February 16, Colombo (LNW): In its latest monetary policy report released on Thursday (Feb.15), the Central Bank of Sri Lanka expressed optimism about the country’s economic prospects for 2024, foreseeing a positive annual growth trajectory that is expected to gradually reach its potential over the medium term.

The report provides forward-looking insights into various economic aspects, with a focus on inflation and overall economic growth. It aims to assess potential risks to projections, taking into account both domestic and global developments.

Highlighting Sri Lanka’s achievements in 2023, the Central Bank noted the successful reduction of the inflation rate to single-digit levels, thereby restoring price stability after addressing the historically high inflation observed in 2022. The report projects inflation to stabilize around the targeted level of 5% (year-on-year) over the medium term.

Despite potential deviations from the target in the short term, attributed mainly to recent amendments to the Value-Added Tax (VAT) and supply-side disruptions, the Central Bank anticipates such impacts to be short-lived.

The report also acknowledged the government’s decision to increase VAT from 15% to 18% at the beginning of 2024, a measure taken to meet revenue targets under the International Monetary Fund (IMF) program.

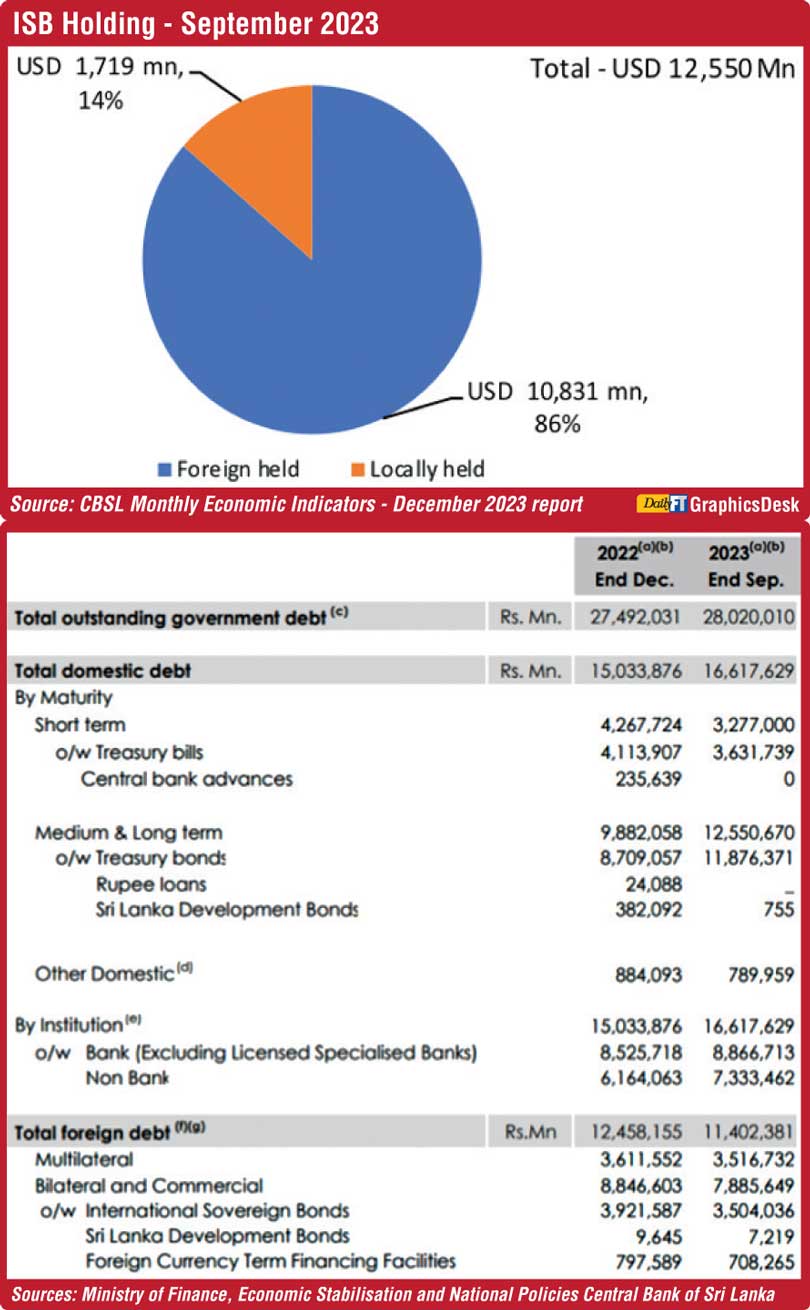

Sri Lanka’s economic recovery is discernible, with traces attributed to the IMF’s bailout package of USD 2.9 billion. The island nation had faced its worst financial crisis since independence in 1948 and defaulted on its foreign debt for the first time in history in April 2022. The IMF support has played a crucial role in stabilizing the nation’s economic situation.