Sri Lankan President Ranil Wickremesinghe on Monday (15) said that history has brought India and Sri Lanka together like two sides of the same coin and the two countries must forge ahead together.

The President made this comment during an event to hand over a Dornier 228 Reconnaissance aircraft to Sri Lanka by India.

The President called for both countries to commit to further strengthening their relationship as India and Sri Lanka share many commonalities and the two countries have to build on it.

Addressing the gathering, President Wickremesinghe emphasized on the importance of ties between the two countries.

“He aid that the two countries are two sides of a single coin. It is not possible to split a coin for one face to fall one way and the other face to fall the other way.

For whatever it is, history has put us together and we have to stay together. The two countries are both marking our 75th anniversaries. let us commit ourselves to further strengthening our relationships,” he said.

The first ever Dornier Reconnaissance Aircraft from India to enhance the maritime surveillance capabilities of Sri Lanka was inducted to Sri Lanka Air Force Fleet yesterday (15th August 2022) in a ceremonial procession.

President Ranil Wickremesinghe was welcomed at the Sri Lanka Air Force Base in Katunayake by Air Force Commander Air Marshal Sudharshana Pathirana. The President was also accorded a special Guard of Honour by the Air Force troops.

The two countries have common viewpoints in many areas. Sri Lanka is a small country in the middle of the ocean, while India, while looking after its own interests must also look at its role as a global power.

After all India is our closest neighbor and there are many issues that are common to us of which we are understanding, of which we have to resolve. Not only issues pertaining to Indo-Lanka relations but to the region and to the world.

So in these areas it is possible for us, and it has been on many occasions for us to come to an agreement or have a similar viewpoint with India. It is with those that we consolidate.”

Congratulating India on its 75th Anniversary of independence, President Wickremesinghe noted, “India today is becoming a world power and it is still on the rise and by the mid-century when we are no longer there, you could see a powerful India playing a dominant role on the global stage.”

SL President says India and SL must forge ahead as two sides of the coin

Standard and Poor’s declares SL bankrupt

Standard and Poor’s (S&D), one of the world’s leading credit rating agencies, has downgraded Sri Lanka’s international sovereign bond rating to grade D.

The country has been downgraded to grade D, the lowest rank issued by the S&D which is equivalent to being bankrupt, due to non-payment of international sovereign bonds.

MIAP

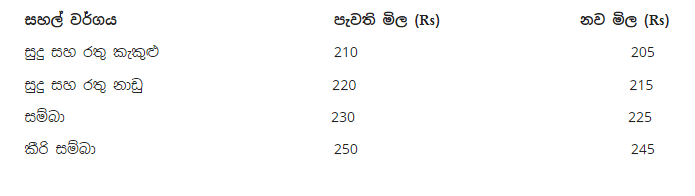

Rice price drops from today

A decision has been made to slash the prices of all types of rice issued by the Paddy Marketing Board by Rs. 05.

Accordingly, the price drop will be in effect from today (16), revealed the Agriculture Ministry.

Below are the revised prices of rice.

MIAP

Chinese defence vessel Yuan Wang 5 arrives in SL despite controversy (PHOTOS)

The controversial Chinese defence vessel Yuan Wang 5 has arrived at the Hambantota Port a short while ago.

The vessel has anchored at the port and photographs have been made available to media.

