By: Staff Writer

October 16, Colombo (LNW): Sri Lanka is losing billions in potential tax revenue as nearly 70% of the country’s gambling activity now takes place online, outside the reach of existing regulations, the Parliament Secretariat revealed yesterday. Findings presented to the Committee on Public Finance (CoPF) show that only 30–40% of casino-related operations occur in licensed physical establishments, while the vast majority of digital betting platforms remain untaxed and unregulated.

At the meeting chaired by opposition MP Dr. Harsha de Silva, the CoPF stressed the urgency of addressing this fast-growing online gambling trend, which has attracted thousands of young Sri Lankans in recent years. According to industry and cybersecurity experts, over 300,000 Sri Lankans, many between 18 and 35 years, are estimated to engage in online betting through foreign-based apps and websites each month. The total volume of wagers placed online is believed to exceed Rs. 50–60 billion annually, most of which flows out of the country through unofficial payment channels.

The committee highlighted that the State earns no tax revenue from these operations, despite the sector’s explosive growth. In contrast, Sri Lanka’s six licensed casinos, which account for less than half of total gambling activity, are subject to annual license fees and taxes under the Betting and Gaming Levy Act. “This is a massive regulatory blind spot,” Dr. de Silva warned, emphasizing that the unregulated digital gambling ecosystem not only undermines fiscal revenue but also exposes the financial system to money laundering and illicit fund transfers.

To address the issue, the CoPF has called for the immediate establishment of the Gambling Regulatory Authority (GRA), a long-delayed initiative aimed at bringing both physical and online gambling under a unified legal framework. Officials from the Finance Ministry and Inland Revenue Department informed the committee that they have agreed to operationalize the Authority by 30 June 2026, with nominations underway for a seven-member board and the appointment of a Chief Executive Officer to lead the process.

Dr. de Silva reiterated that the move is vital for Sri Lanka to meet Financial Action Task Force (FATF) compliance standards on anti–money laundering and counter-terrorism financing. “Without an independent regulatory mechanism, we risk not only losing tax income but also failing to prevent gambling-linked financial crimes,” he cautioned.

The proposed GRA is expected to introduce licensing and tax procedures for online casinos, as well as mandatory age and identity verification systems to curb underage participation. Experts say effective regulation could generate over Rs. 10–15 billion annually in additional tax revenue, while providing greater consumer protection and financial transparency.

With online betting platforms rapidly expanding among tech-savvy youth and digital payment usage soaring, the CoPF’s warning signals a critical turning point: Sri Lanka must either move swiftly to regulate the digital gambling space or continue losing vast sums—and social control—to the unmonitored online betting world.

Online Gambling Surge Drains Sri Lanka’s Revenue, Hits Youth Hard

United Petroleum Launches Legal Action against Sri Lanka Over Failed Exit Deal

By: Staff Writer

October 16, Colombo (LNW): United Petroleum Lanka Ltd., the Australian-owned fuel retailer, has initiated formal dispute resolution proceedings against the Government of Sri Lanka, alleging failure to honour commitments under an exit agreement signed in April 2025. The company claims the Government’s continued inaction and delays in implementing agreed terms have forced it to terminate the exit arrangement and seek legal remedy.

In a statement issued yesterday, United Petroleum Lanka said the dispute stems from the Government’s inability to fulfil key undertakings, despite repeated extensions and follow-ups. The company described the situation as a breach of good faith, which has further eroded investor confidence at a time when Sri Lanka is attempting to liberalise its energy market and attract foreign capital.

United Petroleum Lanka, a subsidiary of Australia’s United Petroleum Group, entered Sri Lanka’s fuel retail market in August 2024 after a Government-led process to bring in foreign investors to enhance competition and service standards. Backed by Australian technical expertise and operational best practices, the company was granted licences and entered into supply, import, and distribution agreements with the Ceylon Petroleum Corporation (CPC) and the Ceylon Petroleum Storage and Logistics Company (CPSTL).

