01. The IMF Executive Board approves the EFF proposed for Sri Lanka to address the macroeconomic stability and debt sustainability, mitigate the economic impact on the poor and vulnerable, safeguard financial sector stability, and strengthen governance and growth potential, with an amount of about US$3 billion, and approves the immediate disbursement of US$ 333 million: IMF MD Kristalina Georgieva urges a more comprehensive anti-corruption reform agenda guided by the IMF that conducts and assessment of the island nation’s anti-corruption and governance framework.

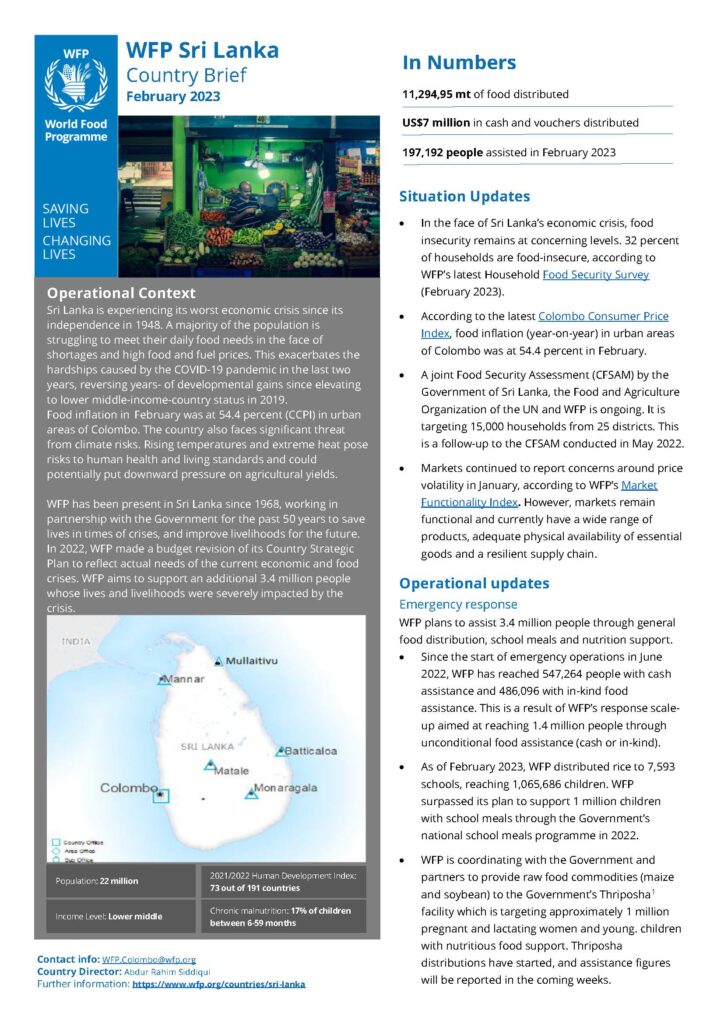

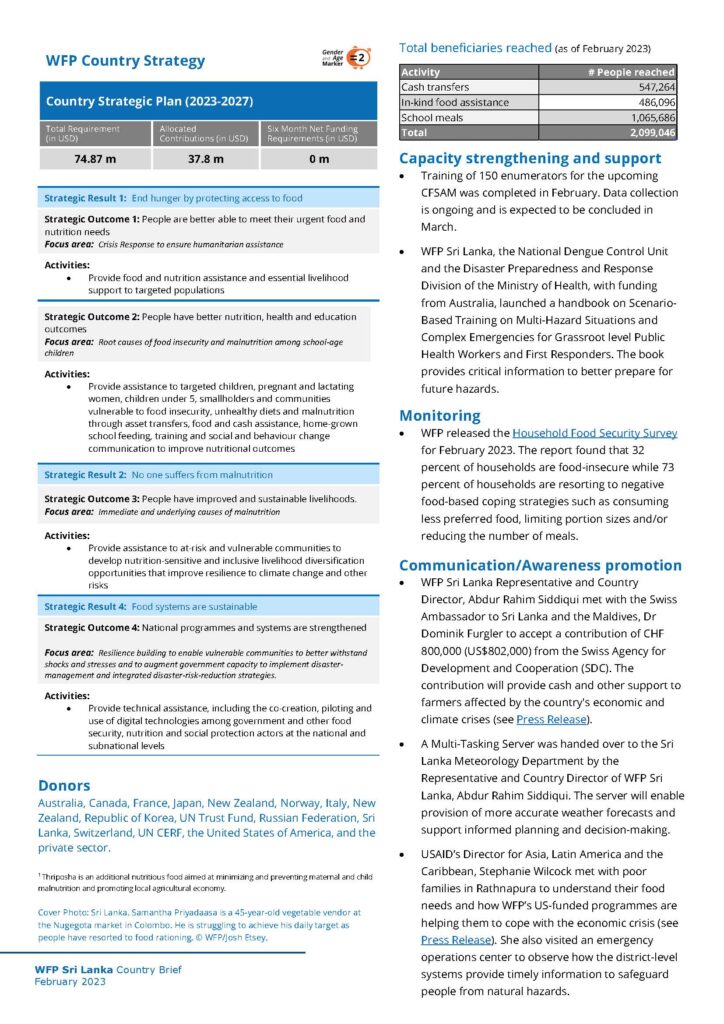

02. The WFP’s latest Household Food Security Survey for February 2023 reveals food insecurity in Sri Lankan households continues to remain at concerning levels amidst the economic crisis; stresses 32 per cent of Sri Lankan households suffers from food insecurity, whilst price volatility remains concerned; adds however that Sri Lankan markets remain functional and currently are of a wide range of products, adequate physical availability of essential foods and a resilient supply chain.

03. Three FR petitions files demanding annulment of ex President Gotabaya Rajapaksa’s pardon on ex MP Duminda Silva, who was convicted and pending death row over the murder of Bharatha Lakshman Premachandra, taken up for hearing at the Supreme Court: Hearing of petitions adjourned till March 30, 2023.

04. The ‘18 Hairpin Bends’ section of the Kandy – Mahiyanganaya Road closed for traffic from 8 pm to 5 am daily until due notice: Motorists urged to use alternate routes during this period: Earlier, the second hairpin bend was temporarily closed due to an earth slip and a rock slip, but the stretch of road was reopened for traffic after clearing the debris.

