September 13, Colombo (LNW): State Minister Shehan Semasinghe commended President Ranil Wickremesinghe’s leadership in transforming a country once on the brink of bankruptcy into one where economic development and public support are now attainable. Speaking at the “Ranil ta Puluwan” (Ranil Can) rally in Medawachchiya, Semasinghe highlighted the steady financial stabilization since 2022 and the government’s significant efforts to improve the lives of the people.

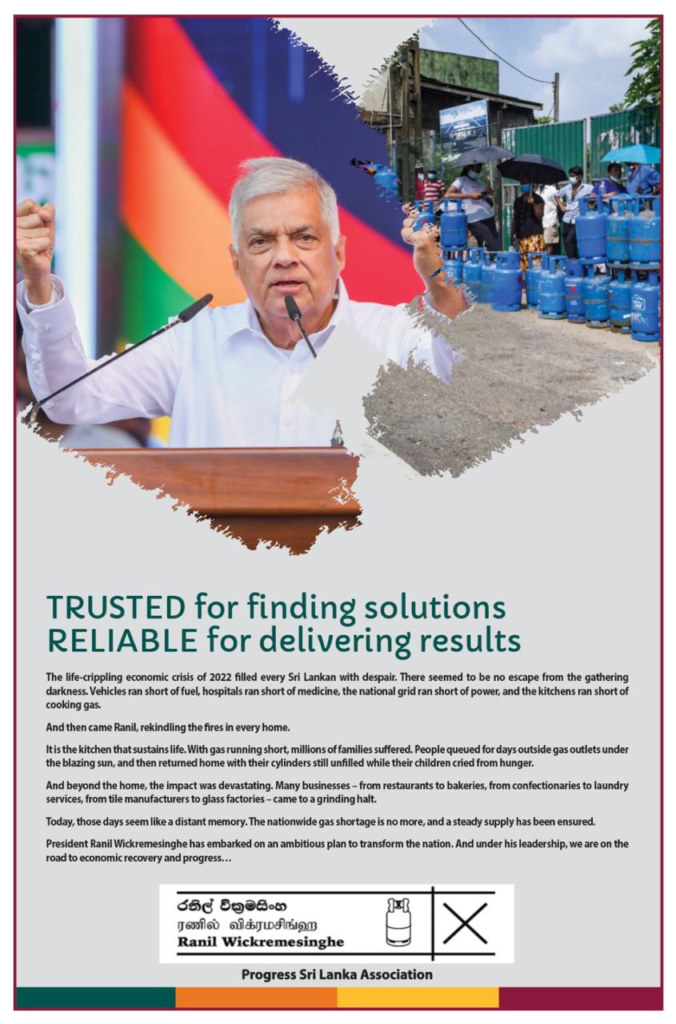

“We faced a crisis with 13-hour power outages, and shortages of fuel, food, and gas,” Semasinghe said. “No leader was willing to take on the country at that time, but President Ranil Wickremesinghe stepped up, addressing the basic needs of the people, such as providing fertilizers to farmers and ensuring a support scheme amounting to Rs. 25,000 per farmer for the upcoming season.”

He criticized NPP Presidential Candidate Anura Kumara Dissanayake, stating that he “lacks the capability to address the country’s needs” and engage with the International Monetary Fund (IMF). Semasinghe argued that the National People’s Power (NPP), led by the Janatha Vimukthi Peramuna (JVP), has focused on maintaining public distress rather than offering solutions, citing their responsibility for halting the Sampur power plant and delaying the Uma Oya project by seven years.

Semasinghe also criticized opposition leader Sajith Premadasa, stating that despite his claims of having a capable team, they were unwilling to take charge during the 2022 crisis. “Only President Ranil Wickremesinghe took effective control, ensuring resources for the people without shortages and working to stabilize the economy,” he said.

Looking ahead, Semasinghe expressed optimism for the next five years, anticipating that President Wickremesinghe will continue to provide relief and enhance the quality of life for citizens. He highlighted the President’s allocation of funds for the development of the North Central region and support for the Mahakanadara project, as well as the planned increase of Rs. 25,000 in state employees’ salaries from next year.

He concluded by emphasizing the importance of granting President Wickremesinghe a mandate for the next five years, reiterating that under his leadership, economic development and public support are now achievable.