By: Staff Writer

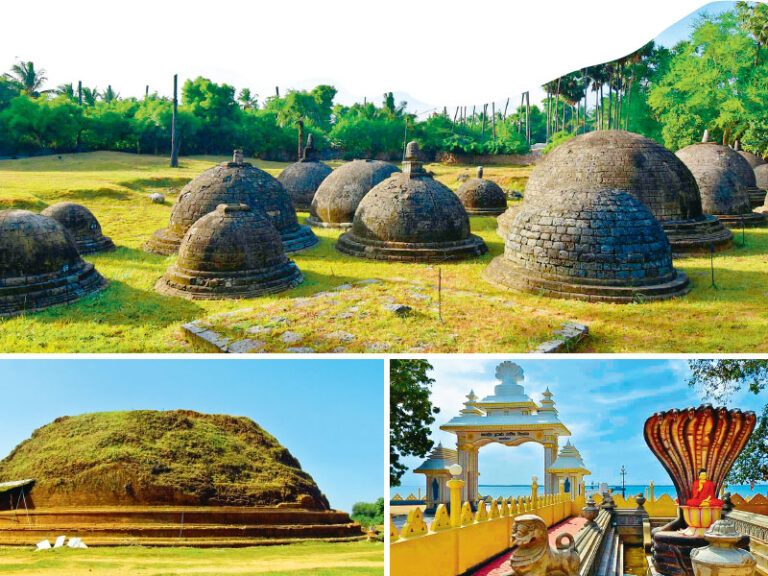

November 16, Colombo (LNW): Sri Lanka’s ability to protect its rich archaeological heritage has come under sharp scrutiny following revelations of major gaps in site documentation, law enforcement and financial management within the Department of Archaeology purview.

Despite having a dedicated state institution and a vast catalogue of ancient sites, nearly half of the country’s known archaeological locations remain without official protection, exposing them to theft, encroachment and destruction.

According to the latest National Audit Office report, the Department of Archaeology had identified 5,664 archaeological sites by the end of 2023. Yet 2,706 of these a staggering 48 percent had not been declared and published in the National Archaeological Sites Gazette. Without formal gazetting, these sites lack legal safeguards, leaving them vulnerable to illicit digging, treasure hunting and unauthorised development.

The department’s digital documentation efforts are equally concerning. Of the 1,758 sites uploaded into its geospatial database, more than 69 percent of geographic data for registered locations had not been fully recorded. This means that a majority of ancient sites do not appear in the official digital mapping system, undermining monitoring, research and enforcement.

The audit also points to troubling failings in the enforcement of the Antiquities Ordinance. In 2023 alone, 179 incidents related to the theft, destruction or illegal excavation of antiquities were reported. In 12 cases, suspects were never identified, and in 64 others, although suspects were known, legal action was never initiated. These lapses have allowed offenders to evade prosecution, sending a damaging signal that illegal antiquities trade can continue with minimal consequences.

Further, the department has failed to execute key legal responsibilities under the Antiquities (Amendment) Act of 1998. The law requires authorities to recover illegally used antiquities, secure endangered sites and reward informants by allocating half of the court-imposed penalties to an antiquities reward fund.

However, due to delays in drafting and implementing necessary regulations, Rs. 130.5 million in court fines collected in 2023 were never transferred to the fund. As a result, informants, law enforcement partners and field officers received no incentives to assist in heritage protection.

Financial inefficiencies extend beyond legal penalties. The Department of Archaeology also neglected to revise fees for providing archaeological recommendations for mineral and stone extraction despite clear instructions to review charges every three years, with increases capped at 15 percent.

The failure to update these fees since 2019 has cost the government significant revenue. Similar lapses were noted in the temporary leasing of the historic Nupe Old Holland Market Building in Matara, where fees remained unchanged at just Rs. 5,000.

These shortcomings collectively highlight a systemic failure in safeguarding the nation’s historical legacy. With nearly half of archaeological sites lacking legal protection and enforcement mechanisms weakened by poor administration, Sri Lanka’s ancient heritage faces mounting risks. As calls grow for stronger protection frameworks, the Audit Office’s findings underscore an urgent need for reform, accountability and modernised practices to prevent the irreversible loss of history.

