By: Staff Writer

Colombo (LNW): Benefiting from the cost-reflective prices on fuel, Ceylon Petroleum Corporation (CPC) recorded a profit of Rs. 29.7 billion in the first quarter of 2023. However, Ceylon Electricity Board (CEB) recorded a loss of Rs. 34.4 billion in the first quarter of 2023 as the cost-reflective pricing mechanism was implemented only in mid-February 2023.

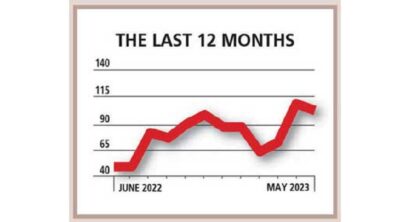

Despite the regular price adjustments since May, the CPC recorded an operating loss of Rs. 6.2 billion for the full year in 2022, compared to a loss of Rs.41.3 billion in 2021..

As an initial step, the Government decided to restructure CPC’s balance sheet by transferring the outstanding balance of the Government-guaranteed foreign currency denominated debt stock of the CPC, to the central Government debt stock.

This amounted to USD 2.44 billion (Bank of Ceylon: USD 1.34billion and People’s Bank: USD 1.09 billion), asof end December 2022.

However the CPC has residual liabilities to the Government for its on-lending of the Indian Line of Credit facility (USD 697 million), liabilities to the National Iran Oil Company (USD 251 million), and the Bankof Ceylon (Rs. 87 billion) , respectively with regard to importation of petroleum products

The State-run Ceylon Electricity Board (CEB) is no longer incurring losses from the supply of electricity, CEB Chairman Nalinda Illangakoon said .

Commenting on the CEB’s income and expenditure, the CEB Chair said: “they expect annual collection to be around Rs. 723 billion and the monthly collection to be Rs. 55 billion.

CEB is also anticipating a daily income of over Rs. 2 billion and we received this expected income in April and a similar income for May,” he said.

However during the year 2022, the Government took a policy decision to re-classify the selected foreign currency debts on the CEB balance sheet obtained from the China Exim Bank into the Government Balance sheet.

Accordingly,the outstanding loan balance of Rs. 214.7 billion (USD 591.4 million) as at the end of December 2022 obtained for the construction of the Norochcholai power plant was transferred into the Government Books of Accounts.

Further, action was also taken to convert the debts amounting to Rs. 146.5 billion, which were recorded as sub-loans in the CEB financial statements, into equity investment by the Government in CEB as at end December 2022.

In light of the challenged liquidity positions of both the CEB and CPC, the Government channeled Rs. 80 billion to the CEB to settle its outstanding debts to CPC during the year 2022.

Nonetheless due to large legacy debts, as of the end of the year 2022, CEB’s total outstanding debt to CPC and Independent Power Producers (IPP) remained elevated at Rs. 193.1 billion.

In the meantime, the total debt liability of the CEB to the state banks and project loans stood at Rs. 220.7billion at the end of year 2022.