According to the company, these agreements were critical to establishing investor trust in the country’s fuel market reforms. “United Petroleum Lanka complied with its contractual obligations and operated in good faith,” the statement said. However, the firm encountered “persistent challenges” due to the Government’s inability to uphold essential contractual terms, creating what it described as an “economically unsustainable environment.”

As difficulties mounted, United Petroleum suspended its fuel supply operations in December 2024 and agreed to an orderly exit from the market. The exit agreement, signed in April 2025 and endorsed by the Cabinet, was expected to be concluded by early May. Despite the company’s full compliance, a key undertaking from the Ministry of Energy remains unfulfilled, the statement said.

After several months of extensions and unheeded requests, United Petroleum terminated the exit agreement in October 2025 and commenced formal dispute resolution procedures.

The company expressed “deep disappointment” that the same bureaucratic and policy inconsistencies that hampered its operations have now complicated its exit as well. “Our experience underscores the importance of policy consistency, transparency, and adherence to contractual obligations, particularly for nations seeking to attract and retain foreign investment,” the statement noted.

United Petroleum Lanka reiterated that it maintained “integrity and professionalism” throughout its entry, operation, and exit process, affirming its adherence to international corporate and investor standards.

Breakthrough: Scientists Create ‘Universal’ Kidney To Match Any Blood Type

ScienceAlert : After a decade of work, researchers are closer than ever to a key breakthrough in kidney organ transplants: being able to transfer kidneys from donors with different blood types than the recipients, which could significantly speed up waiting times and save lives.

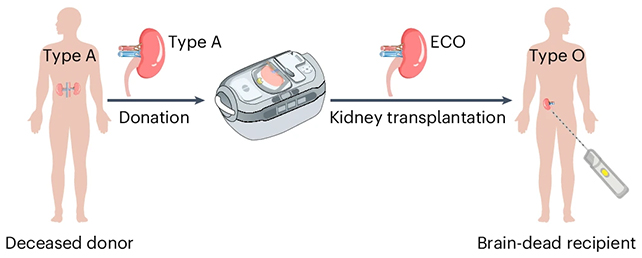

A team from institutions across Canada and China has managed to create a ‘universal’ kidney, which can, in theory, be accepted by any patient.

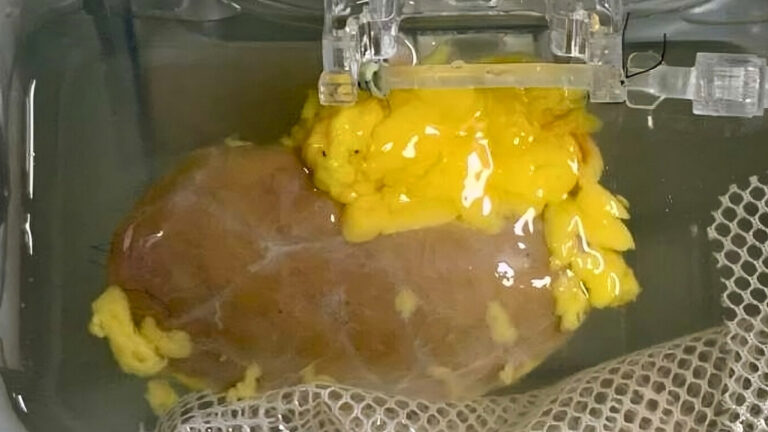

Their test organ survived and functioned for several days in the body of a brain-dead recipient, whose family consented to the research.

“This is the first time we’ve seen this play out in a human model,” says biochemist Stephen Withers, from the University of British Columbia in Canada. “It gives us invaluable insight into how to improve long-term outcomes.”

