August 17, Colombo (LNW): Sri Lanka’s services sector recorded a marked upswing in July, as key industries such as retail, finance, and freight transport drove a significant increase in overall business activity, according to the most recent data from the Central Bank of Sri Lanka (CBSL).

The Services Purchasing Managers’ Index (PMI), a key indicator of sector performance, climbed to 70.1 in July, rising sharply from 61.9 in the previous month. This notable improvement suggests growing momentum in the country’s economic recovery, particularly within consumer-facing and logistics-related services.

Strong performances were observed in wholesale and retail trade, where business activity surged, reflecting heightened consumer demand and improved market conditions. The financial services sector also demonstrated continued resilience, underpinned by a rise in lending and broader improvements in banking activity. Freight transport services saw further gains, likely supported by increased movement of goods and improved supply chain operations.

In addition to these core sectors, several other service areas reported upward trends. Personal care services, postal and courier activities, digital broadcasting, telecommunications, and hospitality — including food and beverage services — all contributed to the overall sectoral uplift. Health care services also saw steady improvement, indicating a wider rebound in public and private demand.

The expansion of new business was particularly encouraging, with the corresponding index rising to 64.9 in July from 62.9 in June. This growth was largely attributed to heightened activity in trade and financial services, pointing to sustained investor and consumer confidence.

Labour market conditions within the sector improved as well, with the employment index increasing to 59.8 from 51.6, suggesting that businesses are actively recruiting to cope with growing demand. At the same time, firms reported a rise in unfinished workloads, indicating pressure on capacity despite the hiring boost.

Looking ahead, the outlook for the next quarter appears optimistic. According to the CBSL, expectations for future business activity have strengthened, buoyed by improving macroeconomic stability and a more favourable business environment across the country.

Robust expansion in Sri Lanka’s services sector amid broad-based growth in July

Several districts to further witness showers (Aug 17)

August 17, Colombo (LNW): Showers will occur at times in the Western and Sabaragamuwa provinces and in Kandy, Nuwara-Eliya, Galle and Matara districts, the Department of Meteorology said in its daily weather forecast today (17).

A few showers may occur in North-western province. Mainly fair weather will prevail over the other areas of the island.

Strong winds of about (40-50) kmph can be expected at times over Western slopes of the central hills and in Northern, North-central, North-western and Southern provinces and in Trincomalee district.

Marine Weather:

Condition of Rain:

Showers will occur at a few places in the sea areas off the coast extending from Colombo to Matara via Galle.

Winds:

Winds will be south-westerly to westerly and wind speed will be (30-40) kmph.

Wind speed can increase up to (50-60) kmph at times in the sea areas off the coast extending from Chilaw to Mannar via Puttalam and from Matara to Pottuvil via Hambantota.

Wind speed can increase up to 50 kmph at times in the sea areas off the coast extending from Chilaw to Matara via Colombo and Galle and from Mannar to Trincomalee via Kankasanthurai and Mullaittivu.

State of Sea:

The sea areas off the coast extending from Chilaw to Mannar via Puttalam and from Matara to Pottuvil via Hambantota will be rough at times.

The sea areas off the coast extending from Chilaw to Matara via Colombo and Galle and from Mannar to Trincomalee via Kankasanthurai and Mullaittivu will be fairly rough at times.

SL Customs Launches Anti-Corruption Drive with Tech and Oversight Reforms

Sri Lanka Customs is currently implementing anti-corruption measures including the setting up of an Internal Affairs Unit to probe public complaints and new technology to improve transparency and efficiency.

These reforms are being carried out in accordance with the National Anti-Corruption Action Plan (NACAP) 2025-2029 to foster a corruption-free environment, improve public trust, and facilitate trade and travel, finance ministry sources revealed.

With a views of curbing revenue leakages the government will enact necessary legislation by end-October 2025 to mandate the Customs Department with clear and unfettered responsibility for the clearance, movement, and control of goods to and from the special economic zones (SEZ) a high official of the ministry said.

