October 21, Colombo (LNW): Digital services provided by numerous state institutions in Sri Lanka have returned to normal following a technical failure that disrupted access for over a week.

According to the Information and Communication Technology Agency (ICTA), the issues affecting the Lanka Government Cloud (LGC) infrastructure have now been fully addressed, and all systems are functioning reliably.

The LGC, which forms the backbone of the government’s online operations, encountered a significant malfunction that led to interruptions across a wide range of digital platforms. As a result, citizens faced difficulties accessing various public services, including administrative, regulatory, and information portals.

The disruption impacted approximately 34 government departments and institutions, affecting services that are increasingly relied upon for day-to-day transactions.

A spokesperson for the ICTA confirmed today (21) that the necessary technical rectifications had been completed and that the cloud system’s stability had been verified. Measures have been implemented to prevent similar incidents in future, while affected services are being restored in stages to ensure consistency and performance.

Authorities acknowledged the inconvenience caused to the public and have assured that contingency plans are being developed to improve response times and system resilience.

Government Cloud Services Restored After Extended Outage

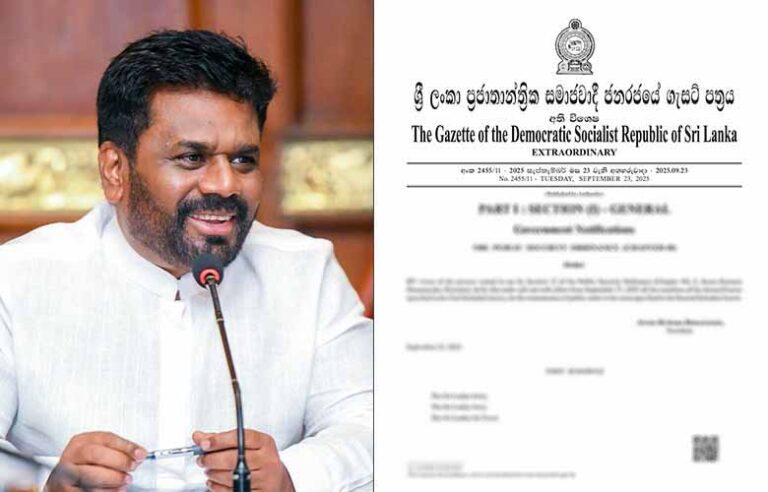

President Issues Fresh Gazette Reallocating Ministerial Duties After Cabinet Reshuffle

October 21, Colombo (LNW): A newly released government gazette has officially redefined the responsibilities and areas of oversight for multiple ministries.

The changes, which come into immediate effect, were authorised by President Anura Kumara Dissanayake, reflecting the outcomes of a recent reshuffle within the Cabinet.

The updated distribution of duties among ministries is expected to address emerging national priorities, optimise coordination between departments, and align governmental operations with the administration’s evolving policy direction.

Prevailing low-level atmospheric disturbance still persists: Heavy falls above 100 mm expected (Oct 21)

October 21, Colombo (LNW): The prevailing low-level atmospheric disturbance to the east of the island still persists, and it is likely to develop into a low pressure area within the next 24 hours, the Department of Meteorology said in its daily weather forecast today (21).

Under the influence of this system, cloudy skies are expected over most parts of the island.

Showers or thundershowers will occur at times in Western, Sabaragamuwa, Central, North-western, Southern and Northern provinces. Heavy falls above 100 mm are likely at some places in these areas.

Showers or thundershowers will occur elsewhere of the island after 1.00 p.m.

The general public is kindly requested to take adequate precautions to minimise damages caused by temporary localised strong winds and lightning during thundershowers.

Marine Weather:

Naval and fishing communities engaged in fishing and naval activities in the deep and shallow sea areas around the island are requested to be vigilant in this regard.

Condition of Rain:

Showers or thundershowers will occur at times in the sea areas off the coast extending from Kankasanthurai to Pottuvil via Mannar, Colombo, Galle and Hambanthota. Showers or thundershowers will occur at several places in other sea areas around the island during the afternoon or night.

