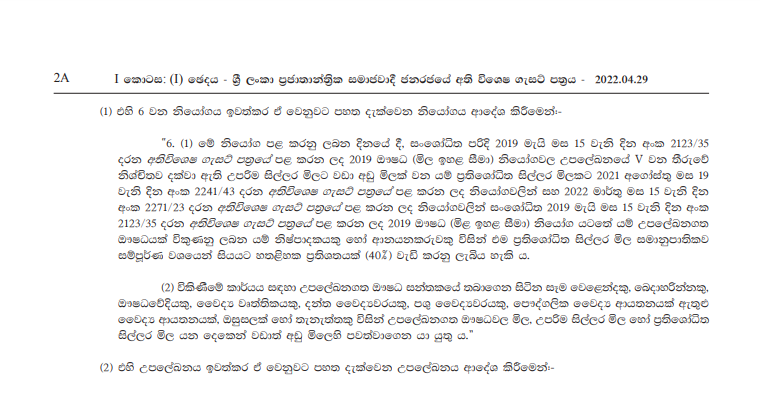

The Central Bank has taken new measures to improve the domestic foreign exchange market to present forex liquidity in local banks .

Finance Ministry will issue a new gazette notification under the Import and Export Control Act, making all payments on imports to Sri Lanka through a banking system compulsory, says the Central Bank Governor. Dr. Nandalal Weerasinghe

Addressing a special media briefing on Friday 29 , Dr. Nandalal Weerasinghe said several measures will be taken by the Finance Ministry and the Central Bank to curb the transactions in foreign exchange outside the banking system.

He noted that the reason for the foreign exchange shortage in the local banking system is the remittance of funds through informal transfer systems such as Hawala and Undiyal.

As the first step against informal fund transfer methods, a gazette notification is expected to be issued either today or tomorrow to make it mandatory that all payments for imports to the island are made through the banking system.

He also assured that the Central Bank would give its best to minimize these informal fund transfers and demand for such transfers.

If the payments are not made through the banking system, the imported items will not be cleared by the Customs, the Central Bank governor added.

He noted that going forward imports will be allowed only on the basis of Letters of Credit (LCs), Documents against Payment (DP) or Documents against Acceptance (DA) terms. Any imports other than these three methods will not be cleared by the Customs. About 20% of imports come via Open Account terms.

The move, according to the Governor, will help curtail the grey forex market as well as unofficial remittance channels such as Hawala or Undiyal which is a source to finance imports made in Open Account method.

It was pointed out that given the demand for forex by those engaged in Open Account imports, the grey market thrived with help from Hawala/Undiyal channels. This also encourages a higher premium for foreign currency via this option.

Whilst noting that the premium or the gap between rates offered by formal banking channels and grey market is reducing, Dr. Weerasinghe said the latest measure will minimise it further.

More importantly, ban of Open Account transactions will also help reduce unnecessary imports. Due to ongoing initiatives, imports in March had reduced to $ 1.7 billion from $ 2 billion in December whilst the Central Bank hopes new measures will help it to be reduced to $ 1.5 billion.

Though noting that there was a degree of overshooting of the currency or that it is overvalued, CBSL Chief urged migrant workers to channel their remittances via official banking channels.

“He recalled that the country used to get $ 500 million monthly and $ 7 billion annually in the past in the form of workers’ remittances and helping the Balance of Payments.

He dismissed the perceptions that sending money via official channels gets squandered by the Government and stressed that such a course will only help their families whilst benefiting the nation.

In response to a question on the mandatory foreign currency conversion by tourists in order to obtain goods and services, Dr. Weerasinghe said the Central Bank will look into relaxing the directive to encourage all foreign currency remittances to be routed through the banking system.

This is not good for the tourism industry and it is an inconvenience for the tourists, he added.

Meanwhile, with regard to the recruitment of debt advisors, Dr. Weerasinghe said the process is in progress and that the Central Bank expects to submit its proposals to the Cabinet of Ministers within a period of one or two weeks.