Sri Lanka Fails to Safeguard Ancient Heritage despite Oversight

BOC’s Nine-Month Results Cement Its Role as Sri Lanka’s Economic Anchor

By: Staff Writer

November 16, Colombo (LNW): The Bank of Ceylon has reinforced its status as the country’s most influential financial institution, reporting a Profit before Tax of Rs. 87.7 billion for the first nine months of 2025. The strong results signify the bank’s ability to stabilise, expand, and support the wider economy at a time when Sri Lanka continues rebuilding from recent fiscal shocks.

Chairman Kavinda de Zoysa said the results underscore how BOC blends commercial success with social responsibility. “Our growth must uplift every Sri Lankan. Through youth empowerment, SME support, and affordable digital services, we aim to build an economically empowered nation,” he said.

BOC recorded a 62% jump in Net Interest Income to Rs. 153.2 billion, supported by strategic interest rate management and rising customer activity. Interest income grew by 15%, while interest expenses fell by 5%, helping the bank widen its margins significantly. Non-interest income grew 11% to Rs. 16.8 billion on the back of expanding retail and digital banking usage.

Total operating income reached Rs. 181.1 billion, while costs were tightly controlled, rising only 6% and reducing the cost-to-income ratio to 32%. After settling taxes on financial services and income, BOC posted a Profit after Tax of Rs. 55.7 billion. The bank also contributed Rs. 55.3 billion to government revenue, underscoring its fiscal importance.

CEO Y.A. Jayathilaka highlighted that beyond financial performance, BOC’s strategy is anchored in community impact and long-term stability. “We are building a future of resilience, shared prosperity, and real economic value for the next generation,” he said.

BOC’s total assets rose to Rs. 5.5 trillion, with notable increases in government securities. Loans climbed to Rs. 2.5 trillion and deposits to Rs. 4.6 trillion. Credit quality remained stable, supported by an 18.7-billion-rupee impairment charge and strong provisioning.

The bank maintained solid capital levels and sector-leading liquidity, while key profitability metrics such as ROA and ROE remained strong.

Its digital transformation gathered momentum with the launch of the BizPlus MSME credit card, enhanced remittance platforms, and wider digital adoption across customer segments. Sustainability also gained traction, with 100 branches generating solar power and BOC joining global carbon-accounting initiatives.

On the ground, the bank expanded financial inclusion with new agent banking centres, the Gammana programme, and rural outreach efforts aimed at raising financial literacy and access.

With top global rankings from The Banker, recognition as Sri Lanka’s most valuable brand, and its AA-(lka) national rating reaffirmed by Fitch, BOC enters the remainder of 2025 in a position of unmatched strength, poised to deepen its role as the country’s economic anchor.

Who Really Approved Sri Lanka’s 2022 Debt Default Decision?

By: Staff Writer

November 16, Colombo (LNW): Sri Lanka’s contentious 2022 decision to suspend external debt repayments has resurfaced, with former Finance Minister Ravi Karunanayake challenging the legality and transparency of the move that pushed the country into its first-ever sovereign default. His renewed scrutiny has revived debate over whether the suspension announced by newly appointed Central Bank Governor Dr. Nandalal Weerasinghe was a necessary economic safeguard or an unconstitutional act executed without proper authority.

Karunanayake, in a detailed letter to President Anura Kumara Dissanayake, has demanded clarity on who authorised the April 12, 2022 declaration halting all foreign debt servicing. He alleges that neither Parliament nor the Cabinet approved the decision and that no legal framework permitted the Central Bank or Finance Ministry to unilaterally suspend payments. The move, he argues, “redefined the country’s economic destiny without the people’s representatives being consulted.”

Media reports from the time confirm that Dr. Weerasinghe, only days into office, told reporters that debt repayment had become “challenging and impossible,” describing the suspension as a temporary measure until negotiations with the IMF and creditors progressed. It was widely portrayed as a prudent step to conserve scarce foreign reserves for critical imports, including fuel, medicine and essential food items.

