had indicated he is willing to resolve the longstanding national question.

- Chairman of Cricket Selectors, Pramodya Wickremasinghe lashes out at his former skipper Arjuna Ranatunga: reminds that Captain Dasun Shanaka’s men clinched the Asia Cup: also says if the Sports Minister want his resignation, he will submit it, provided a valid reason is given.

- Central Bank data shows Govt Debt has increased by at least Rs. 3,900bn from 1st April to 25th November 2022 (239 days): total debt up from approximately Rs.21,700bn to approximately Rs.25,600bn, during that period: increase works out to a staggering Rs.16.3bn per day.

Sri Lanka Original Narrative Summary: 27/11

Anwar: Not Malaysia’s Mandela, but something more

By Krishantha Prasad Cooray

Something extraordinary happened in Malaysia this week. After a bitterly fought general election with no clear winner, the King had the wisdom and the courage to appoint Datuk Seri Anwar Ibrahim as Malaysia’s 10th Prime Minister. To those observing from the outside, it was a remarkable sight. So, one can only imagine the gravity of the moment from the point of view of Malaysia’s new Prime Minister.

Anwar Ibrahim travelled to Istana Negara for the ceremony on Thursday from Sungai Long with his wife, the accomplished and independently remarkable Datuk Seri Dr Wan Azizah Wan Ismail, who for 24 years, has taken her husband’s crusade against corruption and bigotry in Malaysia and made it her own. When Anwar was imprisoned, she stood in for him and embodied his cause with an authenticity and ferocity that saw her become Malaysia’s first ever female opposition leader.

When they arrived at the ceremony, one of the many dignitaries assembled for Anwar’s swearing in was Malaysia’s Chief Justice, Tun Tengku Maimun Tuan Mat, the first woman to hold that office, who herself has long stood out as a judge with little patience for corruption or abuse of power. Whether in the 1MDB appeals or in holding firm against other powerful special interests, she has embodied the kind of judicial independence for which Anwar has fought.

As Anwar, the Prime Minister in waiting, took the instrument of his appointment into his hand and began reciting his oaths, he must have felt the weight of every word he swore of the pledge he has long dreamt of taking. Perhaps no Malaysian politician has distinguished himself on the world stage as Anwar did as Malaysia’s finance minister between 1991 and 1998.

His outstanding performance in transforming the Malaysian economy and navigating the perils of the 1997 financial crisis, while lauded across the globe, threatened entrenched interests, leading not just to his sacking and repeated imprisonment, but to a systematic 24-year long campaign to tear him down, destroy his name, and vanquish the causes of good governance and egalitarianism that he stood for. It was a campaign that was almost comical in its corruption.

Beginning in September 1998, every time it ever looked like Anwar was raising his head and might score a major political victory, either an arrest, a court ruling, gerrymandering or some other element of state machinery interceded to intercept him and keep him from power.

His multiple imprisonments on what the world agrees are trumped up charges are well known, as is the black eye bestowed on him by the fists of Malaysia’s chief of police. However, it is often forgotten that his Pakatan Rakyat won a 51.4% majority of the popular vote at GE13 in 2013, “losing” the election in practice only because of the first past the post electoral system by which the votes were apportioned. Whatever else Malaysia’s elite entrenched special interests disagreed about, they all seemed to agree on one thing: stopping Anwar at all costs.

Most of those who sacrificed their conscience and integrity over the years to keep Anwar down are now out of the spotlight, shunned by the electorate, recognized for their crimes by the judiciary, or cast aside by their political handlers once their utility expired. None were present in the corridors of power at the royal ceremony last Thursday to witness the totality of their failure.

It was heartening to see the local markets react to Anwar’s appointment with the biggest rally they have shown in two years, and to see the world market respond through the Ringit seeing its best day in the currency market since 2016. As Anwar prioritizes tackling the skyrocketing cost of living for ordinary Malaysians in the backdrop of a looming global recession, these signals of confidence are a promising sign.

As he begins to combat poverty while forming his cabinet and steering a fragile coalition, the new Prime Minister will have to grapple with bringing about good governance, combatting corruption and ensuring judicial independence. With corruption as deep-rooted as Anwar himself has charged, he should expect and be prepared to combat the fiercest opposition and subterfuge. To those who live on graft, this is not just a matter of policy. They stand to lose everything, their livelihood and their liberty, if he succeeds.

It is difficult to argue against anti-corruption initiatives or transparency in government, so his opponents will try, as they did throughout his time in the opposition, to paint Anwar as an outsider, unpatriotic, anti-Malay, anti-Islam. It will be up to Anwar and those around him to ensure that from the bully pulpit of the Prime Minister’s office, he can show a larger swath of Malaysians who he is and unite them.