Winds:

Winds will be south-westerly or variable in direction and speed will be (25-35) kmph. Wind speed can increase up to (55-60) kmph at times in the sea areas off the coast extending from Galle to Pottuvil via Matara and Hambantota. Wind speed can increase up to 50 kmph at times in the sea areas off the coast extending from Trincomalee to Galle via Kankasanthurai, Mannar and Colombo.

State of Sea:

The sea areas off the coast extending from Galle to Pottuvil via Matara and Hambantota will be rough at times. The sea areas off the coast extending from Trincomalee to Galle via Kankasanthurai, Mannar and Colombo will be fairly rough at times. The other sea areas around the island will be slight to moderate.

Temporarily strong gusty winds and very rough seas can be expected during thundershowers.

Was CBSL Borrowings Under Indrajith: The Root Cause of Sri Lanka’s Bankruptcy?

By Adolf

Sri Lanka’s economic meltdown in 2022 did not happen overnight. It was the result of a series of decisions—short-sighted, politically expedient, and economically reckless—that left the country dangerously exposed to global capital markets. Chief among them was the Central Bank’s policy of aggressive commercial borrowing between 2015 and 2019, under successive administrations, and most significantly, during the tenure of Dr. Indrajith Coomaraswamy as Governor.

Between 2015 and 2019, Sri Lanka issued seven International Sovereign Bonds (ISBs) amounting to nearly USD 10 billion, at interest rates ranging between 5.5% and 8.9%. The timeline tells its own story:

• 27 Oct 2015 – USD 1.5 billion (10-year)

• 11 July 2016 – USD 500 million (~5.5-year)

• 18 July 2016 – USD 1 billion (10-year)

• 11 May 2017 – USD 1.5 billion (10-year)

• 18 April 2018 – USD 1.25 billion (10-year)

• 7 March 2019 – USD 2.4 billion (5-year + 10-year tranches)

• 24 June 2019 – USD 2 billion (5-year + 10-year tranches)

In less than five years, the country’s external commercial debt stock ballooned from USD 5 billion to over USD 15 billion, while the maturity profile shortened dangerously. In essence, Sri Lanka borrowed short-term, high-cost money to fund long-term fiscal gaps and recurrent expenditure.

These borrowings were often defended by the Central Bank as part of “liability management exercises” — a euphemism for rolling over maturing debt with fresh, more expensive loans. The claim was that refinancing would “smoothen the maturity profile.” In reality, it merely postponed the crisis, piling up obligations on future governments while doing little to strengthen reserves or expand export capacity.

By the time the bond spree ended in 2019, Sri Lanka’s external debt service obligations exceeded USD 4 billion per year, while annual export earnings hovered around USD 11 billion. This mismatch was unsustainable. The foreign reserves, which stood at USD 8.2 billion in 2014, fell to USD 7.6 billion by end-2019 — despite billions borrowed.

The real tragedy was that none of these funds were directed toward growth-enhancing investments. Instead, they were used to prop up the rupee, fund public sector salaries, and pay off older loans. The government’s failure to pursue fiscal reforms — especially broadening the tax base and curbing subsidies — meant the country was trapped in a vicious cycle of debt rollover.

Dr. Coomaraswamy, while respected for his professionalism, also conferred Deshamanaya by President Sirisena , presided over one of the most imprudent borrowing phases in post-independence history. His administration failed to challenge the Treasury’s excessive appetite for external debt, even when the macro fundamentals did not justify it. The result was a debt profile heavily tilted toward commercial borrowings, with over 50% of foreign debt in ISBs by 2019 — a level of exposure that would later prove fatal.

When the COVID-19 pandemic struck and global markets tightened, Sri Lanka’s access to refinancing vanished overnight. With no fallback reserves and no IMF arrangement in place, default was inevitable. The first missed ISB payment in April 2022 marked the country’s first-ever sovereign default since independence — a direct consequence of the 2015–2019 borrowing binge.

