- IMF to release the first tranche of the 4-year loan of USD 2.9 bn amounting to about USD 332 mn in the next couple of days.

- IMF reveals Sri Lanka will search for options to “restructure” domestic debt: says the authorities and their financial advisors will weigh options and associated legal procedures to optimise the design of a local debt treatment: authorities expected to announce parameters of such external & domestic debt operations before end-April: previously, CB Governor Nandalal Weerasinghe asserted there would not be any local debt restructure.

- IMF to start “in-depth governance diagnostic exercise” on Sri Lanka, a first in Asia: wealth transfer tax & inheritance tax also to be introduced in Sri Lanka from 2025: Ceylon Chamber of Commerce congratulates Govt on securing IMF Programme.

- Mission Chief for Sri Lanka and Asia Pacific, IMF Masahiro Nozaki says the Central Bank must purchase USD 1.4 bn from the market in 2023 to rebuild the reserve: says a period of 4-10 years granted to repay the new loan from the IMF.

- Moody’s Analytics says Sri Lanka has a difficult road ahead irrespective of how much funding it receives from multilateral and global financial agencies: asserts “the IMF support is definitely not like the silver bullet they think”: also says the exuberance will fade unless there are some significant improvements from the Govt.

- SJB General Secretary Ranjith Madduma Bandara files a contempt of court charge before Supreme Court against Treasury Secretary Mahinda Siriwardene for not complying with a court order not to withhold allocated funds through the Budget to hold LG polls.

- NCPI rate of Inflation almost flat at 53.6% in Feb’23 from 53.2% in Jan’23: food inflation decreases to 49% from 53.6% in Jan’23: non-food Inflation increases to 57.4% in Feb’23 from 52.9% in Jan’23.

- Justice Minister Dr Wijeyadasa Rajapakshe and Foreign Affairs Minister Ali Sabry to visit South Africa to further study on establishing a “Truth and Reconciliation Commission” in Sri Lanka.

- Colombo University Economics Professor Sirimal Abeyrratne says he has not seen the IMF conditions for the loan as yet: asserts however that the programme will improve Sri Lanka’s credit worthiness enabling it to borrow from other financial institutions: also says there will be multi-lateral and bi-lateral lenders willing to provide funds to Sri Lanka, while the Govt could also access commercial borrowings.

- Energy Minister Kanchana Wijesekara says fuel prices would be reduced by a considerable margin at the routine fuel price revision according to the fuel price formula next month: also says the Govt would be able to procure fuel shipments at a lower and competitive bidding after the IMF bailout.

Sri Lanka Original Narrative Summary: 22/03

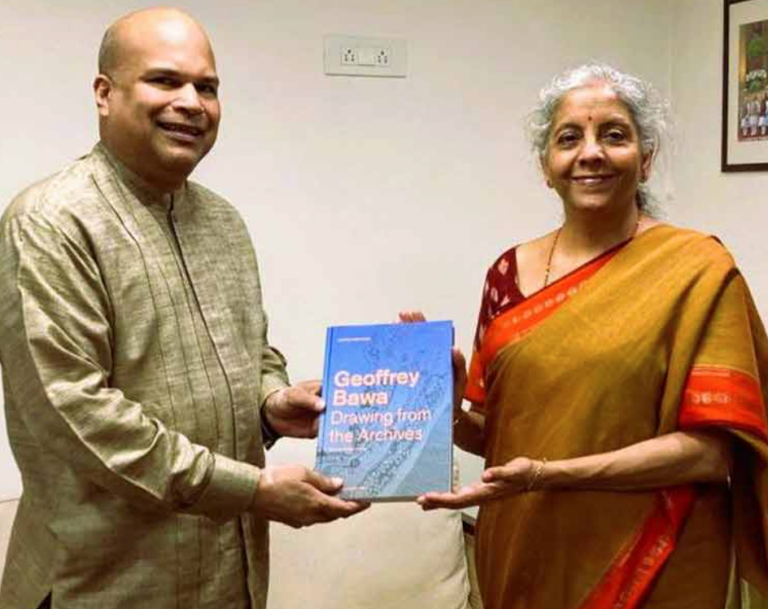

A special meeting between Milinda Moragoda and the Indian Finance Minister

A special meeting was held yesterday (21) between the High Commissioner of Sri Lanka to India Milinda Moragoda and the Indian Finance Minister S. Nirmala Sitharaman.