Anwar has the most essential quality of a unifying politician, in that he is a “we” politician and not a “me” politician. Notwithstanding the formidable cult of personality that has been built around him, he is quick to redirect any personal praise or flattery by sharing credit with others and putting them in the spotlight and doing so with a humility and sincerity that endears him to other leaders.

While Anwar Ibrahim is fond of calling himself a ‘village boy’ due to his affection for the simplest pleasures of life, there is nothing simple about his pedigree. He was born with UMNO in his blood, with an UMNO parliamentarian for a father and political organizer for a mother. He is accused of being anti-Malay for his egalitarian politics, even though his entire undergraduate education was devoted to the study of Malay culture, history and literature. The idea that he would oppose the legitimate interests of Malays is unthinkable.

So it is important that he succeed as Prime Minister where he failed as a candidate, in persuading more Malay people that they have nothing to fear from him. In fact, their interests are better served by a level playing field that would enable them to thrive and compete not just in the shelter of the cosy, subsidized affirmative action bubbles that other parties have tried to woo them with, but in the world at large.

Anwar’s in-depth study of the Bible does not make him any less devout a Muslim, but a stronger, more confident one. An unapologetic ally of the Palestinian people, Anwar’s opposition to the suffering imposed by Israelis on Palestinians is only sharpened, not blunted, by his assertion of Israel’s right to exist. He is confident in who he is. Even torture, and years spent in the darkest depths of solitary confinement in a gruesome prison cell were not able to make him waver in his values or political principles.

It is already evident that Anwar’s appointment has raised Malaysia’s standing in the world. Several governments who either vocally or privately protested the way he was treated over the last quarter century have responded to his appointment with a new vigor and eagerness to engage with Malaysia and deepen political and economic ties with the country. Anwar demonstrated in opposition that he has a gift for advocating for Malaysia on the world stage. As Prime Minister, this is a gift that will serve him in good stead.

Wherever they sit on the political spectrum, no Malaysian could deny the sincerity that Anwar brought to his first press conference on Thursday following his appointment. He means to do the job, and do it well, responding thoughtfully and obediently to the King’s direction to form a unity government. He has clearly taken to heart the words of the monarch that “those who won did not win everything, and those who lost did not lose everything.”

The lesson in that message for every politician is that Malaysians are sick and tired of political knife fighting, of “moves”, from Kajang moves to Sheraton moves. No doubt some confederacy of politicians are already plotting the next creative ‘move’ to bring Anwar down, but they may find themselves outmatched by history.

Pundits have quipped that Anwar’s journey this week was one of “prison to palace”, forgetting that he earned that particular honor on 16 May 2018, when he was released from prison and had to deal with the dizzying experience of being driven directly to the palace for an audience with then Yang di-Pertuan Agong Muhammad V. He has been dubbed Malaysia’s “Nelson Mandela” as both men were imprisoned for their politics and came to power soon after. But such reductions do little service to Anwar, whose time in prison, as horrific as it was, is not what defines him or best qualifies him to govern Malaysia in such perilous times.

Prime Minister Anwar was born Malay and has always been a devout Muslim. Unlike the African Mandela in white apartheid South Africa, Anwar was born to power. And he was not directly elected to his office by a clear majority as Mandela was, but instead, Anwar was appointed Prime Minister after no one won a majority. He is not Malaysia’s Mandela, or Malaysia’s Barack Obama. But history has examples more fitting of Anwar’s pedigree, principles and intellect.

There was another politician once, who, like Anwar, had the privilege of sailing into politics through an established political party. That politician too, like Anwar, was from the majority community, but over time grew to vocally oppose discriminatory policies and helped form a new political party. That politician too, like Anwar, was an accomplished orator and compelling communicator. And he did not directly win nomination for the American presidency in May 1860. Instead, he was selected following much debate after no candidate secured a clear majority. And just like Anwar will have to do in the coming days, President Abraham Lincoln had to assemble a broad coalition, a team of rivals, to get his country through the most perilous of times.

Prime Minister Anwar shares other qualities with America’s most revered President. Lincoln too was known for having little patience for pettiness, and to extend a hand of friendship to sworn rivals. The American President’s devotion to his children was also legendary. Anwar rarely responds to questions about his ordeal in prison without sharing his anguish that his five daughters and only son had to endure in watching their father suffer and be persecuted.

Having either taught or studied at schools of the calibre of Oxford, Georgetown and Johns Hopkins, an astute student of history such as Prime Minister Anwar has no doubt already drawn some of these parallels and knows how to take the right pages out of Lincoln’s book to thread the political needle and form a stable government. As a battle-tested politician, there is little doubt that if any Malaysian can rise to the challenge and hold together a team of rivals, it is Anwar Ibrahim.

For Anwar to truly succeed, he will have to transform Malaysian politics and bring about the paradigm shift in Malaysia’s political culture that his supporters have rallied behind for so long. Anwar may be the first Malaysian Prime Minister since independence who does not plan to leave behind a legacy for his children of titles, property, monuments or fortunes.

