Sri Lanka is turning to Russia for overcoming the grave fuel crisis while renewing the bilateral ties at a time where the country has been depending on US , India, China, Japan and even Bangladesh credit lines.

Russia has received an appeal from Sri Lanka for help in overcoming the energy crisis raging in the country and is now considering the next steps to provide assistance, the Russian Foreign Ministry said on Thursday.

Last Thursday, Sri Lankan Energy Minister Kanchana Wijesekera told reporters that Colombo is counting on Moscow to help overcome the energy crisis and acute shortage of energy resources by receiving Russian oil supplies.

“We can confirm that such appeals have indeed been received by the Government of the Russian Federation and the Russian Embassy in Sri Lanka,” the ministry told Sputnik.

The ministry added that the question of how Moscow can help Colombo is still under consideration and that it is too early to talk about concrete steps

Russia has already purchased 90000 MT Russian crude oil shipment through a private procurement deal by paying US $ 72 million to run the Sapugaskanda oil refinery recently and the stock is now exhausted compelling the authorities shout down the refinery.

Sri Lanka’s prime minister Ranil Wickremasinghe said he may be compelled to buy more oil from Russia as he hunts desperately for fuel to keep the country running amid a dire economic crisis

The Sri Lankan envoy in Moscow, Prof. Janitha Liyanage yesterday said that Sri Lanka has sought a US$ 300 million Credit Line from Russia to purchase crude oil, gas and coal.

“We have made a request to the Russian Government through the Sri Lankan Foreign Minister to have a credit line to purchase crude oil, gas and coal from Russia”, she said, adding that the Ambassador said that Russia had earlier offered a US$ 500 million credit line to the country.

An intergovernmental agreement between the two countries on cooperation and mutual assistance in customs matters is being prepared for signing.

The intergovernmental commission noted the prospects for cooperation on the peaceful use of nuclear energy, including the construction of nuclear power plants, as well as the use of nuclear technology in medicine and agriculture.

In the interest of ensuring the energy security of the island, Russia also intends to increase the supply of coal and petroleum products, and cooperation in the hydropower industry is also planned in the future.

There is potential in the civil aviation, construction, chemical and pharmaceutical industries,diplomatic sources said.

Sri Lanka seeks US$ 300 million credit line from Russia with love

US special delegation arrives in SL. Discussions with many parties ready

A high-level US special delegation has arrived in Sri Lanka to explore the most effective ways to assist Sri Lanka in its crisis.

The delegation representing the US State Department and the US Treasury Department has arrived in Sri Lanka this (26) morning on a special flight. Among the delegates are US Deputy Assistant Secretary of the Treasury for Asia Robert Caprott and Deputy Assistant Secretary of State for South and Central Asia Kelly Keiderlin, reports said.

The delegation is expected to stay in the island till July 29 and is set to visit political representatives, economic experts and representatives of international organisations.

MIAP

The country can be built only by a free and independent people’s struggle: Opposition Leader (VIDEO)

The Pohottu-led government has driven the country into a tragic situation making it a one big refugee camp due to their short-sighted, superstitious journey, said Leader of the Opposition Sajith Premadasa, addressing the occasion of appointing District Representatives of the Samagi Jana Balawegaya’s National Council of Intellectuals yesterday (25).

The only option to come out of this situation is a democratic, free and independent people’s struggle, the Opposition Leader noted.

Instead of understanding the actual situation of the country and changing their programme into a people-friendly one, the current rulers of the country have appointed a gatekeeper paving the way for them to enjoy their luxuries for the remaining two years via politics influenced by myths, Premadasa alleged.

There is no use of a government that fails to fulfill the promises made to people and protect them, the Opposition Leader went on, adding that the rulers prioritise the growth of their own dollar deposits instead of the dollar deposits of the country.

He added that a huge sum of money has been defrauded through gas in the second phase of the Central Bank Scam, and the information divulged before the Committee on Public Enterprises (CoPE) have been concealed from the public.