It is in New Delhi, India.

Since November 2021, several rounds of discussions were held between Milinda Moragoda and the Indian Finance Minister regarding India’s support to Sri Lanka and assistance to Sri Lanka.

The meeting was held yesterday as another step in the series of discussions and the High Commissioner expressed the gratitude of the Sri Lankan people to India for the crucial support given by the Indian government to Sri Lanka in obtaining the extended credit facility of the International Monetary Fund.

Also, in view of the current situation, High Commissioner Milind Moragoda has expressed special thanks for Sitharaman’s personal intervention to solve the problem in Sri Lanka with bilateral development partners and multilateral financial institutions including the International Monetary Fund.

Also, in this meeting, special attention has been paid to the issues of bilateral economic cooperation between the two countries, attracting Indian investors for investment opportunities in Sri Lanka and increasing the number of Indian tourists coming to Sri Lanka.

Sri Lanka’s Approval of IMF Credit Facility Signals End of Bankruptcy Status, Says President Wickremesinghe

In a special statement following the approval of the extended credit facility by the Executive Board of the International Monetary Fund (IMF), President Ranil Wickremesinghe emphasized that Sri Lanka is no longer deemed bankrupt by the world.

The President further stated that the loan facility serves as an assurance from the international community that Sri Lanka has the capacity to restructure its debt and resume normal transactions.

Additionally, the President noted that the government is working to gradually lift import restrictions on essential goods, medicines, and tourism-related goods, as the foreign exchange situation improves. He expressed gratitude to all countries that supported the International Monetary Fund agreement, as well as the heads of the International Monetary Fund and the World Bank.

The President plans to present a full statement on the matter in Parliament tomorrow (22), and the agreement with the International Monetary Fund will also be tabled in Parliament.

President’s Media Division (PMD)

Ceylinco Life retains market leadership for 19th consecutive year in 2022

By: Staff writer

Colombo (LNW): Ceylinco Life policyholders received a mammoth Rs. 18.9 billion in net claims and benefits in 2022, as the company achieved its 19th consecutive year of market leadership in Sri Lanka’s life insurance sector with gross written premium income of Rs. 29.16 billion for the 12 months ending 31 December.

Premium income grew by a healthy 14% despite the unprecedented challenges of the year, and the figure of Rs. 18.9 billion for net claims and benefits represented a growth of 48.9% over the Rs. 12.7 billion paid in respect of 2021, and was the highest net claims and benefits paid in Ceylinco Life’s history, the company said.

Total revenue for the year grew by 21% to Rs. 49.2 billion, with investment and other income improving by an impressive 33% to Rs. 20 billion, an announcement by Ceylinco Life said.

The company’s Life Fund grew by 12.7% to Rs. 134.9 billion as of 31 December 2022, after a transfer of Rs. 4.8 billion to the Shareholders Fund in respect of the year under review.

Ceylinco Life’s total assets grew by Rs. 17.8 billion or 10.2% to stand at Rs. 191.5 billion at the end 2022, while its investment portfolio recorded an increase of 7.4% in value over the 12 months to reach Rs. 165.9 billion as of 31 December 2022.

“Our performance in a year that saw disposable incomes contract alarmingly due to the additional financial burdens placed on the populace, reflects the value of the trust and confidence we have built over more than three decades, and the importance of our unrelenting focus on business fundamentals,” Ceylinco Life Managing Director/CEO Thushara Ranasinghe commented.

Ceylinco Life’s basic earnings per share for the year amounted to Rs. 152.64, an improvement of 12.7% while net assets value per share stood at Rs. 987.98 as of 31 December 2022. Return on assets for the year was 3.98% and return on equity 15.45%.

Adjudged Sri Lanka’s ‘Brand of the Year’ and ‘Service Brand of the Year’ by the Sri Lanka Institute of Marketing (SLIM) and ‘Best Life Insurer in Sri Lanka’ by World Finance for the ninth consecutive year in 2022, Ceylinco Life has been the country’s leading life insurer for more than half of the 35 years it has been in existence.

The company was also ranked the ‘Most Valuable Life Insurance Brand in Sri Lanka’ by Brand Finance and certified a ‘Great Workplace’ in Sri Lanka for the third consecutive year in 2022.

Ceylinco Life has close to a million lives covered by active policies and provides innovative life insurance solutions which offer protection while de-risking the goals and ambitions of the company’s policyholders.

