While keeping his radio silence and switching on his ‘rediffusion’ , Central Bank Governor Nandalal Weerasinghe said with or without the International Monetary Fund (IMF), Sri Lanka needs to bring in reforms to correct the economy and put it on a sustainable footing.

“As an economy, we need medium- to long-term reforms to restructure the economy,” he said, speaking at the CA Sri Lanka’s Annual Research Symposium recently.

The Central Bank Governor also set the record straight on bilateral creditor discussions, citing that it had been miscommunicated disputing the announcement made at the recent cabinet media briefing. .

“During the post-Cabinet meeting media briefing, it has been informed that we have concluded the negotiations with bilateral creditors Paris Club, China, India and Japan.

“I saw some reports in the media as well. I think it was probably a miscommunication. We have not concluded discussions, but have made good progress. We are in the process of completing it. We intend to obtain the financial assurance somewhere in January,” he stressed.

Weerasinghe said once the financial assurance is obtained the next step is to present it to the IMF along with our macroeconomic policies. “On that basis, we will be able to stimulate the economy in the short term. But of course, we need long-term reforms and correct policies to fix the imbalances,” he added.

The third meeting between bilateral creditors and the Government concluded last Thursday in Colombo.

“We appreciate the progressive and constructive engagements,” State Minister for Finance Shehan Semasinghe said. “We wish to reiterate that we will maintain an equal, comparable and transparent debt treatment policy,” he said via a tweet.

Sri Lanka’s outstanding debt due to bilateral creditors’ amount to US $ 14 billion of which 52% is to China. Others include Japan and India.

Lanka held the third meeting with its bilateral creditors on debt restructuring, State Finance Minister said, as the island nation’s $2.9 billion International Monetary Fund (IMF) loan has been delayed amid agreement among its creditors are yet to be seen.

Sri Lanka could not hold the third meeting with bilateral lenders scheduled for November 17 citing the creditors need some clarification before the next meeting.

The creditors include geopolitical rivals China and India. No country has so far fully agreed with any of the debt restructuring system, government sources have said.

“Central Bank Governor Nindalal said Sri Lanka is now eyeing the January deadline for the IMF board approval to secure a $2.9 billion loan.

Officials say lack of consensus among Sri Lanka’s creditors over debt restructuring and some pending reforms in loss-making state owned enterprises (SOEs) have resulted in the delay.

Sri Lanka held its first meeting with bilateral creditors on October 14 and the second on November 03, though no consensus has been reached. President Ranil Wickremesinghe’s administration has said that it has been negotiating with India and China for debt restructuring separately.

Central Bank Governor says in rediffusion SL needs reforms with or without IMF

Korean firm takes the lead towards developing Trincomalee industrial harbour

Sri Lanka’s initiative of developing Trincomalee as an “industrial harbour” is now underway with a Korean firm stepping into setting up a container factory in Trincomalee with US$ 50 million investment.

The economically beleaguered nation will put up a couple of thousand hectares of land on lease to set up industries in a special economic zone and the associated development of the strategically located port, stirring up geopolitical interest in that part of the Indian Ocean.

Yakdong Industries Co. Ltd., one of the 10 leading companies in Korea has been given 50 acres site in Trincomalee for the establishment of a large scale container manufacturing factory in Trincomalee, according to the office of Prime Minister Dinesh Gunwardena.

Yakdong Industries Chairman Heung SeokGwon and the Vice Chairman Kyeong Won Shin called on Premier Gunawardena on Wednesday and assured that the constructions of the factory will be completed soon so as to commence production within the next six months.

The factory will be established on a 50 acres site in Trincomalee and the expected production is 10,000 containers per month. It has already selected 32 welders from Sri Lanka to work initially in Korea and they will be used to supervise the employees in the Sri Lankan factory in future. They will recruit 70 more employees to the factory.

A statement from the Prime Minister’s office said that leading international freight companies have already given orders to build containers.

The factory will also purchase discarded containers to be renovated and used for several other purposes such as sales outlets, dwellings, agricultural purposes etc.

Sri Lanka Ports Authority owns a large land, some 2,400 hectares, that surrounds the port of Trincomalee,” senior official of the SLPA said.

