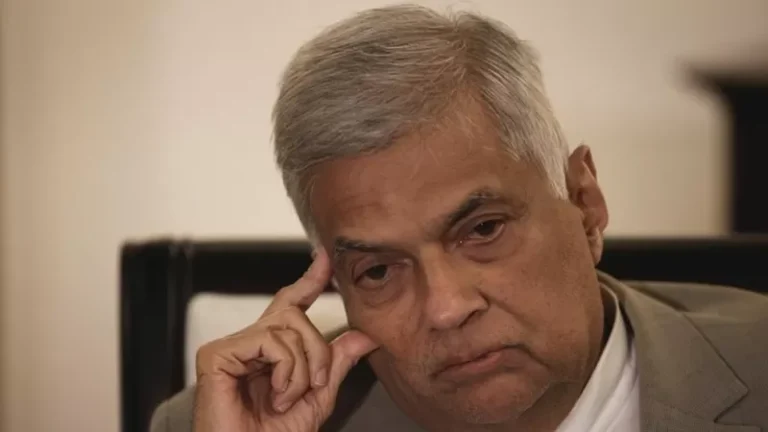

Sri Lanka’s acting president, Ranil Wickremesinghe, has declared a state of emergency as his administration seeks to quell social unrest and tackle an economic crisis gripping the island nation.

“It is expedient, so to do, in the interests of public security, the protection of public order and the maintenance of supplies and services essential to the life of the community,” a government notice released late on Sunday said.

Wickremesinghe had announced a state of emergency last week, after president Gotabaya Rajapaksa fled the country to escape a popular uprising against his government.

It was unclear whether that order had been withdrawn or had lapsed, or whether Wickremesinghe had reissued the order in his capacity as acting president, having been sworn in on 15 July. A spokesperson for Wickremesinghe’s office did not respond to Reuters request for comment.

The specific legal provisions of the latest emergency are yet to be announced by the government but previous emergency regulations have been used to deploy the military to arrest and detain people, search private property and dampen public protests.

The country’s commercial capital, Colombo, remained calm on Monday morning, with traffic and pedestrians out on the streets.

Bhavani Fonseka, senior researcher at the Centre for Policy Alternatives, said declaring a state of emergency was becoming the government’s default response.

“This has proven ineffective in the past,” Fonseka told Reuters.

Rajapaksa’s resignation was accepted by parliament on Friday. He flew to the Maldives and then Singapore after hundreds of thousands of anti-government protesters came out on to the streets of Colombo a week ago and occupied his official residence and offices.

Sri Lanka’s parliament met on Saturday to begin the process of electing a new president, and a shipment of fuel arrived to provide some relief to the crisis-hit nation.

Wickremesinghe, an ally of Rajapaksa, was nominated by the ruling party as its candidate to be the next president but protesters also want him gone, leading to the prospect of further unrest should he be elected.

Wickremesinghe was appointed interim president on Friday after informally occupying the role since Wednesday, and the announcement was greeted with anger and frustration on the streets of Colombo.

Wickremesinghe, who has now been prime minister six times, stands accused of protecting and propping up the Rajapaksa family dynasty for years, shielding them from corruption charges and enabling their return to power.

His decision to agree to become a caretaker prime minister two months ago was seen by many as the reason Rajapaksa stayed in power for weeks longer than he would have otherwise.

The public frustration at Wickremesinghe has manifested multiple times, from his private residence being burned down to his offices being stormed by protesters on Wednesday.

Wickremesinghe will be the candidate for the Rajapaksas’ ruling party, the Sri Lanka Podujana Peramuna (SLPP), which still has the largest number of seats in parliament. He stands a high chance of being elected after the vote by MPs in parliament scheduled for next Tuesday or Wednesday.

Wickremesinghe’s nomination even appeared to cause divisions with the SLPP. The party chair, GL Peiris, sent a letter to the party’s general secretary expressing “amazement and total disbelief” at the statement that it would be backing Wickremesinghe as its presidential nominee.

However, Wickremesinghe will be up against several candidates in the presidential secret ballot next week, including the leader of the opposition, Sajith Premadasa – who has vowed to make sure “an elective dictatorship never, ever occurs” and go after the leaders who “looted the country” – and another SLPP politician, Dullas Alahapperuma, which could split the vote of the ruling party.

Former army chief Sarath Fonseka has also signalled his intention to run.

The Guardian

Acting president declares state of emergency ahead of MPs’ vote

Sri Lanka crisis is a warning to other Asian nations

Sri Lanka is in the midst of a deep and unprecedented economic crisis that has sparked huge protests and seen its president quit after fleeing the country – but other countries could be at risk of similar troubles, according to the head of the International Monetary Fund (IMF).