Photos: BBC Sinhala

MIAP

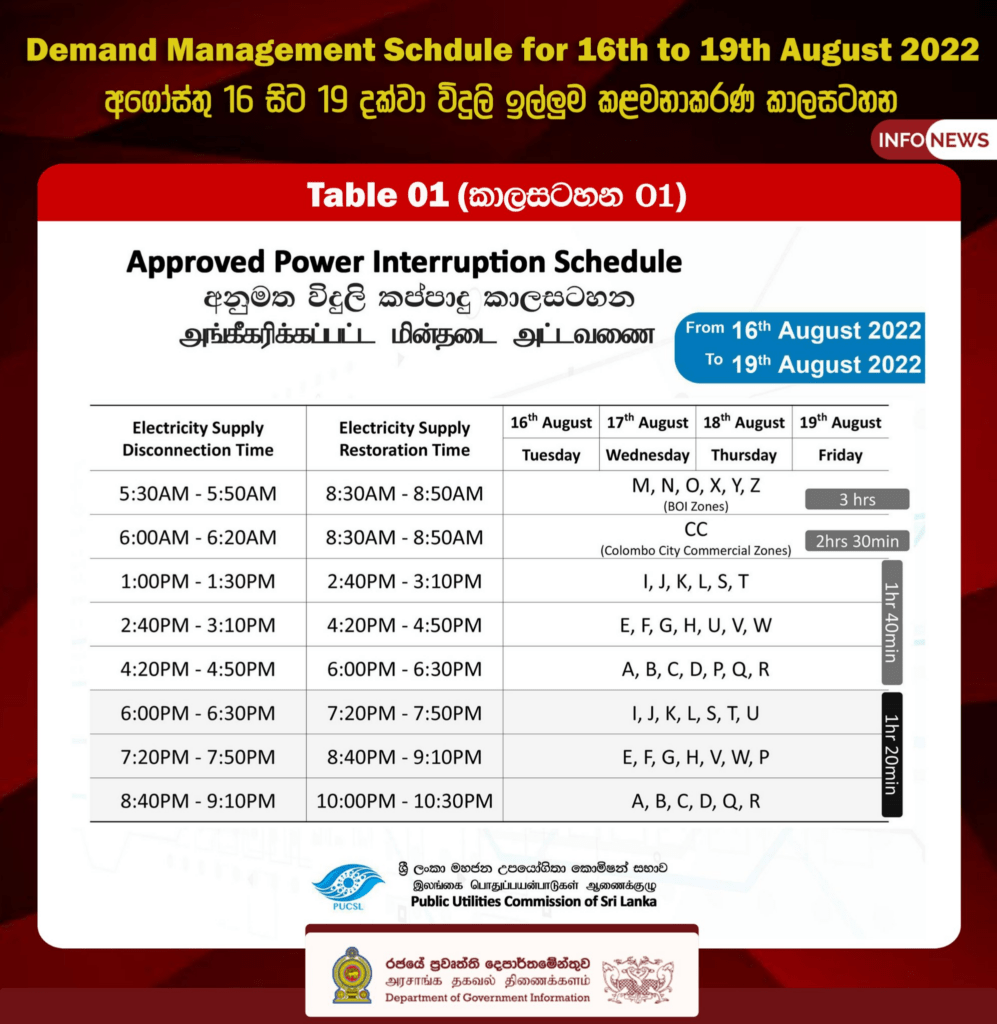

Daily power cuts increase due to fault at Norochcholai

The daily power cuts will increase up to three hours from today (16) revealed the Public Utilities Commission of Sri Lanka (PUCSL).

This is mainly due to a fault at the Unit 01 at the Norochcholai Power Plant. The maintenance may require about 14 – 15 days.

The approved demand management schedule from today will run up to August 19 as follows.

MIAP

Tamil Diaspora gets a chance in bringing dollars to settle SL economic crisis

The Government’s move of de-listing six Tamil international organizations including the Global Tamil Forum (GTF) and 317 individuals from the banned organization label will pave the way for Tamil Diaspora towards helping Sri Lanka to overcome dollar crisis and pay off its foreign debt of $ 52 billion, political analysts said.

Under this situation the Tamil National Alliance could also join hands with President Ranil Wickremasinghe to form the all party government,political analyst attorney at law Prathiba Mahanamahewa said.

The Tamil Diaspora has now been an opportunity to make their dollar investments in the development of the North and East while helping the government to tackle the massive external debt crisis, he pointedout.

There was a call from Sri Lankan elected leaders for help from the Tamil Diaspora for Sri Lanka’s economic crisis.