The plan to develop an industrial harbour in Trincomalee is a long-standing plan to monetize land that belongs to the Sri Lanka Port Authority, by getting foreign and local investment for a special economic zone, an industrial park, or an energy hub.

This would also entail the development of the port for non-containerized cargo traffic, such as cement, coal or other industrial raw material.

Prices of all short-eats slashed

The prices of all short-eats will be slashed with effect from today (18), as per a decision by the All Ceylon Restaurant Owners’ Association.

Accordingly, the prices of all short-eats will be slashed by Rs. 10, revealed Union Chief and Consumer Rights Activist Asela Sampath.

The decision comes in for the conveyance of the benefit of the price slash of several raw materials to the public, Sampath noted.

MIAP

SL’s manufacturing sector continues its decline amidst up in services

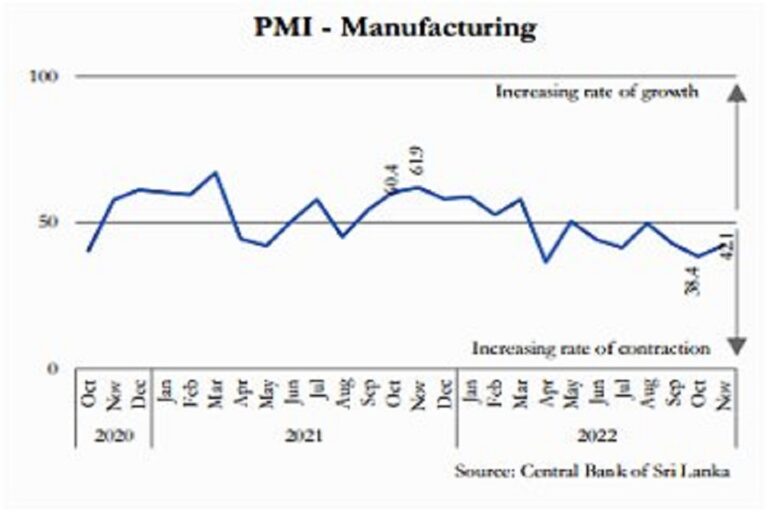

In the wake of 11.8 percent contraction of the economy in the third quarter, the country’s manufacturing sector entered the fourth quarter with a downturn continuing In November 2022 as per the Purchasing Managers Index (PMI) of the Central Bank.

The Central Bank has indicated a setback in manufacturing and service sector activities on a month-on-month basis.

Manufacturing sector setback was contributed by subdued performance observed in all the sub-indices, except for Suppliers’ Delivery Time.

New Orders and Production remained contracted in November mainly due to the subdued demand conditions, particularly in the manufacture of the food and beverages, and textile and wearing apparel sectors.

Many respondents representing the food and beverages sector mentioned that deterioration of purchasing power of the consumers was the major reason for the decline in demand.

In the meantime, export-oriented manufacturers, particularly in the textile and apparel sector, highlighted that the subdued demand was due to the economic slowdown in major export destinations and shifting of orders to other countries amidst stiff competition.

Besides these, acquiring required raw materials was an issue for certain manufacturers due to a shortage of foreign exchange.

Furthermore, Employment and Stock of Purchases declined in-line with the decline in New Orders and Production. Meanwhile, Suppliers’ Delivery Time lengthened in November 2022 compared to the previous month.

Expectations for manufacturing activities for the next three months indicated an improvement in November 2022 anticipating improvements in economic conditions.

Services sector recorded a slight increase in November 2022, but , yet remained slightly below the neutral threshold level.

The rate of decline in services activities was softened with the improvements observed in New Businesses, Business Activities and Expectations for Activity. However, Employment and Backlogs of Work declined during the month.

New Businesses improved in November 2022 compared to October 2022, particularly with the increases observed in some financial services, insurance, and other personal activities.

Business Activities in the services sector continued its increasing trend in November 2022 due to the upcoming festive season.

Accordingly, business activities related to other personal activities, financial services and telecommunication sub-sectors showed improvements compared to the previous month. Further, in line with the increase in tourist arrivals, business activities in accommodation, food and beverages sub-sector also increased.

However, business activities related to the wholesale and retail trade sub-sector declined further during the month amid the continued cost of living challenges.

