In a fresh fiscal policy stance of austerity measures, the Finance Ministry has cut down non-essential capital expenditure in ministries, departments and state institutions in a bid to save money during this economic crisis, a Ministry circular revealed.

Treasury Secretary Mahinda Siriwardene in a circular to government departments, provincial councils and statutory boards has ordered to cut controllable expenditure by at least 30 per cent with suggestions to curb spending, ranging from development projects, advertisement and publicity to overtime allowance.

It has also been directed to suspend all new projects and those that have been started and stalled due to lack of raw materials.

“Improving the government revenue is essential to control present financial crisis situation,” Mr. Siriwardene said adding that public expenditure will have to be controlled to save cash inflows for the most essential services for a certain period.

This austerity move comes close on the heels of Treasury findings that Sri Lanka spends too much on defense and spends its budget inefficiently. In fact, the government spends more on defense today than it did at the war’s peak – a finding that stands even when adjusting for inflation.

According to the Ministry analysis, it estimated that the government could gain a paradigm improvement in the level and quality of its security while cutting defense expenditure from 2.1 per cent of the gross domestic product (GDP) to below 1.5 per cent.

In the most efficient scenario, the government could significantly improve its security services while reducing defense spending to 0.7 per cent of GDP amounting to annual savings of Rs.466,62 billion.

The Ministry has recommended cutting Rs.5 billion from the allocation of Rs.12 billion made from 2022 budget for the ongoing construction work of the Sri Lanka’s Pentagon-styled Defense Headquarters building complex at Akuregoda, Battaramulla.

In addition, necessary action will be taken to totally slash the sum of Rs. 111.6 million set apart for modern technology and infrastructure facilities to strengthen national security.

It has also recommended cutting down Rs 20 million out of Rs 50 million allocated for infrastructure facilities at Kotelawala Defense University and Rs 40 million from the allocation of Rs. 50 million to its teaching Hospital at Werahera Boralesgamuwa.

Financial allocations allocated to Health and Education will not be slashed, a senior Treasury official said adding that with the proposed interim budget 2022, it is just about cutting down expenditure, to the bone where possible and transferring it to welfare of the poor and vulnerable people in the country.

Finance Ministry prunes ministries and department spending

SOEs face fresh operational and financial challenges amidst political turmoil

Sri Lanka’s State Owned Enterprises (SOEs) are encountering significant operational and financial challenges for its survival in unprecedented political turmoil amidst the weakest state of the economy at present, recent report of the Finance Ministry revealed.

The lack of foreign exchange liquidity has adversely affected the supply chain management of many key SOEs, particularly in the energy and transportation sectors. The negative impacts of this have been experienced across the entire economy.

During the first four months of 2022, the key 52 SOEs reported a significant loss of Rs. 859 billion which is a significant deterioration compared to the loss of Rs. 13 billion in the corresponding period in 2021.

The key driver of the loss is the foreign exchange loss of CPC due to the depreciation of the currency. The exchange loss of Ceylon Petroleum Corporation (CPC) stood at Rs. 549 billion in the first four months of 2022, the report disclosed.

The primary concern is the legacy debt of CPC that is predominantly in foreign currency, resulting in frequent foreign exchange losses for the entity which in turn results in additional fiscal stress for the government and financial stress for the state owned banks.

As a result, the CPC has negative equity of Rs. 986 billion as at end April 2022. The Ceylon Electricity Board (CEB) has also not revised electricity tariffs for close to 8 years, contributing to an accumulated loss of Rs. 236 billion.

The rising cost of fuel and coal in the global market coupled with the depreciation of the currency has contributed to a spike in the CEB’s operating cost, which calls for an urgent adjustment of pricing for this sector.

It is important to address the financial position of these two key energies related SOEs in order to ensure a stable and sustainable supply of energy to support economic activity across the board, the Finance Ministry report suggested.

As a result, the CPC has negative equity of Rs. 986 billion as at end April 2022. The Ceylon Electricity Board (CEB) has also not revised electricity tariffs for close to 8 years, contributing to an accumulated loss of Rs. 236 billion.

Sri Lankan Airlines (SLA) is another SOE that has significant fiscal implications with losses for 2021/22 reaching Rs. 171 billion, creating a going concern issue for the entity, the report added.

