Press Release

Pan Asia Banking Corporation PLC reflected resilience amidst a multitude of adversities emanating from challenging macro-economic conditions. The Bank’s financial performance for the period ended 30th September 2022 demonstrates judicious portfolio management and prudency exercised in dealing with possible fallout on its asset quality from the sharp increase in interest rates. During the period under review, the Bank increased its net interest income by 11% to Rs. 7,433.6 million as testament to the enhanced management of its asset and liability portfolio, making the most of the rising rates. For the nine-month period, the Bank reported a Pre-Tax Profit of Rs.626 million and a Post-Tax Profit of Rs.433 million.

“Our performance is a testament that we have put quality over quantity this year, when the circumstances dramatically changed from what we witnessed last year. This was achieved while managing the assets and liabilities to generate returns from our existing portfolio, along with keeping a closer tab on operational expenses amid runaway inflation,” noted Nimal Tillekeratne, the Bank’s Managing Director/Chief Executive Officer.

The Bank sensibly increased its provision buffers for loan losses during the period under review by introducing changes to impairment models, taking into consideration increased risks and uncertainties emerged due to the turbulent economic conditions in the country, including additional provisions on the Bank’s investments in foreign currency denominated financial instruments of Government of Sri Lanka. The impairment expense for the reporting period includes provisions made on foreign currency exposures to the Government of Sri Lanka and amounted to Rs.1.58 billion.

Meanwhile, the Bank’s Net Fee and Commission Income recorded a growth of 6% mainly due to increased volumes and rates of international trade activities, guarantees and remittances. The Net Gains from Trading increased by 264% mainly resulting from reporting high premiums in forex swap agreements due to the unconventional developments in the swap market, which was heavily discounted in the previous period.

The Bank strived for earnings maximization through portfolio re-alignment and cost management despite sector vulnerabilities that prevailed since last year. The Bank’s Cost-to-Income Ratio improved during the period under review, owing to excellence in core banking performance, which is reflected in growth across most key revenue lines and due to various strategies and measures taken to contain the increase in overhead costs. In fact, the Bank managed to contain the increase in Other Operating Expenses at 15% during the period under review compared to the previous period despite rising commodity prices.

The Bank’s Total Asset base stood at Rs. 205 billion as at 30th September 2022, after posting a growth of 8% during the nine-month period, supported mainly by the expansion in investments and loan book. The Gross Loans and Advances book recorded a growth of 4% to reach Rs. 157.04 billion, with major contributions from the Retail segment. The Customer Deposits recorded a growth of 8% to reach Rs.157.64 billion as at 30th September 2022.

The Bank maintains all its Capital and Liquidity Ratios well above the regulatory minimum standards. The Bank’s Tier 1 Capital Ratio and Total Capital Ratio as at 30th September 2022 stood at 13.44% and 15.41% respectively. The Bank’s Statutory Liquid Assets Ratio (SLAR) as at 30thSeptember 2022 stood at 23.50% and 83.93% for Domestic Banking Unit and Off-Shore Banking Unit respectively. Meanwhile, the Bank’s Liquidity Coverage Ratio (LCR) under BASEL III stood well above the statutory minimums. The Bank maintained LCR of 194.77%and207.16% for All Currencies and LKR respectively.

The commitment to technology adoption was demonstrated via many activities deployed during 2021/22 to ensure a seamless banking experience. Pan Asia Bank became the First Bank to integrate with the Lanka Clear, Common Interface of Lanka Pay Payment platform, through Internet Banking – enabling customers to carry out government payments digitally. Existing customers were also empowered to open savings accounts through Internet Banking and to check their credit card balance through a missed call facility without having to reach the contact centre. The implementation of the new leasing system during the period under consideration enhanced internal processes and the overall customer experience. Despite the external environment, the Bank continues to invest and focused on the core operation, product management, people development, and technology integrations.

Going from strength to strength, Pan Asia Bank secured the Runner-up Award – Banking sector, and the Merit Award – Corporate Governance category, at the annual National Business Excellence Awards (NBEA), organized by the National Chamber of Commerce of Sri Lanka. It was also selected by LMD as one of the top 15 ‘Most Awarded Entities’ and top ‘Most Respected’ Entities along with many other accolades and recognitions. The most recent addition to this list is Pan Asia Bank’s award as one of Business Today’s Top 40 business organizations for 2021-2022. This award is given to the largest organizations in the country based on a variety of criteria such as portfolio, profits and risks taken, resilience, passion, and how well challenges are met.

Recording consistent growth year after year, Pan Asia Bank is strongly positioned as the ‘Truly Sri Lankan Bank’, marking an illustrious journey that has promoted financial security and fulfilled the aspirations of its customers while supporting the prosperity of the nation. Pan Asia Bank’s journey of progress continues with renewed commitment as the most trusted Truly Sri Lankan Bank.

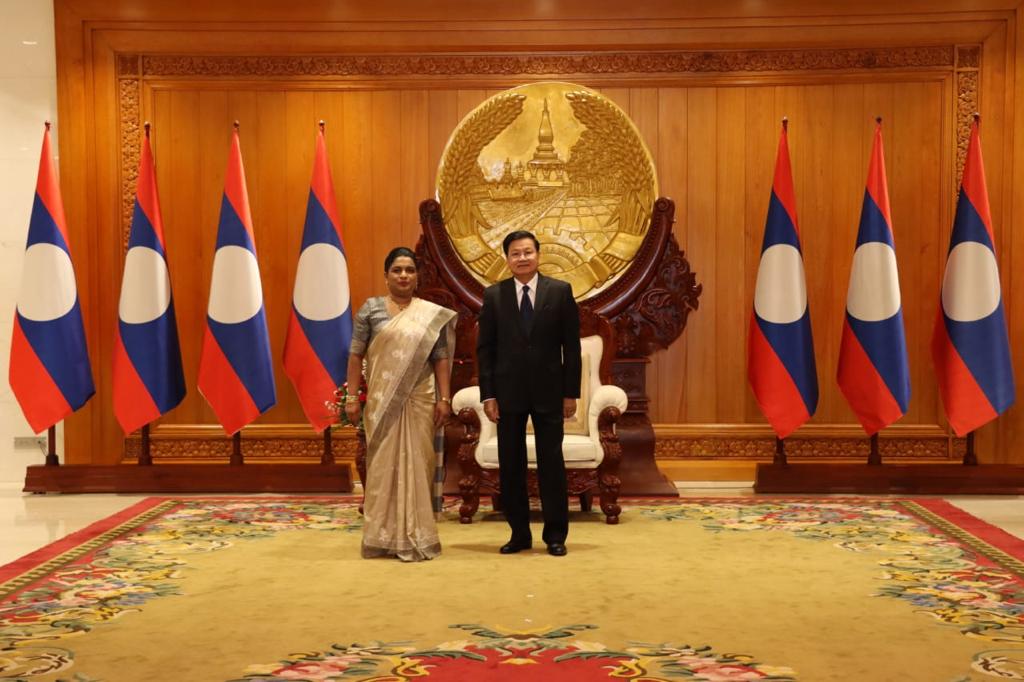

Photo caption: Jayantha S B Rangamuwa – Chairman of Pan Asia Bank and Nimal Tillekerathne – MD/CEO of Pan Asia Bank