In hindsight, the Central Bank’s strategy under Indrajith and his successors was fundamentally flawed on three counts:

1. Overreliance on commercial debt: Instead of mobilising cheaper, long-term concessional financing from multilaterals and bilateral partners, Sri Lanka chose to rely on volatile capital markets.

2. Poor debt management coordination: The Central Bank and Treasury operated in silos, with little medium-term fiscal strategy to manage repayment risk.

3. Lack of accountability: Borrowings were presented as “routine” or “market-friendly,” without adequate parliamentary scrutiny or public disclosure of repayment implications.

The outcome was predictable. By 2020, nearly half of Sri Lanka’s external debt was owed to private creditors, leaving the country with little room to negotiate or restructure quickly. The steep depreciation of the rupee, soaring inflation, and collapse in investor confidence were all symptoms of the same underlying disease: fiscal indiscipline compounded by monetary complacency.

The painful lessons of this period must not be lost on policymakers. Sri Lanka cannot afford to repeat the mistakes of 2015–2019 — where technocratic convenience and political expedience replaced prudent economic judgment. The Central Bank’s independence must be matched by accountability, and every dollar borrowed must be linked to measurable economic outcomes.

If there is one truth the bankruptcy laid bare, it is this: a nation cannot borrow its way to prosperity. Borrowing, when not anchored to reform, only delays the reckoning. Sri Lanka’s road to recovery must therefore begin not with more loans, but with institutional discipline, transparency, and a commitment to live within its means.

Sri Lanka’s Growing Crypto Market Faces Regulatory Uncertainty

By: Staff Writer

October 20, Colombo (LNW): A quiet financial revolution is unfolding in Sri Lanka. As the rupee weakens and inflation erodes savings, thousands of citizens from tech-savvy youth to small business owners — are increasingly turning to cryptocurrency as an alternative store of value. What began as a niche experiment has grown into a widespread movement taking place largely beyond the reach of the country’s financial regulators.

A recent South Asian Journal of Finance study estimates that more than 320,000 Sri Lankans currently hold some form of cryptocurrency. International data provider Datawallet projects this figure could exceed 1.16 million by 2026, suggesting that crypto adoption could rival that of regional peers.

For many, digital assets like Bitcoin and Ethereum are seen less as speculative plays and more as protection against inflation and rupee depreciation. “Young professionals and small investors are quietly moving into crypto to preserve value,” said a Colombo-based financial analyst. “It’s happening under the radar outside banks and the stock market — but the momentum is real.”

Despite this surge, crypto trading in Sri Lanka remains legally unregulated. The country has yet to license any local exchanges, forcing most transactions onto offshore platforms or peer-to-peer networks, where oversight is minimal. This leaves investors exposed to fraud, hacking, and market manipulation without any legal protection.

The Central Bank of Sri Lanka (CBSL) has repeatedly cautioned the public about the risks of virtual currencies. Governor Dr. Nandalal Weerasinghe reaffirmed that the Sri Lankan rupee remains the only legal tender, warning that crypto investments are neither regulated nor guaranteed. “We are not banning crypto holdings,” he clarified, “but no one should believe crypto is a safe investment. Transparency and oversight are critical.”

In an effort to close the regulatory gap, the CBSL has proposed amendments to the Financial Transactions Reporting Act (FTRA). The changes would require Virtual Asset Service Providers (VASPs) to register with the Financial Intelligence Unit (FIU), bringing them under anti-money laundering and counter-terrorism financing (AML/CFT) supervision. Once enacted, the rules would force crypto intermediaries to report suspicious or large-value transactions, similar to banks and finance companies.

Meanwhile, the global crypto market continues to soar. Bitcoin recently crossed US$109,000, up more than 60% since late 2024, driven by U.S. regulatory reforms and institutional buying. Analysts predict it could hit US$150,000 by 2025, drawing even more attention from Sri Lankan investors seeking quick returns.

