The Central Bank (CBSL) yesterday further expanded the trading band of USD /LKR.

CBSL Governor. Nandalal Weerasinghe directed banks to use Rs. 353.65 as the middle spot Exchange rate of USD/LKR inter bank transactions and the variation margin of Rs. 7.50 on either side (+/-) of the middle spot exchange rate.

He also said rates applicable to other currency transactions against the Sri Lanka Rupee should also be derived based on the new USD/LKR middle spot exchange rate and the variation margin.

Previously on 27 February, the CBSL expanded the daily trading band to +/- Rs. 5.00 of the middle spot exchange rate. Prior to that revision, the variation margin was +/- Rs. 2.60.

Yesterday the CBSL quoted USD telegraphic transfers rate as Rs. 343.97 (buying) and Rs. 356.73 (selling). On Wednesday they were Rs. 351.72 and Rs. 362.95 respectively.

Wealth Trust Securities said the USD/LKR on cash to spot contracts were traded within the range of Rs. 346.15 to Rs. 347.00 while the middle rate for USD/LKR spot contracts appreciated further to Rs. 353.6543 against its previous days of Rs. 358.4593.

The foreign news agencies reported that the US dollar stood at 136.40 yen in Asian trade yesterday, against 136.17 yen in New York on Wednesday.

It said talk of more aggressive US rate hikes boosted the dollar on Thursday.

There is a growing expectation rates would top out around 5.5%, though some commentators are tipping 6%, from the current 4.5-4.75%.The rise of Rupee comes amidst a rebounding US Dollar.

The dollar has risen nearly 4% from its recent lows and stands near a seven-week high against a basket of other major currencies , driven by bets the Federal Reserve will need to raise rates higher than many investors had previously forecast to cool inflation, several economic experts said.

The U.S. currency remains some 8% below the twenty-year high it attained last year.

Yet its rebound, along with a surge in Treasury yields, has already complicated the outlook for a range of trades that prospered as the dollar tumbled in the latter half of 2022.

A stronger dollar tends to tighten global financial conditions while diminishing appetite for risk-taking and weakening global trade, the Bank for International Settlements said in a report in November.

It also makes it more difficult for countries that borrowed in the U.S. currency to service their debt, a problem often acutely felt by emerging market economies.

Central Bank expands foreign exchange US dollar trading band

Not so quiet on the western front

Nicholas Barber is right to air significant objections to loaded inventions in Edward Berger’s remake of All Quiet on the Western Front (Germans are right to be incensed by All Quiet on the Western Front, 27 February).

Erich Maria Remarque was invalided out of the army in 1917, but used his experiences to portray the life of a young soldier throughout the war, up to its end, when he portrayed the German army as retreating. Berger’s remake, however, goes out of its way to emphasise that the German army was holding the same lines of four years previously and, in case we hadn’t noticed it, tells us the same in a closing caption.

There were doubtless places where this held true, but it does not reflect the general military situation in the autumn of 1918, when the German army retreated from much occupied territory.

Few in Britain or Ireland would have needed reminding in 1928 – or in 1930 when the Hollywood version was released – that British troops had liberated the city of Lille in France.

Alas, in this country we have favoured monuments to much more questionable colonial victories, and so remembrance is left to fictional creations.

This film, as Barber observes, sets up the “stab-in-the-back [by civilians] myth” in a way that would have delighted the National Socialists, and would have appalled Remarque, who had to flee the Nazis.

Roger Macy

London

• Nicholas Barber has provided a valid critique of Edward Berger’s recent film adaptation of All Quiet on the Western Front. One other key omission in the film was Paul Bäumer’s return home, and the alienation he felt when confronted by a total lack of insight by civilians into the realities of trench warfare.

Lewis Milestone’s 1930 film version went one step further, depicting a speechless Paul in front of a class of eager youngsters when encouraged by his old teacher to describe daring action in the trenches. The remake added nothing to the novel or the original cinematic version.

Ian Ferguson

Thornton Dale, North Yorkshire

Inaugural People’s Convention concludes with determination to tackle SL crisis

The People’s Convention for Good Governance was held at the BMICH in the midst of an exclusive audience, all of them invited and registered by the organizers on 25 February at the BMICH.

The Convener of this national initiative Richard de Zoysa set the tone for the day out lined that the four forums that were to be the hub of the program, would speak on how we have reached this perilous predicament, what exactly is the situation we are at present and how we should work to overcome the challenges.