Related: Surgeons Resuscitate ‘Dead’ Heart in Life-Saving Organ Transplant to Baby

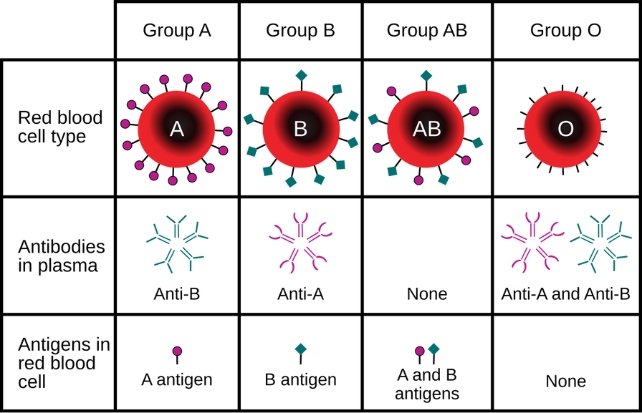

As it stands today, people with type O blood who need a kidney usually have to wait for a type O kidney to become available from a donor. That accounts for more than half the people on waitlists, but because type O kidneys can function in people with other blood types, they’re in short supply.

Blood type (or blood group) is determined, in part, by the ABO blood group antigens present on red blood cells. Antibodies in our blood plasma detect when a foreign antigen marker is present (InvictaHOG/Public Domain/Wikimedia Commons)

While it is currently possible to transplant kidneys of different blood types, by training the recipient’s body not to reject the organ, the existing process is far from perfect and not particularly practical.

It’s time-consuming, expensive, and risky, and it also requires living donors to work, as the recipient needs time to be prepped.

Here, the researchers effectively converted a type A kidney into a type O kidney, using special, previously identified enzymes that strip away the sugar molecules (antigens) acting as markers of type A blood.

The researchers compare the enzymes to scissors working on the molecular scale: by snipping off part of the type A antigen chains, they can be turned into the ABO antigen-free status that characterizes type O blood.

“It’s like removing the red paint from a car and uncovering the neutral primer,” says Withers. “Once that’s done, the immune system no longer sees the organ as foreign.”

Related: Your Blood Type Affects Your Risk of an Early Stroke, Study Reveals

There remain plenty of challenges ahead before trials in living humans can be considered.

The transplanted kidney did start to show signs of type A blood again by the third day, which led to an immune response – but the response was less severe than would usually be expected, and there were signs that the body was trying to tolerate the kidney.

The statistics surrounding this issue are pretty stark: at the moment, 11 people die waiting for a kidney transplant each day, in the US alone, and the majority of those are waiting for type O kidneys.

It’s a problem that scientists are tackling from multiple angles, including making use of pig kidneys and developing new antibodies. Broadening the number of compatible kidneys these people can have promises to make a significant difference.

“This is what it looks like when years of basic science finally connect to patient care,” says Withers. “Seeing our discoveries edge closer to real-world impact is what keeps us pushing forward.”

The research has been published in Nature Biomedical Engineering.

Government Revives Dollar Bond Sales Locally Amid Fiscal Strain

By: Staff Writer

October 16, Colombo (LNW): In a move that revives a controversial strategy initiated by the previous administration, Sri Lanka’s new government led by the National People’s Power (NPP) has approved the sale of foreign currency denominated bonds to the domestic market. Cabinet Spokesman Dr. Nalinda Jayatissa confirmed that the Treasury plans to issue dollar bonds worth around USD 100 million, targeting maturities between one to three years.

The decision comes as the government struggles to manage a tight external financing position, with limited access to global capital markets following the 2022 sovereign default. According to Treasury sources, the move aims to tap into idle foreign currency deposits held in the local banking system estimated at over USD 8 billion—as a means to settle part of the upcoming foreign debt maturities while easing pressure on the exchange rate.

A Revival of a Past Policy

The initiative echoes the previous regime’s Sri Lanka Development Bonds (SLDB) program, which attracted local dollar holdings to finance external debt. That program, however, saw diminishing investor appetite due to rising risk premiums and poor secondary market liquidity. Analysts note that the new NPP government is effectively rebranding the concept while promising better structuring, transparency, and investor protections.

