China hopes relevant countries and international financial institutions will work with China to play a positive role in helping Sri Lanka overcome the current difficulties.

Chinese foreign ministry spokesperson Mao Ning made the remarks when asked to comment on media reports that an International Monetary Fund (IMF) team will travel to China this week to discuss faster progress on debt restructuring for countries including Sri Lanka, which is trying to get an assistance package from the IMF.

Mao said China has long-standing sound cooperation with the IMF and other international economic and financial institutions.

Concerning Sri Lanka’s debt issue, Mao said China attaches high importance to Sri Lanka’s difficulties and challenges.

“We support the financial institutions in working out ways with Sri Lanka to properly solve the issue,” she said.

We also hope relevant countries and international financial institutions will work with China and continue to play a constructive role in helping Sri Lanka overcome the current difficulties, ease its debt burden and realize sustainable development, she added.

Sri Lanka won’t be able to resolve its debt restructuring problems without help from China as the country teeters on the brink of economic collapse, according to analysts.

China may become the key factor in deciding the timing of the International Monetary Fund (IMF)’s loan disbursement for Sri Lanka to ease the ongoing unprecedented economic crisis, local and international analysts say.

China has agreed to help Sri Lanka in facing the economic crisis, but so far has not committed for any debt restructuring plan, government officials who are dealing with the debt structuring said

The completion of debt restructuring – either through a haircut or rescheduling the debts – is mandatory for the approval for the IMF loan from the global lender’s Executive Board.

China has, instead, proposed a refinancing strategy: more lending by China to Sri Lanka in order to repay Beijing’s own debts in the past.

Sri Lanka has defaulted on its debt, plunging the island nation into its worst financial crisis since independence in 1948. In addition to fuel shortage, the country also faces the prospect of running out of food, staples and medicines.

Public frustration over the deepening economic crisis has spilled over to raging street protests in recent months. President Gotabaya Rajapaksa, who has been blamed for the economic mismanagement, was forced to resign and fled overseas last week as anger toward his government spiraled.

China’s willingness to provide substantial debt relief to Sri Lanka will be vital to accelerate the debt restructuring and in helping the country get out of its current situation, said an economic expert.

China calls for joint efforts of foreign donors to ease SL’s debt burden

Central Bank Independence for whom?

IMF must accelerate the Board approval to release the first tranche of $500 million without pushing for CBSL independence. Other than Nandalal Weerasinghe no one else wants greater independence given to CBSL. Seriously look at the knowledge of state officials on international trade and exports and impact of it. Everyone blames politicians only. As Dr Harsha recently pointed out the data available in this country is not correct in any sector and they do not do data analytics at all. For example CBSL Governor without the approval parliament made the country to default . The consequences of that decision is far worse than LTTE dropping bombshells in Colombo and destroying the Airport. So he says he does not have independence? He is doing as he pleases with no consequences ably supported by Coomraswamy, and even the executive President is watching in silence as the man does what ever he wants with no consequences and accountability . So the IMF wants to give him more independence? Unfortunately IMF thinks we are a bunch of idiots because we acted like idiots during the GotabayaR Regime?

CBSL Independence

Inflation is not the problem we have today. To raise interest rates by 100% and destroy the private sector. When history is written it will be said that this is the stupidest decision we took next to the soft default ? What kind of business can you run by borrowing at 32% , only a brothel or undertakers. What is our real problem. We have run out of Dollars. Why did we run out of dollars? Why do we have huge rupee and dollar debt ? Why did we continuously borrow? Even after the default, why are we going behind lenders and begging for more loans ? Because we are a nation of consumers, not a nation of producers! We are a population of 22 million consuming more than we are generating ( or producing ) . Obviously, if you spend more than you earn, you end up borrowing!

Inflation will get rid of this anomaly. Inflation will push people to be productive to survive. Inflation will adjust the prices of goods and services and will demand consumers to pay the cost of their consumption, by themselves. Inflation will ensure that by running a three wheeler, wayside boutique shop, or small salon/spa, an individual cannot maintain a family. In short, inflation will demand you be more productive, or perish! Inflation shall be addressed by productivity and not by adjusting the policy rates. CBSL’s usage of CCPI as a the main indicator is incorrect because it includes food and fuel, whereas the Core CPI used by the Fed excludes these two. Also CCPI is a lagging indicator – if it has come down in October and November – it is showing the ground situation as at July. Unless CBSL starts reducing rates, we will end up in a severe recession and defaulting on Rupees..What we must implement is more productivity focused economic policies and not consumer based policies.