Solutions to the foreign exchange crisis

Given that fuel supplies will run out, the Government has closed schools, extended power cuts, and restricted fuel issues. Through this the Government is desperately trying to stretch out the remaining fuel supplies for a few more days until the supplies come next week and thereby ensure the country will not shut down totally and industries operate.

The export industries have devised a scheme to keep their diesel supply going by paying in USD. Ironically people have to stay in queues for more than 48 hours to get fuel. This has affected the transportation of goods and essentials, people are finding it near impossible to go to work. According to sources, shipment of diesel and petroleum is due on 13 and 14 July, as the Government admitted Sri Lanka is running short of USD to pay for the shipments. The usable reserves are estimated to have grown to around $ 200-300 million. The Government needs around $ 400 million to import oil and gas for a month. The Government, according to the Prime Minister, is already about $ 750 million in debt to several fuel suppliers. So what can the Government do in the short term to improve the forex liquidity?

Solutions

The country, according to the Prime Minister, is fully focused on obtaining assistance from the IMF, WB, ADB and friendly foreign governments and restructuring the debt. The Central Bank is also meanwhile looking to make the exporters bring back all the earnings to the country as well as imposing a proper system of checks to ensure this is done. Analysts say around 20% of the foreign exchange does not return to the country for surrender. There is no real data to back this argument until the Central Bank and Treasury up their game. Until this is resolved there will never be a solution to the forex crisis in the near term. This has nothing to do with the Havala system or Undial that moves millions of $ around monthly.

The Government according to experts has several options in the short to medium term to manage the forex liquidity:

A. Goods exports

1) Make mandatory export bills on DA/DP terms and retain the open account ban on exports.

2) Exporters be allowed to both surrender the export proceeds in part or in full and retain USD for imports of export inputs only, including emoluments of expatriate staff.

3) Aviation fuel and other goods supplied for payment in USD should be subjected to full surrender into LKR

4) Disallow banks and financial institutions from lending LKR to exporters, even on the collateral of their holdings of USD balances – both resident and non-resident.

5) Disallow exporters from purchasing USD for LKR from banks to pay for USD imports, charges and other USD outflows, when it is below their USD holdings anywhere in the banking system

B. Services exports

1) Allow open account exports for services only or import bills

2) Services exporters be allowed to both surrender the exports proceeds in part or in full and retain USD for imports of export inputs only, including emoluments of expatriate staff,

3)Give a Foreign Exchange Earnings Certificate (FEEC) in LKR up to (say) 25% of the surrendered USD and valid for 12 months, which can be used for specific LKR payments via the banking system – machinery Capex, IT software/hardware, settlement of LKR debts from the banking system, etc.

4) Export of services for payment in USD should be subjected to full surrender into LKR, subject to retention for specific import content like expat USD emoluments, import of input goods

5) Disallow banks and financial institutions from lending LKR to service exporters, even on the collateral of their holdings of USD balances – both resident and non-resident.

6) Disallow service exporters from purchasing USD for LKR from Banks to pay for USD imports, charges and other USD outflows, when it is below their USD holdings anywhere in the banking system

C. Worker remittances

1) Give a Foreign Exchange Earnings Certificate in LKR up to (say) 35% of the surrendered USD and valid for 12 months, which can be used for specific LKR payments via the banking system – motor vehicle purchases, IT software/hardware, settlement of LKR debts from the banking system, etc.

D. Prioritise imports with limited forex

1) Food imports where local substitutes are unavailable

2) Fuel imports transportation/aviation and power generation – aviation fuel should be sold in USD and the proceeds subject to full surrender into LKR

3) Medicines and hospital supplies

4) Energy imports like LP gas and Coal

E. Multilateral, bilateral and commercial/bond market borrowings

1) Interest payments, preferably restructured debt or otherwise

2) Capital repayments, preferably restructured debt or otherwise

F. Import control measures

1) Increase duty and tariff charges on non-essential items to discourage imports. This will also help increase government revenue.