“Countries with high debt levels and limited policy space will face additional strains. Look no further than Sri Lanka as a warning sign,” said IMF Managing Director Kristalina Georgieva on Saturday.

She said developing nations had also been experiencing sustained capital outflows for four months in a row, putting their dreams of catching up with advanced economies at risk.

Sri Lanka is struggling to pay for crucial imports like food, fuel and medicine for its 22 million people as it battles a foreign exchange crisis. Inflation has soared about 50%, with food prices 80% higher than a year ago. The Sri Lankan rupee has slumped in value against the US dollar and other major global currencies this year.

Many blame ex-President Gotabaya Rajapaksa for mishandling the economy with disastrous policies whose impact was only exacerbated by the pandemic.

Over the years, Sri Lanka had built up a huge amount of debt – last month, it became the first country in the Asia Pacific region in 20 years to default on foreign debt.

Officials had been negotiating with the IMF for a $3bn (£2.5bn) bailout. But those talks are currently stalled amid the political chaos.

But the same global headwinds – rising inflation and interest rate hikes, depreciating currencies, high levels of debt and dwindling foreign currency reserves – also affect other economies in the region.

China has been a dominant lender to several of these developing nations and therefore could control their destinies in crucial ways. Buy it’s largely unclear what Beijing’s lending conditions have been, or how it may restructure the debt.

Where China is at fault, according to Alan Keenan from International Crisis Group, is in encouraging and supporting expensive infrastructure projects that have not produced major economic returns.

“Equally important has been their active political support for the ruling Rajapaksa family and its policies… These political failures are at the heart of Sri Lanka’s economic collapse, and until they are remedied through constitutional change and a more democratic political culture, Sri Lanka is unlikely to escape its current nightmare.”

Worryingly, other countries appear to be on a similar trajectory.

Laos

The landlocked East Asian nation of more than 7.5 million people has been facing the risk of defaulting on its foreign loans for several months.

Now, a rise in oil prices because of the Russian invasion of Ukraine has put further strain on fuel supplies, pushing up the cost of food in a country where an estimated third of people live in poverty.

Local media outlets have reported long lines for fuel, and said some households had been unable to pay their bills.

Laos’ currency, the kip, has been plunging and is down by more than a third against the US dollar this year.

Higher interest rates in the US have strengthened the dollar, and weakened local currencies, increasing their debt burden and making imports costlier.

Laos, which is already heavily in debt, is struggling to repay those loans or or pay for imports like fuel. The World Bank says the country had $1.3bn of reserves as of December last year.

But its total annual external debt obligations are around the same amount until 2025 – equivalent to about half of the country’s total domestic revenue.

As a result, Moody’s Investor Services last month downgraded the communist-ruled nation to “junk”, a category in which debt is considered high risk.

China has loaned Laos huge amounts of money in recent years to fund big projects like a hydropower plant and a railway. According to Laotian officials speaking to Chinese state news agency Xinhua, Beijing has undertaken 813 projects worth more than $16bn last year alone.

Laos’ public debt amounted to 88% of its Gross Domestic Product (GDP) in 2021, according to the World Bank, with almost half of that figure owed to China.

Experts point to years of economic mismanagement in the country, where one party – the Lao People’s Revolutionary Party – has held power since 1975.

But Moody’s Analytics has flagged increased trade with China and the export of hydroelectricity as positive developments. “Laos has a fighting chance of avoiding the danger zone and the need for a bailout,” economist Heron Lim said in a recent report.

Pakistan

Fuel prices in Pakistan are up by around 90% since the end of May, after the government ended fuel subsidies. It’s trying to rein in spending as it negotiates with the IMF to resume a bailout programme.

The economy is struggling with the rising cost of goods. In June, the annual inflation rate hit 21.3%, the highest it has been in 13 years.

Like Sri Lanka and Laos, Pakistan also faces low foreign currency reserves, which have almost halved since August last year.

It has imposed a 10% tax on large-scale industry for one year to raise $1.93bn as it tries to reduce the gap between government revenue and spending – one of the IMF’s key demands.

“If they are able to unlock these funds, other financial lenders like Saudi Arabia and the UAE [United Arab Emirates] may be willing to extend credit,” Andrew Wood, sovereign analyst at S&P Global Ratings told the BBC.

Former Prime Minister Imran Khan who vowed to fix some of these problems, was ousted from power although the faltering economy is not the only reason for that.