There are two million Tamils from Sri Lanka who proudly call them Tamil Diaspora and live in foreign countries. Most of them are financially well-off, highly educated, and well trained and experienced in various fields.

While de-listing six Tamil international organizations including the Global Tamil Forum (GTF) and 317 individuals, the government has added 55 new individuals and three more organizations to the banned list as part of this year’s review, informed sources said.

According to the gazette notification issued on July 28 this year signed by Defence Ministry Secretary General

(Rtd) Kamal Gunaratne ban on Global Tamil Forum (GTF), Australian Tamil Congress (ATC), World Tamil Coordinating Committee (WTCC),TAMIL Eelam Peoples Assembly (TEPA), British Tamil Forum (BTF) and Canadian Tamil Congress (CTC), have been lifted.there were 18 entities that were listed as banned organizations in Sri Lanka.

At the same time a ban on 317 individuals out of 577 individuals, has been lifted. GTF Spokesman Suren Surendiranan is also among those delisted.

The ban was retained on fifteen entities including the Liberation Tigers of Tamil Eelam (LTTE),TAMIL Rehabilitation Organization (TRO), Transnational Government of Tamil Eelam (TGTE), National Thowheed Jama’ath (NTJ) and Save the Pearl.

According to UN resolution 1373 (adopted in 2001), UN member states should appoint a Competent Authority and it should recommend to the Minister of the respective country, regarding the removal of the names of any person, group or entity designated from the List every year after reviewing each and every entity and individual.

A senior military official said that the listing or delisting process should be carried out following a thorough investigation into those entities and individuals and it should be reviewed every year.

In response to the reason for de-listing the influential Tamil diaspora organization Global Tamil Forum, the official confirmed that during last year there had been no evidence that the above organization financed terrorism-related matters.

S&P Global downgrades Sri Lanka Bonds to ‘D’ after missed payments

Global ratings agency S&P Global on Monday slashed its rating on Sri Lankan bonds to ‘D’, representing default, following missed interest and principal payments

As foreign reserves dried up, unable to make interest payments on the loans, the country defaulted on the debt of USD 51 billion in May 2022.

After suspending all debt payments, the government took steps to restructure the country’s debt as a prerequisite for bail out loan from the International Monetary Fund (IMF), official sources said.

Sri Lanka succumbed to an embarrassing “hard default” as the grace period for the International Sovereign Bonds (ISB) Coupon payment lapsed.

Sri Lanka announced a pre-emptive negotiated default of all outstanding debt as of 12 April.

On 18 April ISB Coupon worth $ 78 million fell due and those had 30 days to obtain “Consent Solicitation” from all ISB holders for payment suspension by 18 May.

Creditors were hoping that Sri Lanka would get its act together to appoint financial advisors and legal consultants for debt restructuring. This process could have enabled the Government to obtain “Consent Solicitation” from all ISB holders for non-payment.

Soon after the Government announced a pre-emptive default, rating agencies downgraded Sri Lanka to ‘C’ from ‘CC’. It said Sri Lanka will be further downgraded to restricted default ‘RD’ once a payment on an issuance is missed and the grace period has expired.

As per the Ministry of Finance debt suspension list, apart from $ 78 million ISB Coupon that fell due on 18 April, some of the others that fell due until 11 May included $ 51.38 million ISB Coupon 3 May, and $ 46.5 million ISB Coupon 11 May.

Those falling due from 20 May includes $ 19.9 million ISB Coupon on 3 June, $ 15.88 million ISB Coupon on 28 June, a further $ 34.13 million on 18 July and $ 1 billion ISB Maturity on 25 July. Debt suspended include IMF debt repayment and those due to other lenders.

Under this set up Global ratings agency S&P Global on Monday slashed its rating on Sri Lankan bonds to ‘D’, representing default, following missed interest and principal payments.

