The loss-making Mattala Rajapaksa International Airport (MRIA) facilitated 11,926 international tourists in February 2023 gaining air traffic momentum with the revival of tourism this year, Airport and Aviation Services (Private) Limited of Sri Lanka (AASL) announced.

The Airport has incurred a net loss of Rs 4.44 billion and the capital expenditure of Rs 36,564 million, spent for the construction of Mattala International Airport, was not used effectively.

According to the report, only 2,396 flights have been operated in the last five years and a cumulative net loss of 20,590 million rupees from 2017 to 2021, Auditor General’s recent report revealed.

While Sri Lanka’s tourism industry has recorded 107,639 international tourist arrivals in the month of February 2023 with a growth of 11.5% compared to the month of February 2022, the MRIA has facilitated 11,926 international tourists in February.

This includes 6259 arrivals and 5667 departures with over 72 international aircraft movements.Further, after 2021, the MRIA has facilitated the first flight of SCAT Airlines of Kazakhstan today (March 06) with 188 international tourists arriving in the country.

Altogether, 602 international tourists arrived in Sri Lanka through the exotic gateway on Monday, including Red Wings Airlines, a Russian regional leisure airline based in Moscow, which carried 414 international tourists onboard to the country, while 407 tourists departed on the same flight.

Meanwhile, the AASL had made all necessary arrangements to welcome the guests and facilitate smooth operations to process 1009 tourists.

If the trend continues, the year 2023 would be one of the best recovery years for Sri Lanka and tourism will support rebuilding the economy, the AASL added.

The Mattala International Airport has incurred a net loss of Rs 4.44 billion, a recent annual report by the Auditor General revealed.

According to the report, the capital expenditure of Rs 36,564 million, spent for the construction of Mattala International Airport, was not used effectively.

The Treasury paid a sum of Rs 1,708 million as loan interest from 2010 to March 2015 for the loan of USD 190 million, obtained for that construction. The report also shows that Airport and Aviation Services Limited paid a sum of Rs 3,532 million from April 2015 to March 2022.

According to the report, the loan balance was USD 109 million as of 31 December 2021.Although the Mattala International Airport’s expected annual passenger capacity is around one million, the total number of passengers who have used the airport in the last five years is 91,747, according to the Auditor General’s report.

According to the report, only 2,396 flights have been operated in the last five years.It cited that the Mattala International Airport operations resulted in a net loss of 4,440 million rupees in 2021, and a cumulative net loss of 20,590 million rupees from 2017 to 2021.

The Treasury paid a sum of Rs 1,708 million as loan interest from 2010 to March 2015 for the loan of USD 190 million, obtained for that construction. The report also shows that Airport and Aviation Services Limited paid a sum of Rs 3,532 million from April 2015 to March 2022.

According to the report, the loan balance was USD 109 million as of 31 December 2021.Although the Mattala International Airport’s expected annual passenger capacity is around one million, the total number of passengers who have used the airport in the last five years is 91,747, according to the Auditor General’s report.

Mattala International Airport (MRIA) gains momentum with 11,926 tourist arrivals

Sri Lanka Original Narrative Summary: 07/03

- Main Opposition parties including the SJB, NPP, TNA, SLMC, ACMC, TPA, and breakaway factions of the SLPP jointly demand that LG election be held on or before 19 March, fulfilling the undertaking given to Supreme Court by the EC.

- Former State Finance Minister and CB Governor Ajith Nivard Cabraal says abandoning the “fixed” exchange rate policy pursued since 12th May 2022 and making the LKR “flexible” once again as per the IMF instructions, is likely to lead to the depreciation of the LKR into new levels within weeks.

- US Treasury Secretary Janet Yellen expresses support for Sri Lanka’s IMF-supported programme “to advance economic reform and achieve a strong and durable recovery”: also welcomes “Sri Lanka’s commitments to transparency and comparable treatment for all bilateral official and private creditors”: analysts still skeptical there was no comment re. providing “comparable treatment” to loans by IMF, WB and ADB

- Pivuthuru Hela Urumaya Chief & SLPP rebel Udaya Gammanpila MP says the

Wickremesinghe-Rajapaksa Govt and the US Embassy in Colombo should come

clean on CIA Director William Joseph Burns’ Colombo visit: asserts he is 100% sure Burns was in Colombo on 14th February: challenges Govt and US Embassy to contradict him. - Energy expert Dr. Tilak Siyambalapitiya says Sri Lanka has the 2nd highest electricity prices in Asia: laments Sri Lanka is not doing what is needed to emerge from the energy crisis.