Premadasa emphasised that an era of exploitation of even medicines and gas has now been created and that there are gatekeepers defending the Rajapaksas and opportunists working for narrow interests who are rejected by the entire country.

MIAP

LITRO Chief promises to end gas crisis 100% with a new journey from July 5 – 12

The mission to end gas crisis in Sri Lanka is already in progress and the new journey beginning from July 05 – 12 with the arrival of two new gas ships will end the gas queues 100 per cent, Chairman of the state-run LITRO Gas Company Muditha Peiris said, speaking to a programme aired on TV Derana yesterday (25).

Q: Do you believe that a fair solution will be provided to this gas crisis with the new journey beginning from July 05 – 12 through the two ships you mentioned?

“It’s a yes, 100 per cent. I believe gas will be supplied without a shortage. I won’t be thinking about it in an uncertainty. I believe that this would be 100 per cent successful. I took this over as I was aware of the difficulties and as I had the belief that this could be done. I took this over when no one else was ready to take it over. Nor does anyone can. Both the two leaders of the country asked me to take this over in a time when no one else was ready to. So, I believe that we will be able to solve this 100 per cent. Not only that, after the arrival of 25,000 tonnes of gas between July 10 and 15, when those 25,000 tonnes run out, another 20,000 – 25,000 tonnes will arrive into the Maldivian Sea. The empty consignment will be sent back to Oman. Then refilled and taken back. So, until a hundred thousand tonnes – a volume which would suffice for about four months – is consumed, the gas problem in Sri Lanka will be solved. If we were able to provide 80,000 a day in 25 days, all the queues we see in Sri Lanka will end and the people will be able to breath a sigh of relief. Technically put, it takes about 47 days to deliver all four million cylinders. But it won’t even come to that, by the delivery of about three to three and a half million cylinders, a huge change will be evident in the gas crisis of Sri Lanka, we will be able to solve it.”

MIAP

Costly food and energy are fostering global unrest

“Money no longer had any value in Istanbul,” laments the narrator of “My Name is Red”, a novel by Orhan Pamuk set in the 16th century. “[B]akeries that once sold large…loaves of bread for one silver coin now baked loaves half the size for the same price.” The royal mint was slyly reducing the amount of silver in each coin. When the Janissaries (an elite military force) found that their wages had been debased, “they rioted, besieging Our Sultan’s palace as if it were an enemy fortress.”Listen to this story.

Galloping inflation afflicts Turkey again today. Officially it is 73%, but everyone suspects it is higher. Mr Pamuk, a Nobel laureate for literature, says he has “never seen such a dramatic rise in prices”. He makes no predictions about what the political consequences might be. To criticise Turkey’s modern sultan, Recep Tayyip Erdogan, would be risky. But from his book-strewn flat overlooking the Bosporus, Mr Pamuk observes that his compatriots are reacting with “shock, surprise and anger”.

A visit to a street market suggests the novelist is right. A vine-leaf seller gripes that he has had to treble his prices since last year. “People used to buy 5kg at a time and put them away for winter. Now they can only afford 300g.” A grandfather complains that his pension has been so eroded that he has not eaten meat this year.

“The government is responsible, who else?” he says. He voted for Mr Erdogan’s party at the most recent election, in 2019, but will not do so again. “The solution is to change the government,” says the vine-leaf seller. “I want to leave the country,” says his younger brother. “I’ll clean toilets in Europe if I have to.”

All around the world, inflation is crushing living standards, stoking fury and fostering turmoil. Vladimir Putin’s invasion of Ukraine has sent prices of food and fuel soaring. Many governments would like to cushion the blow. But, having borrowed heavily during the pandemic and with interest rates rising, many are unable to do so. All this is aggravating pre-existing tensions in many countries and making unrest more likely, says Steve Killelea of the Institute for Economics and Peace (iep), an Australian think-tank.