05. The Appeal Court orders the extension of the interim injunction issued preventing the hearing of a case filed against SDIG Deshabandu Tennakoon until March 28, 2023: The plaint against the SDIG had been filed at the Colombo Fort Magistrate Court in connection with the large sum of money found inside the President’s House during the July 09 uprising by the ‘Aragalaya’ protesters.

06. The Agriculture Ministry says measures will be taken to provide TSP fertiliser free of charge from March 20, 2023 to all 1.2 million paddy farmers in Sri Lanka, after three cultivation seasons: The stock of 36,000 MT of TSP fertiliser imported from Egypt official handed over to the Ministry by the US.

07. The Treasury Secretary informs Sri Lanka Telecom PLC and Lanka Hospitals PLC that the Cabinet has granted approval in principle for the divestment of the stakes held by the Treasury Secretary: The Treasury holds a 49.5 per cent stake of the share capital of SLT, and 51.34 per cent stake of the share capital of Lanka Hospitals is held by the Sri Lanka Insurance Corporation, representing the government.

08. Leader of Pivithuru Hela Urumaya MP Udaya Gammanpila says the government contradicting its own statement that money cannot be ‘printed’ for the holding of the LG Polls due to IMF conditions has printed Rs. 113.5 billion on a single day, March 15; stresses the CBSL under the tenure of current governor Weerasinghe has printed a staggering Rs. 867 billion since he took office, making it questionable as to why Rs. 9 billion cannot be ‘printed’ for the LG Polls.

09. The CBSL asks the Attorney General to initiate criminal proceedings against three ‘pyramid’ related schemes for violating Section 83C of the Banking Act: These schemes run by ‘Fast3cycle International Pvt. Ltd.’, ‘Sport Chain App, Sport Chain ZS Society in Sri Lanka’, and ‘Onmax DT’.

10. Appeals filed by the defendants pending death row over the murder of schoolgirl Sivaloganathan Vidya in 2015, seeking acquittal from the sentences fixed for hearing at the Supreme Court on October 06, 2023: The defendants convicted by the Jaffna High Court for abduction, acquaintance sexual assault and murder of the minor.