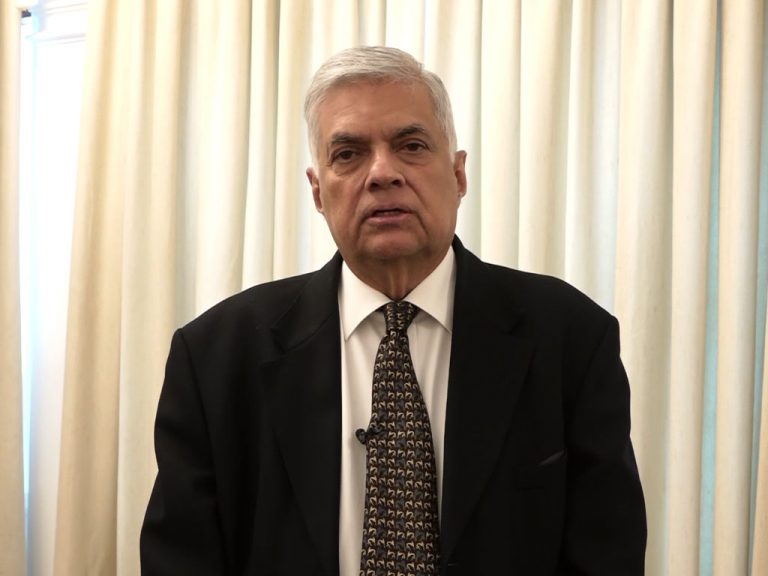

Sri Lanka will convene a donor conference with the participation of representatives of China, India and Japan to mobilise more foreign assistance and present an interim budget in August prime minister Ranil Wickremasinghe divulged on Wednesday, amid ongoing negotiations with the International Monetary Fund (IMF).

He disclosed that a staff-level agreement with the International Monetary Fund (IMF) and the programme for a bailout package would be finalized by the end of July.

The country needs the support of India, Japan and China who have been historic allies. We plan to convene a donor conference with the involvement of these countries to find solutions for Sri Lanka’s crisis,” Wickremesinghe told parliament.

“We will also seek help from the U.S.,” he said, adding that his administration will use US$70 million from the World Bank for buying cooking gas, which has been in short supply, setting off sporadic protests.

A high-level delegation from India will arrive on Thursday for talks on additional support from New Delhi, and a team from the U.S. Treasury will visit next week, Wickremesinghe revealed.

India has so far provided around $4 billion worth of assistance, the prime minister said, including a $400 million swap and credit lines totalling $1.5 billion.

China, which has traditionally jostled with New Delhi for influence over the Indian Ocean island, is considering an appeal from Sri Lanka to renegotiate the terms of a yuan-denominated swap worth $1.5 billion to fund essential imports.

An interim budget will be presented in August, seeking to put public finances on a more sustainable path and increase funds to the poor who have been hardest hit he divulged.

“The interim budget will set the path forward. This, together with an IMF programme and debt sustainability, will lay the foundation for Sri Lanka to return to economic stability,” he said.

Negotiations with an IMF team, which arrived in Colombo this week, have made progress, with a staff-level agreement with the lender likely by the end of the month, Wickremesinghe said.

“We have discussed multiple points including fiscal policy, debt restructuring and direct cash transfers,” he said.

“Parallel to this we have also started talks on a debt restructuring framework, which we hope will be completed in July.”

Sri Lanka, which suspended payment on $12 billion of foreign debt in April, is seeking around $3 billion from the IMF to put its public finances on track and access bridge financing.

PrIme Minister Wickremesinghe said that once an agreement with the IMF was reached, his government would focus on a plan to increase Sri Lanka’s exports and stabilise the economy.

“It is no easy task to revive a country with a completely collapsed economy,” he said, calling for opposition support for his economic recovery plan.