The strongest predictor of future instability is past instability, finds a forthcoming paper by Sandile Hlatshwayo and Chris Redl of the imf. Historically, the probability that a country will experience severe social unrest in a given month is only 1%, but this quadruples if it has suffered it within the previous six months and doubles if a neighbouring country has experienced it, they calculate. Protesters are more likely to surge onto the streets if they think others will join them.

This is bad news, since unrest has been building for years. The iep calculates that 84 countries have become less peaceful since 2008; only 77 have improved. Its measure of violent protests is up by 50% over the same period. Using a different method—counting mentions in the media of words associated with unrest across 130 countries—the imf estimated in May that social turmoil was near its highest level since the pandemic began.

The Economist has built a statistical model to assess the relationship between food- and fuel-price inflation and unrest. We used data from acled, a global research project, on “unrest events” (ie, mass protests, political violence and riots) since 1997. We found that rises in food and fuel prices were a strong portent of political instability, even when controlling for demography and changes in gdp.

We also found cause for alarm about the coming months. Expenditure on imports of food and fuel is set to increase, especially in poor countries (see chart 1). Poor countries’ debts have also risen (see chart 2). The average low-income country has a public-debt-to-gdp ratio of 69.9%, estimates the imf. This, too, is set to increase, and to overtake the (unweighted) average for rich countries this year. Since poor countries typically have to pay much higher interest rates, many of their debts look unsustainable. The imf says 41 countries, home to 7% of the world’s population, are in or at high risk of “debt distress”. Some, such as Laos, are on the brink of default. Our model suggests that many countries will see a doubling of the number of “unrest events” in the coming year (see map).

Places that were precarious before may be tipped over the edge. In Turkey, for example, the disruption of food and fuel imports from Ukraine and Russia adds to the damage already being caused by barmy monetary policy. Mr Erdogan believes that high interest rates cause inflation, rather than curbing it. So he has ordered rates cut even as prices have raged out of control.

To defend the Turkish lira, Mr Erdogan has since the end of 2021 urged people to put their money into special depreciation-proof accounts. The state promises to make up the difference if these deposits lose value against the dollar, as they have been doing. The lira has already fallen by almost 25% this year. No wonder that over 960bn lira ($55bn, or 7% of gdp) has been stashed in the accounts in six months, creating a vast liability for the government.

“It’s the dynamite under the system,” says Garo Paylan, an opposition mp. It will probably explode before the next election, which is a year away. Mr Erdogan is expected to lose unless he does something drastic, so he might do something drastic. He could start a new war in Syria against the pkk (a Kurdish group the government calls terrorists) or ban his strongest opponents from politics, speculates Behlul Ozkan of Marmara University. In short, the economic crisis could lead Turkey to eject an erratic strongman who has ruled for nearly two decades—or the strongman could throttle what is left of Turkish democracy. Tranquillity seems the least likely scenario.

In country after country, the global economic storm has exacerbated underlying troubles. Take Pakistan, where squeezed living standards help explain why in April parliament ousted the prime minister, Imran Khan, with a nod from the army. He has since led mass rallies to get his job back. In India riots erupted over a plan to reduce the number of jobs for life in the army. (When times are hard, people particularly crave job security.)

Sri Lanka gives a taste of how quickly things can spiral out of control. President Gotabaya Rajapaksa banned agrochemicals last year and told farmers to go organic instead. Harvests plunged. Six months later he lifted the ban but, by then, thanks to other daft policies, there was too little hard currency to import enough chemical fertiliser. The next harvest is predicted to be miserable. Sri Lanka needs food and fuel, but cannot afford to import them.

On May 9th protesters clashed with a pro-government rally. They pushed buses into lakes or set them on fire. They attacked government supporters with poles; your correspondent also saw some wielding hockey sticks. They burned the homes of politicians and smashed up a museum dedicated to the Rajapaksa family. Troops dispersed protesters who burst into the prime minister’s residence. The president tried to calm the crowds by pushing out the prime minister (his brother).

But Sri Lankans are still furious. Shop shelves are bare, even for basics, and people queue for hours for petrol. Schools and government offices are temporarily closed. The government has defaulted on its debts. imf officials arrived in Colombo, the capital, on June 20th to discuss a bail-out.