Anwar’s own oldest daughter, Nurul Izzah Anwar, in her congratulatory message to her father, said that the legacy she expects to be left for the next generation is not a material one, but one of “ideals, principles and values that cannot be bought or sold.” Over the last 24-years, Anwar, his family, his party, and their supporters have braved unimaginable odds to take this simple message to Malaysians.

Whatever policy compromises Anwar may have to make to assemble a stable coalition government, he, like Lincoln, will be defined by whether he is able to remain true to his core principles while governing effectively. After so many years of struggle, so many years of trying to awaken Malaysians to the future that could await them if they unleashed the potential of all Malaysians and empowered grassroots industries and businesses to thrive, Anwar will finally get a chance to show them through deeds instead of words.

Sri Lankan Monetary Policy – A White Collar Public Crime?

The Monetary Board at its meeting held on 23rd has decided to maintain its policy interest rates at current levels of 14.5% and 15.5%, despite the continuance of hyper-inflationary pressures. The contents of the press release issued on 24th are clear evidence that the Monetary Board has no clue whatsoever as to what the monetary policy should be for the bankrupt Sri Lankan economy in terms of the public mandate given by the Monetary Law Act.

Therefore, the purpose of this article is to establish the meaninglessness of the monetary policy as revealed from the contents of its press release. My comments are given below under 6 categories of contents in the press release.

Overall, the press release is formal evidence for Monetary Board’s inability to carry out a sort of monetary policy to assist the government and general public to recover the economy from the current bankruptcy caused by the monetary policy itself. Therefore, the mandate given to the Monetary Board by the Parliament through the Monetary Law Act is meaningless and non-operative in the current context.

1. Maintenance of tight monetary policy to contain any demand driven inflationary pressures in the economy

- The Board noted that the maintenance of tight monetary policy stance is necessary to contain any demand driven inflationary pressures in the economy, while helping to further strengthen disinflation expectations, thus enabling to steer headline inflation towards the targeted level of 4-6 per cent over the medium term.

- The Board was of the view that the prevailing tight monetary policy stance is necessary to rein in any underlying demand pressures in the economy.

My comment

- The Monetary Board is not sure about whether there is demand driven inflationary pressures in the economy. Therefore, it refers to any demand driven inflationary pressures.

- In fact, demand driven inflationary pressure should prevail only if the money stock/monetary liquidity rises in real terms faster than the growth of production/supply. The inflation believed by central banks for the monetary policy is a situation when the demand for goods and services carried by monetary expansion rises faster than the supply.

- However, the present contraction of the supply/economy is around 9%-10%. The YoY contraction of the real money stock in September is 32.3%. While the contraction was 2% in January, it has accelerated since May (i.e., 14.8%).

- Therefore, there is no demand driven inflationary pressures in the economy. Wording in the press release is a routine one without any facts.

- Disinflation expectations are not supported by any research. Therefore, statement that tight monetary policy will strengthen disinflation expectation is baseless as nobody except the Central Bank economists believes in the monetary policy to control inflation in modern monetary/financial economies.

2. Envisaged Disinflation

- Supported by favourable supply side developments and tight monetary policy measures, headline inflation pivoted towards the envisaged disinflation path in October 2022, after passing the peak in September 2022.

- The deceleration in inflation is expected to continue in the ensuing period, supported by subdued aggregate demand pressures, expected improvements in domestic supply conditions, normalisation in global commodity prices, and the timely passthrough of such reductions to domestic prices, along with the favourable statistical base effect.

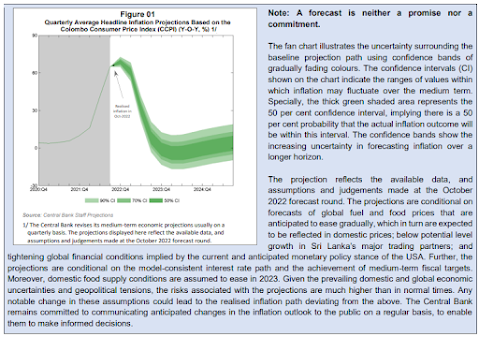

- Global as well as domestic risks to the inflation outlook in the near term are tilted to the downside, thereby supporting the disinflation path (Figure 01) and stabilising inflation at the desired levels towards the end of 2023.

My Comments

- Reported marginal decline in inflation (or cost of living index) in October is due to momentary easing of few food items with a high weight in the cost-of-living basket and, therefore, it is not a reversing trend from a such a high level of inflation above 70%.

- There is no information on global inflation to ease soon. Therefore, all central banks are still raising interest rates. The Fed raised interest rates by 75 bps on 2nd November although inflation started falling since June (i.e., from 9.0% to 7.7% in October). The Central Bank of Sweden also raised interest rates by 75 bps on 24th November.