However, legal experts warn that without local regulation, the risks far outweigh the rewards. “If your crypto vanishes from an offshore exchange, there is no legal remedy in Sri Lanka,” said a financial lawyer.

As economic pressures mount, crypto’s rise reflects the public’s search for financial autonomy. Whether Sri Lanka integrates digital assets into its formal economy or continues to let them thrive in the shadows will determine if this digital boom becomes a success story or a cautionary tale.

Sri Lanka Seeks EU GI Tag to Protect Ceylon Tea

By: Staff Writer

October 20, Colombo (LNW): Sri Lanka is taking a major step to safeguard its most famous export — Ceylon Tea — by applying for Geographical Indication (GI) status from the European Union, a move aimed at protecting authenticity, curbing counterfeits, and boosting export value. The initiative, supported by a €1 million French-funded program, is expected to give Ceylon Tea stronger legal recognition and market advantage across Europe and beyond.

Sri Lanka Tea Board Chairman Raaj Obeysekere described the certification drive as a landmark effort to preserve the tea’s identity and enhance its global profile. Speaking at a forum in Colombo on “Perspectives on Geographical Indication in Sri Lanka,” Obeysekere said GI registration would strengthen brand credibility and reward the country’s tea producers.

“GI status is a powerful tool that safeguards the origin of Ceylon Tea, combats imitation, and positions it as a premium global product,” he said. “It ensures fair value for our producers and long-term benefits for rural communities.”

The certification initiative is being financed through a €1 million grant from Agence Française de Développement (AFD), France’s development agency, which has helped similar projects in nearly 20 countries.

AFD Country Director Yazid Bensaïd said the initiative reflects France’s long-standing commitment to promoting sustainable trade and quality assurance. “Tea is Sri Lanka’s second-largest export and employs more than one million people. The GI process here has been deeply participatory, involving over 500 stakeholders to define quality standards and establish a robust control system,” he noted.

The technical groundwork was led by France’s Agricultural Research Centre for International Development (CIRAD), which also assisted Sri Lanka in securing GI recognition for Ceylon Cinnamon in 2022. CIRAD Legal Researcher Dr. Delphine Marie-Vivien said the process was rooted in collaboration and trust.

“Defining rules collectively is essential to protecting a product’s reputation,” she said. “The strength of this project lies in the strong commitment and shared motivation of Sri Lankan partners.”

Plantations Minister Samantha Vidyaratne acknowledged France’s support since 2021, emphasizing that Ceylon Tea’s global reputation must now be reinforced through international standards. “Ceylon Tea has been synonymous with Sri Lanka for 150 years,” he said. “In today’s competitive markets, GI recognition is not just a label it’s a necessity. Our application has been submitted, and I am confident of its approval.”

French Ambassador to Sri Lanka Rémi Lambert said the GI recognition would put Ceylon Tea among the world’s most prestigious regional products. “Once registered, Ceylon Tea will join the global family of certified products whose heritage and quality are protected,” he said. “Just as Champagne and Piment d’Espelette represent France, Ceylon Tea will stand as a proud symbol of Sri Lanka.”

Vehicle Registrations Surge to 48,708 in September Currency Risk Looms

By: Staff Writer

October 20, Colombo (LNW): Sri Lanka recorded a sharp uptick in vehicle registrations in September 2025, with total units reaching 48,708, a 27 % increase from August.

Cars rose to 4,268 from 2,329, while SUVs and crossovers surged to 5,813 from 3,800. Motorcycles alone accounted for 32,626 registrations, up from 27,585, and three-wheelers jumped to 3,015 from 2,497.

This sharp expansion is being driven by the lifting of import curbs and a pent-up demand for personal mobility. The government is benefiting from high taxes on vehicle imports, which generate significant rupee tax revenue.

But that benefit comes with a major trade-off: each imported vehicle draws down foreign currency reserves, putting pressure on the external sector and the Sri Lankan rupee.