Foreseeing red

No one can be sure which country or region will explode next. Mr Killelea frets about the Sahel, which has seen five coups in the past two years. Others point to Kazakhstan, where the government called in Russian troops to help suppress civil unrest in January, or Kyrgyzstan, which relies on wheat and remittances from Russia and has ousted three presidents since 2005.

One country with nearly all the harbingers of havoc is Tunisia. It has a history of unrest. Almost 12 years ago a Tunisian fruit-seller, Muhammad Bouazizi, set fire to himself after police kept shaking him down. His death set off the Arab spring, a wave of protests that swept the Middle East and toppled four presidents. Tunisia’s democratic revolution initially went well. But last year the president, Kais Saied, assumed autocratic powers. Falling living standards have turned the country into a powder keg once more.

Half the population is under 30, and a third of young men are unemployed. In slums around Tunis, the capital, they loiter on street corners, smoking and bellyaching. “Young people here have nothing to lose. They’ll join a riot just for a chance to steal phones and rob shops,” says Muhammad, a 23-year-old selling pot in the street.

“I’m always angry, from the beginning of the day to the end,” says Meher el Horchem, who works in a café in Goubellat, a small town. Business is down 70-80% in recent months, he reckons: “No one can afford to go out.” He waves a 20-dinar ($6.40) note in the air. It is his day’s wages. “You walk into a shop with this and you come out with nothing,” he complains.

He is in his 30s and lives with his parents. “Of course I want to be married. Everyone does,” he says. But he cannot afford to on his inflation-sapped wages. “I can’t have a life,” he fumes, adding: “All the youth are angry at the system. I’m hoping to God it won’t lead to a civil war.”

So far, it has not. But a general strike on June 16th stopped buses and trains. The government is trying to make a deal with the imf, but a big union objects to its conditions, which include cutting the public-sector wage bill. President Saied is trying to buttress his own power: on July 25th Tunisians will vote on a new constitution, the text of which he has not yet shown them.

Ordinary Tunisians yearn for calories, not constitutional reform. But policies intended to satisfy their hunger have perverse consequences. Like many countries, Tunisia fixes the price of a staple food (in this case, bread). Bread subsidies cost more as wheat prices rise; this is one reason why the government needs an imf bail-out.

Farmers, meanwhile, must sell their grain to the state for a low, fixed price. This discourages production. In a field near Goubellat a group of labourers share lunch. “The earth in this country is good,” says Neji Maroui, their manager. There is plenty of spare land. If they could earn a market rate for their wheat, they would plant more of it, he says. But they receive less than a fifth of the world price, so they don’t.

Inflation stimulates corruption, argues Youssef Cherif of the Columbia Global Centre in Tunis. In poor countries, each civil servant typically supports a large extended family. Grocery bills have gone up. Wages have not kept pace. “That creates an incentive to demand more bribes.”

That, in turn, makes unrest more likely. As graft intensifies, the chances of another frustrated victim like Muhammad Bouazizi staging a spectacular protest somewhere must surely increase. In Goubellat Rafika Trabelsi boils with rage as she slices potatoes. She wanted to expand her roadside kiosk and sell a wider range of drinks and snacks. But local officials refused her permission and bulldozed her tiny extension. Other people got permits because they paid bribes, she says.

Though Mr Putin is responsible for a big chunk of global inflation, people tend to blame their own governments. In Peru Pedro Castillo won power last year with the slogan “no more poor people in a rich country”. Covid-19 made that harder—it has been deadlier in Peru than almost any other country, according to The Economist’s excess-deaths tracker. And just as the economy was recovering, Mr Putin’s war choked off its supply of fertiliser. Peru had relied on Russia for 70% of its imports of urea, the most commonly used sort. Now farmers struggle to get hold of the stuff, and they are livid.