The Customs compliance will be enhanced by (i) implementing more robust risk assessment so that percentage of shipments assigned to the green channel approaches 80 percent, and (ii) closing the long rooms and eliminating face-to-face document review of customs declarations prior to their formal submission.

According to memorandum of economic and financial Policies submitted to the International Monetary Fund (IMF) the finance ministry will begin quarterly publication (on the Ministry website) by each revenue department on the implementation progress of the anticorruption measures including the digitisation and automation beginning from second quarter of 2025.

The establishment of the Internal Affairs Unit was recommended in an IMF diagnostic report, highlighting the need for dedicated units to investigate staff misconduct in customs administrations.

Customs trade unions are now collaborating with the department’s management to combat corruption, indicating a positive shift in the overall approach to integrity.

Structural reforms of Customs Department included the implementation of stricter legislation and bringing in new technology..

It also targets human resource management, for example, streamlining recruitment processes and constructing infrastructure.

Public dissatisfaction with the current operations of Customs, including inefficiency, fraud, and corruption, has been one of the reasons for these reforms, a top finance ministry official said.

It is aim to increase transparency and accountability within the department, reducing opportunities for corruption and improving public perception.

Digitisation of Customs procedures is a priority method to reduce manual processes that are prone to corruption.Overall, Sri Lanka Customs is actively fighting corruption on the basis of a multi-pronged approach encompassing institutional reforms, technology, and collaboration with stakeholders, including trade unions and the general public.

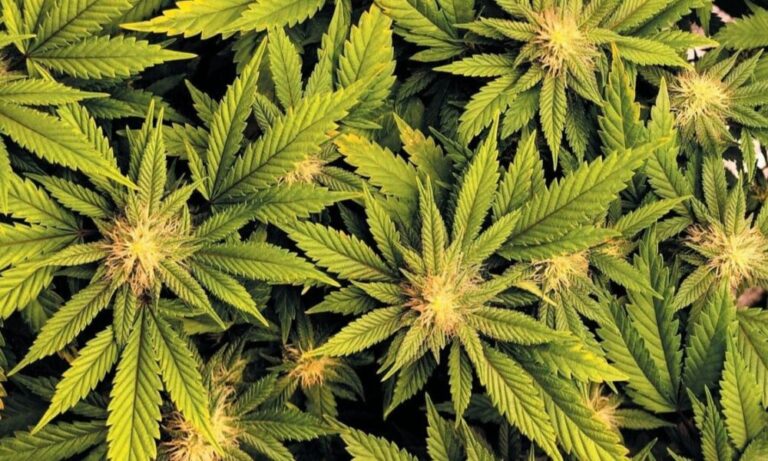

SL Government’s Cannabis Export Plan Faces Fierce Protests despite Gains

Sri Lanka’s first legal cannabis cultivation project for medicinal export has now moved from policy to implementation, yet the government’s landmark decision is unfolding amid an escalating storm of religious protests, civil society objections, and public mistrust.

The Cabinet this week confirmed that seven foreign investors have been approved to commence cultivation on a 64-acre site in Mirigama, marking the first time such a venture has been sanctioned under Sri Lankan law.

The project, originally approved in April 2024 under then State Minister of Indigenous Medicine Sisira Jayakody, is being rolled out under a stringent regulatory framework designed to reassure both local communities and international buyers.

Health and Mass Media Minister Dr. Nalinda Jayatissa announced that investors must commit at least US $5 million in capital along with a US $2 million security deposit held by the Central Bank. Cultivation licenses, valid for six months at a time, will require clearance from the Ayurveda Department, Ministry of Environment, and Ministry of Public Security, while the Special Task Force and police will provide round-the-clock security.

All cannabis plants must be imported and strictly confined to export markets in North America and the European Union, with the government insisting that not a single gram will be diverted to local markets.