Analysts estimate that only about one-third of the retail price of imported cars and crossovers impacts the foreign exchange market because duties and taxes are paid in rupees but the rest still translates into dollars leaving the country.

With cars and crossovers in September reaching pre-crisis levels totaling 10,081 units up from 6,137 in August the scale of dollar outflow is beginning to rival other large import categories.

If an average import cost per car/SUV is US$20,000 (a conservative estimate given higher-end import vehicles), then 10,081 units translate into roughly US$201 million and potentially more dollars flowing out in one month.

Over a nine-month period, assuming similar pace, this could add up to US$1.6–2 billion, magnifying the risk to the country’s balance of payments.

On the revenue side, heavy taxes mean the state pockets large sums in rupees upfront, but the revenue cannot fully offset the foreign exchange impact. With external reserves tight and the rupee facing depreciation pressures partly driven by imported goods that draw on scarce dollars — the vehicle boom could undermine macro stability even as it boosts short-term revenue.

The key challenge for policymakers is balancing the immediate revenue wind-fall from vehicle import taxes against long-term currency stability and external sector resilience. Unless matched with export growth or foreign-exchange-earning measures, the surge in imports risks turning a Treasury win into a broader economic vulnerability.

Electrical Engineers Warn unbundling of CEB risks Operational Breakdown

By: Staff Writer

October 20, Colombo (LNW): In a stark warning to Parliament, the engineers’ union of the Ceylon Electricity Board (CEB) has raised grave concerns over the government’s move to un-bundle the utility into separate generation, transmission and other successor companies.

The union says the approved “Preliminary Transfer Plan” (PTP) lacks fundamental information on how assets, liabilities, cash-flows and operations will be divided threatens to undermine the continuity of electricity supply.

The CEB Engineers’ Union (CEBEU), in a letter to the Sectoral Oversight Committee on Infrastructure and Strategic Development, states that when CEB is split the PTP fails to detail how loans will be shared or how cash will flow from the distribution company via Power Purchase Agreements to enable the generation entity to service debt.

It also says there is no clarity on how the generation, transmission and the proposed National System Operator will work together operationally.

The letter points to a host of statutory violations: for example no valuation of land, plant and machinery by the chief valuer as required under Section 39.1(b), and absence of inter-company reconciliation of receivables and payables, inventories and stocks (Sections 18.2(a), 18.3(b)).

It also highlights that only four of the six intended successor companies have been incorporated despite the law requiring six, including a trustee/pension fund company and a residual entity. These omissions, the union argues, breach Section 17.2, 18.3(d), 18.3(e) and others of the Sri Lanka Electricity Act, No. 36 of 2024.

The union further complains that the PTP was circulated only to selected management in CEB on 25 September 2025 and that it had already been forwarded to the Ministry of Finance, Sri Lanka for approval the same day, with Finance Minister’s approval dated 11 October 2025, despite the very short window for comment and without full employee or trade-union input.

With no operational agreements crafted between the successor companies, no clear Power Purchase Agreements, Transmission Service Agreements or draft licences for the National System Operator or National Transmission & National Supply entities, the union argues the reform may collapse the entire sector “not because of the employees of CEB, but entirely due to the Ministry’s reckless and irresponsible handling of the process.”

The unbundling process is part of a larger reform agenda tied to the country’s committed programme with the International Monetary Fund (IMF) to restructure state-owned enterprises and open the electricity sector to private investment, improve transparency and attract financing.

But the engineers’ union’s letter suggests that the reform’s legal and operational foundations are not yet in place.

The union is urging the parliamentary committee to review the reform process urgently, summon relevant officials for clarification, permit the union to present its professional observations and proposals, and ensure the transition is implemented strictly according to law, transparency and accountability.

Sri Lanka Launches Dedicated Unit to Tackle Illicit Asset Accumulation

October 20, Colombo (LNW): The Sri Lanka Police officially unveiled the Proceeds of Crime Investigation Division (PCID) today (20), marking a significant move in the country’s efforts to clamp down on financial crime and unlawful asset accumulation. The newly established division, created under the provisions of the Proceeds of Crime Act No. 05 of 2025, is expected to play a pivotal role in tracking, investigating, and disrupting the flow of illicit wealth.