In April they blocked roads to protest against inflation. Toll booths were burned; shops were looted. Mr Castillo panicked and tried to impose a fresh pandemic-style lockdown on Lima, the capital. Critics howled “autocrat”. He relented.

The president’s approval rating is now around 20%. “We thought he was like us,” says Gricelda Huaman, a mother of three in a shantytown outside Lima, but, “he’s forgotten us.” She often skips meals so her children have more. She sometimes can’t afford pills for lupus, an autoimmune disease. Without them, she cannot walk.

Unless Peru secures more fertiliser, the next harvest could be drastically reduced, says Eduardo Zegarra of grade, a local think-tank. Mr Castillo has been distributing guano, a traditional fertiliser that Peru once produced in large quantities. He recently told farmers that “only the lazy” would go hungry. They are unimpressed. “If we don’t see concrete actions in favour of farmers soon, he’ll have us on the streets,” says Arnulfo Adrianzén, who grows rice. Peru has had five presidents in the past five years. It may not be long before another puts on the increasingly uncomfortable sash of office.

Some regimes will keep a lid on unrest through force. No one expects protests to get out of hand in China, for example. In Turkmenistan, where food shortages have long been rife because of a mismanaged economy, anyone who buys more than their allocation of bread faces 15 days in jail. Egyptians are wary of speaking up. The last mass protests, in 2013, ended when the regime massacred perhaps 1,000 people.

In Uganda, President Yoweri Museveni has told his people to eat cassava if there is no bread. An opposition leader has urged them to take to the streets. Kizza Besigye, a former presidential candidate, led protests during the previous big inflationary spike, in 2011. This time the state is taking no chances. Dr Besigye has been locked up.

Protests in Uganda are unlikely to succeed. The state, like Egypt’s, has no compunction about shooting demonstrators. Also, many Ugandans live hand-to-mouth, which makes protest difficult to sustain: if people don’t work, they don’t eat. Still, frustration is rising. Ugandans spend 43% of their income on food, so price rises hurt.

Authoritarian regimes such as Uganda’s face a dilemma. To crush dissent they must divert ever more resources to the security forces and patronage, reducing their capacity to respond to economic shocks. Dr Besigye says “the repressive apparatus” in Uganda is stronger than ever. But by squandering so much money on the army, he adds, Mr Museveni has “intensified the conditions for discontent”.

Uproar to downturn

Global unrest could hobble growth. Investors get skittish when mobs burn down factories or overthrow governments. A working paper by Metodij Hadzi-Vaskov and Luca Ricci of the imf and Samuel Pienknagura of the World Bank finds that big outbreaks of unrest are on average followed by a percentage-point reduction in gdp, relative to the previous baseline, a year and a half later. This could in theory be because, say, a previous policy of fiscal austerity led both to popular anger and to lower growth. But the authors find that the link holds true regardless of whether the unrest is preceded by fiscal austerity or low growth. They conclude that unrest does indeed hurt economies.

They also find that unrest motivated by socioeconomic factors (such as inflation) is associated with more severe contractions than unrest sparked by political factors (such as a disputed ballot). When the unrest has both political and socioeconomic motivations, the damage to gdp is worst of all. A good example was the rioting that rocked South Africa in 2021, when covid-19 was causing economic hardship and a rogue ex-president was urging his supporters to protest against his being put on trial for corruption. In the quarter when the looting occurred, gdp shrank by 1.5%.

A final and intriguing finding is that although unrest typically causes stockmarkets to fall, this effect has historically been negligible in countries with more open and democratic institutions. The implication is that societies cope better with turmoil when they have good institutions and the rule of law.

The thing protesters around the world so often demand—cleaner, better government—is exactly what their countries need. But it takes time, and stability, to build. The short term will be turbulent.

THE ECONOMIST

Fuel prices go way up again!