No friendly country or lending institution shall lend money to Sri Lanka to re-implement or maintain this unproductive, subsidized society. Because if they do, these lenders will also not get their money back and the country will declare bankruptcy again in a few more years! Lenders including IMF must insist that no imported goods , including fertilizer and fuel shall ever be subsidized. They must insist that the dolling out of money by way of various other subsidy schemes be stoped. They must insist that retirement age of all government employees must be at 60 years and not 65! Lenders must demand that loss making government business ventures be shut down or to privatized. Don’t lend us to defend our currency artificially. “ also we need to prosecute the plunderers.

We need to wake up, not only to chase these political vultures and incompetent bureaucrats away, but also to change ourselves, our attitudes, and our society. With electricity tariffs going up by 100% , taxes doubling and interest rates not getting reduced because of the adamance of Weerasinghe the President could soon have a serious Aragalaya on his hands fueled by hunger and a desperate power hungry opposition . 2023 is certainly not looking good for Sri Lanka, and all what CBSL wants is independence. Well and good if people are held accountable for their actions!

Adolf

Foreign donor agencies agree on coordinated aid program for Sri Lanka

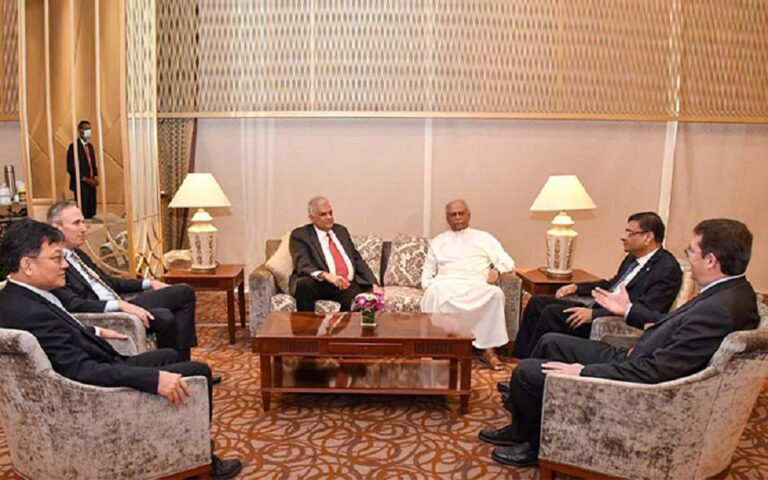

World Bank (WB), Asian Development Bank (ADB), International Monetary Fund (IMF) and Asian Infrastructure Investment Bank (AIIB) representatives decided that a coordinated assistance program supported by the multilateral financial institutions is required for Sri Lanka to recover from the economic crisis the country is currently facing.

They reached the agreement following a lengthy round table discussion held yesterday (06) with President Ranil Wickremesinghe in Colombo where the latter presented Sri Lanka’s development program associated with the economic recovery and growth along with the vision for long term development.

The President presented the program at the round table discussion in his capacity as the Minister of Finance, Economic Stabilization and National Policies.

The round table discussion was held with Vice President of the World Bank Mr. Martin Raiser, Vice President of the Asian Development Bank Mr.Shixin Chen, IMF’s Senior Mission Chief Mr.Peter Breuer and Dr.Urjit Patel of the Asian Infrastructure Investment Bank along with the senior officials of those institutions, who are currently in Sri Lanka.

Following the detailed discussion, it was agreed that a coordinated assistance program supported by the multilateral financial institutions is vital for Sri Lanka to recover from the present economic difficulties.

In the interim, the government is expected to set the contours of Sri Lanka’s economic reform programme—tax hikes, spending cuts, and rationalizing state-owned enterprises—to reassure international creditors that the country is on an adjustment path.

Sri Lanka’s economic crisis is deepening with unsustainable debt and a severe balance of payment crisis on top of lingering scars of the COVID-19 pandemic.

Debt restructuring and the implementation of a deep reform program are critical for Sri Lanka’s economic stabilization,SL development program highlighted. .