However, no official documentation Cabinet papers, Monetary Board decisions or advice from the Attorney General has ever surfaced confirming formal approval for the default announcement. The absence of a clear decision-making trail has intensified questions over procedural legitimacy.

The economic backdrop in early 2022 was catastrophic. By March, Sri Lanka’s usable reserves had dwindled to near-zero. Total official reserves stood at US$1.9 billion most of it unusable while foreign debt obligations for the year exceeded US$6 billion.

World Bank data later revealed that by mid-2022, reserves excluding the Chinese swap line had plunged below US$400 million. Maintaining debt payments and financing essential imports had become virtually impossible.

Economists generally agree that default was inevitable under these conditions. But the crux of Karunanayake’s argument is that inevitability does not override constitutional procedure. A sovereign debt default, he stresses, cannot be declared through a press briefing alone.

The fallout was immediate and devastating. International credit rating agencies slashed Sri Lanka to junk status, the rupee plummeted by nearly 80 percent, and inflation soared above 60 percent. Millions were pushed deeper into poverty, and by 2023, the government was compelled to secure a US$3 billion IMF Extended Fund Facility to stabilise the economy. Sri Lanka’s exclusion from global capital markets continues to hamper recovery efforts.

Three years on, the questions remain unresolved. Karunanayake’s renewed call for accountability highlights what many analysts describe as a deeper governance failure, a life-altering national decision made without transparency, legal clarity or parliamentary oversight. As Sri Lanka struggles to rebuild trust among investors and citizens, one question continues to loom large: not just who announced the default, but who actually authorised it.

IMF-Aligned 2026 Budget Raises Red Flags on Slowing Revenue Streams

By: Staff Writer

November 16, Colombo (LNW): The Committee on Public Finance (CoPF), chaired by Dr. Harsha de Silva, has completed its internal review of the draft report on the 2026 Appropriation Bill, concluding that the proposed Budget remains broadly consistent with Sri Lanka’s ongoing IMF reform program but not without emerging fiscal risks that could challenge next year’s stability.

The draft report, prepared under Standing Order 121(5)(i), was examined at this week’s CoPF meeting in Parliament. According to the committee’s technical assessment, the 2026 Budget complies with the requirements of the Public Financial Management (PFM) Act, the Public Debt Management (PDM) Act, and the fiscal benchmarks outlined in the IMF’s Extended Fund Facility (EFF) program.

IMF Review Looms as $347 Million Hangs in the Balance

The IMF announced this week that it is currently reviewing Sri Lanka’s 2026 Budget as part of the fifth EFF program review, completed recently at staff level. The Fund’s Executive Board will decide whether to release the next $347 million tranche based on whether the Budget maintains the agreed fiscal path, structural reforms, and debt sustainability commitments.

Adding to this, Fitch Ratings noted that the Budget signals continued commitment by President Anura Kumara Dissanayake’s administration to the fiscal discipline required under the international reform program.

Revenue Boom in 2025, but 2026 Outlook Weakens

One of the key findings highlighted by CoPF is the strong revenue performance in 2025, with total collections exceeding forecasts by Rs. 100 billion. The surge is attributed largely to higher-than-expected tax income from vehicle imports, an area that delivered a surprising boost to state finances this year.

This windfall has provided the Government with greater fiscal room when planning the 2026 expenditure framework. However, the committee cautioned that this favourable trend is temporary. A significant decline in vehicle imports expected next year could sharply reduce this revenue stream, posing challenges for maintaining the same momentum in 2026.

The report warns that unless alternative revenue channels are strengthened—notably through tax administration reforms, broadening the tax base, and improving compliance—the Budget may face pressure as early as mid-2026.

Civil Society Flags Transparency and Equity Concerns

After concluding its technical review, the CoPF met with representatives from civil society groups, who raised concerns on several fronts:

Transparency of allocations, especially in large spending ministries

Equitable distribution of funds across provinces and key social sectors

Weaknesses in the fiscal framework, including gaps in monitoring and evaluation

Need for more accountable spending, particularly in state-owned enterprises

Committee Chair Dr. de Silva assured that all recommendations and observations would be formally communicated to the Finance Ministry, noting that public engagement is an essential part of ensuring budget credibility and public trust.