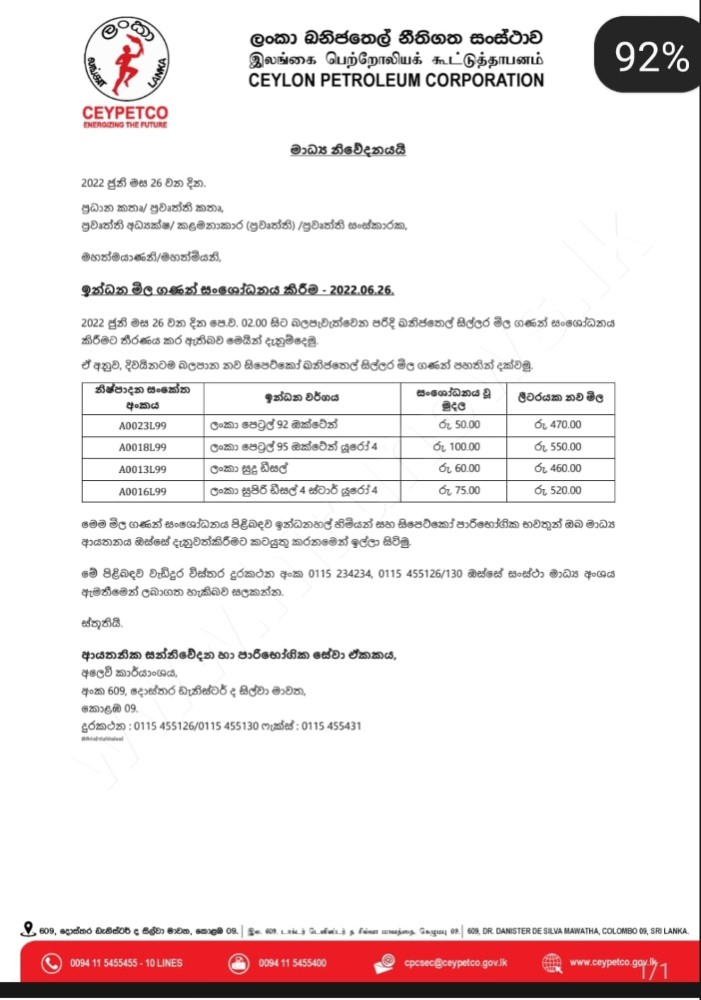

The Ceylon Petroleum Corporation (CEYPETCO) has decided to increase the price of fuel effective from 2 am this (26) morning.

Accordingly, the price of Octane 92 Petrol will soar by Rs. 50 per litre, Octane 95 Petrol by Rs. 100 per litre, Lanka White Diesel by Rs. 60 per litre and Lanka Super Diesel by Rs. 75 per litre.

The Lanka Indian Oil Company (LIOC) has also revised its fuel prices matching that of CEYPETCO.

MIAP

Sri Lanka Trade Development Council demands Govt. to save SMEs

Lanka Trade Development Council (SLTDC) recently demanded immediate action from the Government to protect the small and medium enterprises (SMEs) with a plan to Cabinet paper, warning they would otherwise bring all engaged in the sector to the streets.

The SME sector has been the worst hit by back-to-back blows since 2019, and the economic crisis has worsened the situation with most unable to operate their businesses or on the verge of bankruptcy.

The key demands of SLTDC include; immediately extending a financial relief package to all SMEs for one year whilst suspending all recovery actions, supporting the SME sector to convert businesses to export-oriented companies by providing special credit facilities and tax reliefs.

“SMEs are the live wire of the economy that helps to at least maintain it in this dire straits. We have been the worst hit with triple blows since 2019. Yet, the resilient SMEs managed to continue despite internal and external challenges.

But now, we have exhausted ourselves with no support whatsoever from the authorities. Hence, we submitted key proposals to the Government to implement immediately to protect the SMEs,” SLTDC Chairman Roshana Waduge said. .

He said the proposals were submitted to Prime Minister Ranil Wickremesinghe, Industries Minister Dr. Ramesh Pathirana, Trade Minister Nalin Fernando, Labour Minister Manusha Nanayakkara, and Justice Minister Wijeyadasa Rajapakshe requesting to table as a Cabinet paper.