“The idea itself is not new,” said a senior financial analyst. “But if properly structured—perhaps through syndicated arrangements with reputed lead managers—it could offer the state short-term relief without excessive reliance on money printing or dollar borrowings abroad.”

Potential Benefits

Economists view the domestic dollar bond initiative as a pragmatic, if limited, solution to the country’s financing bottlenecks. By sourcing foreign exchange internally, the government could reduce pressure on reserves and the rupee, while avoiding the higher costs associated with borrowing from external markets.

Latest Central Bank data shows that as of August 2025, Sri Lanka’s gross official reserves stood at USD 5.2 billion covering about 3.2 months of imports while the government faces foreign debt service obligations of over USD 4 billion in 2026. Mobilizing local dollar liquidity could therefore help bridge near-term funding gaps.

Risks and Concerns

However, the move is not without risk. Financial experts warn that dollar-denominated borrowings, even from domestic sources, could increase the state’s exposure to currency risk. If the rupee depreciates further, the cost of servicing such debt could surge, deepening fiscal vulnerabilities.

Moreover, the domestic banking sector’s exposure to government securities—already exceeding 40 percent of total assets—could expand further, tightening liquidity and heightening systemic risk. Some also argue that attracting dollar deposits into government paper might drain foreign exchange from trade finance and private investment, potentially dampening economic recovery.

Balancing Act Ahead

The NPP government’s decision reflects a delicate balancing act: stabilizing the fiscal position without derailing macroeconomic progress achieved under the IMF program. The IMF’s Fourth Review (September 2025) cautioned Sri Lanka against expanding foreign currency liabilities unless backed by credible debt management and reserve-building strategies.

Ultimately, success will depend on investor confidence and market perception. If well-managed, the revived dollar bond issuance could serve as a temporary financing tool. But if poorly executed, it risks repeating past mistakes trading short-term relief for long-term fragility in Sri Lanka’s debt-laden economy.

Sri Lanka’s Passport Slides Further in Global Mobility Rankings

October 16, Colombo (LNW): Sri Lanka’s position on the global travel stage has weakened further, with the country’s passport dropping to 98th place in the 2025 Henley Passport Index—two places lower than its previous ranking. This decline highlights the continuing constraints Sri Lankan citizens face in terms of international mobility.

According to the latest update of the index, holders of a Sri Lankan passport now have visa-free or visa-on-arrival access to only 41 countries. This limited access places Sri Lanka among the lower tier of passports worldwide, underscoring ongoing diplomatic and policy challenges affecting travel freedoms.

The Henley Passport Index, a widely recognised global ranking of passport power, assesses 199 passports based on their access to 227 international destinations. It is used as a key reference for understanding the relative ease—or difficulty—of global travel for citizens of different countries.

In stark contrast, Singapore has once again claimed the top spot in the 2025 rankings, with its passport offering visa-free entry to an impressive 193 destinations. South Korea follows closely in second place with 190 countries, while Japan sits in third, granting access to 189 destinations without prior visa requirements.

UNP Appoints Committee to Initiate Talks with SJB

October 16, Colombo (LNW): The United National Party (UNP) has taken steps to open formal dialogue with the Samagi Jana Balawegaya (SJB) by appointing a three-member committee tasked with initiating discussions between the two parties.

The committee is composed of senior UNP figures: Deputy Leader Ruwan Wijewardene, General Secretary Thalatha Atukorale, and President’s Counsel Ronald C. Perera, reflecting the party’s intent to engage at a high level.

In a statement accompanying the announcement, the UNP reaffirmed its longstanding position that all democratic parties must set aside differences and unite in defence of the country’s multi-party system.

Calls Grow for Tax Reform in Sri Lanka as Report Links Revenue Shortfalls to Declining Public Services

October 16, Colombo (LNW): A new report has raised serious concerns about Sri Lanka’s taxation system, arguing that decades of low revenue collection and preferential treatment for businesses and the wealthy have undermined vital public services and contributed to the country’s economic collapse in 2022.

