Financial institutions mushrooming in the island without a proper oversight as co-operative banks’ with branches in several regions are to be scrutinised and regularised, Trade and Co-operative Minister Wasantha Samarasinghe disclosed.

He blamed provincial councils and some governors of provinces for approving the setting up of such irregular finance companies taking deposits from rural masses.

Minister Smarasinghe stressed the need to close the loopholes in the cooperative bank act ”Establishing cooperative banks are done under the Co-operative Societies Law, No. 5 of 1972, with power vested in the provincial councils to approve their setting up”, he added. .

The government has already taken steps to promptly introduce new laws to regulate the cooperative sector including the cooperative banking system.

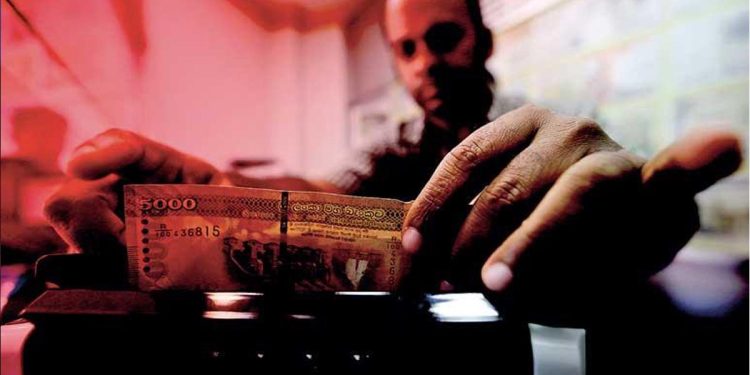

Trade and Co-operative Ministry is probing some financial institutions such as Saubhagya Cooperative Bank Ltd (SCD) of the North Central Province and Anuradhapura District Rural Capital Development Cooperative Society Ltd (RCD).started in recent years as ‘co-operative banks’ which are opening branches rapidly without a proper oversight,

These institutions, while performing quasi-banking functions such as accepting deposits and issuing loans, are not licensed under the Banking Act and are therefore not subject to Central bank supervision.

Instead, they operate under the Co-operative Societies Law No. 5 of 1972, and are monitored by the Department of Co-operative Development under the Ministry of Trade, Commerce and Food Security.

This legal framework allows for the registration of financial co-operatives at district and provincial levels, with a focus on community-based development, self-financing, and microcredit lending, a high official of the finance ministry said.

However all Cooperative rural banks are registered with the Regional Commissioner of Cooperatives and the Cooperative Development Department is monitoring and auditing the accounts of these cooperative societies.

Almost all cooperative societies are registered under the Co-operative Societies Law No.5 of 1972, by which they are authorised to accept deposits from public and lend monies to their members.

In addition, there is a large number of Thrift and Credit Cooperative Societies, which are also categorized as Cooperative banks as they perform banking functions at grassroots level.

There are around 7,000 rural financial institutions and a significant number of significant number of Cooperative Rural Banks (CRBs) with 1,933 branches countrywide, Cooperative Development Department‘s available data shows .

These banks operate under the umbrella of the cooperative movement, with a focus on microfinance activities. The number of CRBs has grown considerably over time, starting from just three at the end of 1964.