“We strongly believe that the Central Bank could have been more proactive in supporting the SMEs, but they have kept mum about it. Therefore, we made the request to the Government and hope they will take immediate steps to put forward a Cabinet paper next Monday before the sector collapses,” he added.

Waduge said it was sad that the gravity of the economic crisis and the urgency to protect local businesses has still not been comprehended by the political authorities.

“In other countries, SMEs are the first to be taken care of as they represent the backbone of an economy. However, in Sri Lanka, the banking and financial sector is killing the already crippled SME sector with recoveries and legal actions, while imposing high-interest rates of 30% on facilities obtained previously at low rates of 7-8% in an unfair manner.

“If the SMEs collapse, it will have an unimaginable adverse impact on the economy which will lead to an increase in unemployment, poverty, and scarcity of products and services,” he explained.

SMEs make up the largest part of the economy, accounting for 80% of all businesses whilst contributing to over 52% of GDP, and 45% of the total workforce accounting for 4.6 million employees engaged in the sector.

SLTDC Vice Chairman Indika Sampath Merenchige said the ignorance by the Government will only lead to economic peril.

“If the political authorities ignore our appeal to protect the backbone of the economy, we assure to take the lead for the next phase of people’s struggle by taking the baton from them. It will mean 4.6 million people in SMEs taking to the streets,” he warned.

Merenchige said the urgency today is a complete system change and not just the 21st Amendment to the Constitution. “We need consistent national policies to ensure economic development, stability, and sustainability,” he pointed out.

He claimed that President Gotabaya Rajapaksa did not appoint representatives from the SME sector for his Economic Council Advisers, adding that all are chosen from large-scale companies.

“They should at least appoint a steering committee with SME participation to protect the local entrepreneurs,” he said.

Merenchige also requested the SMEs not to act like cowards when they know they are being maltreated.

SLTDC Vice Chairman Ajantha Nallapperuma claimed the Government had no plan to protect local industries or SMEs.

“The difficulties people face today have just scratched the surface of the deeper economic crisis.

If no immediate actions are not taken now, no one will be able to survive the economic blow within a month or two. Unfortunately, the 225 MPs and senior Government officials responsible are not understanding the gravity of the crisis seriously,” he added.

UK Parliament suggests attaching HR conditions to IMF bailout for SL

Conservative Member of the Parliament of the United Kingdom, Eliot Colburn urged the UK Government ensure that any IMF bail-out is attached to human rights conditions, similar to that of GSP+.

UK MP Eliot Colburn also pointed out that while the economic crisis on the island has indeed led to increased militarization in Sri Lanka, the Rajapaksa Government continues to fall apart.

Member of the United Kingdom Parliament and the The Parliamentary Under-Secretary of State for Foreign, Commonwealth and Development Affairs, Vicky Ford has insisted that the current economic situation in Sri Lanka does not distract the country from human rights.

In response to MP Colburn,she stated that the UK will work with fellow members on international debt forums on a solution to the country’s debt problem, and to improve the situation with regard to human rights.

The UK Parliament Member, speaking further, mentioned that although the articles of the IMF do allow for conditionality linked to economic policy or to tackling the balance of payments, there is no provision to impose political-linked or human rights-linked conditionality in the IMF process.

Therefore, Ford said that they will work with fellow members on international debt forums on a solution to the country’s debt problem, as well as continuing to lobby the Sri Lankan Government and working in other international forums on human rights.

MP Ford continued to state that the Prime Minister had underlined UK’s continuing support for the people of Sri Lanka during their economic difficulties, and offered UK support through multilateral organizations such as the World Bank and IMF, and international forums such as the Paris Club.

“We have a very significant voice on international debt forums and we are working closely with Paris Club members and multilateral organizations to find solutions to the debt crisis.” she added.

As Sri Lanka’s crisis deepens , India extends more humanitarian aid

As Sri Lanka grapples with a massive economic crisis , India yesterday (June 24) delivered a humanitarian consignment containing 15,000 metric tons of essential items including rice, milk powder and pharmaceuticals to Sri Lanka.