The government’s economic argument is anchored in the explosive growth of the global medicinal cannabis industry. Analysts project the worldwide cannabidiol market will rise from US $5.49 billion in 2019 to over US $26 billion by 2027, while the industrial hemp sector, which includes medicinal cannabis, is expected to grow from US $7.9 billion in 2023 to nearly US $32 billion by 2030.

Sri Lankan officials believe the country’s Ayurvedic heritage, coupled with its strategic location, will position it as a competitive and reputable supplier.

They also point to the potential for significant job creation, with Board of Investment data suggesting that large-scale export agriculture projects in zones like Mirigama could collectively generate over 75,000 direct and indirect jobs and bring in more than US $2.6 billion in foreign exchange annually.

Investor interest in the scheme has been strong. Out of 37 applicants, seven companies have been selected in the first round, all of them foreign-backed and well-capitalized.

The government says this ensures access to advanced cultivation technology, quality control, and compliance with the rigorous testing demanded by premium overseas markets. Officials stress that by limiting participation to highly funded investors and maintaining multi-agency oversight, Sri Lanka can protect its domestic market while capturing lucrative export revenues.

However, the project’s rollout has unleashed a wave of social and political backlash. Today, Buddhist clergy led by the Asgiri Chapter warned that cannabis cultivation, even under the guise of medicinal production, is morally and culturally inappropriate.

Senior monks described the move as a “national disaster” that risks normalizing drug use. Civil society groups such as the Alcohol and Drug Information Centre echoed these concerns, warning that no regulatory framework can guarantee zero leakage into the domestic market and that illicit diversion is inevitable when “good money” is involved.

Social media reactions have been equally scathing, with users warning that cannabis could serve as a gateway to more dangerous drugs and that the policy prioritizes foreign profit over public welfare.

Human rights observers have also linked the controversy to Sri Lanka’s shrinking civic space, noting that recent years have seen increased restrictions on protests and dissent. Activists argue that the government’s willingness to push through such a socially contentious policy without broad public consultation reflects a deeper democratic deficit.

For now, the cannabis fields in Mirigama remain under heavy guard, the government confident in its ability to deliver both economic returns and regulatory compliance.

Yet the protests on the streets and the moral outrage from the pulpit suggest that Sri Lanka’s entry into the global medicinal cannabis trade may prove as politically combustible as it is financially ambitious.

Whether the projected billions in export revenue will outweigh the cultural, social, and political costs is a question that will be tested in the seasons ahead.

Sri Lankan Banks Post Record 1H Profits as Recovery Gains Pace

Sri Lanka’s banking sector has delivered a landmark performance in the first half of 2025, with both state-owned and private lenders posting record profits amid a more favourable economic environment. A combination of easing interest rates, a stronger rupee and renewed credit demand has driven the sector’s earnings surge, signalling a decisive shift from crisis-era survival to growth-oriented lending.

Lower funding costs, stemming from recent Central Bank policy rate cuts and stable inflation, have improved operating margins. The Finance Ministry’s latest fiscal review highlighted increased system liquidity and a stronger external position, while the country’s current account surplus in the first half has bolstered market confidence and supported credit expansion.

Among state-owned banks, Bank of Ceylon (BOC) set the benchmark with a profit before tax (PBT) of Rs. 59.4 billion for the first six months of the year, representing a 165% jump from Rs. 22.4 billion a year earlier. Profit after tax (PAT) reached Rs. 35.9 billion, supported by a 79% surge in net interest income to Rs. 102.7 billion and greater operational efficiency.

This followed an exceptional first quarter, when BOC posted a PBT of Rs. 30 billion, up 222% year-on-year, and a PAT of Rs. 17.1 billion, reflecting a 95% rise in net interest income. National Savings Bank (NSB) also reported strong results, with a profit after tax of Rs. 7.59 billion for the first quarter, up 124% from last year, aided by higher operating income and tight cost management.

