By: Staff Writer

Colombo (LNW): The Hotels Association of Sri Lanka (THASL) has stressed that Sri Lanka’s golden opportunity to reposition tourism via Minimum Room Rate must not be squandered and it should not impact tourist arrivals but enhance much needed higher foreign exchange earnings

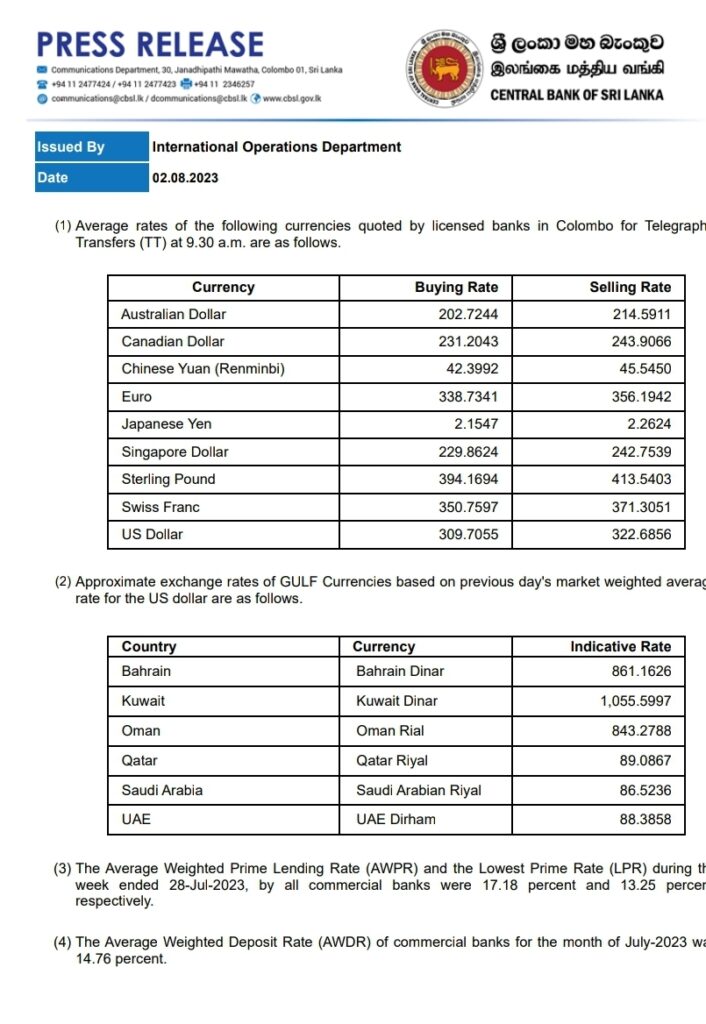

It warns selling 5 star double room per night at US$ 60 net no longer acceptable pointing to DMCs only accounting for 20% of city hotels bookings while insisting higher room rate means higher contribution to Govt, hotels and economy.

The Hotels Association of Sri Lanka (THASL) President M. Shanthikumar yesterday expressed his concern over tour operators trying to scuttle efforts to earn much needed additional foreign exchange from a rebounding tourism industry.

“It is a pity that some members of Sri Lanka Association of Inbound Tour Operators (SLAITO) with vested interests are objecting to the implementation of the Minimum Room Rate (MMR) for the Colombo city tourist hotels,” charged Shanthikumar.

“Whilst the hoteliers endorse President Ranil Wickremesinghe’s vision for tourism and are working towards improving the present pricing structure in the city to reasonable levels through a MRR, we are surprised that SLAITO is trying to scuttle this move through a series of press articles voicing their objections. This is purely for the benefit of a few individuals,” THASL Chief alleged.

According to Shanthikumar, Sri Lanka has a golden opportunity to reposition the tourism industry under the Presidency of Ranil Wickramasinghe and the leadership of Tourism Minister Harin Fernando. “This opportunity shouldn’t be squandered,” THASL Chief said.

Shanthikumar said strong and effective travel agents have given Sri Lanka the confidence that the country can be marketed aggressively even if a MRR is in place and they have assured they will target a different segment of the market, especially from destinations such as India.

According to him, the immediate survival and higher revenue generation is the need of the hour. Tourism Minister Harin Fernando has assured that the global promotional campaign by SLTPB will be rolled out towards the last quarter and the President Wickremesinghe has proposed to roll out the new tourism plan later this year. These efforts will yield positive results by 2024 early 2025.

In a statement it claimed that a study done, of rates, in competing destinations in the region, shows that the rates being proposed are more than 130% above the average market rates, offered by hotels in the competing destinations.

“If implemented, it will be detrimental to the tourism industry and the Colombo hotels themselves that are already struggling.

Therefore it is abundantly clear, that this move will result in destination Sri Lanka, out-pricing itself,” they pointed out. It warned that the Indian market, particularly the Meetings, Incentives, Conferences, and Exhibitions (MICE) sector, will be impacted most by MRR.