The South Asian nation, which had defaulted on a bond payment earlier this year and has $12 billion in overseas debt with private creditors, has been battling the worst financial crisis in its independent history.

Sri Lanka’s external public debt freeze prevents payment of interest and principal obligations due on the government’s international sovereign bonds.

S&P said it did not expect the Sri Lankan government, which remains in default on some foreign currency obligations, to make the bond payments within 30 calendar days after their due dates.

The ratings agency affirmed its ‘SD’ long-term and ‘SD’ short-term foreign currency sovereign ratings on Sri Lanka, as well as reiterated the outlook for the island nation at ‘negative’.

The country is considering a restructuring of local and foreign debt. It is due to restart bailout talks with the International Monetary Fund (IMF) in August in the hope of securing $3 billion in funding.

SL Confectionery Manufacturers cry foul over charges of price hike

Claiming that they have never made unreasonable increases in confectionery items such as biscuits, Lanka Confectionery Manufacturers Association said certain elements were spreading false propaganda on social media with the aim of destroying the confectionery industry.

Its Chairman SMD Suriyakumara told a news conference that they would take legal action against those who spread such false propaganda.

He said that the price of its products has not been increased compared to the increase in the price of raw materials, and that the price increases in its industry, which consists of 100% local entrepreneurs, have been done in such a way that the profit is very minimal.

Executive Director of the Association Ashoka Bandara said price of the raw materials used in the production of sweets mainly wheat flour, vegetable oil and sugar have been increased by almost 200% in past few months.

He said unless the prices of their products were not increased in line with the increase in raw materials, they could not continue the business.

“The price of a kilo of wheat flour, which is the main ingredient used In the production of sweets, has increased by 277% from Rs.77 rupees to Rs. 290.

The price of a kilo of sugar has increased by 180% from Rs.114 to Rs. 320, and the price of vegetable oil has increased by 195% from Rs.475 to Rs.1,400. But compared to that, the price of biscuits has been increased by only 171% from Rs.100 to Rs. 271, he said.

The Association said if the factories are closed, 50,000 direct jobs and 500,000 indirect jobs may be lost, not only the workers but also their dependents will be in a desperate situation.

They said at present, more than 20,000 farmers are in direct contact with the confectionary manufacturers and supply their products and if there is any impact on this industry, they too will not be able to sell their products.

“With this economic crisis, we felt its pressure and impact. Therefore, we wanted to somehow maintain these industries without closing them down. That is why some prices have been increased. All the other products are now being increased enormously. However, we have never made unreasonable increases,” they said.

The Association requested the President, the Prime Minister, the Minister of Finance and all other ministers to provide the necessary support to maintain these industries without allowing them to perish

Sri Lankans make crypto Ponzi scam claims

Many Sri Lankans have been duped by a fake cryptocurrency investment scheme which has swindled millions of rupees.

Colombo, Sri Lanka–When 37-year-old Harshana Pathirana quit his job in the hotel sector, sold his car and invested in what he believed was a cryptocurrency, he dreamed of making a fortune, especially as the economy around him cratered.

More than a year later, with the tourism sector battered in the face of Sri Lanka’s worst economic crisis, Pathirana is unemployed and has lost all his investment.

“I invested 2.2 million Sri Lankan rupees ($6,162) and was promised a five times higher return. But I only received about 200,000 Sri Lankan rupees ($560.20),” Pathirana told Al Jazeera. “I lost everything.”

Pathirana’s name has been changed to protect his identity as his family is unaware that he has lost his money. “My family thinks I sold the car and deposited the money in my bank account,” he said. He is now trying to migrate to find a job and earn some money.

Pathirana is one of the many Sri Lankans both locally and overseas who claim to have been deceived by a group of men that ran a fake cryptocurrency investment scheme and swindled millions of rupees. While it is not clear how many people in total claim to have been duped, one person that Al Jazeera spoke to said easily a thousand people had joined in his district alone, and that since the model worked on bringing on new investors, the scheme had a cascading effect.