Maithri Gunaratne PC, former Governor of Central and Uva Province, noted that the present situation where the Constitution does not always enforce the will of the people was also crafted during his fromer President JR Jayawardena’s tenure. Gunaratne summed up by stating that the Rajapaksa Government, though ending the separatist war, failed to reconcile the country and plunged it into bankruptcy, together with the governments that followed.

Omar Khan, a US national of Pakistani heritage, having come to Sri Lanka in 1993 and a well-known motivational speaker, headlined his address a ‘Visionary Catalyst’, and spoke of the importance of following up on decisions made, if a country is to progress.

Murtaza Jaferjee the Chairman of the Advocata Institute delivered a flawless speech on Economic Recovery with a presentation of facts that had the audience captivated. Prof. Arjuna Parakrama moderated the Education Reforms panel that included Dr. Tara de Mel, Prof. Harendra de Silva and Nile Anandappa.

Shehara Parakrama and Sharhan Muhseen, a top rung investment banker and an expert in mergers and acquisitions, exchanged thoughts on the Production and Services forum.

Dr. Pakiasothy Saravanamuttu moderated an interesting panel on Ethnicity which included Selvi Sachithanandam, Ishan Jalill, Jeremy Liyanage, and Arun Siddarth who had a thought-provoking discussion on the minorities.

Arun Siddarth was candid about the caste problem that is still preventing him from entering certain facilities that are reserved for the upper caste Tamils. He also declared that it was the politicians who created the rift between the Sinhalese and the Tamils.

The Guest of Honour Dr. Walter Jayasinghe who lives in California, and does an enormous amount of social work for the underprivileged, declared open the Empowering Lanka website that will be a fully transparent fundraising platform with the inflow and outflow clearly visible.

Primarily to help alleviate poverty and develop districts that lack basic infrastructure needs, the first Directors Dr. Walter Jayasinghe and Richard de Zoysa will source funds from both international and local donors.

The funds raised will be disbursed to those who conform to a predetermined criteria laid down by the Board of Directors of the company limited by guarantee.

Once commissioned officially, funds will be used to develop District by District monthly as planned by Dr. Sarath Seneviratne who mooted this concept 15 years ago.

Sri Lanka public administration to become more efficient and productive.

Sri Lanka’s public administration sector, including divisional secretariats, is set to accept the challenge of becoming more efficient and productive and efficient, willingly enhancing businesses and investments in the island.

The Parliamentary Select Committee (PSC) that looks into enhancing the ease of doing business has asked the Sri Lanka Administrative Services Association (SLASA) recently to submit a proposal towards this end.

Public administration sector including divisional secretariats has been directed to increase productivity and efficiency, when starting businesses and investments in Sri Lanka.

A group of officials representing Sri Lanka Administrative Services Association, Sri Lanka Accountancy Services Association, Sri Lanka Planning Services Association were summoned to the Select Committee of Parliament to study the practical problems and difficulties.

These issues have arisen in relation to enhancing the rank in the Ease of Doing Business Index in Sri Lanka and public officials make its proposals and recommendations when they met recently under the chairmanship of Member of Parliament Madhura Withanage.

Increasing the efficiency of the public administration sector and process in starting new businesses and investment opportunities in Sri Lanka was discussed at length at the meeting.

The committee pointed out that many investment and business opportunities are lost to the country as the process to be carried out to start investment or business in the current administrative structure is not efficient.

The committee emphasized that the management principles of the administrative sector including district secretariats and divisional secretariats should be changed accordingly.

Thus, the need to formulate new and permanent policies in this regard was emphasized in the formulation of public policies.

It was discussed that there are currently 332 divisional secretariats in Sri Lanka and the lack of a proper system to monitor their functioning is a major shortcoming.

For the convenience of the investors, it was proposed to establish a separate ‘Investment Cell’ for each district secretariat to facilitate investors and provide prompt service. The need for proper training programs for those public officials was also discussed here.

Sri Lanka Administrative Services Association pointed out the need to carry out reforms in the state administrative sector, and it was also suggested to take steps to establish a separate ministry for administrative reforms in the future.

It was also suggested to call all the divisional secretaries and hold an awareness program for them.

It was also discussed about the difficulty in obtaining land required for investments through the Divisional Secretariats.

It was discussed that land irregularities are taking place on a large scale especially in the northern and eastern provinces and the need for immediate intervention.

Two UK and Australian firms continue mineral explorations in the North East

The Eastern and Northern Coastline of Sri Lanka have been made into a busy work site via mineral explorations at present with at least two UK and Western Australian companies have resumed activities, official sources said.