Employment continued to fall in November due to increasing resignations, migrations and retirements though few recruitments took place in several companies. Meanwhile, Backlogs of Work dropped at a faster pace during the month.

Expectations for Business Activities for the next three months improved further especially with the festive season and optimism regarding improvements in economic conditions.

India’s Chief of Naval Staff leaves SL concluding official visit

India’s Chief of Naval Staff Admiral R Hari Kumar who arrived in Sri Lanka on 12th December 2022 on an official visit, left for India from the Bandaranaike International Airport yesterday (17) morning.

During his visit, Admiral Kumar had the opportunity to hold discussions with Commander of the Army, Lieutenant General Vikum Liyanage, Commander of the Air Force, Air Marshal Sudarshana Pathirana, Chief of Defence Staff, General Shavendra Silva, Defence Secretary, General Kamal Gunaratne (Retd), State Minister of Defence, Premitha Bandara Tennakoon, Prime Minister Dinesh Gunawardena, and President Ranil Wickremesinghe on matters of bilateral importance.

Moreover, the Indian Navy Chief took time off to pay his tributes to the fallen Indian soldiers at IPKF Memorial in Battaramulla. Visit to the National Defence College in Colombo and paying homage to the Temple of the Sacred Tooth Relic in Kandy have also been in his itinerary.

At the invitation of SL Navy Commander Admiral Nishantha Ulugetenne, he, as the Chief Guest, revived the Commissioning Ceremony of Midshipmen held at the Naval and Maritime Academy in Trincomalee on December 15.

Admiral Kumar also embarked on sightseeing tours in Galle and Trincomalee, before concluding his 06-day official visit to Sri Lanka.

On the sidelines of this visit, the Navy Seva Vanitha Unit, under the directives of its President Chandima Ulugetenne, had also organised a special programme for Mrs Kala Hari Kumar, the spouse of Chief of Naval Staff of India.

MIAP

Heavy showers above 100mm likely to occur at some places

Showers will occur at times in Eastern, Uva and Central provinces and in Polonnaruwa and Hambantota districts, and heavy showers above 100mm are likely at some places, said the Department of Meteorology in a statement today (18).

Showers or thundershowers will occur at several places elsewhere over the island during the afternoon or night. Fairly heavy showers about 75mm are likely at some places.

General public is kindly requested to take adequate precautions to minimise damages caused by temporary localised strong winds and lightning during thundershowers.

Marine Weather:

| The low-pressure area over Southeast Bay of Bengal persists over same region. It is likely to move westward towards southwest Bay of Bengal during next 36 hours. Wind speed will increase up to (50-60) kmph at times and showers or thundershowers can be expected in deep sea areas of South East Bay of Bengal and South West Bay of Bengal. Therefore, Naval and fishing communities are requested to be vigilant while engaging in marine activities in the above sea areas. Fishing and naval community are requested to be attentive to future forecasts issued by the Department of Meteorology in this regard. |

| Condition of Rain: |

| Showers or thundershowers may occur at several places in the sea areas around the island. |

| Winds: |

| Winds will be north-easterly and wind speed will be (30-40) kmph. Wind speed may increase up to (50-55) kmph at times in the sea areas off the coast extending from Trincomalee to Hambantota via Batticaloa Pottuvil and Kankasanthurai to Colombo via Mannar and Puttalam. |

| State of Sea: |

| The sea areas off the coast extending from Trincomalee to Hambantota via Batticaloa, Pottuvil and Kankasanthurai to Colombo via Mannar and Puttalam will be rough at times. Other sea areas around the Island will be fairly rough at times. Temporarily strong gusty winds and very rough seas can be expected during thundershowers. |

MIAP

As an island nation, SL should maintain good relations with all countries: President

President Ranil Wickremesinghe said that Sri Lanka should adopt a non-aligned foreign policy in dealing with the international community, as an island nation.

The President also pointed out that Sri Lanka can be elevated to a higher level in the international sphere by adopting a non-aligned foreign policy rather than supporting or being dependent on any powerful country or group of countries.

President Ranil Wickremesinghe made these observations yesterday morning (17) while taking part in the 97th Passing out Parade of the cadet officers of the Diyatalawa Military Academy.