Next Steps

The draft report will be submitted to Parliament in the coming days, ahead of the Budget debate. With the IMF’s upcoming Board decision dependent on the government’s fiscal direction, the 2026 Appropriation Bill has now become a crucial test of Sri Lanka’s commitment to economic reforms—and its ability to sustain revenue in the face of slowing import-driven income

Tourism Gains Further Momentum: Earnings Reach $2.6 Bn in First 10 Months

November 16, Colombo (LNW): Sri Lanka’s tourism sector continues to show signs of recovery, with total earnings for the first ten months of 2025 reaching approximately US$ 2.66 billion, according to the Central Bank of Sri Lanka (CBSL).

For October alone, the island nation generated around US$ 186 million from tourism, reflecting a modest yet encouraging increase compared with the same month last year. Overall, revenue from January to October represents a near 5 per cent rise from the US$ 2.53 billion recorded over the same period in 2024.

Data from the Sri Lanka Tourism Development Authority (SLTDA) reveals that nearly two million international visitors arrived in the country from the start of the year until November 12.

India remains the largest source market with over 440,000 arrivals, followed by the United Kingdom with 180,000 visitors, Russia with 144,000, Germany with 123,000, and China contributing around 115,000 tourists.

In the first twelve days of November alone, Sri Lanka welcomed more than 82,000 foreign travellers, underscoring sustained interest in the country as a tropical destination.

Authorities Begin Printing Long-Delayed Permanent Driving Licences

November 16, Colombo (LNW): The Department of Motor Traffic has started printing permanent driving licences that had been delayed due to a shortage of cards required for production, ending the temporary reliance on provisional permits.

Commissioner General Kamal Amarasinghe confirmed that approximately 350,000 permanent licences are set to be produced across three centres: the main facility in Werahera, along with additional printing units in Hambantota and Anuradhapura.

He added that the department anticipates issuing around 6,000 licences each day, including 1,500 under the expedited one-day service, with the remaining 4,500 processed through the standard procedure.

Officials expect the backlog of pending licences to be fully cleared within the next fortnight.

Amarasinghe also noted that the country is preparing to import one million additional licence cards soon, ensuring a steady supply for future demand and preventing further delays for applicants.

CAA Imposes Fresh Price Caps on Popular Canned Fish Products

November 16, Colombo (LNW): The Consumer Affairs Authority has released a new gazette introducing revised ceiling prices for a range of canned fish products, with the changes taking effect from yesterday (15).

The update replaces the pricing order published on December 27, 2024.

Under the latest revisions, a 155g tin of tuna may not be sold for more than Rs. 165, while the larger 425g tin has been capped at Rs. 380. For mackerel, the authority has fixed the maximum price at Rs. 210 for the smaller pack and Rs. 480 for the 425g size.

Jack mackerel has also seen adjustments, with the 155g can set at a maximum of Rs. 240 and the 425g version limited to Rs. 560.

The CAA stressed that traders are strictly prohibited from selling, displaying, or offering these items above the new price limits. Officials added that monitoring teams will be deployed more frequently over the coming weeks to ensure retailers comply with the regulations, noting that such measures aim to maintain fair pricing amid rising consumer concerns over the cost of essential food items.

Minister Criticises Excessive Overseas Travel by Parliamentary Staff

November 16, Colombo (LNW): Leader of the House Minister Bimal Rathnayake told Parliament yesterday (15) that certain members of the parliamentary secretariat have been travelling abroad far more often than necessary, raising concerns about accountability and value for money.

He observed that a number of officials had undertaken several overseas visits yet failed to bring back a single meaningful proposal or recommendation that could support national development.

At the same time, he said, many capable officers who could genuinely benefit from international exposure had never been afforded such opportunities.

Rathnayake remarked that a small cluster of staff appeared preoccupied with perks rather than public service, reminding the House that Parliament ultimately operates under the mandate of the people, not personal entitlement.

Addressing delays in administrative matters, the Minister noted that the Speaker had instructed the Secretary-General on September 30 to submit a report on salary restructuring and related appeals.