These investors are feeling the pinch amid Sri Lanka’s economic crisis which has seen inflation hit 60.8 percent in July, causing acute shortages of essentials, and making basic meals almost unaffordable.

The scam is said to have affected professionals like doctors, security personnel and people from lower middle-income backgrounds in rural districts, mostly between the ages of 30 and 40.

Some of those who spoke to Al Jazeera were Sri Lankans who had made investments while working in countries like South Korea, Italy and Japan.

Most of them had given up their jobs, pawned their jewellery, mortgaged their property, and sold their vehicles to invest all they could, hoping they would receive significant gains.

“If I had my money today, I could have opened up a fixed deposit account and used it to improve the economic status of my family,” Roshan Marasingha, 38, who spoke to Al Jazeera from South Korea, said.

He said that he had invested 3.1 million Sri Lankan rupees ($8,683) and received only 550,000 Sri Lankan rupees ($1,540) in return.

“Unfortunately, we were the bottom-level investors in their pyramid (scheme). So we didn’t receive the return that was promised,” Marasingha lamented.

The scheme

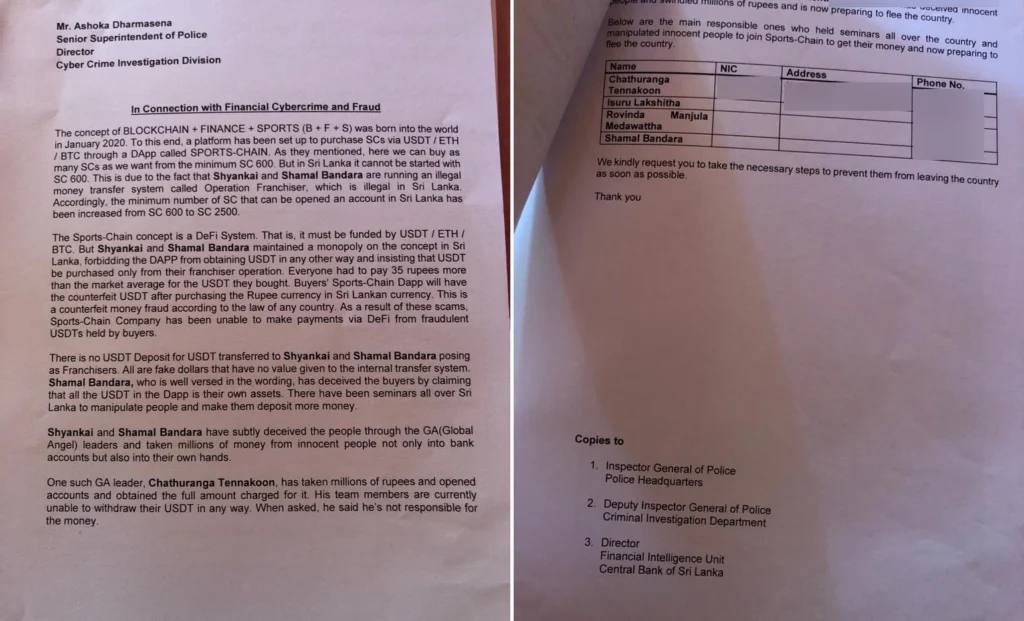

In official papers filed with Sri Lankan authorities, the investors say that in early 2020 Shamal Bandara, a Sri Lankan, and Zhang Kai, introduced to the investors as Chinese, had set up “Sports Chain”, which they said was a cryptocurrency investment platform.

They are alleged to have run their operations as a Ponzi scheme, a fraudulent venture in which existing investors were paid with funds collected from new investors.

On its website, Sports Chain calls itself a “highly profitable” and “anonymous” venture, which aims to “become a steadily rising cryptocurrency used in the digital finance of the sports industry”.

Sports Chain’s website is riddled with grammatical errors and promotes itself as the “world’s first competitive public chain platform”.