Three hundred and fifty-one (351) cadet officers who completed their training at the Diyatalawa Military Academy were commissioned at the passing out ceremony.

It was a significant occasion where cadet officers from four foreign countries who received their training at the Diyatalawa Military Academy were also among those who were commissioned.

The Commander-in-Chief, President Ranil Wickremesinghe, who arrived at the Military Academy, was received amidst customary military pomp and pageantry.

The day’s events commenced with the President laying floral tributes at the war heroes’ memorial at the Diyatalawa Military Academy.

After the inspection of the parade, President Ranil Wickremesinghe presented the championship flag to the best cadet team and swords to the cadet officers.

The President also posed for a group photo with the commissioned cadets and planted a ‘Na’ sapling on the college premises to mark his visit.

The statement made by President Ranil Wickremesinghe is as follows:

Today is a very important day for you all as you complete your training at the Diyatalawa Military Academy. But it is a new beginning in your life for you will commence serving as regular members of the Army.

As the leaders of the Sri Lanka Army, you also have a responsibility of protecting the Army, and its soldiers and protect the republic from the enemy. It is entrusted to you by the republic and it is also of paramount importance to protect the honour and reputation of the institution where you were being trained.

As a country, we are not aligned or in any agreement with the world powers as we are an island nation. We should be friendly with all countries.

You are entrusted with the responsibility to protect this country and you have the capacity to protect the country from internal as well as external influences. The Army which you enroll into has war experiences including international warfare experiences since they are together with the UN Forces taking part in the operations in the state of Mali.

Hence you have the capacity to face any kind of challenge that may come in the future and I, therefore, entrust you with that responsibility to move forward strongly.

State Minister of Defence Pramitha Bandara Thennakoon, Chief of President’s Staff and Presidents’ Senior Adviser on National Security Sagala Rathnayake Defence Secretary General Kamal Gunaratne (retd), Chief of Defence Staff General Shavendra Silva, Army Commander Lieutenant General Vikum Liyanage and Diyatalawa Military Academy Commandant Major General Niyangoda were present at the event.

PMD

Sri Lanka Original Narrative Summary: 18/12

- Chief Government Whip Prasanna Ranatunga says SLPP would contest the next election under a new alliance with the symbol to be decided later: also says SLPP would form an alliance with the UNP: describes incumbent administration as a Wickremesinghe-Rajapaksa Govt.

- UNP General Secretary Palitha Range Bandara says the SLPP and UNP have not yet come to an agreement about contesting together in the coming elections: also says the UNP is ready to work with anyone to develop the country.

- Several SLPP MPs file Petition in the Court of Appeal seeking an order directing the authorities to conduct an investigation to ascertain whether former Army Commander General Shavendra Silva, IGP Chandana Wickremaratne or any others disobeyed President Gotabaya Rajapaksa’s orders to prevent damages to property and people on 9th May.

- Foreign Minister Ali Sabry says holding an election is not going to be a solution to the current crisis: asserts the solution depends on structural reforms that are to be done: also says no one is more knowledgeable and capable of undertaking that reform, than President Wickremesinghe: explains the ground reality is that people are happy with the President’s leadership.

- Lanka Coal Company Chairman Shehan Sumanasekera says coal imports from South Africa have been scheduled months ago to operate the coal-fired thermal plants: also says he doesn’t understand why CEB engineers say the country would face blackouts from March ’23 due to lack of coal at its thermal power stations.

- Negombo Additional District Judge Nuwan Tharaka Heenatigala orders to lay-by cases filed against President Ranil Wickremesinghe by the relations of those who died from the Easter Sunday bomb blast in Katuwapitiya, Negombo as long as Wickremasinghe holds the Presidency: asserts he is entitled to immunity as per Article 35(1) of the Constitution.

- Police arrest 75 persons during a drug raid carried out near 122 schools in the Western Province: recover 2.148 kg of ‘Mava’, 9.345 gms of heroine, 1.522 gms of ICE and 10 Ecstasy pills.

- Police spokesman says a total of 1,441kgs of heroin along with 45,801 suspects, 11,881 kgs of Ganja with 34,062 suspects, and 109 kgs of ICE with 10,532 suspects have been taken into custody so far this year.

- All Ceylon Bakery Owners Association Chairman N Jayawardena announces that the price of bread has been reduced by Rs.10.