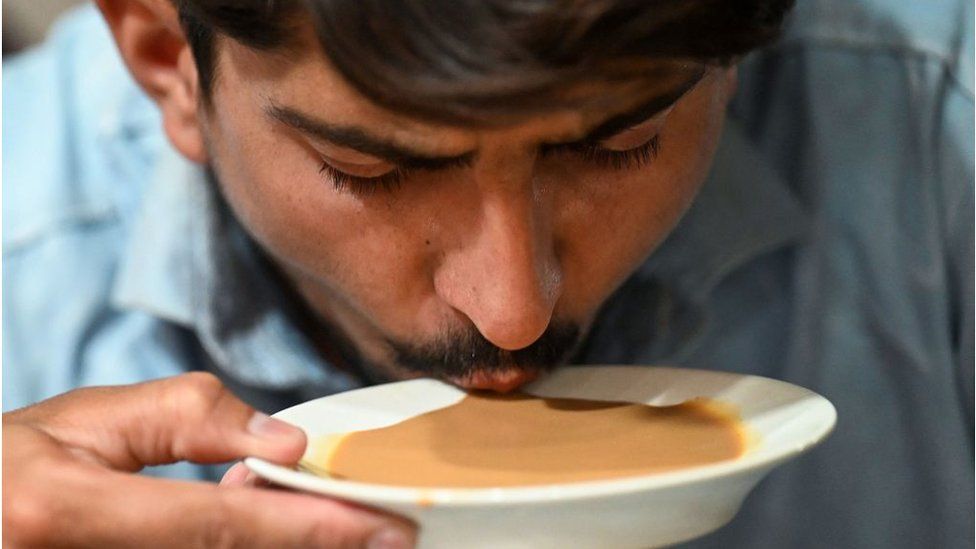

Last month, a senior minister in Pakistan’s government asked citizens to reduce the amount of tea they drink to cut the country’s import bills.

Again China plays a role here, with Pakistan reportedly owing more than a quarter of its debt to Beijing.

“Pakistan appears to have renewed a commercial loan facility vis-a-vis China and this has added to its foreign exchange reserves and there are indications they will reach out to China for the second half of this year,” Mr Wood added.

Maldives

The Maldives has seen its public debt swell in recent years and it’s now well above 100% of its GDP.

Like Sri Lanka, the pandemic hammered an economy that was heavily reliant on tourism.

Countries that depend so much on tourism tend to have higher public debt ratios, but the World Bank says the island nation is particularly vulnerable to higher fuel costs because its economy is not diversified.

US investment bank JPMorgan has said the holiday destination is at risk of defaulting on its debt by the end of 2023.

Bangladesh

Inflation hit an 8-year high in May in Bangladesh, touching 7.42%.

With reserves dwindling, the government has acted fast to curb non-essential imports, relaxing rules to attract remittances from millions of migrants living overseas and reducing foreign trips for officials.

“For economies running current account deficits – such as Bangladesh, Pakistan and Sri Lanka – governments face serious headwinds in increasing subsidies. Pakistan and Sri Lanka have turned to the IMF and other governments for financial assistance,” Kim Eng Tan, a sovereign analyst at S&P Global Ratings, told the BBC.

“Bangladesh has had to re-prioritise government spending and impose restrictions on consumer activities,” he said.

Rising food and energy prices are threatening the pandemic-battered world economy. Now developing nations that have borrowed heavily for years are finding that their weak foundations make them particularly vulnerable to global shockwaves.

BBC News

CPC slashes fuel prices slightly still maintaining inflated price

Realizing the reality of accepting the pump up of fuel price to a new high in an irregular fuel pricing formula ,the Ceylon Petroleum Corporation (CPC) has slashed fuel prices with effect fro10 am yesterday although it was a very nominal reduction compared to current inflated price,

The price of a litre of Petrol (Octane 92) has been slashed by Rs. 20 to Rs.450 per litre and Petrol (Octane 95) by Rs. 10 per litre to Rs.540, auto diesel by Rs. 20 to Rs.440 and super diesel by Rs. 10 Rs. 510 .

Due to a combination of spot purchases, unsolicited bids (instead of established term contracts) and miscalculation of the pricing formula, Sri Lankan motorists – in recent months – are forced to pay more for fuel at the pump.

Before this marginal reduction, motorists are forced to pay an additional sum of around Rs.145 per litre for 92 petrol, Rs.162 per litre for 95 petrol and Rs.175 per litre for auto diesel due to the recent practice of spot purchase of fuel from any supplier at their selling price in unsolicited bids, a senior Finance Ministry official said. .

He noted that the Energy Ministry has no option other than approving the Ceylon Petroleum Corporation (CPC)’s unsolicited proposals to procure fuel from available suppliers due to the present dollar crisis.

The increase in prices on June 26 was based on an inflated landed cost under a new fuel pricing formula introduced on May 24, Sri Lanka Customs and Finance Ministry data showed.