However on CoinMarketCap, a website for tracking crypto assets, there is no “Sports Chain” cryptocurrency registered or trading in the market.

The Sports Chain mobile application is not available on Google Play or the App Store and has to be downloaded using a web link.

To use the app, investors had to enter the referral key of the partner who introduced the concept to them. Sports Chain called this a system of “building a partner network” – which is a way of defining a Ponzi scheme.

To promote this, the men behind the scheme organised multiple events and meetings for investors, sometimes at five-star hotels in capital Colombo.

A video of one of these meetings, seen by Al Jazeera, showed one of the men explaining how the money deposited by new investors would be divided among the existing ones.

Using the mobile app, investors were asked to empty their virtual wallets by transferring “Sports Chain coins” to an option called the “Power Pool” where coins were multiplied by five.

Every day, a few cryptocurrency coins were sent back to the wallet from the Power Pool.

“We were asked to deposit money to a bank account, download a mobile application and start trading,” Ranjan, an investor, told Al Jazeera.

He preferred to be identified only with his first name as he works for the Sri Lanka Navy.

“I joined this because I was convinced that I could receive a good return on investment,” he said.

To receive more coins in their wallets, investors had to bring in more partners to the network.

The investors allege that by mid-2021, the people behind Sports Chain had run out of money to pay investors, as the number of new investors began to drop drastically after word spread that it was a scam.

“Initially, we could make withdrawals after we received about 150 coins to the wallet. Then they kept raising the limit to about 500,” another investor Priyanga Kasturiarachchi, 40, told Al Jazeera. Kasturiarachchi had deposited 1.8 million rupees and had managed to withdraw 1.3 million rupees, he said.

Kasturiarachchi claims that after he and his daughter highlighted their situation on social media, they received threatening phone calls.