- Worlds in the press release such as subdued aggregate demand pressures, expected improvements in domestic supply conditions, normalisation in global commodity prices and the timely passthrough of such reductions to domestic prices which are used as reasons for disinflation are meaningless worlds because no evidence has been produced.

- The favourable statistical base effect given as a reason for the decline in inflation is not a macroeconomic case to analyse inflation. It shows that inflation is a statistically flawed number, not having any macroeconomic rationale.

- Wording of stabilization of inflation at desired levels towards the end of 2023 is highly meaningless. The supporting figure/chart given in the press release is highly unacceptable as it mentions that the inflation forecast given is neither a promise nor a commitment (see Figure 01 below). If the forecast is neither a promise nor a commitment, monetary policy taken on such forecasts has no basis. The public credibility and accountability of monetary policy have no grounds if policies are taken based on such meaningless information.

- Talking about desired levels of inflation without specifying those levels is meaningless.

- Further, no country has experienced stability in inflation. Even if statistical inflation falls to monetary policy targets of 4%-6%, it is still an increase continued on levels of skyrocketed prices. Therefore, stability in inflation will not reach unless prices fall in general to pre-crisis levels.

3. Contraction of the Economy

- The real economy is expected to contract in 2022 impacted by the stability-oriented policy measures that led to tightened monetary and fiscal conditions, along with supply side constraints and prevailing uncertainties, among others.

- Nevertheless, economic activity is expected to make a gradual, yet sustainable recovery, supported by envisaged improvements in supply conditions, improved market confidence, and the impact of corrective policy measures being implemented to stabilise the economic conditions.

- Outstanding credit extended to the private sector by commercial banks is expected to have contracted for the fifth consecutive month in October 2022, reflecting the impact of increased market lending interest rates and the moderation in economic activity

My Comments

- The contraction already experienced is due to the monetary policy failure of the Central Bank (i.e., loss of control over foreign reserve, exchange rate and debt management) that disrupted the supply side.

- If stability-oriented policy measures have contracted the economy, such policies are public crimes and, therefore, those who are responsible should be prosecuted. Stability policies in fact are to help the public avoid bad outcomes for living standards.

- So called “corrective policy measures implemented to stabilize the economic conditions” cannot help sustainable recovery as they are hurdles to the economy. They have already contracted the economy. Tightened fiscal condition is not because of stabilization policy but because of liquidity problems caused by debt default and bankruptcy.

- If the credit to the private sector has contracted by high interest rates, the recovery cannot be expected. Credit has declined not because of interest rates and moderation in economic activities, but because of private business bankruptcies and risk aversion by banks due to high default risk. In fact, the economy has not moderated but contracted significantly.

- Improved market confidence is just a rosy word not supported by data. An economy with default of debt, interest rates around 30% and no foreign reserve cannot have market confidence or a recovery.

4. Persistent anomalies in the interest rate structure

- Market deposit interest rates have also risen notably disproportionate to the adjustment in the policy interest rates.

- The continued excessive upward adjustment in market interest rates, despite the improvements in domestic money market liquidity and the deceleration of inflation, has resulted in persistent anomalies in the interest rate structure.

- Going forward, the anomaly in market interest rates is expected to be rectified, benefiting mainly from the notable reduction in the overall money market liquidity deficit and the anchoring of inflation expectations in line with the envisaged disinflation path.

- Meanwhile, yields on government securities are showing some signs of easing recently, and are expected to moderate further.

- Further, the high-risk premia attached to the yields on government securities are expected to shrink in the period ahead as the debt restructuring process progresses and fiscal sector performance improves with the consolidation measures in place.

- The Central Bank would expect a moderation of excessive market interest rates, in line with the prevailing policy interest rates. If an appropriate downward adjustment in the market interest rates would not take place in line with the envisaged disinflation path, the Central Bank will be compelled to impose administrative measures to prevent any undue movements in market interest rates.

- However, the Board noted with concern the anomalous rise in market interest rates, particularly deposit interest rates and short-term lending interest rates, despite the recent improvements in overall money market conditions and the adverse implications on business and economic activity.

My Comments

- Central banks do not have a system to describe differences in market interest rates based on policy rates because central banks are not aware of the risk premium underlying each layer of interest rates. Interest rate structure is only a conceptual tool to analyse trends of interest rates and risk premia across classes of credit and investments. Therefore, anomaly or rectification of anomaly referred to in the press release has no basis.

- Yields on government securities are determined by the Central Bank largely through direct purchase of Treasury bills and not by market factors. Therefore, easing in yields referred to the press release is also an act of the Central Bank. Further, easing is only a difficult few basis points.

- High risk premia on yields on government securities cannot shrink as debt default cannot be rectified and so-called fiscal consolidation is not achievable. However, if the Central Bank cuts policy interest rates, the yields also would follow as it is the reality.