- Ministry of Ports, Shipping and Aviation Official says 3 Sri Lankan companies have shown interest in launching a ferry service between South India (Puducherry) and

Kankesanthurai: affirms the service is expected to commence in January or February 2023.

“DP Coding School” Inaugural Ceremony at Delgoda Mahamevna Vidyalaya (VIDEO)

“DP Coding School,” the latest initiative by “DP Education” introduced by business magnet Dhammika Perera for free education for the children of Sri Lanka, was inaugurated at Delgoda Mahamevna Buddhist College on December 16, 2022.

The event was organised at the counsel of School Advisor Ven. Aludeniye Subodha Thera and the invitation of Principal C.C.D. Gamlath.

The awarding of certificates and prizes of the simultaneously held Information Technology contest and the opening of a new laboratory and a new Information Technology laboratory at the school have also taken place under the patronage of Mr. Dhammika Perera.

“What should be done for the country from my end, I am doing it. I made up my mind not to talk about politics, which is not out of disappointment. I have nothing to feel disappointment about. Because I came to serve what I was signed up for. As a Minister, I was given 16 days, out of which I was able to serve for only 10 days. During those 10 days I already fixed the institutions that should have been fixed. I do not see ministries, or responsibilities as a big deal. In my book, there is the way to fix all the ministries,” Perera told the reporters.

DP Education founded by Dhammika Perera and Priscilla Perera is an online free education platform dedicated to transforming learning and teaching experiences through free online education, best-in-class teachers, and the development of education infrastructure, and its latest initiative DP Coding School can be accessed Here : https://dpcode.lk/dashboard

MIAP

Why Monetary Policy further tightened in US, UK and EU, despite inflation peaking? What is the Rationale?

The year 2022 was seen as a historic year of super-monetary tightening by central banks across the world to tame high inflation. This high inflation is commonly accepted as the result of global supply chain bottlenecks inclusive of the Russian invasion in Ukraine since February 2022. The dramatic increase in energy prices consequent to Russian-Ukraine war led inflation to be persistent and wide-spread across the world because of the energy-driven-world economy. Therefore, the present level of inflation is considered as 40-year high in the developed world.

However, despite primary causes of such a high inflation, the policy response by central banks across the world has been to raise interest rates faster to bring down inflation to their targets in the unknown future.

Therefore, this article is to highlight the present status of the world monetary policies as shown by last week’s monetary policy decisions of the US Fed (Fed), Bank of England (BOE) and European Central Bank (ECB) who are the world’s leading central banks because their currencies are the reserves of the world monetary system similar to the gold prior to the Breton Woods Agreement and establishment of the IMF.

Habit of central banks during inflationary times

Historically, inflation is bread and butter of central banks on the old hypothesis of inflation believed to be a result of monetary expansion that causes people to demand goods and services more than the existing supply. Therefore, the monetary policy rule followed by central banks during unhealthy inflationary periods has been to tighten monetary conditions by raising interest rates to reduce the bank credit expansion. Their present monetary model is to raise or change the overnight interest rate (known as policy rates) that central banks apply on transactions with banks.

Therefore, the inter-bank bank overnight interest rate is the conduit that passes the monetary policy effects across the economy. Although both the inflation hypothesis and monetary policy rule have not been empirically proved so far despite the present information era, central banks follow them as the God-given, despite broad mandates given to them under relevant public laws.

Therefore, irrespective of ground reasons for high inflation, central banks and old monetarists behind them interpret inflation as the situation of the imbalance of the economy arising from the demand for goods and services being greater than their supply. This causes central banks to use their monetary policy tools to reduce the growth of bank credit or money by hoping that such credit tightening would help slow the demand to match the supply in the economy over the time not specified. Therefore, central banks believe that the lower demand will drive down prices and inflation. This is the inflation control hypothesis that central banks are accustomed to in their comfort zones.

Last week’s decisions of the Fed, BOE and ECB

All three central banks commenced raising interest rates after inflation rose to significantly high levels above their targets of 2%. Their rate hikes of 50 bps in the last week are as follows. In response, many central banks raised their interest rates be consistent with.

- Fed – 50 bps to 4.25%-4.50% on 14 December 2022. This is the seventh consecutive hike since March 2022.