- SL’s Permanent Rep to the UN Office in Geneva Himalee Arunathilaka says Sri Lanka has once again objected to Resolution 51/1 adopted against SL by the UNHRC in Oct’22: also says such resolutions are unhelpful to the people of SL and will fail to serve the objective of promoting reconciliation.

- SLFP Party Leader Maithripala Sirisena appoints former Chief Minister of the Central Province and Deputy General Secretary of the SLFP Sarath Ekanayake as the Acting General Secretary of the fast-fragmenting SLFP.

- The world’s largest passenger plane, the Airbus A380-800 arrives at the International Airport, Katunayake for refuelling: the flight EK 449 of Emirates Airlines was flying from Auckland to Dubai: the 413 passengers and 29 crew members did not disembark.

- A top official of the Health Ministry says there are plans to expand cancer hospitals in the country and modernize facilities as funding improves in the future: also says the President has directed the Ministry to establish 4 new hospitals for cancer patients in Jaffna, Hambantota, Badulla and Anuradhapura Districts.

- Actor Ryan Reynolds says Hikkaduwa is his favorite movie shooting location of all time: recollects his first movie, “Ordinary Magic 1993” which was filmed in Sri Lanka.

14 years of LNW

Today (March 07) marks the 14th Anniversary of LNW. Below is a remark gushing over the 14 years of LNW and the hardships we came through.

Founded in 2009, LNW (then ‘Lanka News Web’) stepped itself out from the crib into a world so repressive of journalists seeking the truth, following the brutal assassination of Lasantha Wickremetunga, Editor of ‘Sunday Leader’, on January 08, 2009. Considered to be one of the worst moments of media repression in the history of Sri Lanka under the wrath of the then Rajapaksa Regime, the year led to the calling in of a dialogue related to the creation of a new web portal amongst a group of media experts, who at the time were living overseas for their own protection, in a mission to fulfil the need of a platform that advocates for Media Freedom, Human Rights, and opposes State-Repression.

After one month of painful trials, ‘Lanka News Web’, a trilingual web portal, was launched on March 07, 2009.

Starting a journey at a time Sri Lanka was suffering from State-Repression and nationalistic provocations triggered by the thirty-year-old Civil War, making the pit to the media a living hell, whilst forcing journalists of alternate visions to flee the country or resort to self-censorship, Lanka News Web blossomed so well that at one point it was even banned by the State within the local servers for months. Despite the ban, Lanka News Web continued to fight for the freedom of Sri Lankan Media and Human Rights and against corruption and fraud by publicly disclosing stories, becoming itself a hurdle jumper since 2009.

Lanka News Web was recently rebranded as ‘LNW Media Network’ and currently operates within walls that are preferring the Corporate Sector, and most notably is subjugated to criticism by our oldest readers for ‘walking out’ of the nature characterised as argumentative as we once were. However, LNW at present values the primary objective of creating job security for our staff who maintain the website’s continuity as a trilingual (Sinhala/Tamil/English) news aggregator.

In the days of Covid, LNW had to go through a very difficult situation financially, and notwithstanding being ‘financially challenged’ being second nature to us, the Pandemic improvised the scenario to a point where we barely escaped unscathed and without having to close our company.

The immense hardships during the Pandemic taught us a lesson, that we ought to maintain ourselves not only within the boundaries of socio-economic objectives, but business objectives as well. The responsibility of securing the future of the local and foreign staff working for us by embracing the risks we are passing through and trusting us for a long time was not easy, hence the rebranding being taken place.

LNW, accordingly, decided to cross the border and reach beyond the status of just a news aggregator, by spreading to several new dimensions including the Social Media. LNW is currently at the process of advancing itself into connecting with the Corporate Sector.