- The significant increase in deposit rates is due to the Central Bank’s force unnecessarily applied on banks. In fact, the Monetary Board has issued an order requiring banks to raise deposit rates under the false premise that deposit mobilization would curtail aggregate demand and ease inflationary pressures. However, inflation sharply accelerated from 18.7% in March to 69.8% in September. The reality behind high deposit rates is the bank investment out of deposits in government securities at yields of 30%-32% at auctions plus guaranteed private placements at the weighted average auction yield.

- In present overnight-interbank based monetary policy models, central banks can control only policy interest rates through money printing. They cannot control any other interest rates unless they print money for those credit sectors. This happens in Sri Lanka only for Treasury bills. Therefore, the reference to imposition of administrative measures to control market interest rates is only a bluff. The Central Bank attempted to do this twice in the recent past, but it miserably failed.

- The market liquidity cannot improve under present level of tight monetary policy unless Central Bank prints money. The acute shortage of liquidity in the banking sector and government is revealed from rising overnight lending to banks and Central Bank direct subscriptions to Treasury bill issuances. it is reveled that, despite the ultra tight monetary policy, the Central Bank lends to banks through term reverse repos to help resolve systemic liquidity problems.

- The monetary policy does not have psychological tools to anchor inflation expectations of the pubic. This is a term just borrowed from western monetary policy rhetoric.

- Financial loss caused by a 8% hike in policy rates so far from April to the public on government debt alone will be multi-trillions if same argument raised against bond auctions carried out in 2015 is followed.

5. Exchange Rate Stability

- The merchandise trade deficit for the ten months ending October 2022 contracted significantly, owing to the robust export earnings and a substantial decline in import expenditure due to policy measures taken to curtail demand for imports, amidst the shortage in foreign exchange

- Amidst the improvements observed in liquidity in the domestic foreign exchange market, the Central Bank continued to facilitate the import of essential goods to ensure the availability of energy, power and other supplies necessary for uninterrupted economic activity.

- Workers’ remittances are expected to improve in the period ahead with rising departures for foreign employment, while the tourism sector is set to mark an improvement in view of the upcoming season for tourist arrivals.

- Risks to external demand could emerge amidst moderating global growth prospects in the near term, however, rising prospects of the tourism sector and workers’ remittances would help offset any negative spillovers to a large extent.

- Meanwhile, the exchange rate remained broadly stable.

My Comments

- Everybody knows that tourism and workers’ remittances cannot address the acute foreign currency problem in the economy and risk to external demand/acute shortage of imports.

- Whether rising departure is for foreign employment is not supported by figures. Further, whether those will send remittances through official channels is not certain.

- Everybody knows that the exchange rate from May onwards does not have any market element. Therefore, exchange rate stability is only a result of administrative fixing of the rate unlawfully by the Central Bank and does not have any macroeconomic background.

- It is well known that the foreign currency reserve is at rock bottom without any improvement. Therefore, notation of improved domestic foreign exchange market stability is not true and economic activity continues to be heavily interrupted by acute shortages of foreign currency and imports.

- Reference to contraction of merchandise deficit is meaningless as its a forced action on import controls and does not have any importance to the monetary policy. What matters for the economy and monetary policy is the overall BOP balance. For 9 months so far in 2022, the overall deficit has continuously risen to 2,927 million US dollars as compared to 2,573 million US dollars for corresponding period in 2021. This means higher foreign borrowing from various official sources.

- Therefore, there is no rationale for the Monetary Board to talk about improvement in domestic foreign exchange market and exchange rate stability under the monetary policy.

6. False Promise of Price Stability and Financial System Stability

- At the same time, the Board reiterates its continued commitment to restoring price stability and ensuring financial system stability, and remains confident that inflation would follow the projected disinflation path underpinned by the prevailing monetary policy stance, while supporting the economy to reach its potential over the medium term.

My Comments

- It is an illusion that the present monetary policy that has bankrupted businesses and supply side would help disinflation path from present hyper-inflation prevailing around 70% seen among few countries in the world. Monetary policy will help reduce inflation only in economies with high growth, not in depressed economies. Therefore, the Monetary Board cannot have policy measures for restoring the price stability as it has lost almost all monetary policy instruments other than printing of money to bailout the government on daily basis.

- Smokes of financial system instability are flowing out everywhere although the Monetary Board is not aware, despite its white collar macroprudential surveillance mechanism. Foreign currency crisis is not expected to ease any soon. The worsening plight of high non-performing loans due to bankrupt economy is a sure way to cause a banking crisis as the Central Bank does not have any policy strategy to resolve the non-performing loan problem. The high dependence of bank assets on government securities is a sure way to banking crisis on concerns over domestic debt restructuring and rollover risks. In the event of a financial crisis, the Central Bank does not have any crisis resolution package as fiscal measures are not available at present.