Plunged into its worst-ever economic crisis, Sri Lanka’s real GDP is expected to fall by 9.2 percent this year and a further 4.2 percent in 2023.

High commodity prices also worsened Pakistan’s external imbalances, bringing down its reserves. After devastating climate-change-fueled floods submerged one-third of the country this year, its outlook remains subject to significant uncertainty.

Sri Lanka money printing galore leads to economic collapse

Despite tightening of monetary policy and curtailing money printing, the Central Bank is compelled to increase the reserve money base as a result of the finance ministry’s proposal to raise the government borrowing ceiling to over Rs. 4.5 trillion from present Rs 3.84 trillion.

State Finance Minister Ranjith Siyambalapitiya has presented the proposal to raise the sate credit ceiling by Rs 663 billion to Rs 4.51 trillion claiming that the money printing has dropped by 7.8 percent compared to last year and bills were printed to meet essential recurrent expenditure.

In addition, a proposal was also tabled to raise the limit for Treasury Bills from Rs. 4 trillion to Rs.5 trillion.

The Central Bank has no option other than the raising of reserve money to Rs 2.4 trillion from the present level of Rs.1.4 trillion ,a high ranking treasury official said.

This will result in massive monetary expansion in 2 -3 years’ time unless corrective measures to taken to raise revenue and increase foreign reserves by implementing economic reforms in accordance with commitments made to the IMF, he warned.

This was confirmed by an eminent economist who is familiar with the monetary affairs adding that the Central Bank has to accommodate fiscal deficits by purchasing Treasury bills and bonds and providing temporary advances to the Government.

It will end up Net Credit to the Government (NCG) on the asset side of CB’s balance sheet causing a rise in the reserve money exerting pressure on the aggregate money supply and the overall liquidity level of the economy, he explained.

According to Central Bank Governor Nandalal Weerasinghe who clarified the money printing status, it has printed money to the tune of Rs. 341 billion in 2021 and it has dropped to Rs. 47 billion from January to October this year.

The reserve money base has gone up to Rs. 1.38 trillion during the first 11 months from Rs. 1.31 trillion by the end of 2021.

This will increase money supply slightly in another 1 and ½ years to 2 years high official of the ministry divulged.

The government’s daily revenue is set to increase to Rs9.5 billion in 2023 from Rs.6.53 billion in 2022 while the expenditure is expected rise to Rs.21.60 billion next year from Rs.17.05 billion this year, finance ministry estimates showed.

As per the budget 2023 revenue and expenditure estimates volume 01 , the government’s expenditure is estimated at Rs.5.82 trillion but the sum of Rs.3.80 trillion worth Treasury bills that should be repaid next year has not been included under the expenditure heading.

Therefore the actual expenditure is expected to be Rs.9.62 trillion .The International Monetary fund (IMF) will definitely consider this treasury bill amount when they consider the country’s debt structure next year.

The government is expected to collect Rs 3.42 trillion out of which Rs.915 billion would be from income tax and the balance Rs.2.50 trillion from other taxes. Raising such a massive amount from taxes is unrealistic under the present economic crisis, several economic experts and tax consultants said

SRI LANKA ORIGINAL NARRATIVE: 07/12

- President Ranil Wickremesinghe says steps being taken to introduce a “strong new economic system that can face 2050 without implementing economic reforms that offer no solutions to the current economic crisis”.

- President Ranil Wickremesinghe says Sri Lanka has offered the East Container Terminal of the Colombo Port to Japan: Colombo Port’s West Terminal has been given to India’s Adani Group to develop as a joint venture after the Govt of previous President cancelled the ECT deal with India and Japan.

- World Bank approves Sri Lanka’s request to access concessional financing from the International Development Association: move said to enable Govt to implement reform programme “to stabilize the economy and protect the livelihood of millions of people facing poverty and hunger”.

- NFF Leader and MP Wimal Weerawansa says Central Bank is unable to take legal action against exporters who have not repatriated their forex earnings into the country, as the Foreign Exchange Act of 2017 removed the ability of the authorities to take any action against such practices.

- Chinese Embassy in Sri Lanka says essential medicines and medical supplies worth Rs.2 bn donated by China to the Sri Lankan people has arrived in a shipment weighing over 255 MT: says China has donated Rs.5 bn worth medicines to Sri Lanka since June.