We are of a clear political view, a view that disregards party politics and takes the side of the people, the oppressed. We are unconditionally against any form of discrimination targeted against a person or a constituency and value the freedom of the people. That being said, we harbour no tradition of appearing to the oppressor in the cloak of impartiality, and provide equal opportunity for all parties, political or otherwise, to raise their opinion.

Being able to provide information to the public in a continuous journey for 14 years amongst a large number of news websites in Sri Lanka, LNW faced endless challenges on the way, but we truly thank our readers and friends who have stood by us and strengthened us in every moment. We invite everyone of you to further stay with us and grow with us, as we continue to change and renew.

Monetary policy by the IMF staff – Should we restructure CB like other SOEs?

By looking at the monetary policy press release issued by the Economic Research Department of the Central Bank (CB) on 3 March, I felt that the country now does not need a Monetary Board or a Central Bank if they are to implement monetary policy decisions made by the IMF staffers. Therefore, the Monetary Law Act after 72 years has now become an invalid piece of legal paper.

I further felt whether macroeconomic management policy framework of the country and its economy have now been outsourced to the IMF as our internationally trained policy economists are incompetent. In every policy action whether fiscal or monetary, we hear the policy origin as the IMF in looking for 2.9 bn. USD. Therefore, one might interpret the IMF deal as the situation of the country’s sovereignty being invaded by or rented out to the IMF by those who manage the economy.

Monetary policy decision on 3 March

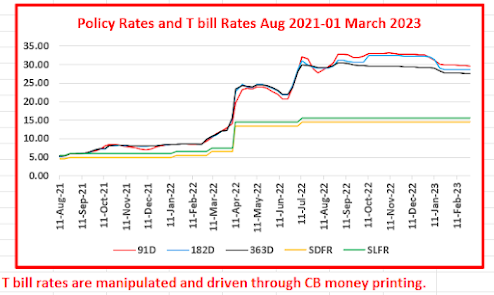

The Monetary Board/CB on 3 March 2023 raised its policy interest rates by another 1% to 15.5%-16.5% band (i.e., SDFR and SLFR). Accordingly, the total rate hike from August 2021 so far is 11% whereas 9% has been effected by the present Governor since 8 April 2022.

The CB states that such rate hikes are expected to curtail the excess demand in the economy in order to bring down inflation back to 4%-6% target in the medium-term and thereby to stabilize the economy.

Trend of inflation and recent market interest rates

However, the inflation estimated as the percentage increase in the Colombo Consumer Price Index (CPI) has accelerated from 5.7% in July 2021 to 69.8% in September 2022 and decelerated thereafter to 50.6% in February 2023. The new CPI introduced from January 2023 also has statistically helped reduce inflation from 57.2% in December 2022 (based on old CPI) to 51.7% in January 2023 (based on new CPI).

Accordingly, in view of disinflation path and projections of single digit inflation towards the end of this year, the CB commenced several strategies outside the policy rates to reduce market interest rates such as Treasury bill yields and inter-bank rates.

In fact, some media saw recent decline in Treasury bill yields as a healthy sign of gaining economic stability back and spread expectations of rate cuts by the CB in the near future. The CB also expressed hopes of market interest rates coming down gradually due to its new policy actions such as new OMO restrictions announced on 2 January 2023, series of selective reverse repo liquidity auctions and more private placements in sale of government securities.

Background of the rate hike

However, the media and markets were shocked by 1% rate hike announced on 3rd March. The Governor at the press conference disclosed that the rate hike decision was taken as part of the staff agreement with the IMF which has insisted a rate hike of 2.5% to unlock the IMF loan facility of 2.9 bn USD being awaited.

When present level of high inflationary pressures above 50% being broad-based in the economy and seen sustaining for a long period to come, further rate hike approach of the IMF is seen highly appropriate in the present policy interest rates-based monetary model believed by both IMF and CB (However, I am totally against this model for Sri Lanka).

Many central banks led by those in developed market economies are presently in same direction although inflation has been peaking during last few months because of sustained inflationary pressures of four decades high. Therefore, the CB’s temptation to reduce market interest rates through administrative actions are seen inconsistent with the monetary policy concept. In fact, the CB maintained policy rates unchanged at 14.5%-15.5% at five last meetings despite high inflationary pressures.