Indian High Commissioner to Sri Lanka Gopal Baglay, Minister of Health Keheliya Rambukwella, Minister of Trade Nalin Fernando, MPs M.A Sumanthiran, V. Radhakrishnan, M. Udaya Kumar, Angajan Ramanathan, and several others including Senthil Thondaman welcomed the donation.

It consists of 14,700 metric tons of rice, 250 metric tons of milk powder and 38 metric tons of medicines donated by the people of India.

The total value of this consignment is more than LKR 3 billion, the Indian High Commission in Colombo said in a statement.

The consignment of humanitarian supplies underscores abiding people-to-people bonds between India and Sri Lanka as also concerns of the people of India for the well-being of their brethren in Sri Lanka, the statement read further.

These supplies are planned to be distributed among beneficiaries by the Sri Lankan government in the coming days.

This is the second consignment provided under a larger commitment of 40,000 metric tons of rice, 500 metric tons of milk powder and medicines by the government of Tamil Nadu.

India’s unprecedented economic, financial and humanitarian assistance to the people of Sri Lanka stands at over USD 3.5 billion in 2022.

In addition to the three credit lines to the tune of more than USD 1.5 billion and forex support of around USD 2 billion, assistance from the government and people of India has taken the form of supply of medicines to several health-related establishments in various parts of Sri Lanka, distribution of kerosene among the fishermen of Sri Lanka, handing over of dry rations to needy sections etc.

Sri Lankans reduce the use of credit cards in economic downturn

Sri Lankans, whose real incomes are getting hammered on a daily basis from soaring inflation, have reduced the use of their credit cards, as there was a slight drop in the outstanding balance of credit cards, when the financial and economic misery became more pronounced

According to the cards data, the outstanding credit card balance has come down slightly by Rs.2.19 billion to Rs.136 billion as of May –end from Rs138.19 billion in April

Sri Lanka banks introduced another hike in interest rates charged on credit cards as the Central Bank lifted administrative caps on credit card and other select loans, giving complete leeway for banks to set the prices of such loans.

Banks which initially raised their rates from 20 percent to 30 percent from May onwards in response to the April policy rate hike are now raising their rates again to the north of 40 percent as one bank yesterday announced its decision to raise cards’ interest rate by another 6 percent to 36 percent effective from July.

As uncertainty mounts and the pressure builds up again on Treasury yields on the back of the worsening economic crisis, banks are adjusting their rates to effectively prevent people from swiping their cards when the going gets tougher with runaway prices.

Other banks have also indicated that they are considering similar moves and would follow suit with sizable increases in their rates as they run a greater risk of non-performing loans from cards.

As the Monetary Board accelerated the pace of policy rate hikes since January onwards, the Central Bank in March raised the hitherto prevalent ceiling rate on credit cards from 18 percent to 20 percent only to fully remove any administrative rate caps on the collateral-free pre-approved loan facilities on April 10.

Although there was a sudden spike seen in the card balances, the steep increase in the interest rates on credit cards could make conditions worse for the cardholders, prompting them to think twice before swiping their cards.

After the Central Bank eliminated the maximum interest rate ceilings on credit cards in the third week of April to reflect the fast-rising interest rates in the economy, the banks soon raised their interest rates up to 30 percent on the cards’ outstanding balance, which came into effect from their next credit cycle.

Meanwhile, the banks are also tightening their credit standards and are declining requests for balance enhancements and requests for new cards, irrespective of the applicants’ credit standing. Some banks do not even provide reasons for the rejection of the request, a very bad practice by them.

However, the banks also face heightened credit risks from their card customers, as they confront wilful defaulters after using the entirety of the balance in the card. Credit card is a clean facility marked by a bank to its clients and no security is typically involved.

In an economic downturn in the likes of what Sri Lanka is facing today, credit cards are the last to be settled after all other loans by the borrowers. Hence, the banks face a higher risk of non-performing loans from credit cards