Final decision on date of LG Polls on Thursday

By: Isuru Parakrama

Colombo (LNW): A Final decision on whether the Local Government Election will be held on April 25, 2023 will be made on Thursday (23), the Election Commission said.

Accordingly, secretaries of all political parties will be called in to the Commission in making this decision, Commission Chief Nimal Punchihewa said.

African market worth US $ 3.4 trillion opens for SL companies

By: Staff writer

Colombo (LNW): Taking a cue from President Ranil Wickremesinghe’s presidential announcement of according Great importance to the African continent in doing business, International Consultants UK has stepped into promote trade and investment ties between Sri Lanka and South Africa.

This initiative was taken in collaboration with the EDB, Sri Lanka High Commission in South Africa, and the Investment and Export Promotion Agency (APIEX) of Mozambique.

At a meeting organised by the Foreign Affairs Ministry on 3rd February 2023 at the Presidential Secretariat to coincide with the momentous occasion of Sri Lanka’s 75 independence ceremony International Consultants Chairman Ranjiv Goonawardena has taken up the task of sponsoring a major export-orientated webinar conference.

The webinar conference titled “Gateway to Africa” organized in collaboration with the Sri Lanka Export Development Board (EDB) and the Sri Lanka High Commission in Pretoria will be a series of events and the inaugural session will be deliberating on “Doing Business in Mozambique” starting on the 28th March 2023 at 1.30 p.m. Colombo time.

The inaugural webinar conference to focus on the key sectors from Sri Lanka comprising the Power and Energy, Civil Construction, Engineering services and Telecommunication sectors.

At the pre-launch event on the 10th March Goonawardena stated Sri Lanka has a competitive edge compared to its rivals from the Western Hemisphere. Due to the cost of labour being far less in comparison to its counterparties. The quality of work is of international standing or even better than their competitors.

African countries have signed the African Union Free Trade Agreement (FTA). African free trade agreement comprising three protocols which pertain to Trade in Goods, Trade in Services; Rules, and Procedures on the Settlement of Disputes.

The deal creates a continent-wide market embracing 54 countries with 1.3 billion people and a combined GDP of $ 3.4 trillion. In time to come, which will create a single market similar to the internal market of the European Union where goods and services can be imported and exported without any tariffs plus duty-free.

Under the African Union Free Trade Agreement manufactured goods and services will not incur duties and tariffs. When goods are transported from one African country to another for instance, if goods are transported from Cairo, Egypt to Johannesburg, South Africa may that be by air, sea or overland there are no customs duties to be paid.

This is a great opportunity for some of the companies in Sri Lanka to take full advantage of exporting the goods and services.

Another crucial component is that the majority of the African countries are deemed as least developed economies under the UN description; thereby being eligible for trade preferences, development financing, including official development assistance, debt relief, technical assistance and other forms of support.

Which means that they have free access to the European and the American market duty free indicating Sri Lankan companies could even manufacture goods in the African continent creating three accessible markets. The African free trade agreement areas can be a tremendous opportunity.

Govt. takes action to divest treasury stake in SLT and Lanka Hospitals

By: Staff writer

Colombo (LNW): The Government has taken a very ambitious course of action for the country’s economic transformation by divesting stakes in nonstrategic assets and minority stakes in strategic assets of state owned business enterprises, finance ministry sources disclosed.

Observing the 52 State-Owned Enterprises (SOEs) monitored by the Ministry of Finance (MoF), an aggregate profit has come down in most of these enterprises including Ceylon Petroleum Corporation, Sri Lankan Airlines Ltd. Sri Lanka Transport Board, Sri Lanka Telecom PLC (SLT) and Lanka Hospitals PLC etc.

Sri Lanka is no stranger to divesting SOEs. Divestment of public enterprises were incorporated into the state policy in 1987 with an aim of reducing the fiscal burden, and improving the efficiency and profitability of entities. This led to extensive SOE reforms being carried out between 1989 and 2002 with partial and full divestiture of 84 enterprises.

Divestiture can bring in investors with the capacity to invest in expansions. For example, Hilton has much potential for further development but owing to financial constraints, the government is unable to pursue such developments.

The Hyatt project is also another example that requires significant investments to reach completion, which the Government is not in a position to undertake.

The Secretary to the Treasury has informed the Board of Directors of Sri Lanka Telecom PLC (SLT) and Lanka Hospitals PLC that the Cabinet of Ministers has granted approval in principle for the divestment of the stakes held by the Treasury Secretary in the two companies.