Capital Metals PLC, a UK mineral resources company listed on the London Stock Exchange, is ready to commence development of its high grade mineral sands project in the Eastern Province.

The extensive studies completed by the local Sri Lankan subsidiary, Damsila Exports Ltd. indicated the availability of commercial quantities of high grade mineral sands in this region.

Most importantly, Capital Metal’s pioneering project will, no doubt, open up a new industry in mining heavy mineral sands and other valuable mineral resources in the country and pave the way for similar projects in the future, opening up a much-needed new export industry.

Further Western Australia-headquartered Titanium Sands has announced that it is proceeding with the formal mining licence application process for its Mannar Island project, in Sri Lanka.

The company says final exploration resource work over its five main licences all exceed the Geological Survey and Mines Bureau (GSMB) minimum exploration requirements and confirm a significant heavy mineral sands project.

However Capital Metals PLC, a UK mineral resources company listed on the London Stock Exchange, is ready to commence development of its high grade mineral sands project in the Eastern Province.

The extensive studies completed by the local Sri Lankan subsidiary, Damsila Exports Ltd., indicated the availability of commercial quantities of high grade mineral sands in this region.

Local investment company, Keynes Investments Ltd., was recently brought in to hold 60% of Damsila. Keynes is principally held by Dinal Peiris, who is also the Chairman of Lanka Aluminium Industries PLC Group and several other well-known companies in Sri Lanka.

The project commenced in 2015 with Capital Metals, a specialized mineral resource exploration and development company with significant international experience, acquiring ownership of Damsila which held the initial exploration licenses.

With investment from Capital Metals, Damsila completed numerous studies and obtained approval from the Department of Coast Conservation and Coastal Resources Management for its environmental impact studies following extensive local community and governmental consultation.

With total expenditure to date of over $ 11 million, Damsila is now awaiting final approval to commence development.

Key advantages of the planned operations are that no blasting or chemicals are required and there will be continuous cleaning and restoration of the mined areas to remove the black mineral sands leaving the golden sands in place.

This project will also help to position Sri Lanka as a strategic and responsible source for these critical minerals in the global marketplace,” said Capital Metals CEO and Director Michael Frayne.

The project requires a total investment of over us $ 80 million and will bring a multitude of benefits to Sri Lanka and its people as it will generate much needed foreign exchange from export income, significantly upgraded infrastructure, employment and skills transfer, as well as various programmes to support local communities.

It is estimated that over 300 new direct jobs will be created and the Sri Lankan Government will receive over $ 100 million in royalties and taxes.

WB to release another US$ 1.5 bn for SL

By: Isuru Parakrama

Colombo (LNW): The World Bank has agreed to release an aid of US$ 1.5 billion for Sri Lanka, days after the International Finance Corporation (IFC), one of the WB subsidiaries, released a forex facility of US$ 400 million for three private banks in the island nation amidst the worst economic crisis it suffers from.

The US$ 1.5 billion aid is set to be released for the next two years under several stages, and its first stage is believed to be released after Sri Lanka enters an agreement for a programme with the International Monetary Fund (IMF).

Kandy – Mahiyanganaya Road closed from 18 Bends Road

By: Isuru Parakrama

Kandy (LNW): The Kandy – Mahiyanganaya main road has been closed from the 14th bend of the 18 Bends Road aka ’18 Wanguwa’ area, due to the collapse of a mound nearby, revealed the Disaster Management Centre.

Price of gold drops following Rupee appreciation

By: Isuru Parakrama

Colombo (LNW): The price of gold has dropped concurrent to the strengthening of the Sri Lankan Rupee against the US Dollar, indicating a decline of about Rs. 17,000 – 15,000, disclosed the All Ceylon Jewellery Association.

Accordingly, the price list as of yesterday (04) reveals that the price of a 24-carrot-pound of gold is Rs. 170,500 and the price of a 22-carrot-pound of gold, Rs. 157,000, the Association added.