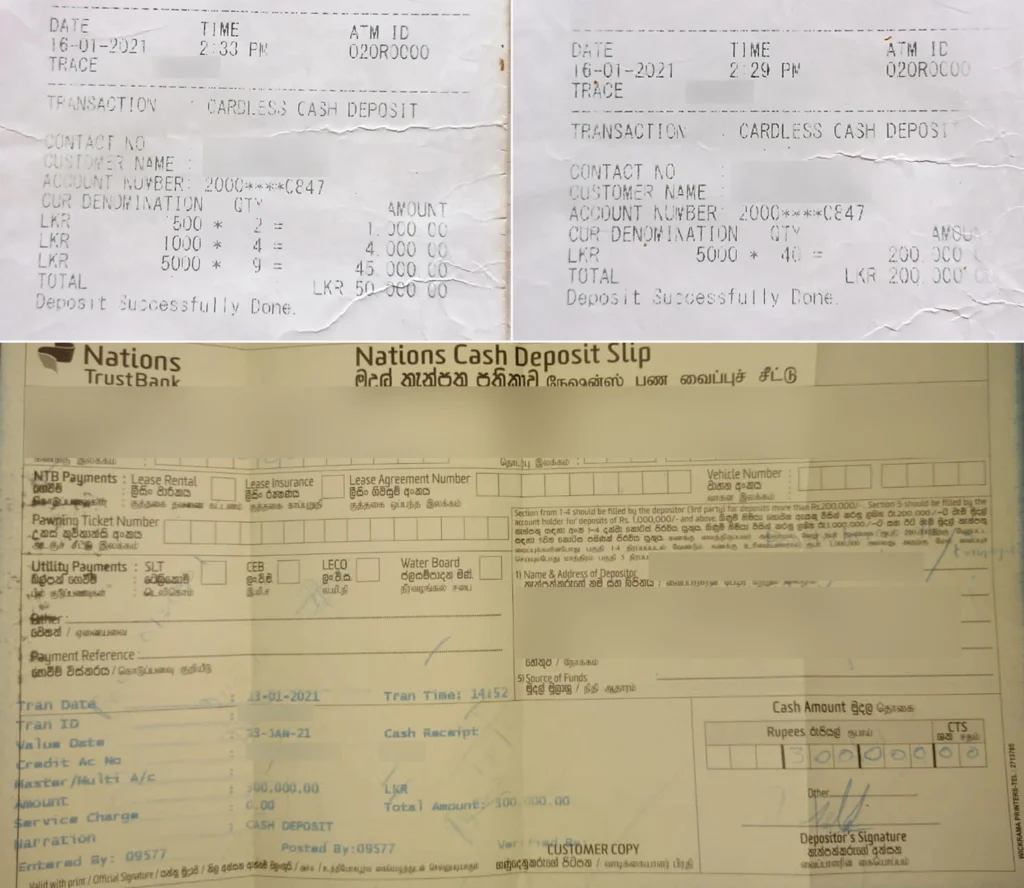

Al Jazeera saw bank deposit slips, many of which were in the local accounts of at least three foreigners – Wu Chungsheng, Yu Shuhui, and Wang Yixiao – while several others were in the names of Sri Lankans. It’s not clear what, if anything, is the connection between these people and Bandara and Zhang. None of the payments had been made directly to the bank accounts of Shamal Bandara or Zhang Kai who are alleged to have led the scam. Bandara did not respond to a WhatsApp message sent to his mobile phone. Al Jazeera could not reach any of the others.

No licence for cryptocurrencies

The central bank of Sri Lanka says it “has not given any license or authorization to any entity or company to operate schemes … including cryptocurrencies”.

Under Sri Lanka’s law, running pyramid or Ponzi schemes can result in imprisonment between three to five years. According to the country’s Banking Act, offenders also have to pay a fine of 2 million Sri Lankan Rupees or twice the amount received from the participants in the scheme.

Investors have now filed complaints with the Police Financial Crimes Investigation Division (FCID), and the Central Bank of Sri Lanka.

They have accused the alleged scammers of deceiving them through the fake cryptocurrency scheme, and later threatening them for revealing details on social media.

“We are conducting an inquiry to determine whether we have to file a civil or criminal lawsuit,” a senior officer at the FCID office in Mirihana – a Western Province suburb, told Al Jazeera. He declined to be named as he is not authorised to speak to the media.

“In most cases, the investors are paid for the first few months and then they don’t receive anything at all,” he added. “It is important to raise awareness so that people don’t fall for these schemes.”

In response to Al Jazeera’s queries on whether the central bank was investigating this matter, it said complaints of fraudulent schemes generally needed to be directed to the police for legal action. The central bank did not respond to specific queries on the Sports Chain scheme.

Chathuranga Perera, 31, said he had deposited 3.2 million Sri Lankan Rupees ($8,963) in January 2021, money that he earned by working in the tourism industry. In a series of withdrawals by April he managed to get 400,000 Sri Lankan Rupees ($1,120) back, but not any more.

“This is what I saved for years. Now, I don’t have a job. I’ve lost almost everything,” he told Al Jazeera.

“This money would have come in very useful as we are facing an economic crisis. It hurts to be in this position,” he said.

Mano Ganeshan ready to support RW, denies ministerial posts (VIDEO)

President Ranil Wickremesinghe’s decision to lift a ban on several Tamil Diaspora groups would be a positive action towards the international community, said Samagi Jana Balawegaya (SJB) MP Mano Ganeshan, speaking to a briefing held in Colombo today (15).

Solutions can be sought to the current financial crisis if the government holds proper discussions with the Diaspora, Ganeshan pointed out, adding that he can involve in this regard without being submissive to a ministerial position.

Praising President Wickremesinghe’s move, the SJB MP emphasised that everyone should be looking at things in a new way.

He added that politicians like Gunadasa Amarasekara, Mohammed Muzammil and Wimal Weerawansa, on the other hand, saw such moves in the wrong angle and stressed that the point of view has to be changed. The country was driven into its current state due to their conduct, the MP alleged.

MIAP