- Energy Minister Kanchana Wijesekara says there could be power cuts between 6 – 8 hours daily from next year if the proposed electricity tariff amendments are not implemented.

- Former Fisheries State Minister and SJB MP Dilip Wedaarachchi asks the

President for a fuel and kerosene subsidy for the fishing community: says the main reason behind the collapse of the fishing industry is the high fuel prices. - Justice Minister Dr. Wijeyadasa Rajapakshe says Govt will formulate new laws to compel the repatriation of billions of US Dollars which have been deposited in foreign countries by exporters: also says the country won’t have to face a forex crisis if that money could be got back.

- Representatives of WB, ADB, IMF and AIIB meet President Wickremesinghe: agree and assert that Sri Lanka needs a co-ordinated assistance programme supported by multi-lateral financial institutions.

- Report by the Office for the Coordination of Humanitarian Affairs for Asia & Pacific reveals that Sri Lanka continues to face a multi-dimensional crisis compounded by food insecurity, threatened livelihoods, shortages of vital and essential medicines, as well as rising protection concerns.

World Bank approves Sri Lanka’s request for IDA concessional financing

The World Bank has approved Sri Lanka’s Eligibility to access concessional financing from the International Development Association (IDA).

This type of financing, which is offered at low interest rates, will enable the country to implement its government-led reform program to stabilize the economy and protect the livelihood of millions of people facing poverty and hunger, said the World Bank on Tuesday (6).

The request is the result of Sri Lanka’s sustained deterioration in economic and social conditions, which have reduced income levels, reversed poverty gains, and affected its access to financial markets. This approval means Sri Lanka now becomes an IDA country.

“We are committed to helping the Sri Lankan people at this time of dire need so their country turns around and restores its economic well-being,” said Akihiko Nishio, World Bank Vice President for Development Finance.

“The World Bank is ready to support Sri Lanka as it implements reforms that will reduce poverty and rebuild the economy, creating the foundation for sustainable growth.”

Through IDA support, the World Bank will provide concessional financing, technical assistance, and policy advice as Sri Lanka implements reforms to drive recovery and enhance the country’s economic prospects, especially measures directed towards the poor.

With this approval Sri Lanka secured a US$ 300 million annual commitment from the World Bank’s International Development Association (IDA) following a meeting of its deputies in Washington recently.

As a member of the World Bank, the IDA is the financial institution that offers concessional loans to developing countries.

At Thursday’s meeting, the IDA reviewed Sri Lanka’s request for a temporary downgrade to lower-income-country (LIC) status from a middle-income-country (MIC) status.

The request was for a reverse classification to allow IDA concessional financing as, after the default in April, Sri Lanka was not credit-worthy for loans from the World Bank’s IBRD (International Bank for Reconstruction and Development). Sri Lanka was eligible for US$ 500 million annually from the IBRD until the default.

Access to IDA’s concessional financing would also alleviate existing debt service pressures given the more favorable terms IDA financing carries. As an IDA country, Sri Lanka will also be subject to IDA operational policies.

The reverse graduation to IDA will enable Sri Lanka to access resources to help sustain institutions to become more resilient and responsive to the needs of the people of Sri Lanka

Access to IDA’s concessional financing would also alleviate existing debt service pressures given the more favourable terms IDA financing carries. As an IDA country, Sri Lanka will also be subject to IDA operational policies, according to the World Bank.

Since 2017, when it first graduated from IDA, Sri Lanka has been creditworthy for lending from the World Bank’s International Bank for Reconstruction and Development (IBRD).

Construction sector suggests government to settle dues issuing treasury bills

The country’s construction sector has suggested to the government to issue them with treasury bills in lieu of their dues if no cash is available.

The government owes the country’s contractors over Rs.200 billion. Out of this, Central Bank Governor Dr. Nandalal Weerasinghe recently said, Rs.25 -20 billion will be settled by end of this year.

“As the dues for large-scale contractors are very high, we strongly recommend that these funds are utilized to settle SME sector dues first, as this would provide relief for a larger number of SME contractors,” Ceylon Institute of Builders President Dr. Rohan Karunaratne said.

“Allocating these funds to large-scale contractors may lead to partial satisfaction of massive dues of a limited number of contractors and would leave contractors’ finances suspended midway,” he added.