Private sector banks have also capitalised on the improved market conditions. Commercial Bank of Ceylon reported a net profit of Rs. 31.17 billion for the first half, up 64.9% year-on-year, while profit before tax rose 61.5% to Rs. 45.24 billion.

The bank saw operating income increase by nearly 40%, while impaired loans declined and customer deposits crossed Rs. 2.5 trillion. Sampath Bank, however, recorded mixed fortunes, with second-quarter profits slipping 17% year-on-year to Rs. 6.7 billion due to higher operating costs.

Nevertheless, its first-quarter performance had been notably strong, with PBT at Rs. 13.4 billion, up 115%, and PAT at Rs. 8.3 billion, a 149% increase, supported by robust non-interest income and capital strength.

Hatton National Bank (HNB) posted a 49% jump in group profit after tax to Rs. 11.1 billion in the first quarter, driven by improved asset quality and solid capital buffers. Nations Trust Bank was among the first to release full half-year results, reporting a profit after tax of Rs. 9 billion, up 10% year-on-year, alongside a 26% increase in its loan book. DFCC Bank also reported double-digit growth in net interest income during the first half, underpinned by a strong capital position.

Mid-tier lenders mirrored the trend, with Union Bank reporting a 247% surge in profit after tax to Rs. 251 million for the first half, while profit before tax rose to Rs. 834 million. SDB Bank posted a Rs. 156 million profit after tax for the same period, supported by improved margins and expanding lending activity.

Overall, the first half of 2025 has marked a clear turnaround for Sri Lanka’s banking sector. The combination of lower interest rates, currency stability, and renewed credit appetite has created a fertile environment for profitability.

Both state-owned and private banks are now better positioned to support the country’s post-crisis economic recovery. However, the Finance Ministry has cautioned that sustaining this momentum will require continued fiscal transparency and steady progress on debt restructuring to safeguard financial sector stability.

Sri Lanka’s Gem Sector Brightens with Bold New Gazette Reforms

Sri Lanka’s gem and jewellery industry has welcomed a new government Gazette as a watershed reform aimed at breaking longstanding bottlenecks and fuelling global competitiveness.

Unlocking Rough Gem Access via New Procedures

The Gazette introduces a streamlined procedure for importing rough gemstones—historically, a cumbersome blockade hindering the industry’s raw material access. By enhancing transparency and aligning import processes with global trading hubs, Sri Lanka aims to inject fresh momentum into its gem value chain.

Sector Poised for Export Surge

Current export data underscores the reform’s timely relevance. In the first five months of 2025, Sri Lanka’s merchandise exports grew by 5.5%, totaling US $5.34 billion, contributing to an overall export rebound of 7.1% to US $6.93 billion

Within the government’s broader export strategy, gems and jewellery are slated to contribute US $650 million toward the US $18.2 billion 2025 export target

.However, the National Gem & Jewellery Authority (NGJA) notes that only around US $360 million—a fraction of potential earnings—is currently captured via formal channels; the remaining 90% of gem exports still flow through informal routes . The formalization push aims to increase traceability, tax contributions, and value capture.

Tackling Industry Bottlenecks and Structural Challenges

Beyond raw material access, the industry faces other headwinds. Parliamentary discussions from 2023 flagged delays in securing mining permits, an obstructive licensing process, and constraints caused by the gold import ban—especially impacting jewellery businesses serving tourism markets

Policy recommendations emerging from these discussions include issuing licenses through consolidated, weekly regional one-stop centres, revisiting the gold import ban to support foreign exchange–earning exporters, and scaling up skill development via localized training institutes to counter low industry entry.