2) Obtain data of goods imported from Jan. to May 2022 against Jan. to May 2021 to identify access quantities of commodities imported and being held as excess stocks. (This data can be obtained from Sri Lanka Customs). Impose higher duty/tariff charges for these items to restrict imports

3) Reporting of unpaid import bills on DA terms is sent by banks to the Imports Controller when bills are outstanding for more than six months. Majority of these payments could still go through Undiyal (Hawala) and six months may be too late to take action. Reduce the same to two months, so that the import controller can act on unpaid bills without delay.

4) Prevent smuggling of goods into the country (hand carrying of items, etc. for commercial purposes) with tighter Customs controls.

Expatriates

5) Lift the restrictions made on outward remittances pertaining to PFCAs held by residents, to encourage more inflows without the fear of funds getting blocked.

6) Permit Dual Citizenship holders and PR Holders to obtain LKR facilities from LCBs for any purpose and with mandatory repayment of these loans through inward remittances.

G. Find innovative ways to bring the USD in the grey market into the banking system.

H. Negotiate a trade finance arrangement with a multilateral partner for opening of and confirming LCs.

Conclusion

Prime Minister Wickremesinghe has warned citizens that “the next couple of months will be the most difficult ones of our lives”. This situation could lead to a major drop in business revenue and loss of hundreds and thousands of jobs. Therefore a PPP crisis management team needs to be established soon to lead the recovery for the next six months with clear goals. The policy of printing money to pay salaries and pensions to public servants and meet the other expenses needs to be gradually reduced, because this will result in hyperinflation followed by a massive increase in the price of goods. However tough, the interest rates need to move down to support business recovery. Therefore unless Sri Lanka sorts out its financial metrics soon and minimises the political drama, the public will have a steep price to pay in the next 12 months for the years of mismanagement of our leaders.

(With contributions from D. Soosaipillai and M. Cooray.)

DAILY FT

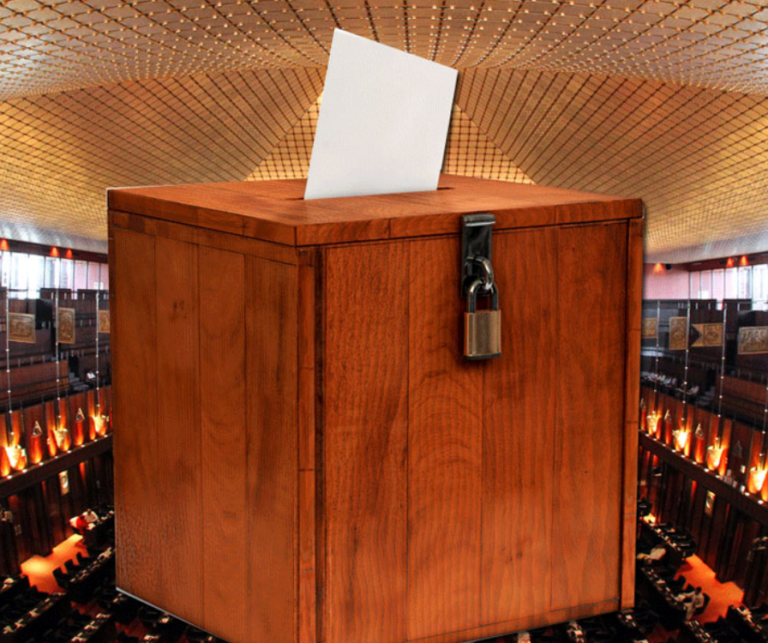

RW to be sworn in as the 8th Executive President tomorrow

Ranil Wickramasinghe, who was elected as the 8th Executive President of Sri Lanka, is scheduled to take oath tomorrow (21).

It will be done from the Parliament complex.

Ranil Wickramasinghe acted as the Acting President after the resignation of Gotabaya Rajapaksa from the office of President and the selection of the successor President was done today (20) by secret ballot in the Parliament.

Accordingly, Wickramasinghe got 134 votes, while Dallas Alahapperuma and Anura Dissanayake, who ran for the presidency, got 82 votes and 03 votes respectively.

Opposition leader Sajith Premadasa, who was going to stand for candidacy, withdrew from the party in support of Dallas Alahapperuma.

However, even though there was public opposition to Ranil Wickramasinghe outside the Parliament, it was not reflected in the Parliament and he was elected as the 8th Executive President.

A special announcement from the Ministry of Education about conducting schools…

The Ministry of Education says that even though the school education activities started from July 25th, the schools will be held only on Monday, Tuesday and Thursday.