Then petrol 92 increased by Rs.50 to Rs.470 per litre, petrol 95 by Rs.100 to Rs.550, diesel by Rs.60 to Rs.460 and Super diesel by Rs.75 to Rs.520.

This price revision under the new formula included all costs incurred in importing, unloading, distribution to the stations, taxes, as well as operational and administration costs, an Energy Ministry report revealed.

However the new formula is based on a report released on estimated cost of imported refined petroleum products by spot purchasing and it cannot be considered as a proper fuel pricing mathematical model, several energy experts including a former CPC chairman told the Business Times.

They noted that considering the spot purchase price of fuel in calculating landed cost of fuel will lead to discrepancies and manipulations in fixing the wholesale and retail price (price at pump).

A previous fuel price formula formulated by the Finance Ministry in 2018 was based on CIF price (FOB + freight + insurance + evaporation losses) to which the following costs were added – port + jetty charges + customs and excise duty + financial charges + storage and terminal charges + marketing and distribution charges – to arrive at the wholesale cost.

The retail price was arrived at by adding the profit margin of 5 per cent + retailer and dealer margin of 2.5 per cent of the wholesale price + VAT.

Fuel prices had been revised monthly at that time to reflect changes in Singapore Platts average FOB price and exchange rates.

The steep fuel retail price was fixed by the Energy Ministry based on the high landed cost compared to the actual cost, Sri Lanka Customs data shows.

According to the table published along with the details of the new fuel pricing formula by the ministry in May this year, the landed cost of 92 octane petrol is Rs. 363.50 per litre but the actual cost indicated in Customs records is Rs.228.26 per litre with the gap being Rs.135.24.

Similarly the landed cost of 95 octane is Rs.367.18 per litre while the actual cost is Rs.235.23 per litre, the difference being Rs.131.95. The landed cost of auto diesel is Rs.403 per litre but the actual cost is Rs. 255 and the difference is Rs.148.

With a view to justifying the fuel price hike to a new high the total tax on 92 octane petrol has also been inflated to Rs.59.26 compared to an actual tax of Rs.49.12, Treasury records show.

According to the fuel pricing formula data the total tax imposed on 95 octane petrol is Rs. 80.54 while the actual tax component should be Rs.49.64.

Auto diesel tax indicated in the new formula is Rs.36 whereas the actual tax component is Rs.19.19.

Dealers with links to black market dollar trade enter commodity imports

Several dealers with links to black market dollar trading registered with the Trade Ministry under the US$ 1 billion Indian credit line are now active in the import of essential commodities taking advantage of easing restrictions on open account transactions, a Pettah Traders Association’s high ranking member alleged.

Special Import License and Payment Regulations, No. 1 of 2011 have been amended with the “Open Account Payment Terms” only to be allowed to importers of 10 essential food commodities with effect from July 1 for a period of two months, the relevant gazette notification published this month revealed.

Central Bank Governor Dr. Nandalalal Weerasinghe has said that easing the open account transaction for certain essential commodity sectors due to some outside pressure will open the dollar trading in black market again.

Hawala/Undiyal business will resume their transactions with several importers through this open account channels, Dr Weerasinghe said adding that they imposed a ban and it has resulted in the decline of black-market rates coming down almost close to the official rate.

At present some of the local essential commodity suppliers have been given an opportunity to import essential food items under the Indian credit line and also enter the essential commodity imports . This has opened the doors for some new politically-influential commodity traders with connections to black market dollar dealers to enter into essential commodity including sugar importation business.

Consultant of the Essential Food Importers and Traders Association P.M Abeysekera said the formal banking channels of the much-needed foreign exchange was baseless. He warned that the country will soon face shortages of essential food items, due to the excessive restrictions imposed on open account trade and easing it for the importation of only 10 essential commodities will not solve the problem.

Top officials of the Central Bank and Treasury with 20-30 year experience know how to handle the dollar black market without confusing the essential commodity import business, he added.

Open account and DA terms are an arrangement between the buyer and seller, based on mutual understanding and trust, to import goods on credit terms, he said adding that local commodity importers are maintaining close ties with overseas exporters.

He noted that most foreign banks and suppliers are not recognizing the letter of credit (LC) facilities of Sri Lankan banks due to downgrading of Sri Lanka by international rating agencies and the suspension of international bond repayments.

The difficulty in opening LC’s in local banks and dollar shortage in the country has compelled the commodity importers to resort to open account transactions with overseas suppliers, he said.

UN urges to ensure peaceful and constitutional transfer of power in Sri lanka

The head of the UN Country Team in Sri Lanka has urged senior politicians to ensure a peaceful transfer of power in line with the national Constitution, following weeks of protests that finally saw the resignation of President Gotabaya Rajapaksa on Thursday.