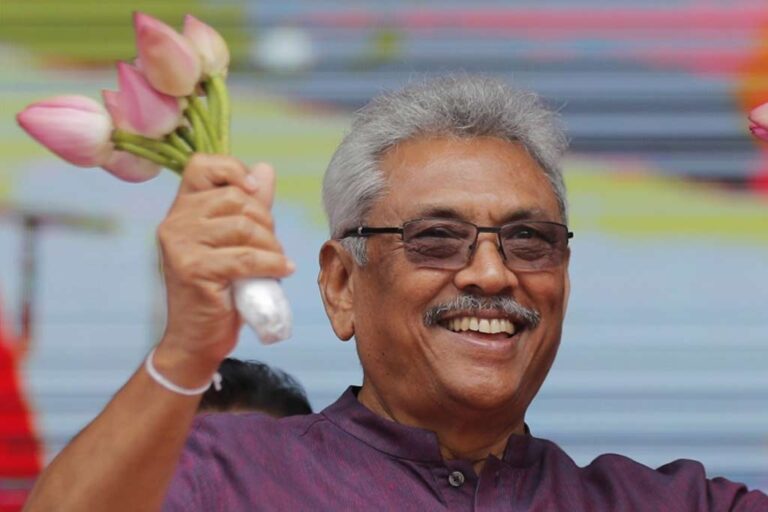

Chemical fertiliser ban incurs Rs. 245 bn loss: Professor

By: Isuru Parakrama

Colombo (LNW): The ban imposed on the use of chemical fertiliser and agro-chemicals by the previous Gotabaya Rajapaksa regime incurred a loss of over Rs. 245 billion within 2022 alone, disclosed Prof. Wasantha Athukorala of the Economics Unit of the University of Peradeniya.

The loss incurred due to the decline in the production of paddy and tea triggered by the fertiliser ban and in the backdrop every farmer has to suffer a loss of about Rs. 100,000, he added citing findings of a special study into the matter.

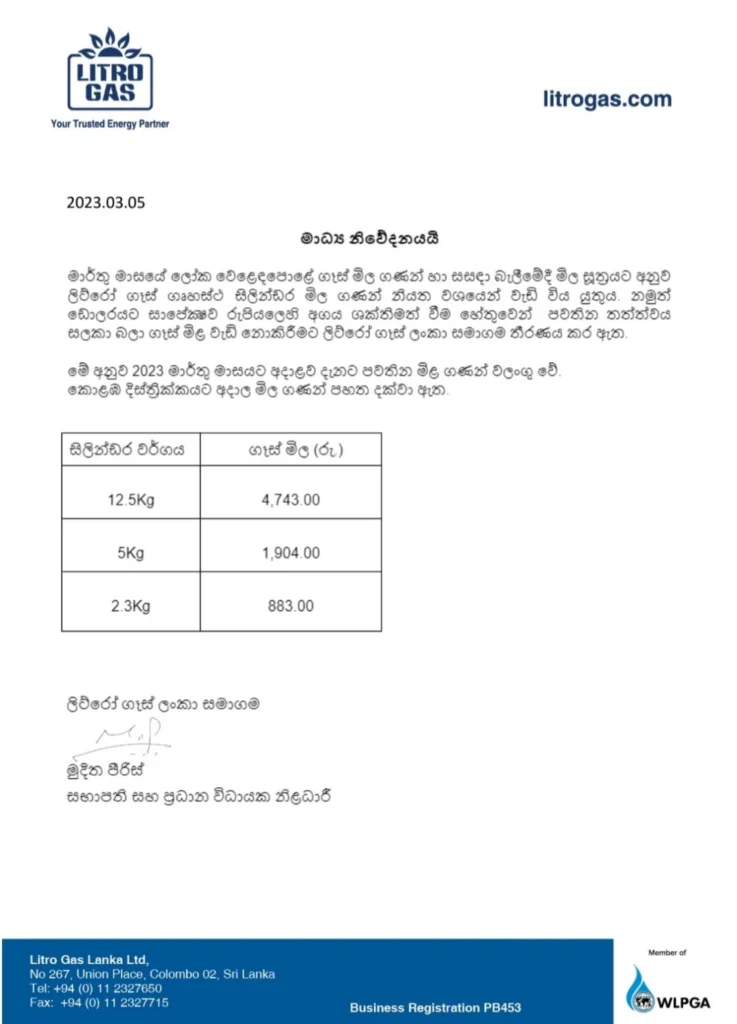

LITRO announces no price revisions for LP Gas

By: Isuru Parakrama

Colombo (LNW): State-run LP Gas distributor LITRO said there will be no increase in gas prices for March, 2023 despite the determined price revision in compliance with the global market.

The decision has been taken in response to the recent strengthening of the Sri Lankan Rupee, Company Chief Muditha Peiris said.

Accordingly, the existing prices will be in effect for the month March, he added in a statement.