The PCID will operate from the old Police Headquarters in Colombo and was ceremonially inaugurated by Public Security Minister Ananda Wijepala. The unit has been specifically designed to probe cases involving the illegal acquisition of money, property, and other financial assets, extending its reach beyond criminal proceedings to civil action where necessary.

Unlike traditional criminal investigations, the PCID will also be empowered to initiate legal steps in instances of suspicious asset accumulation even when a direct criminal offence cannot be established. This broader civil authority is seen as a crucial mechanism for recovering wealth gained through unlawful means while closing loopholes often exploited by financial offenders.

Senior Deputy Inspector General of Police Asanka Karawita has been appointed as the Director General of the PCID for a three-year term, pending confirmation by the National Police Commission. SDIG Karawita concurrently heads both the Criminal Investigation Department (CID) and the Financial Crimes Investigation Division (FCID), bringing significant expertise to his new role.

A Deputy Director General will manage the division’s operational activities, with the PCID expected to work in close coordination with 34 government institutions, as outlined in the new legislation. These include agencies overseeing finance, public administration, law enforcement, and regulatory affairs.

Under its mandate, the division has been granted powers to temporarily freeze or seize assets suspected to be unlawfully acquired for a period of up to 30 days—an interim measure that allows time for further investigation while preventing the movement or disposal of those assets.

IMF Urges Sri Lanka to Stay Committed to Reforms for Lasting Economic Recovery

October 20, Colombo (LNW): The International Monetary Fund (IMF) has called on Sri Lanka to remain steadfast in implementing its ongoing economic reform programme, emphasising that sustained commitment is key to securing long-term economic stability and growth.

Speaking during a media briefing in Washington, D.C., where the IMF presented its latest regional economic outlook, Deputy Director Thomas Helbling acknowledged the considerable progress Sri Lanka has made since emerging from its worst economic crisis in recent history.

He noted that following a deep contraction, the country saw a robust rebound last year, recording an impressive growth rate of 5 per cent, with growth projections for the current and coming year estimated at around 4.2 per cent. Looking ahead, Sri Lanka’s potential growth rate is expected to settle around 3 per cent.

Helbling stressed that these gains are largely the result of the government’s determination to implement far-reaching reforms under the IMF-supported programme. “Sri Lanka has made meaningful strides, but to secure these achievements and unlock further progress, it is crucial to maintain momentum. Continued implementation will allow the country to reap the full benefits of the reforms,” he said.

He also highlighted the importance of safeguarding macroeconomic stability through institutional strengthening, prudent fiscal policy, and improved public sector management. “Key to this journey will be fiscal consolidation and ensuring the financial sustainability of state-owned enterprises. These areas carry significant fiscal risks if left unaddressed,” Helbling explained, adding that reforming public investment and maintaining discipline in public finances are central to building a stable economic foundation.

Electricity pricing reforms were also flagged as a critical area under the programme, particularly the commitment to cost recovery. Helbling acknowledged that price adjustments must account for external variables such as energy markets and climate impacts, but reiterated the importance of aligning tariffs with actual costs to reduce pressure on public finances.

He noted that Sri Lanka’s government has demonstrated strong support for these reforms thus far and encouraged authorities to “stay the course,” regardless of external challenges or political pressures.

Krishna Srinivasan, Director of the IMF’s Asia and Pacific Department, echoed this sentiment, commending Sri Lanka for the difficult choices already made. “The country has come a long way from where it stood just a few years ago. The difficult part has been done. Now, it is about staying committed to the path of reform. The benefits are already visible, and more will follow with consistency and resolve,” he said.

As the global economic environment remains uncertain, the IMF’s message to Sri Lanka was clear: perseverance in reform is not just advisable — it is essential to protect and expand the hard-won progress already made.