Policy governance concerns

The policy press release this time does not contain usual macroeconomic rhetoric of the CB unlike in other monetary policy press releases and it is a slippery, idle one page short one. Therefore, the Monetary Board or monetary policy economists of the CB do not seem to have any macroeconomic justification for the monetary policy decision this time other than the surrender to the IMF ideology.

I used to comment on contents of recent policy statements one by one on technical/economic grounds. However, I have only few contents to be commented in the present statement. They are given below in five points.

1. The CB seems to seek public sympathy for the rake hike this time.

- First, it mentions some differences between the CB and IMF staff on the inflation outlook.

- Second, it cites the consensus reached between the CB and IMF staff on the quantum of the rate hike as it states “the Monetary Board and the IMF staff reached consensus to raise the policy interest rates, in a smaller magnitude, compared to the adjustment, which was envisaged during the initial stage of negotiations.” The Governor stated at the press conference that the IMF requirement in last September was a 2.5% rate hike. Similarly, the IMF in the last week got the Central Bank of the collapsing economy of Pakistan also to hike rates further by 2% to 20% where the central bank stated that the rake hike was to anchor inflation expectations of the economy which is seemingly getting bankrupt in Sri Lankan style, while the disbursement of the IMF loan of 6 bn USD already approved is suspended.

- Third, the CB passes the blame to the government for the surrender to the IMF by stating that “this decision demonstrates Sri Lanka’s commitment to the IMF-EFF arrangement, which has been pursued by the Government in order to ensure stability in the economy on multiple fronts.” It is public secret that the present Governor and Secretary to the Treasury are the people who overwhelmingly ran after the IMF with a motive to newly build their public positions. However, now the CB sees IMF deal as the work of the government and excuse for the rate hike.

2. The purpose of the Monetary Board is now lost because the policy statement recognizes the IMF to resolve the economic crisis. This is established by the statement “the finalisation of the IMF-EFF arrangement is expected to benefit all stakeholders and bolster confidence, which would help restore stability in the economy on a sustained basis. This will incentivise more foreign exchange flows in the period ahead that would aid the economy to overcome the prevailing economic crisis.” How the economy is stabilized by the 17th IMF loan program with 2.9 bn USD disbursed over a period of four years after failing of 15th and 16th IMF programs in the last decade is questionable, especially at the time of present economic crisis confronted by the country.

3. Like in the Central Bank of Pakistan, the Monetary Board also has given a slippery justification for the policy decision by stating that “the Board was of the view that the economy has already traversed through the most difficult and unprecedented times with tremendous resilience and strongly believes that today’s decision would pave way for a faster-than-expected deceleration of inflation.” However, the Monetary Board does not give any time frame for the public to assess its inflation control performance.

4. The Monetary Board also provides uneconomic anticipation from the rate hike by stating that “the Monetary Board anticipates that this monetary policy action would help lower the spread between policy interest rates and high market interest rates. This spread is expected to be further reduced with the reduction in market interest rates in the period ahead, especially the yields on government securities, reflecting the easing of risk premia as the debt restructuring process progresses.” This is a monetary joke made without any idea on economic principles behind interest rates.

- First, the Monetary Board raises policy rates to narrower the gap between policy rates and high market interest rates. In fact, policy interest rates is the base that drives other interest rates. Therefore, if the monetary theory works, market interest rates also should rise in response to higher policy rates in the next week and the spread will continue. Therefore, it is joke expect a narrower spreads while policy rates are raised.

- Second, Monetary Board members are unware of economic/financial fundamentals behind risk premia reflected in interest rates among different credit sectors. Risk premia are determined by credit markets and, therefore, the present mode of policy rates cannot intervene in market risk premia.

- Third, debt restructuring in fact will raise the risk premia on government debt due to concerns over domestic debt restructuring and uncertainty. In fact, the CB purposely drove government securities yield rates to rise at the beginning in order to tighten the monetary conditions without raising policy rates adequately as Treasury bill rates are directly controlled by the CB through various undisclosed devices. In contrast, the recent reduction in Treasury bill rates is also a hidden manipulation to mislead the public that the economy is now stabilizing gradually.