In a statement issued on behalf of the UN in Sri Lanka,Resident Coordinatornna Hanaa Singer said that it was “imperative that the transition of power is accompanied by broad and inclusive consultation within and outside Parliament.

According to news reports, Mr. Rajapaksa offered his resignation after fleeing the country and arriving in Singapore, having first flown to the Maldives on Wednesday after tens of thousands of protesters stormed his official residence in the capital Colombo earlier in the week.

The former president and his family have been blamed by demonstrators for failing to prevent a major economic crisis that has created acute shortages of food, fuel, medical supplies, and left the country teetering on the edge of economic ruin, having entered discussions with the International Monetary Fund over an emergency bailout.

Mr. Rajapaksa’s resignation led to jubilant celebrations on the streets of the capital, and marked the end of nearly 20 years of rule by the powerful family.

Despite the relative calm on Friday morning, there were reportedly long queues once more forfuel and LP gas

In her statement, Ms. Singer recalled that Secretary-General António Guterres has highlighted the importance of addressing the root causes of the current instability and the people’s grievances.

Dialogue with all stakeholders is the best way to address the concerns of fulfil the aspirations of all Sri Lankans”, she said.

She added that the authorities now needed to “ensure that in maintaining law and order, the security forces exercise restraint and operate in strict compliance with human rights principles and standards.”

The Prime Minister Ranil Wickremesinghe – who has held that office a total of six times – was sworn in as president on a temporary basis on Friday, and Sri Lanka’s parliamentarians are due to begin the process of selecting a new president on Saturday, before taking a formal vote on 20 July.

Ms Singer said that the United Nations stood ready to “support the Government and people of Sri Lanka, to address both immediate and long-term needs.”

Ukraine blames Russia for Ongoing Crisis in Sri Lanka

Ukrainian President Volodymyr Zelensky blamed Russia for causing unrest in Sri Lanka as well as around the world due to the blocking of food products during the invasion of Ukraine.

One of the major tactics Russia has used in their invasion of Ukraine is the creation of an “economic shock,” Zelenskyy said, adding that several countries experiencing food and fuel shortages due to the disruption in the supply chain have benefitted Russia’s agenda.

Highlighting the crisis in Sri Lanka during a recent address at the Asian Leadership Conference in Seoul, he further said “The shocking food and fuel price hikes led to a social explosion. No one knows now how it will end.”

War in Ukraine has left an estimated 1.6 billion people in 94 countries exposed to at least one dimension of finance, food, or energy crisis, with around 1.2 billion living in “perfect-storm” countries severely vulnerable.

Amid the ongoing protests, Sri Lanka’s now acting President, Wickremesinghe stepped down from his post of Prime Minister due to the escalation in violence and protests in the country.

Sri Lanka is suffering its worst economic crisis since gaining independence in 1948, which comes on the heels of successive waves of COVID-19, threatening to undo years of development.

Notably, the oil supply shortage has forced schools and government offices to close until further notice. Reduced domestic agricultural production, a lack of foreign exchange reserves, and local currency depreciation have fuelled the shortages.

Moreover, due to the ongoing conflict between Russia and Ukraine, the increase in hunger since the start of the war is only ascending.

The number of severely food insecure people doubled from 135 million prior to the pandemic, to 276 million over just two years. The ripple effects of the war could push this number to 323 million.

The Group of Seven (G7) leaders during the recently held summit also discussed the impact of Russia’s war on food and energy supplies including the global economy and said the bloc is determined to support Ukraine in producing and exporting grain, oil, and other agricultural products.

They called upon Russia to cease, without condition, its attacks on agricultural and transport infrastructure and enable free passage of agricultural shipping from Ukrainian ports in the Black Sea.

In a recent agreement between the Russian Federation and Ukraine, a months-long blockade of grain deliveries via the Black Sea will break, the UN Secretary-General Guterres said in a statement calling it a critical step forward in ensuring the safe and secure export of Ukrainian products.

The Observer view on the upheaval in Sri Lanka

Sri Lankans are to be congratulated on their ousting of the Rajapaksa family, crowned by last week’s hasty flight into exile of the country’s president, Gotabaya Rajapaksa. The dramatic downfall of this predatory dynastic clan, which first took power in 2005, carries salutary lessons for other democracies where a famous name and elite connections sometimes count for more than competence and integrity.

Sri Lanka is frequently described as an exceptional country, and in many ways it is. The peaceful behaviour of most of the anti-government protesters, and the fact the army did not attempt to seize power as a political vacuum developed, clearly set it apart. Yet the root causes of its recent troubles are readily recognisable the world over.

