The United States is working with Sri Lanka to meet urgent humanitarian needs in the island nation while supporting the country to to minimize the impact of current economic hardships among Sri Lankans

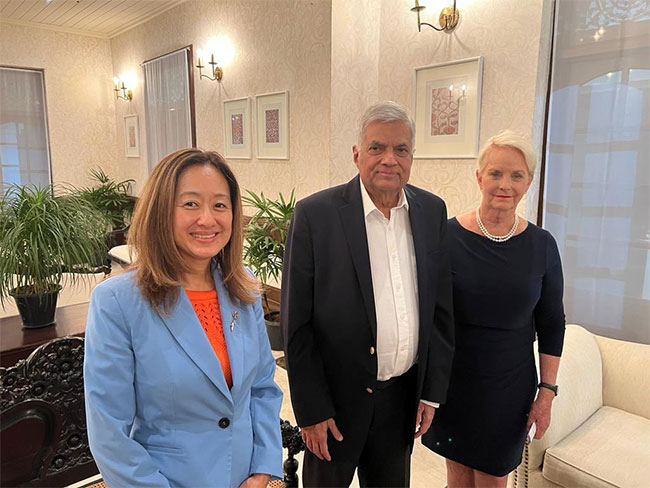

The United States Ambassador to the UN Food and Agriculture Agencies in Rome, Cindy McCain, has focused attention on these humanitarian needs and possible US assistance to overcome the issue when she called on President Ranil Wickremesinghe in Colombo yesterday for a wide-ranging discussion.

U.S. Ambassador to Sri Lanka Julie Chung had also participated in the meeting. Taking to twitter, Ambassador Chung said the meeting was held to discuss the impact of the ongoing economic hardships on Sri Lankans.

She said they also implored the many ways the United States and Sri Lanka are working together to meet urgent humanitarian needs.

Ambassador Cindy McCain had arrived in Sri Lanka earlier yesterday on a four-day official visit. In a tweet after arriving in the island, McCain said she is looking forward to seeing first-hand how US-funded assistance is supporting Sri Lankan communities and families in this challenging period.

The US Embassy in Colombo says Ambassador Cindy McCain is visiting Sri Lanka until September 28 to highlight U.S. food assistance programs in Sri Lanka and reinforce the U.S. commitment and lasting partnership with the island nation.

. Since June, Ambassador Chung has overseen the announcement of nearly US$240 million in new U.S. government assistance to Sri Lanka.

This financial assistance included U.S. Agency for International Development (USAID) Administrator Samantha Power’s September 2022 announcements of an additional $40 million to provide Sri Lankan farmers with fertilizer and $20 million to meet immediate humanitarian needs in the country.

In addition to meeting with senior government officials and aid organizations in Colombo, Ambassador McCain will join U.S. Ambassador to Sri Lanka Julie Chung to travel to Central Province to visit schools, agricultural research facilities, and community organizations.

She will meet with recipients and implementers of relief provided through U.S. government-funded humanitarian assistance programs.

US Ambassador to UN and SL President discuss humanitarian needs

‘High-Security Zones’ in war free times only required by rulers living in fear: Fonseka

In times of a country being free from war or a threat of terrorism, the establishment of ‘high-security zones’ is not necessary, unless the rulers living in it are living in fear, said Samagi Jana Balawegaya (SJB) MP, Field Marshal Sarath Fonseka.

He emphasised that only the rulers who are afraid of their people in a peaceful country need the establishment of such zones, suggesting that the decree to establish ‘high-security zones’ in Colombo demonstrates how afraid Ranil Wickremesinghe and the leaders of his government are of their people.

Based on the conduct of Sri Lankan rulers at present, the establishment of ‘high-security zones’ in a handful of areas would not be enough to save themselves, the Field Marshal went on, adding that the government should have established ‘mobile high-security zones’ every time they make a move from one place to another.

MIAP

SL companies establish contacts with Maldivian firms at ITE Maldives 2022

The inaugural edition of the International Trade Expo, ITE Maldives 2022, Buyer-Seller Meet Mart successfully concluded in Male with several Sri Lankan companies establishing contacts with Maldivian firms successfully, official sources confirmed. .

ITE Maldives 2022 – Buyer Seller Meet Mart, a Business-to-Business meeting platform was jointly organised by Aitken Spence Conventions & Exhibitions, Sri Lanka, and Ace Travels Maldives (Pvt) Ltd under the patronage of the High Commission of Sri Lanka in the Maldives.

It was highly successful for around 20 Sri Lankan companies, representing Construction Material Suppliers, Spices & Herbal manufacturers, Interior designers, Apparel & Fashion, Agriculture, and other service providers, showcasing their products and services to the Maldivian business community.

The opening ceremony was held on Monday, 19 September with the participation of the Minister of Tourism of Maldives Dr. Abdulla Mausoom as the Chief Guest.