5. The Monetary Board states that “the Board urges all stakeholders to remain hopeful and reiterates its commitment to ensuring price and economic stability, and financial system stability, thereby assuring the normalisation of the interest rate structure no sooner the price pressures are sufficiently contained in the period ahead.” This is a meaningless statement.

- First, stakeholders of the Monetary Board are not listed. In fact, the Monetary Board is a stakeholder of the public.

- Second, as the Monetary Board implements the monetary policy of the IMF for Sri Lanka as revealed from the present decision, the Board cannot offer any commitment to the public.

- Third, the nature of the commitment whether Board steps down in the event the stated stability is not restored in a specified period is not stipulated.

- Fourth, normalization of interest rate is only a slang policy word and nobody knows what the normalized level is for any activities.

Concluding Remarks

If Mr. John Exter was alive, he would cry over the pathetic plight of the Sri Lankan Central Bank after 72 years. He recommended the authorities to assess the performance of the CB on its public duties after a period of 10-15 years. However, the authorities have failed to do it even after 72 years and, therefore, the present CB is a technically bankrupt both policy-wise and finance-wise and led the government and economy also to bankrupt after 72 years of its existence.

The present monetary policy press release itself is the evidence for policy bankruptcy. The evidence for the financial bankruptcy is the collapsed foreign currency reserve and resulting heavy exposure to government securities in quasi-default.

Therefore, relevant state authorities have to decide urgently whether they go with a new Central Bank to take risks of banks and financial institutions at a cost to the public under the new law proposed by the IMF or restructure the CB under the present monetary law to help the public recover from the present economic crisis in association with fiscal policies of the governments elected by the public.

Otherwise, the economy of Sri Lanka will be managed by the IMF to facilitate capital flows of international investors belonging to its controlling member countries. This is self-evident from policy statements that the IMF loan program is to rebuild confidence of international investors in Sri Lanka in old style of financial investments that the IMF has failed 16 times so far in the past.

However, the IMF and its agents in Sri Lanka act on past statistics management of the economy without any assessment of natural resource base of the country and potential development. Therefore, the IMF and its agents will definitely fail to stabilize Sri Lankan economy again for 17th time in the Sri Lankan recent economic history.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 10 Economics and Banking Books and a large number of articles publish.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

Economy Forward: https://economyforward.blogspot.com/2023/03/monetary-policy-by-imf-staff-should-we.html

SLFP appoints Ekanayake as acting Secretary General in Jayasekara’s absence – Reports on ousting Jayasekara false

By: Isuru Parakrama

Colombo (LNW): The Sri Lanka Freedom Party (SLFP) has appointed Sarath Ekanayake, who serves as the Party’s Deputy Secretary General, as the acting Secretary General of the SLFP in Dayasiri Jayasekara’s absence.

MP Jayasekara has reportedly left for the United Kingdom to attend the graduation ceremony of his son, and Ekanayake is expected to fill in until his return.

Meanwhile, speculations on the SLFP MP being ousted from the post of Secretary General are completely false, as Ekanayake was appointed as the acting Secretary General by Party Leader Maithripala Sirisena in full consultation with Jayasekara, Party sources said.

SL Ambassador discusses cooperation on climate change with ROK Deputy Minister of Climate Diplomacy

Ambassador of Sri Lanka to the Republic of Korea Savitri Panabokke met with Ambassador and Deputy Minister for Climate Diplomacy of the Ministry of Foreign Affairs of the Republic of Korea Hyoeun Jenny Kim on 02 March 2023.

During the meeting the Ambassador and Deputy Minister discussed issues relating to climate change and means to enhance climate cooperation between Sri Lanka and the Republic of Korea.

The Ambassador also apprised Deputy Minister Kim of President Ranil Wickremesinghe’s vision and policies relating to climate change, and climate change initiatives by Sri Lanka in international fora.

The Embassy’s Second Secretary Sachini Dias and Second Secretary of the Climate Diplomacy Division Eunju Oh also attended the meeting.