Gotabaya Rajapaksa, his brother Mahinda, who preceded him as president, and another brother, Basil, who was appointed finance minister, consolidated their power over a pyre of dead bodies – the thousands of mostly Tamil victims of the long-running civil war they brought to an atrocious conclusion in 2009. War crimes committed during that dreadful time remain unpunished.

Like unscrupulous populists and nationalists everywhere, the Rajapaksas exploited divisions stemming from economic insecurity, prejudice and plain ignorance, setting the Sinhalese Buddhist majority against the mostly Hindu Tamil and Muslim minorities. Rather than heal the wounds caused by the separatist war, they played upon them. After the Easter Sunday Islamist extremist attacks in 2019, they repeated the exercise.

The brothers further cemented control by centralising power around the presidency, offering unaffordable tax cuts and running up extraordinary levels of debt. A “super-growth” spending spree on roads, airports and stadiums raised borrowing by over $14bn amid credible claims of corruption, bribery and money laundering.

More unexpected, perhaps, was the sheer incompetence of the Rajapaksas’ increasingly autocratic rule, especially following Gotabaya’s presidential victory in 2019. Their piling up of new loans, their irresponsible printing of paper money and their ill-advised interest rate cuts collided with the onset of the pandemic, a global downturn and an ensuing collapse in tourism and remittances sent from abroad.

Beijing’s irresponsible foot-dragging echoes the experience of other countries in the global south

Brutality, cupidity, stupidity, iniquity: the too common failings of abusive political leaders around the world, and the Rajapaksas had them all. Sri Lanka was heading for economic meltdown. By early 2022, the country owed $51bn in foreign debt and was running out of dollars. In May, it defaulted. Fuel, basic foodstuffs and medicines grew desperately scarce. Hence the uprising on the streets.

Like other countries that have undergone similar, wrenching upheavals, the pressing question now is whether Sri Lanka can find a better way forward. It will need help, not least from a reluctant China, whose $5bn in no-strings, high-interest loans to the Rajapaksa regime fuelled its profligacy. Other big creditors, including India and Japan, will have to accept a haircut, too. Meanwhile, an IMF bailout is sought.

Janet Yellen, US Treasury secretary, rightly called on China last week to fulfil its obligation under the G20’s “common framework” to help restructure Sri Lankan debt. Beijing’s irresponsible foot-dragging echoes the experience of other countries in the global south, such as Zambia, Chad and Ethiopia. They too have been caught up in Beijing’s self-serving “debt-trap diplomacy”.

Sri Lanka faces a long road back and, once the dust settles, political backsliding poses an obvious risk. A new president will be chosen by parliament this week. There is talk of a unity government and constitutional reform. The fact the protests brought together all the ethnic and religious groups is a hopeful sign. For now at least, and against the odds, Sri Lanka’s democracy has survived a long and testing ordeal.

TheGuardian

Ranil Wickremesinghe: Can Sri Lanka’s acting president restore order?

Ranil Wickremesinghe has suddenly been promoted from being Sri Lanka’s prime minister to its new interim president – but how long he lasts in that job is an open question.

His predecessor in the post, Gotabaya Rajapaksa, fled to Singapore following mass protests over the island’s economic crisis.

Mr Wickremesinghe, a senior opposition MP, has been prime minister six times, but has never seen out a full term.

His latest prime ministerial stint began as recently as May, when he was named to the post in an ultimately unsuccessful attempt by Mr Rajapaksa to cling to office.

Mr Wickremesinghe’s new role as acting president got off to an inauspicious start when he declared a nationwide state of emergency, only to have it defied by thousands of protesters who stormed his office in the capital, Colombo.

In a TV statement, he denounced the demonstrators as “fascists”. But they see him as being too close to Mr Rajapaksa and want him out of power as well. His private residence was set ablaze during unrest on Saturday. He wasn’t at home at the time.

Protests flared up in Colombo in early April. Since then, they have grown in size and spread across the country.

For months, people have been struggling with daily power cuts and shortages of basics such as fuel, food and medicines.

The country’s foreign currency reserves have virtually run dry, meaning it doesn’t have enough funds available to buy goods from other countries.

Resentment at these growing hardships has now boiled over – and at least nine people have lost their lives in the ensuing unrest.

Why are Sri Lankans protesting in the streets?

A lawyer by profession, Mr Wickremesinghe comes from an affluent family of politicians and businessmen.

He was first elected to parliament in 1977 and quickly moved up the party ladder after Ranasinghe Pramadasa was elected president in 1989. He first served as prime minister from 1993 to 1994.

In 1994, he became leader of the United National Party (UNP) when Gamini Dissanayake was killed by suspected rebels of the Liberation Tigers of Tamil Eelam.