“It is recommended that the government can tackle large-scale contractors’ bills via issuing treasury bills if no cash is available at this juncture, “he further said.

Dr. Karunaratne thanked the Central Bank Governor for this arrangement, and expressed hope that the resumption of important infrastructure projects in the country from next year would solve a large part of the problem.

“Furthermore, the government should encourage funding agencies to continue with their funded projects in Sri Lanka.

This may allow about 30-40 percent of contractors to survive and prevent further retrenchment of workers and to restart SME sector companies that are part of the construction supply chain,” he noted.

He also said the Government should encourage financing agencies to continue with their funded projects in Sri Lanka.

“This may allow about 30-40% of contractors to survive and prevent the further retrenchment of workers and to restart the SME sector companies that are part of the construction supply chain,” explained Karunaratne.

“The CBSL Governor should give priority to the settlement of the balance dues to contractors in the year 2023, as this may save contractors and their associated banking sector and finance companies,” he added.

Meanwhile Finance Ministry is taking prompt action to pay the money owed to the public construction contractors in several phases, official sources said.

Accordingly, before the end of this year, an amount of Rs 20 billion rupees is expected to be disbursed and the government is currently working to pay all the remaining arrears in the first quarter of next year.

Sri Lankan government construction contractors numbering around 3000 are in an urgent need of funding for their survival as they have to recover Rs. 150 billion outstanding payment for the work completed in public construction projects including buildings and infrastructure facilities.

ADB finalizes SL’s proposed projects for economic revival through reforms

The Asian Development Bank (ADB) is finalizing proposed projects in Sri Lanka for next year and assured its support for the country’s development and its efforts to overcome economic and fiscal challenges.

ADB has been addressing immediate needs of the country, such as essential medical supplies, materials for water treatment, and working capital for small and medium-sized enterprises by reallocating surplus loan proceeds from ongoing loans.

Vice President of Asian Development Bank (ADB) Shixin Chen now in Sri Lanka stated this when he called on Prime Minister Dinesh Gunawardena yeaterday (Dec. 5) at the Prime Minister’s Office in Colombo

Mr. Shixin Chen said the ADB could provide technical assistance in addition to project support.

He noted that international monetary agencies are highly impressed with the strength of the Sri Lankan leadership and its commitment to achieve speedy economic revival through reforms in monetary sectors, the PM’s Office reported.

The Asian Development Bank (ADB) has provided US $ 750 million as concessional loans last year. Mr. Asakawa said that loans worth US $ 2 billion would be allocated for operational projects this year.

To date, the Asian Development Bank (ADB) has committed 479 public sector loans, grants, and technical assistance totaling $11 billion to Sri Lanka. Cumulative loan and grant disbursements to Sri Lanka amount to $8.64 billion.

These were financed by regular and concessional ordinary capital resources, the Asian Development Fund, and other special funds. ADB’s ongoing sovereign portfolio in Sri Lanka includes 46 loans and 2 grants worth $4.4 billion.

The Prime Minister briefed him about the steps taken by the government to revive the economy and to enact reforms in fiscal sectors as well as to restructure energy, electricity and petroleum sectors, the ADB statement said.

ADB Vice President stressed the need for controlling inflation and to protect vulnerable, under-privileged sections of the society.

The Prime Minister explained the programmes aimed at protecting the vulnerable groups of the society and rural agricultural development plans to increase production and increase export of surplus.

The Prime Minister thanked the ADB for emergency assistance loans and grants provided during Covid-19 pandemic as well as during the current economic difficulties.

He said the ADB supported projects provide crucial support to the government in extending assistance to vulnerable groups and restoring the livelihood of the poor and vulnerable, including farmers.

Govt and CB’s draconian measures begin to bring positive results

The draconian measures introduced by the Government and Central Bank have begun to demonstrate positive results.- Inflation is abating and essential imports are being financed. Interest rates should begin to ease (strong guidance from the Governor). The very high premiums in the forex market has diminished. former central bank governor Dr Indrajit Coomaraswamy discoursed.

In January to September 2022, revenue collected exceeded the revenue for 2021 there has been good control of recurrent expenditure and capital expenditure has been contained by a lack of foreign exchange, he said.