Embassy of Sri Lanka

Seoul

All Opposition parties jointly write to EC demanding LG Polls

By: Isuru Parakrama

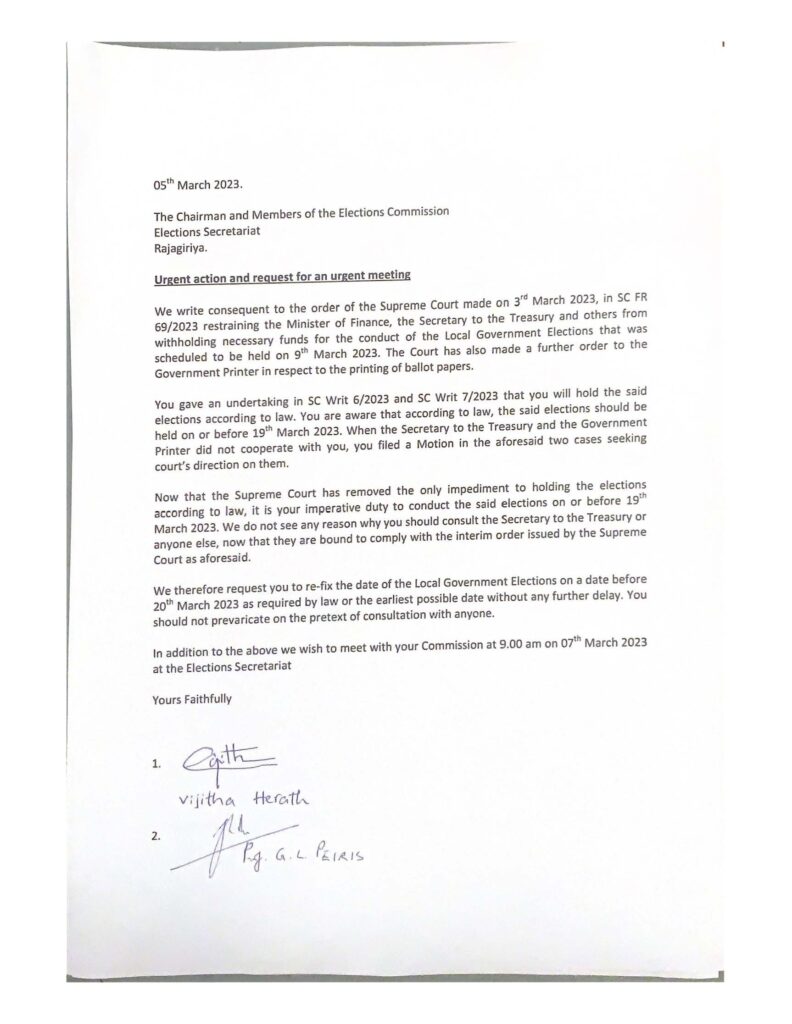

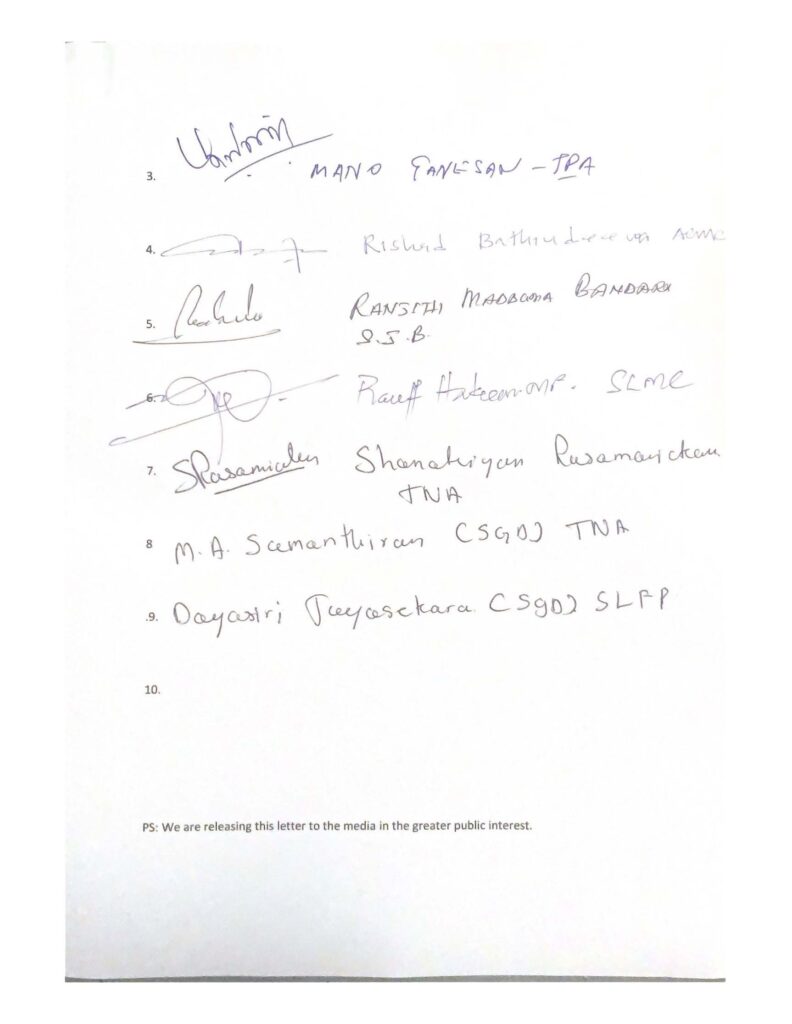

Colombo (LNW): All Opposition parties of the Parliament of Sri Lanka have jointly submitted a letter to the Election Commission demanding the holding of the Local Government Election on March 19, in compliance with the Court order.

Accordingly, the letter was signed by MPs of the Samagi Jana Balawegaya (SJB), National People’s Power (NPP), Tamil National Alliance (TNA), Sri Lanka Freedom Party (SLFP), Tamil Progressive Alliance (TPA), Sri Lanka Muslim Congress (SLMC), All Ceylon Makkal Congress (ACMC) and breakaway fractions of the Sri Lanka Podujana Peramuna (SLPP).

SL to face its sixth review under ICCPR in Geneva, Switzerland

By:Isuru Parakrama

Colombo (LNW): Sri Lanka being accountable for the pledges it has made before international declarations will be facing its sixth review under the International Covenant on Civil and Political Rights (ICCPR) on 08 and 09 March, 2023 in Geneva, Switzerland.

The sixth periodic review by Sri Lanka was submitted on 22 February, 2019 to the Human Rights Committee. The island nation pledged before the ICCPR on 11 June, 1980, and has submitted five subsequent periodic reports from 1983 to 2013. Sri Lanka has participated five reviews from 1983 to 2014.

