By: Staff Writer

September 26, Colombo (LNW): Fitch Ratings has confirmed Sri Lanka’s ‘Restricted Default’ (RD) rating following its sovereign debt default.

Sri Lanka’s new government, formed after the September 2024 presidential election, has raised concerns about potential delays in foreign debt restructuring and the IMF program.

However, progress has been made, with recent agreements on debt restructuring with bondholders and the China Development Bank.

Sri Lanka’s local-currency debt restructuring was completed in 2023, upgrading its local rating to ‘CCC-’. Despite this, Sri Lanka’s debt remains very high, with an expected slow decline in the debt-to-GDP ratio over the next few years.

Positively, the country’s foreign-currency reserves have improved due to increased tourism, remittances, and the halt of debt payments.

However, achieving long-term debt stability will still be a challenge, as revenue collection and economic growth remain priorities for the government. Inflation is under control, and the banking sector is showing signs of stabilizing after the economic stress caused by the debt crisis.

Sri Lanka’s political stability and governance are medium, with concerns over corruption and policy uncertainty affecting the country’s ratings.

Fitch believes the result add uncertainty to the country’s policy direction and could lead to a delay in the completion of the foreign-currency debt restructuring or renegotiation of the IMF programme.

“The upcoming 2025 budget, to be adopted by November 2024, could offer clarity on the new government’s policies.”

Local-Currency Debt Exchange Complete: Sri Lanka completed the local-currency portion of its domestic debt optimisation in September 2023.

This followed the exchange of the Central Bank of Sri Lanka’s treasury bills and provisional advance into new treasury bonds and bills. This led us to upgrade the Local-Currency IDR to ‘CCC-‘. The rating is being affirmed at this level.

The IMF forecasts Sri Lanka’s gross general government debt/GDP ratio to decline only gradually to about 103% of GDP by 2028, from about 116% in 2022. This forecast incorporates a local- and foreign-currency debt restructuring scenario. However, this level of debt would still be elevated, even after the restructuring.

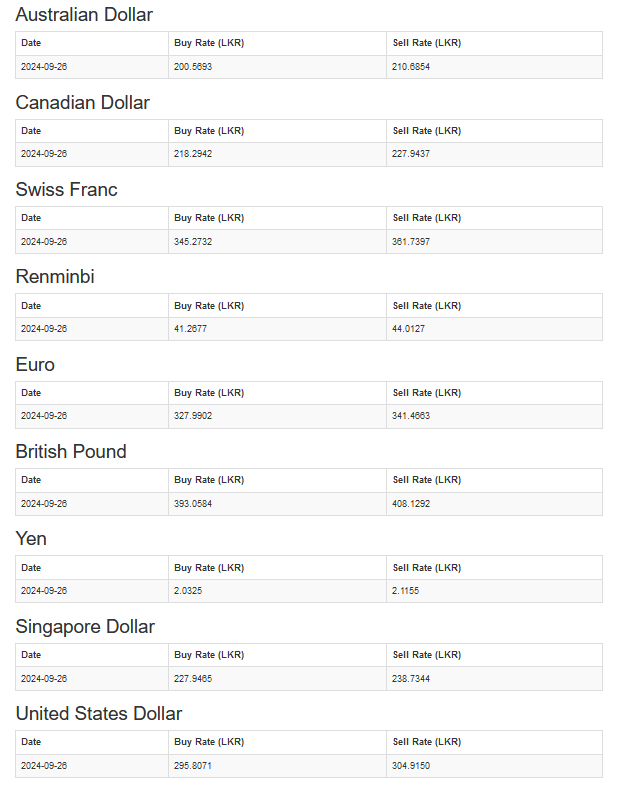

Foreign-currency (FX) reserves have been improving, with gross FX reserves reaching around USD6.0 billion in August 2024, against USD4.4 billion at end-2023, partly due to the suspension of external debt service.

Other supporting factors include an uptick in tourism and overseas worker remittances. The current account was in a surplus in 2023 and we expect a surplus in 2024. The sovereign, however, remains dependent on official financing sources without access to international capital markets.