Sri Lanka is only in the beginning of a very arduous and painful journey towards economic stability amidst fiscal crisis and it is now being called upon to do something it has not been able to achieve to date,

He said that the country has to stabilize the economy with prudent macroeconomic policies while introducing structural reforms that drive sustainable growth and higher value employment.

The low level equilibrium is being achieved at the expense of severe economic contraction. Growth is projected to contract by 8 to 9 percent in 2022. GDP is not expected go back to its 2021 level till 2025 or 2026, he predicted.

The current level of economic contraction cannot be sustained for very long without disturbing social and political ramifications, he said adding that up to now, Sri Lanka has not been able to make significant headway towards the economic transformation needed to increase productivity and create an export driven high growth economy.

Delivering the Sujata Jayawardena memorial oration , Cambridge-educated old Royalist Dr. Coomaraswamy who restored the credibility of the Central Bank and brought professionalism back to the institution eloquently elaborated “Economic Crisis : Where are we, and where do we go from here ?”.

This premier annual event of the Colombo University hosted for the 17th consecutive year by the Alumni Association of the University was held at the BMICH in Colombo this week in memory of its illustrious Past President the late Sujata Jayawardena who rendered immense service to the University.

While emphasizing the independency of the monetary authority, he categorically stated that the Central Bank should not be considered as a state owned development bank

Flexible inflation targeting ( FIT) is expected to be embedded in the new Central Bank Bill. This will increase predictability and consistency while discouraging the type of fiscal dominance we have seen recently, he pointed out.

The new Bill will also prevent the CB from participating in the primary auctions for Treasury Bills. This is the most destructive form of money printing.

After Monetary Board banned the CB from participating in primary auctions, in 2017, there were primary surpluses in the budget in 2017 and 2018.

He noted that that the International Monetary Fund’s (IMF) prescription for economic reforms is not pleasing and that the people will have to essentially curtail their investment and consumption tightening their belts.

He said “Going to IMF is like going to a doctor. You go there when you become sick. So you can’t then blame the doctor for giving medicines that’s bitter. That is what a doctor is intended to do.”

Dr. Coomaraswamy disclosed that Sri Lanka is discussing with the World Bank and the Asian Development Bank (ADB )to get loans of USD 1.9 billion after a reform program with IMF is approved.

Sri Lanka credit card usage comes down in economic misery

Sri Lankans, whose real incomes are getting hammered on a daily basis from soaring inflation, have turned to their credit cards, as there was a significant jump in the outstanding balance of credit cards in October from a month ago, when the financial and economic misery became more pronounced.

Outstanding credit card balance has dipped by a little in October in a dual sign that banks may be tightening their credit card standards while consumers are also pulling back on their spending without taking on any more debt as they are fighting the worst cost of living crisis in their lifetime.

The data for the month showed that the outstanding credit card balance had slipped by Rs.64 million in October to Rs.136.7 billion after slowing down in September.

The trajectory of the credit card balance is counterintuitive where consumers tend to take on more credit card debt to finance their purchases when their incomes become insufficient to meet their monthly household expenses after consumer prices spiked to 70 percent when the economic crisis fired runaway inflation since April this year.

With the October data on card balances, the total outstanding card balance of the licensed commercial banking sector stood at Rs.136.7 billion, an increase of just Rs.3.4 billion in the 10 months.

The card balance also reflects how tight the credit conditions have become in a matter of months after the Central Bank turned extremely aggressive tightening the monetary policy prompting banks to raise their interest rates up to 36 percent on cards, effectively doubling where it was before the crisis unfolded.

Besides, some banks also started slashing the card limits citing the worsening macroeconomic conditions to limit card spend in a bid to contain a possible fallout from potential defaults.

Despite the dent in the outstanding card balance and the tight credit conditions, banks managed to issue 3,496 million new cards in October bringing the number of active cards in the system to 1,975,335.

However, offering a sigh of relief, the prices appear to be easing after back-to-back softening inflation reports in October and November, which signaled deceleration in food prices.

The inflation measured by the Colombo Consumer Price Index rose by an annual 61.0 percent in November, slowing from 66.0 percent in October while the so-called core prices, which leave aside the prices of mostly volatile food, energy and transport, eased to 49.4 percent annual rate, from 49.7 percent.