At the request of Sri Lanka, the sixth review will be held in ‘hybrid format’ and will be led by Sri Lanka’s permanent Representative to the United Nations Himalee Arunatilaka. The Sri Lankan delegation comprises senior officials from the Presidential Secretariat, Ministry of Public Security, Attorney General’s Office, Ministry of Foreign Affairs, and the permanent Mission of Sri Lanka to the United Nations participating in person.

Senior officials from Sri Lanka will also be joining the review virtually representing the Ministry of Justice, Prison Affairs and Constitutional Reforms, Ministry of Defence, Ministry of Women, Child Affairs and Missing Persons, Office on Reparations and Office for National Unity and Reconciliation.

Sampath Bank and CIC Holdings join hands to empower rural agri-entrepreneurs

Local private banks are now introducing innovative financial solutions for rural agricultural and industrial business sectors for the benefit of villagers.

Sampath Bank has officially unveiled the ‘Value Added Agriculture’ program in collaboration with CIC Holdings PLC with the aim of strengthening agri-entrepreneurs in different parts of the country by promoting value added agriculture among rural communities.

This program will take place in the areas where the bank’s flagship, award-winning ‘Wewata Jeewayak’ tank restoration program has been implemented so far.

The ‘Value Added Agriculture’ program was officially launched with the first event being conducted on 23 January with the participation of members of Divulankadawala Farmers Associations in Medirigiriya where the bank successfully completed the tank restoration program in 2018.