Accordingly, the Secretary to the Treasury has informed the Board of Directors of SLT and Lanka Hospitals that the Cabinet of Ministers has granted its approval in principle for the divestment of the stake held by the Treasury Secretary in the respective companies.

The companies have announced that they have received the approval of the Cabinet of Ministers to sell the shares owned by the government in Sri Lanka Telecom PLC and Lanka Hospital PLC, which are two companies listed in the Colombo Stock Exchange (CSE), as per the policy decision of the government.

Notifying the Colombo Stock Exchange of this decision, Sri Lanka Telecom says that the divestiture will be implemented in the near future by the State-Owned Enterprise Restructuring Unit established under the Ministry of Finance, Economic Stabilization and National Policy, subject to following the due process. Meanwhile, Ceylon Hospital PLC has also issued an announcement stating the same.

The Treasury holds a 49.50% stake of the issued share capital of Sri Lanka Telecom PLC.

Meanwhile, a 51.34% stake of the share capital of Lanka Hospital PLC is held by the Sri Lanka Insurance Corporation, representing the Government of Sri Lanka.

Ideal method that can be followed is to offer a significant stake through a competitive tender process or a bidding process conducted on a special board of the Colombo Stock Exchange (CSE) among shortlisted parties.

Balance can be offered through an Initial Public Offering (IPO) allowing members of the general public to become part owners of a SOE.

IMF’s US$2.9 billion bailout loan catalyses multilateral financing

By: Staff writer

Colombo (LNW): Sri Lanka is pinning hopes on the International Monetary Fund’s (IMF) US$2.9 billion bailout loan within weeks following its executive board approval granted on Monday for the country’s economic reform program under the Extended Fund Facility (EFF).

The economic reform program will be a catalyst for the island nation to access financing of up to US$7 billion from the IMF, and multilateral financial agencies such as the World Bank, ADB, Asian Infrastructure Investment Bank (AIIB), European Investment Bank; OPEC Fund for International Development; Nordic Development Fund etc.

For the first time in months, Sri Lankans are hopeful that the IMF’s decision will kick-start the country’s recovery from its worst economic crisis since independence from Britain in 1948.

Investors are betting that the country will make use of its considerable economic potential together with efforts to boost economic resilience and move toward greater integration with regional and global markets.

It has a strong base of human capital and reliable infrastructure. It also occupies a strategic position in Asia, the fastest growing region in the world, and investments over the last decade (particularly in ports and other transport-related facilities) can take advantage of this opportunity.

President Ranil Wickremesinghe has expressed his gratitude for the support of the IMF and other international partners soon after the country received the confirmation of IMF executive board approval.

President is committed to full transparency in all discussions with financial institutions & creditors, & to achieve sustainable levels of debt through prudent fiscal management & an ambitious reform agenda, presidential media division announced.

Minutes after hearing the IMF Board approval for around US$ 3 billion funding under EFF, former finance minister Ravi Karunanayake noted that this augurs well for the country’s progress in achieving durable economic growth and external sustainability.

This is the beginning of economic diversification efforts of the President Ranil Wickeremasinghe to sustain growth over time and make it more resilient and inclusive, he added.

He also stressed the urgent need of proposed the commercialization of some of the State-owned enterprises (SOEs) including Sri Lankan Airlines, SriLankan Airlines, Sri Lanka Telecom, Colombo Hilton, Waters Edge and Sri Lanka Insurance Corporation Water Supply and Drainage board, Ceylon Petroleum Coperation, Ceylon Electricity Board and Road Development Authority.

The United States of America has welcomed the approval of Sri Lanka’s IMF package “Great news & an important step on the road toward economic recovery,” tweeted US Ambassador to Sri Lanka Julie Chung on Monday (20).

She said that the Sri Lankan government will need to continue reforms and conclude debt restructuring agreements to ensure the program – and the economy – stay on track.

She noted that structural & lasting reforms that address good governance & transparency are critical to ensure all citizens of Sri Lanka can prosper.

IMF Managing Director Kristalina Georgieva also noted that she was very pleased the Executive Board of the IMF had approved about $3 bn of IMF support for Sri Lanka’s economic policies & reforms. She said that it was an important milestone with International Creditors coming together to help to restore debt sustainability. “Crucial to unlock Sri Lanka’s growth potential,” she added.