The announcement states that students should be directed to home-based learning processes or online education on Wednesday and Friday, when schools are not held.

Also, as mentioned above, a special schedule should be prepared so that all subjects are taught during the three days of school.

Also, the Ministry of Education emphasized that although it is mandatory for students and staff to come to school on time, they should not be inconvenienced in the case of absences and delays due to reasonable reasons.

Ranil wins!!!

Ranil Wickramasinghe has won the election held in the Parliament to elect a new President.

Votes were received as follows.

Ranil Wickramasinghe – 134

Dallas Alahapperuma – 82

Anura Dissanayake – 3

Two MPs abstained from voting and 4 of the votes cast were cancelled.

4 votes announced as invalid votes

Parliamentary Secretary General Dhammika Dissanayake stated that 4 of the votes cast in the polling held in Parliament today (20) were invalid votes.

Accordingly, the number of valid votes is 219 and a candidate needs to get 110 votes to win.

Ansell Lanka is officially certified as a Great Place to Work

The distinctive people-centered culture at Ansell Lanka, part of a world leader in providing superior health and safety protection solutions that enhance human wellbeing, is now recognized with the Great Place to Work Certification™ awarded by the global authority of workplace culture.

Based on the Trust Index survey by the Great Place to Work Institute followed by a comprehensive and holistic culture brief, over 85pct of employees scored to various positive statements. This milestone goes onto prove Ansell Lanka’s passion and drive to create engaging employee experiences.

Employees at Ansell Lanka are the torchbearers of its global values namely integrity, agility, passion, teamwork, trustworthiness, creativity, involvement and excellence which are deeply rooted and embedded into its culture. Such values are actively reinstated through highly effective activities and programs, including when onboarding and transiting new employees.

Ansell Lanka believes in actively listening to its employees and always stand by them. ‘Ansell Ape’ was established to ensure and encourage employees have a voice in taking up all their concerns, with stringent policies for zero tolerance on harassment and discrimination. Very recently, Ansell Lanka also launched various themes and messages to further enhance understanding on Diversity, Equity and Inclusivity (DEI) practices, namely for different thinking styles, gender diversity, generations in the workplace, race and ethnicity, persons with mobility issues, and women leadership.

Innovation, knowledge sharing, and groundbreaking thinking is a continuous routine at Ansell Lanka. Its employees have consecutively won numerous awards at Ansell’s Innovation Awards, and everyone is included in developing ideas and problem-solving solutions including embracing the Kaizen philosophy and awards for continuous improvements, waste minimization and lean discipline at the floor level.

Some of the benefits at Ansell Lanka include career growth and learning opportunities one could expect from a truly global company, production incentives, monetary rewards for spot recognitions for ideas generated, distress fund, library facilities, extracurricular sporting activities and spacious in-house gym facilities, among others. Employees can access the newly established 24/7 Medical Center inhouse with well trained nursing staff and a qualified doctor.

An Employee Day is held annually with the view of celebrating their contribution including a Family Day to rejoice with their families at our workplace every other year. Ansell Lanka engages with the local communities across the country, and has an annual Scholarship Awards program for employees’ children, who have gained University entrance and those who have been successful at the Year 5 scholarship examination. There is also a program held once every nine months to create awareness for expectant female employees.

COVID-19 is a continued health and safety priority at Ansell. Its organization wide ‘Back to Better’ program includes webinars on topics such as managing burnout, self-care when remote working, resiliency, physical and mental health tips, and posting employee mental health updates and recourses. Managers are also encouraged to have open conversations about mental health and wellbeing.

The voting in Parliament to elect a new President has now ended

The voting in Parliament to elect a new President has now ended.

Accordingly, the counting of votes has started.

Harin Fernando for Ranil Wickramasinghe, Dylan Perera for Dallas Alahapperuma and Vijitha Herath for Anura Kumara Dissanayake have participated in monitoring the counting of votes.

Selvaraja Gajendran and GG Ponnambalam abstained from voting in this poll.

The voting for the election of the new president begins!

The voting in the Parliament to elect a new President has now started.

This is the first time in the history that such a poll is being held in the Parliament of Sri Lanka for the appointment of a successor president.