During the event, a panel of experts from CIC Holdings conducted the knowledge sharing sessions on Value Added Agriculture for the members of the Farmers Association.

A financial literacy program was conducted by Sampath Bank at the event in order to develop the agri-entrepreneurs’ financial management skills.

‘Value Added Agriculture’ generally refers to processes that boost the value of primary agricultural commodities.

This increases the economic value of the commodity as the customer base of a product and revenue sources for the producer are expanded. With the know-how on new agri-based technologies and ‘value added agriculture’ the rural agricultural community will benefit significantly and will be well-positioned to produce farm products with a higher intrinsic value.

The proposed program aligns with the culture, competencies and value systems of both Sampath Bank and CIC Holdings. Both organisations are well-known to possess a deep-rooted understanding of the pulse of the rural communities.

The promotion of climate smart agriculture, modern water management techniques and grooming agri-entrepreneurs are ancillary objectives of the program.

Sampath Bank Chief Human Resource Officer Dr. Lalith Weragoda stated, “To enhance our food security and be better equipped to face the current economic crisis, Sri Lanka needs to take bold steps to increase agricultural output.

We need both high yields and high-quality yields, both of which will be possible through this Value Added Agriculture program. Amidst this process, Sampath Bank plays a significant role by developing a strategic link/synergy to diverse industries.

The program, which combines the inherent strengths of Sampath Bank and CIC Holdings, will go a long way in empowering these agri-entrepreneurs and get them to deploy these agri-based technologies to increase their harvest and their income, leading to a better quality of life for those communities.”

Sampath Bank initiated the ‘Wewata Jeewayak’ tank restoration program in the year 2001 to restore the traditional irrigation network of neglected tanks located in the Dry Zone in Sri Lanka.

India-Sri Lanka relations are at their highest point: Deputy High Commissioner

Deputy High Commissioner of India to Sri Lanka, Mr. Vinod K Jacob says that India-Sri Lanka bilateral relations are at their highest point and attributed deep rooted people to people connect as the main reason for the same. He made references to five specific developments that are central to the excellent bilateral relationship.

First, the people and Government of India extended support during Vaccine Maitri and with expedited issuance of medical visas, immediately after lifting of travel restrictions by Government of Sri Lanka.

Substantial support was extended through the iconic Suwaseriya 1990 ambulance during Covid as well as through medical supplies in response to specific requests from hospitals in Kandy Hambantota and Jaffna.

Government of Sri Lanka the people and Government of India extended economic, financial and humanitarian support worth USD 4 billion in 2022.

India has been supporting Sri Lanka at G20 meetings and also invited HE President Ranil Wickremesinghe to Voice of Global South Summit in January 2023 as a mark of solidarity.

drawing on the recent experiences, there exists considerable scope for deeper engagement in the health and well being sectors as well as in traditional medical systems.

Prime Minister of Sri Lanka Dinesh Gunawardena, was the Chief Guest at the inauguration ceremony of the Medicare 2023 health care exhibition in Colombo on 3 March 2023

A delegation comprising around 40 Indian companies in the healthcare sector including 25 hospitals has set up an ‘India Pavilion’ at Medicare 2023, which is being held during 3-5 March 2023.

India believes that for Sri Lanka to hit the road to economic recovery at full throttle, it has to put the past behind it, particularly in terms of power devolution for the minority Tamil community, which was also the cause of years of protests, followed by decades of youth militancy, in turn graduating into a deadly cocktail of LTTE terrorism and conventional war.

If New Delhi is not concerned about the possible revival of the majority left-leaning Sinhala youth militancy of the early seventies and late eighties (JVP Insurgency I & II, 1971 and 1989), there were no outstanding political issues or policy options that Colombo had to address at present.

It possibly included as the potential for Sri Lanka to make the eastern harbour-town of Trincomalee into an energy hub ’ and also commercially exploit the nation’s wind-energy capacity.

The restoration of the unused tanks would require massive sums, which India is willing to put in, so that they could jointly create a ‘strategic storage’, the kind which could have saved Sri Lanka during last year’s crisis. Needless to say, the nation’s energy security would then hinge on the larger sense of security that it feels, with India putting in the kind of money that would be required for the project.