- It is common practice for all central banks to boast about financial system stability until a financial crisis hits. then, they will start blaming other. The current plight of the economy reflects enough signs of a banking crisis caused by various roots including non-performing loans, illiquidity and shadow banking.

Overall Observations

- Above analysis shows that the public cannot expect a policy stimulus from the Central Bank to recover from the bankruptcy.

- The economic immune system of the economy is lost as the respiratory system, i.e., financial blood circulation, has been blocked by monetary policy and default on debt. Therefore, public economic welfare will be lost for decades as the political leaders do not have any interest in other than taking care of their personal welfare. Therefore, such bureaucracy can continue as white collar criminals who destroy living standards by unfounded monetary concepts developed in tribal economies.

- Undefined words and expectations given in the press release clearly shows the Monetary Board operating without a purpose for the general public.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 10 Economics and Banking Books and a large number of articles publish.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

Economy Forward: https://economyforward.blogspot.com/2022/11/sri-lankan-monetary-policy-white-collar.html

Tamil political parties propose three conditions for power devolution

An agreement has been reached between President Ranil Wickremesinghe and Tamil political parties of the North and East to propose three conditions on the move of power devolution. The agreement has been reached yesterday (25) evening in Colombo, said Spokesman of the Tamil National Alliance (TNA) M.A. Sumanthiran.

“The President spoke of power devolution and the new Constitution. Therefore, we talked with the Tamil political parties representing the North and East provinces today. We are hoping to hold discussions with other parties later. Today, we have identified three factors affecting power devolution,” Sumanthiran said.

He went on: “First, the process of acquiring lands must be stopped immediately. Those acquired in that manner must be released immediately.

Second, all laws pertaining to power devolution in the Constitution must be enacted. The provincial council election must be held.

Third, the power devolution must be carried out via the adaptation of a new Constitution in a manner by which the power is devolved in the North and the East, where Tamil people have been living since the beginning of time. That system must be in effect to other parts of the country as well.”

MIAP

Govt opens digital space for youth to earn dollars working from home

The government has embarked on a formal program to strengthen the banking system in order to establish the financial stability of the country, President Ranil Wickremesinghe said.

Emphasizing that he is in no way ready to turn Sri Lanka into a beggar country, the President stated that we as Sri Lankans must stand up with our own efforts and that the necessary program has been presented in this year’s budget.

The President mentioned this while addressing the function held Wednesday (23) at the Bandaranaike Memorial International Conference Hall to commemorate the 86th birthday celebration of late Minister Lalith Athulathmudali.

Pointing out that Mr. Lalith Athulathmudali’s perception is to elevate Sri Lanka to the top of the international arena, the President further mentioned that he will establish a university named after Mr. Lalith Athulathmudali in Sri Lanka in the future for the study of post-graduate courses.

A digital space was also introduced at the occasion by the Lalith Athulathmudali Foundation to provide the Sri Lankan youth with the facility of independent access to the international market.

This project called ‘Lanka Dollar’ was launched recently to mark the commencement of a digital platform that enables Sri Lankans to earn foreign exchange from home.

‘Youth to Globe’ digital platform especially caters to youths to work for foreign employers without leaving the country.

President Ranil Wickremesinghe was the chief guest at the launch that was held at the BMICH in Colombo at the invitation of former minister Ravi Karunanayake as the chairman of the Lalith Athulathmudali Memorial Foundation.

Delivering a lecture on the occasion to commemorate the late politician, the president said the project would give a great boost to build a digital economy and for youth development

Karunanayake said in his speech that ‘Youth to Globe’ would be a turning point in the revolutionary journey brought about in higher education by the late Lalith Athulathmudali through his Mahapola scholarships.

The project aims to improve language, technical know how and other skills and to provide consultancy and coordination services for work-from-home international jobs.

Networking and promoting the field’s professionals and to act as an influencer in related decision-making are its other purposes.

The core objective is to retain the country’s human resources and to be a key source of foreign exchange earnings with the minimum use of resources.

This project by the Ceylon Global Trust will be assisted by the local branch of the International Chamber of Commerce (ICC) with consultancy services offered by local and foreign experts

UK steps into to strengthen the food security of Sri Lanka small fishermen

The United Kingdom has stepped in to provide humanitarian aid in cash for Sri Lankan fisher community in dire straits.

They have lost their livelihood because of the high costs borne by the fishermen to bring the catch ashore and the slumping prices are putting the entire industry at risk, mainly because the demand is very low.

Usually, more than 200 to 300 Sri Lankan fishing boats set out to sea, however after the economic crisis hit, coupled with an acute shortage of fuel most of the Sri Lankan fishermen have been forced to tie up their boats to the piers, hoping for better days.