He himself narrowly escaped an assassination attempt when a bomb went off at a meeting he was addressing in the town of Eppawala.

Mr Wickremesinghe improved his party’s image by appointing a disciplinary commission to get rid of corrupt party members.

He also tried to change his personal image with various different haircuts to give himself a more appealing look and he tried to broaden the UNP’s public support by touring villages.

In more normal times, around the turn of the century, he was a genuine contender to be elected president, but his star subsequently waned.

He was prime minister during the deadly Easter Sunday bombings in 2019, which killed at least 250 people.

He told the BBC he had been “out of the loop” when it came to intelligence warnings ahead of the attacks.

In the last election, his once ruling UNP managed to scrape together just one parliamentary seat, leaving him its sole representative in parliament – and fuelling his opponents’ claims that he lacks legitimacy for office.

One major reason people are angry at Mr Wickremesinghe has been his perceived closeness to the Rajapaksa family. Many people believe he helped shield them when they lost power in 2015.

In an effort to shore up his authority, Mr Wickremesinghe has now instructed a new committee headed by the military and police chiefs to “do what is necessary” to restore order.

But the turmoil is now so great that it is unclear what measures will be equal to the task – or whether Mr Wickremesinghe is the man to do it.

BBC News

“Can’t Even Go To Practice”: Chamika Karunaratne On Massive Fuel Crisis

Colombo: Sri Lankan cricketer Chamika Karunaratne waits in a long queue at the fuel station to fill up his car after two days. A young international cricketer who made his international debut in 2019 is now upset by the recent crisis in the country.

Speaking exclusively to ANI on Saturday, “Luckily got it after being in a long fuel queue for two days, Due to the huge fuel crisis, I am not able to even go to my cricket practices,” he told ANI.

Sri Lanka is going to host the Asia Cup 2022 in August this year. But the whole country is facing an economic crisis along with an acute shortage of fuel since independence. Even the troubled cricketer does not know what will happen, “I am coming on such a day because two important series and Lanka Premier League (LPL) matches have been announced,” he said.

“Asia Cup is coming and LPL is also scheduled this year. I do not know what will happen because I have to go to Colombo and different places for the practices and do attend club season. Due to fuel shortage. I cannot go to the practices… since two days I did not go anywhere because..I am in a long queues for petrol. Luckily I got it today, but for ten thousand rupees that will go only maximum two to three days,” he told ANI.

Chamika Karunaratne is confident about the readiness of himself and the Sri Lankan team for the upcoming Asia Cup 2022, but shows concern about the recent crisis too.

“We are ready for the Asia Cup and I think for the big event, the country will provide enough fuel. We are playing with Australia and the matches were nice. Even for the Asia Cup preparation is underway,” he told ANI.

The Sri Lankan cricketer also spoke about the ongoing crisis. “I cannot say much on it, but nothing going is going well right now. I hope that when the right people come, something good will happen, people have to choose the right person..so we can take the international support and things will definitely come to the right place.”

In a recent interview with ANI, ace cricketer Sanath Jayasuriya said, “Cricket must go for it at any cost. I would like to thank the Australian cricket captain and High Commissioner who did not cancel the Test match,” he told ANI.”

Sri Lanka had recently hosted Australia for a multi-format series. The series was highly competitive and saw good cricket from both sides. Australia won the T20I series 2-1, the ODI series was won by Sri Lanka 3-2, while the Warne-Murli Trophy in Tests was shared after the two-match series ended in a 1-1 draw.

Sri Lanka has never seen a fuel and economic crisis on the island since independence in 1948 when only 10 per cent of its people are able to obtain fuel on a daily basis.

https://www.ndtv.com/video/news/news/sri-lanka-crisis-can-t-even-go-to-practice-sri-lanka-cricketer-on-massive-fuel-crisis-643196

NDTV

These countries may face Sri Lanka-like economic crisis due to inflation, rising borrowing costs

Traditional debt crisis signs of crashing currencies, 1,000 basis point bond spreads and burned FX reserves point to a record number of developing nations now in trouble.

Lebanon, Sri Lanka, Russia, Suriname and Zambia are already in default, Belarus is on the brink and at least another dozen are in the danger zone as rising borrowing costs, inflation and debt all stoke fears of economic collapse.

Totting up the cost is eyewatering. Using 1,000 basis point bond spreads as a pain threshold, analysts calculate $400 billion of debt is in play. Argentina has by far the most at over $150 billion, while the next in line are Ecuador and Egypt with $40 billion-$45 billion.

Crisis veterans hope many can still dodge default, especially if global markets calm and the IMF rows in with support, but these are the countries at risk.