The study highlights how successive policy choices, stretching back several decades, have eroded state capacity—particularly in education—while disproportionately burdening lower-income citizens.

The 101-page report, published by Human Rights Watch, draws a sharp connection between the island’s long-standing fiscal choices and the erosion of its social infrastructure. It contends that Sri Lanka’s tax system, shaped by waves of deregulation and generous exemptions, has failed to generate the necessary revenue to sustain equitable development.

While GDP figures have often painted a picture of growth, public investment—especially in education—has been allowed to stagnate, leaving behind a legacy of inequality and missed opportunity.

One of the central arguments of the report is that a narrow tax base, skewed in favour of indirect taxes such as VAT and other consumption levies, has placed a heavier burden on the country’s poorest communities. It notes that in recent years, nearly 80 percent of all tax revenue has come from goods and services, while collections from personal income and wealth remain strikingly low.

As a result, citizens with the fewest means are paying a disproportionately high share of national taxes.

At the same time, vast corporate tax exemptions—often granted without transparency—have continued to drain state finances. In 2022 alone, these exemptions were estimated to cost the equivalent of over half of the government’s total revenue, nearly triple what was allocated to education that year.

The study paints a stark picture of the toll these policies have taken on Sri Lanka’s education system. Once a leader in the developing world for access to free education, the country has seen its public education spending drop from between 3 to 5 percent of GDP in the decades following independence to just 1.5 percent in 2022—now among the lowest in the world. This has led to public schools increasingly charging fees for basic materials and resources, compounding financial pressure on low-income families.

Field interviews included in the report detail the lived reality of these pressures. One woman, a domestic worker in the central hill country, spoke of earning a modest income of around Rs.14,000 a month while struggling to pay monthly school fees and tuition expenses for her two children.

“When teachers ask for books or school supplies, I often cannot provide them,” she said, noting that the economic strain has even affected her ability to provide nutritious meals for her children.

Sri Lanka’s recent history of economic mismanagement came to a head in April 2022, when the country defaulted on its foreign debt for the first time. The default triggered widespread hardship, fuel shortages, and a spike in the cost of living. Although a bailout package from the International Monetary Fund was secured in 2023, the government continues to dedicate a large share of its revenue—over half in 2024—to debt servicing, leaving limited fiscal room for investment in public welfare.

In January 2025, the National People’s Power (NPP) coalition led by President Anura Kumara Dissanayake came to power on a promise to overhaul the economy, reduce inequality, and re-invest in public services. Since then, some modest steps have been taken, including the introduction of a bursary for families with school-aged children. However, education spending remains well below international targets, and structural reforms have only just begun.

The report urges the government to take bolder action, including phasing out costly and ineffective corporate tax holidays, enhancing tax administration capacity, and introducing more progressive tax instruments such as a wealth tax. These measures, it argues, are essential not just for economic stability but to meet Sri Lanka’s obligations under international human rights law, which requires states to use their resources to progressively realise rights to education, health, and a decent standard of living.

The findings also resonate more broadly, reflecting challenges faced by many low- and middle-income countries in a global tax environment that encourages competition for foreign investment at the expense of social development. The report supports ongoing efforts to create a new international tax agreement under the United Nations framework, which would aim to promote fairer and more transparent tax practices across borders.

Human Rights Watch concludes that economic growth alone is not a sufficient condition for social progress. Without a fair and effective tax system, it warns, governments risk deepening inequality and undermining the very rights they are bound to uphold.

IPS Urges Sri Lanka to Convert Recovery Into Sustained Growth

October 16, Colombo (LNW): Sri Lanka’s economic recovery is showing encouraging signs of resilience, with stronger-than-expected GDP growth of 4.9 per cent recorded in the first half of 2025. This rebound, supported by improving macroeconomic conditions and a more stable policy environment, is fuelling optimism. Yet, questions remain about the long-term sustainability of this momentum and the structural reforms needed to support it.