“The demand for fish had slumped. The main reason for this is the high cost of fuel and the rising cost of living. A liter of fuel that cost only Rs. 70/- before is now almost Rs. 400/-. The catch has dropped, but the price does not increase because the demand is low,” several fishermen said.

The United Kingdom, through the Food and Agriculture Organization (FAO) of the United Nations is providing GBP 880,000 (USD 1,043,395) to strengthen the food and nutrition security of marginal fishers in Tangalle, Negombo, Colombo, Kalutara, Galle, Matara, Puttalam, Chilaw, and Mannar of Sri Lanka.

In light of World Fisheries Day (November 21) being celebrated this week, the British High Commissioner to Sri Lanka, Sarah Hulton OBE announced the support stating “We recognize that the fisheries sector in Sri Lanka has been going through a very difficult period.

The UK is contributing £880,000 to help address some of the challenges faced by those working in this industry. The support will focus on increasing access to nutritious food and other essentials for families.”

FAO will utilize the contribution of the British government to support over 5,000 small-scale marine artisanal fishers using non-motorized traditional boats, who have traditionally been amongst the poorest within the fishing community.

Eligible fishers will receive US$ 47 per month for a period of 3 months in unconditional cash transfers to help affected households meet their essential needs, including immediate food and livelihood requirements.

Minister of Fisheries Douglas Devananda appreciated the support extended to the fisheries community. “Fish has traditionally been a primary source of protein and a major source of foreign exchange earnings for the country.

He noted that everyone must stand with the fishing community during these times to ensure they can continue their valued work which contributes to the food security and financial stability of the country. he thanked the British government and FAO for supporting the community.”

Speaking on the initiative FAO Representative for Sri Lanka and the Maldives, Vimlendra Sharan stated: “Small-scale fishers have been faced with multiple challenges this year.

Reduced fishing days a week, decreased fish catch, and reduced demand due to the fall in purchasing power in rural areas have all significantly impacted this group

Laws allowing SAMURDHI and Field Officers to contest elections to be enacted

The Cabinet has approved the proposal of allowing SAMURDHI and Field Officers to contest election and Prime Minister Dinesh Gunawardena in his capacity as the Minister of Public Administration, Home Affairs, Provincial Councils and Local Governments has instructed the Additional Secretary of the Ministry of Local Governments and its Legal Officer to adopt the legal basis in this regard.

The move was made when the Ministerial Advisory Committee on Public Administration, Home Affairs, Provincial Councils and Local Governments was convened two days ago (24) under the patronage of the Prime Minister.

Based on the Cabinet approval on field officers being able to contest elections within their own constituencies, the Law Drafting Department has been informed for an amendment on October 19, ministerial officials disclosed.

MIAP

Sri Lanka starts mechanization of tea plucking to tackle labour shortage

Sri Lanka’s Regional Plantation Companies are experimenting with mechanization like use of shears for harvesting tea has led to better yields as they struggle to improve labour productivity amid losses caused by low prices.

In order to improve the plucking efficiency and to overcome the shortage of pluckers, more and more estates are resorting to the use of harvesting shears.

“It is expected that the use of the shears will mitigate this anomaly to some degree but greater effort is required to catch up with the outputs of other countries.”

Sri Lanka’s Tea Board has initiated mechanized tea harvesting as fear of labor scarcity in the industry with no quality or production loss is expected, E.A.J.K. Edirisinghe, Commissioner of the Tea Board said

He said the Tea Research Institute (TRI) has already carried out research collaborating with Japan, and identified that efficiency can be improved, while preserving the same production capacity in estates.

“Machine plucking and hand plucking are two different techniques and when you do hand plucking only, the best buds will be plucked.

When plucking from the machine, we will train the tree for the machine by grooming the tree,” Edirisinghe told reporters at a media briefing on Thursday (24).“Then every 15 days, there will be new buds because of the way we groomed the tree.”

He said currently 55 lands in each TRI division have been cultivated with a motorized tea harvesting model and the cultivators are asked to grow according to the new model.

However, in a publication last year, the TRI mentioned that none of the mechanized harvesting machines tested in Sri Lanka could harvest tea shoots selectively, leaving tender shoots on the bush.

The harvested crop contained mature foliage and twigs etc. which were to be removed by manual sorting.

Average output of machines is in the range between 50 (small machines) and 350 (large machines) kg/day. But, the sorting and cleaning process need more labors, industry experts say.

The machine plucking extends the frequency of harvesting (plucking round) due to non-selective harvesting of shoots. Industry experts say tea yield under mechanical harvesting could fall 30-50 percent in comparison with that of manual harvesting.

Officials from Planters Association of Ceylon have said machine tea harvesting was tested, but it cannot be implemented in Sri Lanka due to the damage it does to the tree.

“But when you start plucking after grooming, the buds will come on the same layer. Then there will be no damage,” he said, adding that countries like Kenya, Japan and Malaysia use the method without any drop in quality and quantity.