- BOE – 50 bps to 3.5% on 15 December 2022. This is the ninth consecutive hike since December 2021.

- ECB – 50 bps to 2.5% (marginal lending rate) on 15 December 2022. This is the fourth consecutive hike since July 2021.

The rate hike history of the current cycle of the three centra banks is given below.

Interest Rate Hikes by Fed, BOE and ECB, bps

| Fed | BOE | ECB |

| March 22 – 50 | Dec 21 – 15 | July 22 – 50 |

| May 22 – 75 | Feb 22 – 25 | Sep 22 – 75 |

| June 22 – 75 | March 22 – 25 | Nov 22 – 75 |

| July 22 – 75 | May 22 – 25 | Dec 22 – 50 |

| Sep 22 – 75 | June 22 – 25 | Now 2.50% |

| Nov 22 – 75 | Aug 22 – 50 | |

| Dec 22 – 50 | Sep 22 – 50 | |

| Now 4.25%-4.75% | Nov 22 – 75 | |

| Dec 22 – 50 | ||

| Now 3.50% |

In addition, they have commenced a gradual balance sheet reduction as another tool to tighten financial conditions to be restrictive adequately with the inflation control phase.

Economic Conditions behind policy decisions

All three central banks focus on bringing down inflation back to 2% target and, therefore, side effects of policy tightening on the economy by way of reduced growth and increased unemployment are not considered. Some market analysists predict a recession in 2023/24 consequent to the high speed of the rate hikes in the current cycle.

The headline inflation numbers used by all three central banks have passed their peaks in recent months as follows.

Recent inflation Rate (%) – US, UK and EU

| 2022 Month | US | UK | EU |

| June | 9.8* | 9.4 | 8.6 |

| July | 8.5 | 10.1 | 8.9 |

| August | 8.3 | 9.9 | 9.1 |

| September | 8.2 | 10.1 | 9.9 |

| October | 7.7 | 11.1* | 10.6* |

| November | 7.1 | 10.7 | 10.1 |

However, they raised interest rates by another 50 bps last week and announced that the rate hikes and policy tightening would continue in 2023 and beyond until they are confident that financial conditions are restrictive enough to bring down inflation back to 2% target in a sustained way.

They welcomed inflation reduction in monthly phase as at present and showed confidence in falling inflation. However, they declined to predict any rate cuts and policy loosening in the near future, given the present level of high inflation broad-based in the economy as compared to the long-term inflation target of 2%. Therefore, peaking inflation was not a factor considered by all three central banks. Therefore, all three announced to stay the course of further policy tightening.

Policy tightening to stay the course despite inflation falling from the peak

All three central banks are not complacent on the reduction in inflation from the peak based on the total consumer price index but assess the persistent price/inflation pressures by analyzing the major categories of the price index. Accordingly, the present ease of inflation has come from falling of food inflation attributable to improvements in supply chains towards pre-pandemic levels. However, energy, housing and services inflation are reported to be strong and rising further.

Energy inflation is a result of ongoing Russian-Ukraine war and not predictable. Housing (rent) inflation is to rise further due to fixed rate lease agreements to be renewed in 2023 with higher interest rates. Therefore, housing inflation cannot be expected to fall until rate cuts are implemented. Service inflation relates to the tight labour market conditions and rising wages. As there is a structural shortage of labor force after the pandemic impact, services inflation cannot be expected to ease until unemployment rises to high levels together with recessionary economic outcomes in next two years resulting wages to come down. A considerable reduction in the GDP growth and employment are predicted by all three central banks as well as markets.

Therefore, inflation passing the so-called peak or falling in last few months is not a factor to stop or ease the present tightening phase of the monetary policy. In fact, the Fed Chairman responding to a question on possible rate cuts in the near future stated that “our focus right now is really on moving our policy stance to one that is restrictive enough to ensure a return of inflation to our 2 percent goal over time. It’s not on rate cuts. And we think that we’ll have to maintain a restrictive stance of policy for some time. Historical experience cautions strongly against prematurely loosening policy.”

However, as inflation is seen to be easing on food after a high speed of rate hikes so far, their question now seems to be not about the speed of hikes but about how high to raise rates by looking at the progress on inflation and assessment of financial conditions whether policy is restrictive enough to bring down inflation back to 2% target in a sustained path.