The High Commissioners of Bangladesh, India, Pakistan and the Ambassador of Japan, as well as the UNDP Resident Representative in Maldives were among the distinguished invitees present at the inauguration ceremony, along with representatives of participating companies from Sri Lanka and Maldivian companies.

The 3-day event from 19 to 21 September 2022, included a Buyer-Seller Meet Mart in the form of B2B meetings on the first two days at the Manhattan Business Hotel, Male, during which Sri Lankan companies were able to meet and establish business contacts with Maldivian firms.

The High Commissioner of Sri Lanka to Maldives, A.M.J Sadiq, during his speech at the inauguration ceremony commended Aitken Spence Conventions and Exhibitions Sri Lanka and Ace Travels Maldives, both part of the leading Sri Lankan diversified conglomerate, Aitken Spence, for organizing this event.

High Commissioner A.M.J Sadiq noted that this was a great initiative to bring together companies from both countries to meet and explore the full potential for bilateral economic cooperation.

The High Commissioner further stated that in order to promote greater economic cooperation between Sri Lanka and Maldives, the Mission has been engaged with the authorities in Sri Lanka to fast-track negotiations on the Avoidance of Double Taxation Treaty and to take urgent steps to initiate talks with Maldives on the Agreement on Promotion and Reciprocal Protection of Investments.

He noted that when the legal framework and the government regulations to facilitate trade and investment flows are in place, it would provide the confidence and encouragement for companies and potential investors to expand their business operations between the two countries.

The final day of ITE Maldives 2022 entailed a field visit for the participating Sri Lankan companies to Hulhumale to explore business and investment opportunities in the fast-developing artificial island adjacent to the Velana International Airport.

The Sri Lankan companies expressed their satisfaction over the excellent arrangements made by the organizers in conducting this inaugural Buyer-Seller Meet in Maldives.

The second phase of ‘I am the person who did best’ now in action: Opposition Leader (VIDEO)

The second phase of – I am the person who did best campaign – is now in action. – Sajith Premadasa Leader of the Opposition

The whole country was dazzled by the false propaganda created at huge cost by the Pohottuwa two years ago. As a result, the country is now bankrupt and in darkness. This was pointed out by the Opposition Leader, Mr Sajith Premadasa.

Mr Premadasa alleged that the pseudo hero who gained power by deceiving the people led the country towards a severe crisis.

He maintained that the country is now in the second phase of this deceptive campaign, with a puppet of the Pohottuwa installed as the ruler.

Mr Premadasa made these comments yesterday (24 September) when he addressed a meeting of the Electoral Committee of Kesbewa, in the colombo District.

This meeting was organised by the Samagi Janabalawegaya organiser for Kesbewa, Mr Gayan de Mel.

India’s lending to Sri Lanka proves exceptional

While claiming that the international community must rise above a narrow national agenda, India said that, for its part, is taking exceptional measures at exceptional times to help its neighbors including Sri Lanka.

“India extended credits of US$ 3.8 billion to Sri Lanka for fuel, essential commodities and trade settlement,” External Affairs Minister, Dr. S. Jaishankar told the UNGA at its 77th Session.

With a total of $ 968 million in loans in four months of 2022, India “has emerged as Sri Lanka’s largest bilateral lender, overtaking China in the process,” India’s ANI news agency reported on Monday, citing Daily Financial Times.

It is a false proposition that India has overtaken China to become Sri Lanka’s largest lender. China has stressed many times that it is neither the only creditor nor the largest creditor of Sri Lanka. Only around 10% of Sri Lanka’s external debt is owed to China.

China and India need cooperation, not competition in Sri Lanka. Chinese Foreign Ministry Spokesperson Zhao Lijian said in June that China is ready to work with India and the rest of the international community to help Sri Lanka and other developing countries experiencing difficulty to pull through the hardship as early as possible.

Although the West’s anti-China narrative deliberately hyped up China-India competition, India should be vigilant to avoid falling into the trap set by the West

Sri Lanka has borrowed not only from China but despite this, Chinese loans have been specifically targeted by anti-China forces.

Critics have accused China of what they call a “debt trap,” saying that the so-called “debt trap diplomacy” has “become a cause of Sri Lanka’s economic crisis”.

Their debt trap lies is a narrative that the US-led camp has used to defame and smear China. The West’s anti-China narrative should not derail Sri Lanka’s cooperation with its friends.

India’s permanent representative to the UN Ruchira Kamboj, was quoted by the ANI report as saying that India had provided nearly $ 4 billion in food and financial assistance to Sri Lanka.

“In our immediate neighborhood, we are continuing to help our good friend and neighbor Sri Lanka to ensure food security,” Kamboj said.