Tea Board and Tea Small Holding Development Authority (TSHDA) will provide 437,000 rupees per acre of tea land for those who follow the new model along with a special irrigation system.

China gets ready to send cruise ships with Chinese tourists to Sri Lanka

In a clear sign of regaining tourism in the island nation following the launching of tourism ministry’s promotion programmes including the latest nautical tourism initiative, China is to open a new market for Chinese cruise ships in Sri Lanka.

This was an immediate reaction of the China’s latest action to support the country to overcome the current challenges by expanding its assistance for the revitalizing of foreign exchange earning sectors including tourism.

Chinese Ambassador Qi Zhenhong today assured President Ranil Wickremesinghe that China would continue to extend its support to overcome the current challenges faced by Sri Lanka.

They reviewed the progressive bilateral & multilateral negotiation on the debt issue of Sri Lanka and denounced misinformation by foreign media on China.

“All ingredients already provided by nature, it is time, Sri Lanka is to take a special interest in emphasising that Sri Lanka really concentrate on developing the Nautical Tourism as a special niche in its new phase of Tourism Development”, official sources said.

Tourism Ministry also explores the possibility of partnering top blue-chip companies to enter the lucrative 40 billion dollar cruise line business that is estimated to carry 22.3 million passengers, with the market growing at 3.2% in volume.

The Sri Lanka Embassy in Beijing says that it is actively exploring the possibility of Chinese cruise ships and yachts visiting Sri Lanka with a view to attracting more Chinese tourists to the island nation.

Sri Lankan Ambassador, Dr. Palitha Kohona has had a very successful virtual meeting with the Vice President of the China Cruise and Yacht Industry Association (CCYIA), Zheng Weihang, on 23 November 2022.

Vice President Zheng said that Sri Lanka will be promoted as a new market for Chinese cruise ships.

On 15 November, he had attended a conference of Chinese cruise ship operators, where he formally proposed that Sri Lanka be designated as a destination for cruise ships after the travel restrictions are relaxed.

Vice President Zheng added that CCYIA plans to organize exhibitions of Sri Lankan products in Shanghai (Nov 2023), Shenzhen (Nov 2023), and Haikou (Apr 2023) and the association will also organize exhibitions and sales outlets on Chinese cruise ships to promote Sri Lankan gems, tea, artifacts and other products.

He had proposed creating four/five Sri Lankan cruise itineraries. Ships will dock at Sri Lanka’s ports for a day and give the passengers the option of taking tours in the region close to the port thus engaging land operators as well.

He specified that the CCYIA will work with the Embassy to promote Sri Lanka at cruise-related conferences Sri Lankan Ambassador responded that the Embassy will also assist with these goals actively.

Sri Lanka has three well-established ports for cruise ships: Colombo, Galle, and Trincomalee. Dr. Kohona stated that there were many cruise visitors from Europe before the pandemic, and recently welcomed the Cruise ship VIKING MARS with 900 tourists on board.

Know your Ranil, from one honest Tamil politician (VIDEO)

“It is quite honestly a disgrace, that he (Ranil) of all people should poke fun at a young man who I think is very serious. He is serious because he’s putting his life in jeopardy. The stakes are high in this. The fact that Wasantha Mudalige and Siridhamma Galwewa thero are being targeted in this way, shows how serious leaders they are. And they are being deliberately punished for no crimes at all. Because if they had committed crimes, they’ll be evidence. Every time the Supreme Court asked, as well as now the Magistrates Court have asked, there has been no evidence given. And they’re not indicted. And now once the Detention Order lapsed, because it came under such heavy criticism, new cases are being created, so that they can somehow be incarcerated. So question is why is this targeting taking place?

…when the people and youth are willing to stand up and call into question and hold those leaders accountable to the mandate that they gave, that they must be crushed. And for that reason you need the PTA. You can tell your international partners that you’re not going to use it. That you’re going to repeal it. But you’re using it to the hilt. Because we all know, with the PTA, there is no justice. There is no law. There is no order. It is completely to be used at the whims and fancies of those who are ruling the police and the military. The Tamils more than anybody else knows that. And that is why we stand in solidarity with those youth. With the people who are struggling.

They were struggling in a non violent way. Why don’t you say that also? When Ranil Wickremesinghe became Prime Minister, he invited people to continue to struggle. Probably because he wanted to oust the President….at that time it wasn’t terrorism. But when did that struggle turn violent? Who created the violence first? Members of this House. It is members of this House that instigated the violence. But that part of it is completely forgotten. But the counter violence….you have destroyed their economy, you’ve destroyed their livelihood. Today they can only afford one meal a day. That is not destruction of the people’s way of life. That’s fine. All that is allowed. But, we in this House, particularly those opposite, must be protected. So you use the PTA.”

MP Gajendrakumar Ponnambalam