Showers, thundershowers may occur in several provinces

By: Isuru Parakrama

Colombo (LNW): Showers or thundershowers will occur at several places in Sabaragamuwa, Central, Uva, North-Central and North western provinces and in Trincomalee, Vavuniya, Mullaitivu and Mannar districts during the afternoon or night and fairly heavy showers above 50mm are likely at some places, the Department of Meteorology said in a statement today (21).

Showers or thundershowers may occur at a few places elsewhere during the afternoon or night.

General public is kindly requested to take adequate precautions to minimise damages caused by temporary localised strong winds and lightning during thundershowers.

Marine Weather:

| Condition of Rain: |

| Showers or thundershowers will occur at a few places in the sea area around the island. |

| Winds: |

| Winds will be south-westerly or variable in direction and wind speed will be (20-30) kmph. |

| State of Sea: |

| The sea areas around the island will be slight. Temporarily strong gusty winds and very rough seas can be expected during thundershowers. |

IMF’s statement on approving EFF for SL

- The IMF Board approved a 48-month extended arrangement under the Extended Fund Facility (EFF) of SDR 2.286 billion (about US$3 billion) to support Sri Lanka’s economic policies and reforms.

- The objectives of the EFF-supported program are to restore macroeconomic stability and debt sustainability, safeguarding financial stability, and stepping up structural reforms to unlock Sri Lanka’s growth potential. All program measures are mindful of the need to protect the most vulnerable and improving governance.

- Close collaboration between Sri Lanka and all its creditors will be critical to expedite a debt treatment that will restore debt sustainability consistent with program parameters.

Washington, DC: The Executive Board of the International Monetary Fund (IMF) approved today a 48‑month extended arrangement under the Extended Fund Facility (EFF) with an amount of SDR 2.286 billion (395 percent of quota or about US$3 billion).

Sri Lanka has been hit hard by a catastrophic economic and humanitarian crisis. The economy is facing significant challenges stemming from pre-existing vulnerabilities and policy missteps in the lead up to the crisis, further aggravated by a series of external shocks.

The EFF-supported program aims to restore Sri Lanka’s macroeconomic stability and debt sustainability, mitigate the economic impact on the poor and vulnerable, safeguard financial sector stability, and strengthen governance and growth potential. The Executive Board’s decision will enable an immediate disbursement equivalent to SDR 254 million (about US$333 million) and catalyze financial support from other development partners.

Following the Executive Board discussion on Sri Lanka, Ms. Kristalina Georgieva, Managing Director, issued the following statement:

“Sri Lanka has been facing tremendous economic and social challenges with a severe recession amid high inflation, depleted reserves, an unsustainable public debt, and heightened financial sector vulnerabilities. Institutions and governance frameworks require deep reforms. For Sri Lanka to overcome the crisis, swift and timely implementation of the EFF-supported program with strong ownership for the reforms is critical.

“Ambitious revenue-based fiscal consolidation is necessary for restoring fiscal and debt sustainability while protecting the poor and vulnerable. In this regard, the momentum of ongoing progressive tax reforms should be maintained, and social safety nets should be strengthened and better targeted to the poor. For the fiscal adjustments to be successful, sustained fiscal institutional reforms on tax administration, public financial and expenditure management, and energy pricing are critical.

“Having obtained specific and credible financing assurances from major official bilateral creditors, it is now important for the authorities and creditors to make swift progress towards restoring debt sustainability consistent with the IMF-supported program. The authorities’ commitments to transparently achieve a debt resolution, consistent with the program parameters and equitable burden sharing among creditors in a timely fashion, are welcome.

“Sri Lanka should stay committed to the multi-pronged disinflation strategy to safeguard the credibility of its inflation targeting regime. As the market regains confidence, the authorities’ recent introduction of greater exchange rate flexibility will help to rebuild the reserve buffer.

“Maintaining a sound and adequately capitalized banking system is important. Implementing a bank recapitalization plan and strengthening financial supervision and crisis management framework are crucial to ensure financial sector stability.

“The ongoing efforts to tackle corruption should continue, including revamping anti-corruption legislation. A more comprehensive anti-corruption reform agenda should be guided by the ongoing IMF governance diagnostic mission that conducts an assessment of Sri Lanka’s anti-corruption and governance framework. The authorities should step up growth-enhancing structural reforms with technical assistance support from development partners.”