Therefore, markets make forecasts of what should be the terminal policy interest rates and how long they will stay before the rate cutting cycle starts. According to the Fed FOMC members’ forecasts, the fed funds rate is 5.1% in 2023 and 4.1% in 2024. Currently, markets predict a terminal rate of 3.0%-3.75% for ECB and 4.25% for BOE. These predictions change in response to updated outlooks for inflation, growth and unemployment.

However, inflation is predicted to fall towards the 2% target only in 2025 or later. Lower inflation predictions are primarily driven by the base effect of high price index reported during the past two years.

Lower inflation is predicted at a significant macroeconomic cost in terms of the reduction in GDP growth and increase in unemployment rate. These central banks are free to raise interest rates as unemployment benefits to people loosing jobs are available through the fiscal front.

Sri Lankan near-term monetary policy outlook

Sri Lankan central bank Governor recently stated at ADA Derana HYDE PARK interview that inflation which could have been peaked at 100% was peaked at 70% and now it is in downward path due to the tight monetary policy and, therefore, interest rates also should be coming down with that as a relief to all. However, this view is questionable on following grounds.

- Sri Lankan monetary policy is also designed on the inter-bank market-based policy models of the Fed, BOE and ECB. Only difference is that Sri Lankan central bank prints majority of money through primary purchases of government securities to fund the budget whereas others do it through the secondary market for the purpose of stabilizing market interest rates at their discretion within the monetary policy. All three central banks as highlighted above are to continue to raising rates despite inflation peaking and falling.

- Sri Lankan inflation peak and marginal fall in last two months have mainly come from the food category consequent to improvement in supply conditions as a result of improvement in fuel and electricity distribution supported with fiscal actions. However, given the current levels of exchange rate, import controls and taxes, non-food prices cannot be expected to fall any time in the future. Further, prevailing high cost of living, increased energy prices and rising wages in the informal sector would keep services inflation persistent.

- At present, policy interest rates in Sri Lanka are 14.5%-15.5% with 4%-6% inflation target in the monetary policy while the CCPI inflation is 61% in November 2022 and both annual average inflation and average core inflation continue to rise. The current phase of inflation is after a jump from 9.9% in November 2021 to the peak of 69.8% consecutively in September 2022. Therefore, the peaking and marginal fall of inflation in the last two months are not factors to be considered in monetary policy if it is geared purely for bringing down inflation back to 4%-6% in a sustained path.

Therefore, when monetary policy statements of the Fed, BOE and ECB on last 14th and 15th are considered, Sri Lankan central bank Governor’s statement of interest rates to come down with presently downward inflation from peak at 70% does not comply with the accepted rationale and principle underlying the present monetary policy model for the control of inflation.

In fact, it requires further rate hikes of high magnitudes in 2023 and 2024 until supply conditions are improved upon the stabilization of the foreign currency front, removal of import controls and a major rate of currency appreciation.

However, if the Governor is to respond that Sri Lankan economy is different from developed countries and now needs to lower interest rates to support the recovery of the economy from the current level of contraction (11.8% in the third quarter 2022) and to reduce the cost of budgetary financing (32% at present despite excessive monetary financing), the central bank must launch a new monetary policy model without delay to suit that view.

Further, two views expressed by the Governor at the above media interview relating to Sri Lankan monetary policy as stated below are factually incorrect in terms of the provisions of the Monetary Law Act (MLA) that governs the monetary policy.

- The main objective of the central bank is the price stability or low and stable inflation at 4%-6%.

- There is a provision in the MLA that if the government cannot finance the budget deficit by raising money through domestic market and external market, the central bank can monetize the balance or print money and finance the deficit. When the central bank does that when the government fiscal policy or Treasury asking to print money, it is inflationary and the central bank cannot maintain the objective of inflation target.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 10 Economics and Banking Books and a large number of articles publish.

The author holds BA Hons in Economics from University of Colombo, MA in Economics from University of Kansas, USA, and international training exposures in economic management and financial system regulation)

Economy Forward: https://economyforward.blogspot.com/2022/12/why-monetary-policy-further-tightened.html