Regulatory Framework: Formal Oversight and Licensing

Formal gem exports are tightly regulated. Exporters must obtain a valid Gem Dealers License from the NGJA—each tied to specific stock values—and process shipments via designated NGJA centres at Bandaranaike International Airport (Katunayake) or Rathnapura, under Customs supervision

. Documentation is intensive: original typed invoices on official letterhead, explicit inclusion of NGJA license and file numbers, and clear FOB valuation are mandatory

Other requirements include multiple invoice copies distributed across various authorities, service fee waivers for exhibition-bound goods (with a Rs 15,000 deposit and 0.25% service levy for returns), and collateral-based waivers for consignment exports

Industry Response and Forward Path

The Sri Lanka Gem and Jewellery Association (SLGJA) applauded the Gazette as a “milestone moment,” praising the collaborative work of President Anura Kumara Disanayake, Minister Sunil Handunneththi, NGJA, the Export Development Board, and the ministry secretaries. They see the reforms as not only export catalysts but also as tools to attract investment and drive sustainable growth across the value chain.

Conclusion

Sri Lanka’s gem industry is now at a turning point. With rough-gem import barriers easing, formalization ramping up, and regulatory clarity improving, the sector is well-positioned to reclaim its place as a key contributor to the nation’s export ambition. The challenge now lies in swift execution, capacity expansion, and ensuring that value creation is fully captured within the island’s shores.

X-Press Feeders Slams $1bn Supreme Court Order Over X-Press Pearl Disaster

Singapore-based X-Press Feeders has strongly criticised the Sri Lankan Supreme Court’s order to pay $1 billion within a year over the 2021 X-Press Pearl maritime disaster, calling it a breach of due process that scapegoats its crew and sets a dangerous precedent for global shipping.

The company accused the court of effectively convicting the vessel’s master and local agents before trials have concluded — in some cases before charges have even been filed. It noted that the master has been stranded in Sri Lanka for four-and-a-half years under a travel ban, separated from his family and unable to work despite offering to post the maximum fine possible.

X-Press Feeders argued that it was given no chance to respond to allegations in court, while the ruling ignored serious failings by Sri Lankan authorities. These included official inspections just days before the fire that raised “no alarm” and the refusal of ports in Qatar, India, and Sri Lanka to offload the leaking container before the blaze. The court itself acknowledged that the Marine Environment Protection Authority’s then-chair failed to order the vessel offshore, a move the operator says could have minimised damage, yet assigned no liability.

The X-Press Pearl, a 2,700-TEU feeder vessel, sank off Colombo in June 2021 after a fire broke out in a container carrying leaking nitric acid. The incident triggered Sri Lanka’s worst-ever marine pollution disaster, spilling hundreds of tonnes of plastic pellets onto beaches. X-Press Feeders says it has already paid over $150 million for wreck removal, plastic pellet clean-up, and compensation to fishermen.

The company warns that the $1bn order — one of the largest interim compensation awards in maritime history — could drive up shipping costs for Sri Lankan trade. It is now urging authorities to adopt “rational decision-making” that balances environmental restoration with the country’s economic needs.

President Reviews 2025 Sports Budget and Sets Vision for 2026

A review of the 2025 budget allocations for the Ministry of Youth Affairs and Sports, along with initial discussions on the 2026 budget proposals, was held this morning (15) at the Presidential Secretariat under the patronage of President Anura Kumara Dissanayake.

The meeting examined the 2025 allocations to eight institutions under the Ministry and assessed the progress of ongoing projects. President Dissanayake noted that while the previous budget provided adequate funding, there has been dissatisfaction over the proper utilisation of these funds. He stressed that budgetary provisions must be fully spent within the financial year to deliver tangible benefits to the public.

For 2026, the President called for proposals aimed at building a strong sports culture, improving sports infrastructure, identifying athletes with international potential, and elevating them to global competition. He emphasised that investments in sports serve broader purposes, including health improvement, crime reduction, drug prevention, social cohesion, and workforce development.

Highlighting the role of training and technology, the President urged the Ministry to provide athletes with advanced resources. He also instructed officials to expedite renovations at the Sugathadasa Stadium and other sports complexes across the country, employ experts for specialised infrastructure work, and seek international consultancy services.

