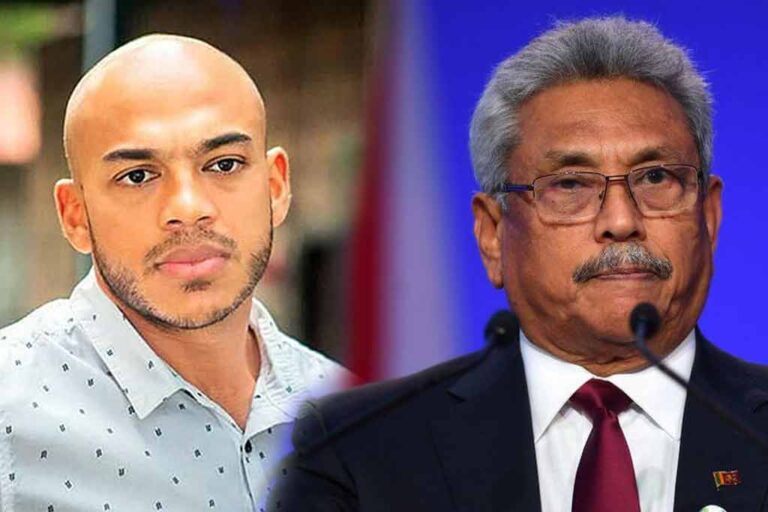

Reports emerge that Yoshitha Rajapaksa, son of ex President Mahinda Rajapaksa, is illegally withholding the key to a government-owned residence arranged for ex President Gotabaya Rajapaksa after his resignation.

Located on Stanmore Crescent in Buller’s Lane, Colombo, the official residence was previously used by Mangala Samaraweera during his tenure as a Minister of the government, and was recently used by former President Mahinda Rajapaska due to several repairs in his official residence on Wijerama Road, Colombo 07.

There had reportedly been an initial agreement to hand over the residence on Stanmore Crescent to Gotabaya, who at the time had left the country due to the turmoil awakened by the ‘Aragalaya’ people’s protest, after the repairs in his brother’s official residence on Wijerama Road, paving the way for the ex President’s privilege to claim an official residence. However, the key to this official residence has not yet been handed over to the relevant authorities, even though it has been two months since Mahinda had left the premises.

Sources claim that it is Yoshitha Rajapaksa who is deliberately withholding the key to the residence on Stanmore Crescent, in negligence over the instructions by both his father Mahinda Rajapaksa and elder brother Namal Rajapaksa to do otherwise.

Yoshitha Rajapaksa served as Mahinda Rajapaksa’s Chief of Staff during his tenure as the Prime Minister, making him one of the most privileged persons in the government. But now that neither of the Rajapaksas are on the authoritative level of the government, Yoshitha, by observation, is committing felony by withholding government property, and as to why no legal actions are being taken to date would also be a serious question the Ranil Wickremesinghe regime has to answer.