Some Western observers have lauded India’s help to Sri Lanka, but China is being blamed by the West for providing same loans and economic assistance to the nation.

Those observers should stop their double standards in criticizing a so-called Chinese debt trap. Loans and aid to Sri Lanka should not be treated differently based on which country they come from.

China is one of the largest infrastructure construction partners and main source of foreign investment of Sri Lanka.

China has worked with Sri Lanka to help meet its financing needs and improve its ability for sustainable development.

China does not impose its will on others or seek any political gains. This is why developing countries, Sri Lanka included, think highly of their cooperation with China.

India does not have to view Chinese investments and loans in Sri Lanka from a competitive perspective. Countries should put geopolitical thinking aside and avoid falling into a trap set by the West, which aims to heat up competition between China and India.

SL requests US court dismiss Hamilton Reserve Bank’s default case

The Sri Lankan government has said that cooperation from the island nation’s creditors would be key to gaining a much-needed bailout from the IMF for the bankrupt country.

It has also asked a US judge to dismiss the complaint filed by Hamilton Reserve Bank for bond default as it will become a stumbling block to the countries debt restructuring process.

On September 1, the International Monetary Fund (IMF) announced that it will provide Sri Lanka with a loan of about USD 2.9 billion over a four-year period to help the island nation overcome the unprecedented economic turmoil.

The bailout package is expected to boost the country’s credit ratings and the confidence of international creditors and investors.

At an online engagement with the creditors, the government on Friday said that assurances from bilateral creditors are required as a prerequisite to the IMF board adoption of the programme. It is expected to materialise by mid-December.

The IMF does not lend to countries whose debt is deemed unsustainable, requiring Sri Lanka to undertake an upfront comprehensive debt treatment.

“In practice, this requires financing assurances to be given by the bilateral creditors, resulting in a sufficient level of comfort to the IMF that bilateral creditors will support Sri Lanka’s efforts to restore public debt sustainability,’’ the government said.

The Sri Lankan government has asked a US judge to dismiss the complaint filed by Hamilton Reserve Bank for bond default, Bloomberg reported.

The government has asked for the case in New York over the country’s debt default to be dismissed, claiming that the litigation initiated by one bank is a “apparent attempt to gain leverage over a nation in crisis and jump ahead of other international creditors.”

Hamilton Reserve Bank, situated in the Caribbean islands of St. Kitts and Nevis, launched legal action in response to the country’s failure to repay a $1 billion sovereign bond.

The 5.875% International Sovereign Bonds were due for payment on July 25, 2022, which was two months ago.

When contacted by News 1st, the Finance Ministry verified that arguments about the relevant issue had been submitted.

According to court records obtained by News 1st, Hamilton Reserve Bank has charged Sri Lanka with owing it a total of US$257,539,331.25 under the conditions of the Bonds. The principal is $250,190,000, and the interest is $7,349,331.25.

The Hamilton Reserve Bank earlier said that Sri Lanka’s default was engineered by people at the highest echelons of the country’s government, and that the Rajapaksa family was to blame.

The government added that bilateral financing assurances are a commitment from official bilateral creditors to grant Sri Lanka a debt treatment compatible with the macroeconomic framework and debt sustainability to underpin the contemplated IMF programme.

Explaining it further the government held that private financing assurances are considered as obtained by the IMF once Sri Lanka is making a “good faith” effort to reach a collaborative agreement with its private creditors – Giving creditors the early opportunity to provide input in the framework underpinning the debt restructuring.

The severe economic downturn, weak Sri Lanka revenues, rising health expenditure and energy needs led to a worsening of the fiscal situation.

While the decline in growth partly led to shrinking revenues, Sri Lanka had to increase spending to safeguard its population from a double-pronged health and energy crisis, primary balance, revenues and expenditures.

In mid-April, Sri Lanka declared its international debt default due to the forex crisis. The country owes US$ 51 billion in foreign debt, of which $ 28 billion must be paid by 2027.

It was said that international bondholders have formed a creditor committee comprising close to 100 members. The group represents more than 55 per cent of the international bondholders.

A group of local private banks holding International Sovereign Bonds have also formed a group.

The presentation said the effective way to obtain financing assurances quickly is the creation of a bilateral creditor coordination platform.

This would enable them to deliver financing assurances and validate the IMF programme through a fast-track solution, allowing Sri Lanka’s economy to recover.

Sri Lanka Original Narrative Summary: 26/09

- President and Finance Minister Ranil Wickremesinghe to chair the ADB for 2 years: leaves for Manila, Philippines to attend ADB meeting: will also attend former Japanese PM Shinzu Abe’s funeral in Tokyo.

- Power and Energy Ministry says Central Bank has agreed to release just USD 6mn out of USD 100mn needed by Lanka Coal Company for the immediate purchase of coal for the Norochcholai Coal Power Plant: power plant able to operate up to 26th October due to Central Bank releasing over USD 300mn, prior to 31st March 22.