The Institute of Policy Studies (IPS), in its flagship publication Sri Lanka: State of the Economy 2025, explores this critical juncture in the country’s post-crisis path, highlighting how gains in productivity and economic efficiency will be essential to transforming the current cyclical upswing into durable, broad-based growth.

While sound monetary and fiscal policies have provided much-needed stability, deeper reforms—particularly in land use, labour regulations, and market access—are seen as central to unlocking further economic potential. However, implementing such changes is politically sensitive and often constrained by short-term socio-economic demands, especially in a nation still grappling with the aftershocks of a financial crisis.

Against this backdrop, the IPS report identifies technology and digital transformation as pivotal in accelerating productivity improvements across sectors. Although national computer literacy remains relatively low at 39 per cent, with stark inequalities such as a 17.9 per cent rate in estate communities, the potential for digital technologies to drive inclusive development is considerable.

Digitalisation offers practical, cost-effective pathways to bridge service gaps in education, health, agriculture, and transport. For example, expanding internet access and digital tools in underserved schools could help reduce disparities in learning outcomes. Encouragingly, nearly 42 per cent of Sri Lanka’s lowest-income earners already use digital payments—an indication that digital adoption is growing at the grassroots level.

This trend opens up opportunities to enhance the country’s e-commerce landscape, modernise public services, and extend critical support to farmers through scalable digital extension services. Moreover, improving digital infrastructure can help Sri Lankan exporters adapt to global regulatory shifts, such as traceability requirements and supply chain transparency, thereby improving competitiveness.

Ultimately, the IPS underscores that while policy reform remains a complex and gradual process, embracing digital innovation can deliver measurable gains in the near term. With the right investments in infrastructure, digital literacy, and regulatory support, Sri Lanka can lay the foundation for a more resilient, inclusive, and future-ready economy.

Adverse Weather Impacts Over 100 Families Across Four Districts

October 16, Colombo (LNW): More than 100 families have been affected by severe weather conditions currently sweeping across several parts of Sri Lanka, with flash floods and strong winds disrupting daily life in multiple regions.

According to the latest situation report from the Disaster Management Centre (DMC), a total of 368 individuals from the districts of Colombo, Kalutara, Galle, and Hambantota have been directly impacted.

In addition to the displacement and disruptions caused, at least 17 homes have sustained partial damage due to the prevailing conditions.

The Department of Meteorology has warned that the unstable weather pattern is expected to continue throughout the day. Widespread showers or thundershowers are forecast to develop after 1.00 p.m. across most areas of the island.

Notably heavy rainfall — exceeding 100 mm — is anticipated in parts of the Western, Sabaragamuwa, Central, Southern, Uva, and North-Western provinces.

Morning showers are also likely in the Western, Southern, and Northern provinces, as well as in the Ampara district, adding to the challenges faced by communities already grappling with the effects of the weather.

Authorities have urged the public to exercise caution, particularly during periods of heavy rainfall and thunderstorms. The DMC has advised taking preventive measures to reduce the risk of injury and property damage caused by temporary strong winds, lightning strikes, and sudden flooding.

New Self-Rehabilitation Centre for Drug Recovery Opens in Polonnaruwa

October 16, Colombo (LNW): A dedicated facility aimed at supporting individuals battling drug addiction has officially opened its doors today (16) at the Senapura Rehabilitation Centre in Polonnaruwa.

The new initiative is designed to provide a structured environment for those who voluntarily seek help to overcome substance dependency.

Commissioner General of Rehabilitation Shiran Amit announced that individuals interested in entering the programme can register by contacting 076 96 277 61. The facility will cater specifically to those opting for self-rehabilitation, offering a supportive and non-judgemental setting for recovery.

This move stems from the national strategy to address the growing demand for addiction treatment services, as more individuals across Sri Lanka actively seek pathways to recovery. According to the Bureau of Rehabilitation, approximately 600 people are currently receiving treatment across the country’s three operational centres, a number that continues to rise.