ARGENTINA

The sovereign default world record holder looks likely to add to its tally. The peso now trades at a near 50% discount in the black market, reserves are critically low and bonds trade at just 20 cents in the dollar – less than half of what they were after the country’s 2020 debt restructuring.

The government doesn’t have any substantial debt to service until 2024, but it ramps up after that and concerns have crept in that powerful vice president Cristina Fernandez de Kirchner may push to renege on the International Monetary Fund.

UKRAINE

Russia’s invasion means Ukraine will almost certainly have to restructure its $20 billion plus of debt, heavyweight investors such as Morgan Stanley and Amundi warn.

The crunch comes in September when $1.2 billion of bond payments are due. Aid money and reserves mean Kyiv could potentially pay. But with state-run Naftogaz this week asking for a two-year debt freeze, investors suspect the government will follow suit.

TUNISIA

Africa has a cluster of countries going to the IMF but Tunisia looks one of the most at risk.

A near 10% budget deficit, one of the highest public sector wage bills in the world and there are concerns that securing, or a least sticking to, an IMF programme may be tough due to President Kais Saied’s push to strengthen his grip on power and the country’s powerful, incalcitrant labour union.

Tunisian bond spreads – the premium investors demand to buy the debt rather than U.S. bonds – have risen to over 2,800 basis points and along with Ukraine and El Salvador, Tunisia is on Morgan Stanley’s top three list of likely defaulters. “A deal with the International Monetary Fund becomes imperative,” Tunisia’s central bank chief Marouan Abassi has said.

GHANA

Furious borrowing has seen Ghana’s debt-to-GDP ratio soar to almost 85%. Its currency, the cedi, has lost nearly a quarter of its value this year and it was already spending over half of tax revenues on debt interest payments. Inflation is also getting close to 30%.

EGYPT

Egypt has a near 95% debt-to-GDP ratio and has seen one of the biggest exoduses of international cash this year – some $11 billion according to JPMorgan.

Fund firm FIM Partners estimates Egypt has $100 billion of hard currency debt to pay over the next five years, including a meaty $3.3 billion bond in 2024.

Cairo devalued the pound 15% and asked the IMF for help in March but bond spreads are now over 1,200 basis points and credit default swaps (CDS) – an investor tool to hedge risk – price in a 55% chance it fails on a payment.

Francesc Balcells, CIO of EM debt at FIM Partners, estimates though that roughly half the $100 billion Egypt needs to pay by 2027 is to the IMF or bilateral, mainly in the Gulf. “Under normal conditions, Egypt should be able to pay,” Balcells said.

KENYA

Kenya spends roughly 30% of revenues on interest payments. Its bonds have lost almost half their value and it currently has no access to capital markets – a problem with a $2 billion dollar bond coming due in 2024.

On Kenya, Egypt, Tunisia and Ghana, Moody’s David Rogovic said: “These countries are the most vulnerable just because of the amount of debt coming due relative to reserves, and the fiscal challenges in terms of stabilising debt burdens.”

ETHIOPIA

Addis Ababa plans to be one of the first countries to get debt relief under the G20 Common Framework programme. Progress has been held up by the country’s ongoing civil war though in the meantime it continues to service its sole $1 billion international bond.

EL SALVADOR

Making bitcoin legal tender all but closed the door to IMF hopes. Trust has fallen to the point where an $800 million bond maturing in six months trades at a 30% discount and longer-term ones at a 70% discount.

PAKISTAN

Pakistan struck a crucial IMF deal this week. The breakthrough could not be more timely, with high energy import prices pushing the country to the brink of a balance of payments crisis.

Foreign currency reserves have fallen to as low as $9.8 billion, hardly enough for five weeks of imports. The Pakistani rupee has weakened to record lows. The new government needs to cut spending rapidly now as it spends 40% of its revenues on interest payments.

BELARUS

Western sanctions wrestled Russia into default last month and Belarus now facing the same tough treatment having stood with Moscow in the Ukraine campaign.

ECUADOR

The Latin American country only defaulted two years ago but it has been rocked back into crisis by violent protests and an attempt to oust President Guillermo Lasso.

It has lots of debt and with the government subsidising fuel and food JPMorgan has ratcheted up its public sector fiscal deficit forecast to 2.4% of GDP this year and 2.1% next year. Bond spreads have topped 1,500 bps.

NIGERIA

Bond spreads are just over 1,000 bps but Nigeria’s next $500 million bond payment in a year’s time should easily be covered by reserves which have been steadily improving since June. It does though spend almost 30% of government revenues paying interest on its debt.

“I think the market is overpricing a lot of these risks,” investment firm abrdn’s head of emerging market debt, Brett Diment, said.

LiveMint