- Foreign Minister Mohamed Ali Sabry says challenges faced by Sri Lanka provides opportunity to implement political, social and economic reforms leading to prosperity: Sri Lanka’s debt default was announced while Sabry served as Finance Minister: Sri Lanka now categorised as a “bankrupt” country.

- Chinese Embassy in Colombo says China and Sri Lanka will accelerate negotiation process to conclude a Free Trade Agreement early: also says FTA will boost confidence and foster economic and trade cooperation.

- Minister Mahinda Amaraweera says the 2nd phase of the Hambantota Ridiyagama Safari Park will open on 4th October.

- Sri Lankan companies set up units and branches abroad to mitigate risks of operating in Sri Lanka: risks cited include restrictions in imports, power cuts, debt default issues, food & other shortages, bank & forex delays, and soaring prices: substantial flight of capital suspected to be taking place.

- Fruit prices sky-rocket to levels beyond the reach of people: apples – 300 each, grapes – 300 per 100 grams, oranges – 500 each, pineapples – 800 to 1000 each, Alphonso mangoes – 2000 per kg, pomegranate – 900 each: very high transport costs and restrictions in imports cited as reasons.

- Beauticians’ Association Secretary Jeyalukshmi Purushothman warns the

beauty industry of Sri Lanka will soon collapse: says business has shrunk by 50% and customers are losing interest in visiting salons. - Government gathers Rs.120bn from new one-time Surcharge Tax: incurs additional Rs.398bn as interest costs in just 5 months.

- Ministry of Public Administration to issue a new circular on public servants’ attire taking the present economic crisis into account: many relaxations expected: pant trousers likely to be allowed for women.

Audit report on nano-nitrogen imports submitted to Agriculture Ministry

A report following the special investigation into the controversial import of liquid nano-nitrogen fertiliser launched by the Auditor General’s Office as demanded by many parties including the Opposition has now been submitted to the Ministry of Agriculture.

The nano-nitrogen stock being imported from India under the regime of ex President Gotabaya Rajapaksa following the ban he had imposed on the importation of chemical fertiliser was subject to a storm of criticism, where the farming community had confronted that the substance does not fill the requirement of commercial farming at all, and the Opposition had alleged that a massive financial fraud was committed during the process.

The Auditor General’s report on the probe into the alleged fraud has been submitted to the Ministry of Agriculture and the Ministry is expected to provide facts from their perspective, after which the report will be referred to Parliament for further action, revealed Auditor General W.P.C. Wickramarathne.

Under Rajapaksa’s regime, nearly 2.1 million litres of liquid nano-nitrogen fertiliser were imported from the ‘Indian Farmers Cooperatives’ of Gujarat, India, at a price of US $ 12.45 per bottle of 500 millilitres, a value staggeringly four times greater than that of a same bottle sold through the internet for just US $ 3.23, critics pointed out.

The Foreign Exchange rates at the time impelled Sri Lanka to pay Rs. 1867 more per bottle of 500 millilitres, considered of which a hypothetical value of Rs. 7841 million may have been swindled, had the stock been purchased for US $ 12.45 per bottle.

MIAP

President’s Fund offers scholarships to those who passed OLs

President Ranil Wickremesinghe has decided to allocate funds through the President’s Fund to offer scholarships to students who have passed their G.C.E. Ordinary Level Examination and are eligible for the G.C.E. Advanced Level Examination.

Accordingly, 30 students will be selected from one education zone for the scholarship programme and 2970 students total from all 99 education zones will be eligible.

Those eligible for the scholarship will be granted a monthly allowance of Rs. 5000 for their Advanced Level studies for two years.

Eligible students will be selected through newspaper advertisements immediately after the results of this year’s OLs Examination.

Saman Ekanayake the President’s Secretary has instructed the Secretary of the Ministry of Education to inform the Provincial Education Directors, Regional Education Directors and School Principals regarding the programme.

MIAP

SYU National Organiser Eranga Gunasekara reminds President ‘Aragalaya’ not over!

Following the forceful disbandment of the demonstration organised by the Socialist Youth Union (SYU) against President Ranil Wickremesinghe’s recent decree on designating high security zones around Colombo and the arrest of 84 protesters near the Lipton Circle yesterday (24), 42 persons were produced to the Colombo Judicial Medical Officer.

The event was dissolved by the Police by launching tear gas and water canon attacks and even baton attacks.

During the event, National Organiser of the SYU Eranga Gunasekara told media that the people’s struggle the ‘Aragalaya’ has recommenced in another round and President Wickremesinghe is mistaken should he believe that the Aragalaya has ended, for it has merely been on temporary hold.

The people’s struggle will not end until Wickremesinghe is sent home too, he added.

MIAP