School sports development was also prioritised, with the President expressing readiness to allocate necessary funds. He further instructed ministry officials to prepare an integrated national plan for sports development.

The meeting also discussed youth-focused programmes inspired by the 2025 National Youth Conference.

The event was attended by Minister of Youth Affairs and Sports Sunil Kumara Gamage, Minister of Labour and Deputy Minister of Economic Development Dr. Anil Jayantha Fernando, Deputy Minister of Youth Affairs Eranga Gunasekara, Deputy Minister of Sports Sugath Thilakaratne, Secretary to the President Dr. Nandika Sanath Kumanayake, Secretary to the Ministry of Finance Dr. Harshana Suriyapperuma, Senior Additional Secretaries to the President Russell Aponsu and Kapila Janaka Bandara, and other senior ministry officials.

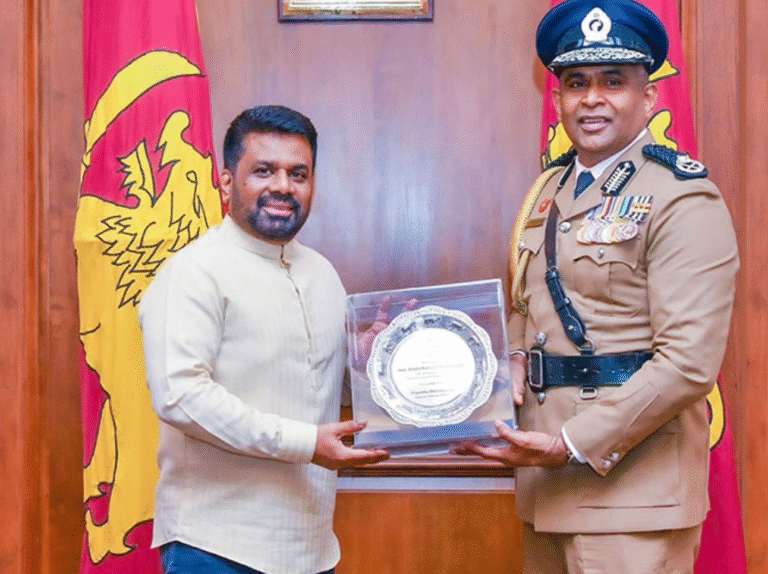

New IGP Priyantha Weerasooriya Meets President Anura Kumara Dissanayake

The newly appointed Inspector General of Police (IGP), Attorney-at-Law Priyantha Weerasooriya, met President Anura Kumara Dissanayake this afternoon (15) at the Presidential Secretariat.

The President conveyed his best wishes to the new IGP, who in turn presented a commemorative gift to the Head of State, the President’s Media Division (PMD) reported.

Priyantha Weerasooriya, the 37th IGP of Sri Lanka, holds the distinction of being the first to rise from the rank of Police Constable to the highest position in the Sri Lanka Police.

CID Complaint Filed Over AI-Generated Defamatory Video Targeting Minister Vijitha Herath

A formal complaint has been lodged with the Criminal Investigation Department (CID) against a prominent young activist of the Samagi Jana Balawegaya (SJB) for allegedly creating and circulating an AI-generated defamatory video targeting Foreign Affairs, Foreign Employment and Tourism Minister Vijitha Herath.

According to the complaint, an individual operating under the name Mujahid Haafiz, via a Facebook account, released a fabricated video that used the Minister’s image, the Janatha Vimukthi Peramuna (JVP) background, and artificial intelligence technology to produce misleading content. The video is alleged to have been deliberately edited with the intent to tarnish the reputations of Minister Herath, President Anura Kumara Dissanayake, and the JVP.

Minister Herath’s Coordinating Secretary, Chaminda Jayantha, filed the complaint yesterday (15), urging the CID to launch an immediate investigation and take legal action against the person responsible for releasing the defamatory material.