Jayati Ghosh

Foreign capital flees poorer countries at the first sign of instability. The pandemic and Ukraine war ensure there is plenty of that around

This January, even before Sanjana Mudalige’s salary as a sales worker in a shopping mall in Colombo, Sri Lanka, was slashed in half, she had pawned her gold jewellery to try to make ends meet. Ultimately, she quit her job, because the travel costs alone exceeded the pay. Since then, she has shifted from using gas for cooking to chopping firewood, and eats just a quarter of what she did before. Her story, reported in the Washington Post, is one of many in Sri Lanka, where people are watching their children go hungry and their elderly relations suffer for lack of medicines.

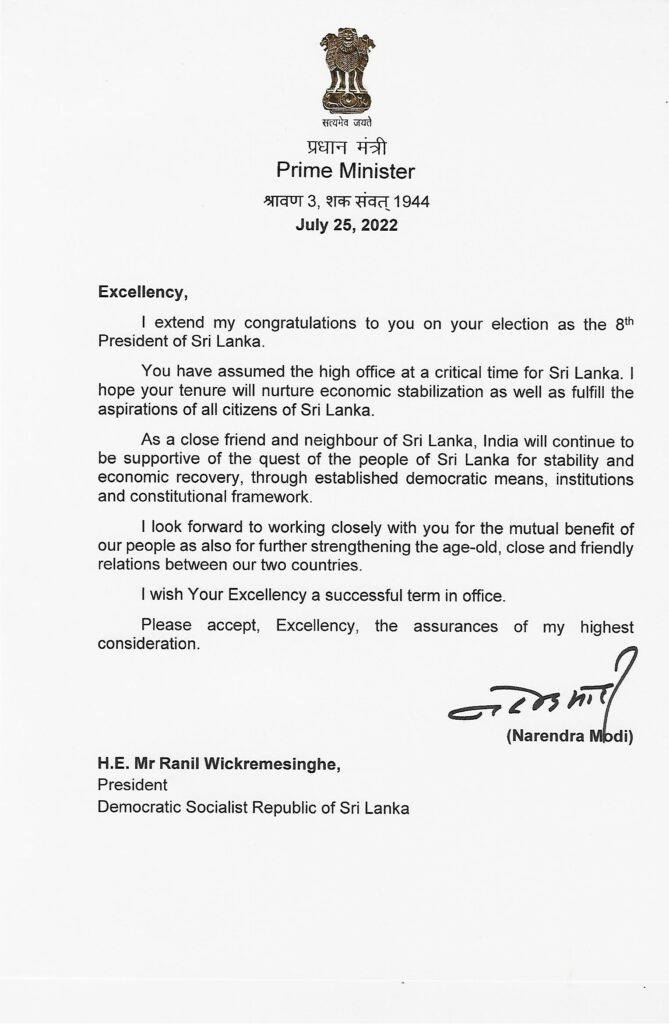

The human costs of the crisis only really captured international attention when the massive popular upsurge earlier this month, known as Aragalaya (Sinhalese for “struggle”), led to the peaceful overthrow of President Gotabaya Rajapaksa. His family had ruled Sri Lanka with an iron fist, albeit with electoral legitimacy, for more than 15 years, and is now being blamed by both national and international media for the desperate economic mess the country is in.

But blaming the Rajapaksas alone is too simple. Certainly, the aggressive majoritarianism that they unleashed, along with the alleged corruption and major economic policy disasters of recent years (such as drastic tax cuts and bans on fertiliser imports), were crucial elements of the economic debacle. But this is only part of the story. The deeper and underlying causes of the crisis in Sri Lanka are barely mentioned by most mainstream commentators, perhaps because perhaps because they reveal uncomfortable truths about the way the global economy works.

This is not a crisis created by a few recent external and internal factors, it has been decades in the making. Ever since its “open economic policy” was adopted in the late 1970s, Sri Lanka has been Asia’s poster boy for neoliberal reform, much like Chile in Latin America. The strategy was the now-familiar one of making exports the basis for economic growth, supported by foreign capital inflows. This led to a significant increase in foreign currency debt, something the IMF and the Davos crowd actively encouraged.

In the period after the 2008 global financial crisis, as low interest rates in advanced economies led to the availability of cheap credit, the Sri Lankan government relied on international sovereign bonds to finance its own spending. Between 2012 and 2020, the debt to GDP ratio doubled to around 80%, with a growing share of this inbonds. The payments due on these debts kept rising in relation to what Sri Lanka could earn from exports and the money sent back home by Sri Lankans working abroad. The disruptions caused by the pandemic and the war in Ukraine made matters much worse, by causing export earnings to fall and sharply increasing the price of essential imports including food and fuel. Foreign exchange reserves plummeted – but the government had to keep paying interest even when it could not import essential fuel.

Looked at in this light, it is clear that Sri Lanka is not alone; if anything, it’s just a harbinger of a coming storm of debt distress in what economists call the “emerging markets”. The past period of incredibly low interest rates in the advanced economies meant that more funds flowed to “emerging” and “frontier” markets from the richer world. While this found cheerleaders in the international financial institutions (IFIs), it was always a problematic process. This is because, unlike in places such as the EU and US, capital leaves low- and middle-income countries (LMICs) at the first sign of any problem.

And these countries were much more battered economically by the pandemic. Advanced economies were able to provide massive countercyclical measures – think of the UK’s furlough programme – because financial markets effectively allowed and even encouraged them to do so. By contrast, LMICs were prevented from increasing fiscal spending by much – because of those same financial markets, which threatened the possibility of credit downgrades and capital flight as government deficits grew larger. Plus they faced significant declines in export and tourism revenues and tighter balance of payments constraints. As a result, their economic recovery has been much more muted and economic conditions remain mostly dire.

The half-hearted attempts at debt relief, such as the moratorium on debt servicing in the first part of the pandemic, only postponed the problem. There has been no meaningful debt restructuring at all. The IMF bewails the situation and does almost nothing, and both it and World Bank add to the problem through their own rigid insistence on repayments and the appalling system of surcharges imposed by the IMF. The G7 and “international community” have been missing in action, which is deeply irresponsible given the scale of the problem and their role in creating it.

The sad truth is that “investor sentiment” moves against poorer economies regardless of the real economic conditions in specific countries. Private credit rating agencies amplify the problem. This means that contagion is all too likely, and it will affect not just economies that are already experiencing difficulties, but a much wider range of LMICs that will face real difficulties in servicing their debts. Lebanon, Suriname and Zambia are already in formal default; Belarus is on the brink; and Egypt, Ghana and Tunisia are in severe debt distress.

Many countries with lower per-capita income and significant absolute poverty are facing stagflation. Billions of people are increasingly unable to afford a basic nutritious diet, and cannot meet basic health expenses. Material insecurity and social tensions are inevitable.

The situation can still be resolved, but it requires urgent action, especially on the part of the IFIs and G7. Speedy and systematic debt resolution actions to bring in private creditors and other creditors, such as China, are needed, as is IFIs doing their own bit to provide debt relief and ending punitive measures such as surcharges. In addition, policies to limit speculation in commodity markets and profiteering by big food and fuel companies must be put in place. Finally, the recycling of special drawing rights (SDRs) – essentially “IMF coupons” – by countries that will not use them to countries that desperately need them is vital, as is another release of SDRs equating to about $650bn to provide immediate relief.

Without these minimal measures, the post-Covid, post-Ukraine global economy is likely to be engulfed in a dystopia of debt defaults, increasing poverty and sociopolitical instability.

- Jayati Ghosh is professor of economics at University of Massachusetts Amherst

The Guardian