However, he pointed out that the report had still not been tabled and said he had no explanation as to why the directive had been ignored.

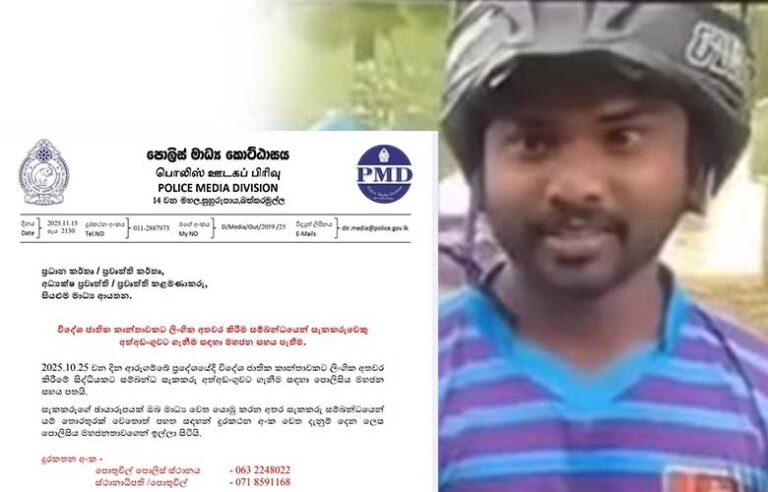

Police Seek Public Help After Foreign Tourist Harassed in Arugam Bay

November 16, Colombo (LNW): Pottuvil Police have appealed to the community for information that could help identify a man suspected of harassing a foreign visitor in Arugam Bay on October 25.

Officers have opened a formal investigation and urged anyone who may have witnessed the incident or recognised the individual to contact the Pottuvil Police Station via 063 2248022, or the Officer-in-Charge on 071 8591168.

The inquiry was prompted by widely circulated social-media footage in which a female tourist, travelling alone in a hired tuk-tuk, is confronted by a man after pulling over. In the recording, the man behaves indecently by exposing himself and attempts to approach her, prompting the visibly distressed tourist to raise her voice in fear.

The traveller, who had been filming her journey as part of a personal travel log, inadvertently captured the encounter. Speaking in the video, she reflects on her shock, remarking that although she had experienced great warmth from locals, the incident had shaken her confidence for the remainder of her stay.

Police said they are treating the matter with urgency and have stepped up efforts in the area to ensure the safety of visitors and residents alike.

Sri Lanka Envoy Hails Gujarat’s Progress, Emphasises Expanding Maritime and Trade Partnerships

November 16, Colombo (LNW): Sri Lanka’s High Commissioner to India, Mahishini Colonne, has praised Gujarat’s development trajectory following a meeting with the state’s Chief Minister, Bhupendra Patel, noting that Sri Lankans have long watched Gujarat’s rise with interest.

Speaking to journalists after the meeting, Colonne highlighted the shared maritime character of both regions, remarking that their historic and geographical ties naturally lend themselves to deeper cooperation.

She conveyed the greetings of President Anura Kumara Dissanayake and the Sri Lankan government, adding that Gujarat’s transformation—observed since the period when Narendra Modi served as Chief Minister—had often been viewed in Sri Lanka as an instructive example of economic progress. According to her, the “Gujarat model” had generated considerable attention among policymakers in Colombo.

Colonne went on to underline the longstanding links between Gujarat and Sri Lanka, noting that both possess extensive coastal traditions and rely heavily on maritime commerce. She observed that Sri Lanka’s ports play a crucial role in handling India’s transhipment cargo, a point that had also been underscored by Sri Lanka’s Prime Minister Harini Amarasuriya during her recent visit to India. At the time, the Prime Minister had suggested that Sri Lankan ports could serve as strategic gateways for India’s global trade routes.

Discussions between Colonne and the Chief Minister reportedly covered a range of potential collaborations, from textiles and pharmaceuticals to tourism and hospitality—sectors she described as ripe for investment and knowledge exchange.

A significant development during the Sri Lankan delegation’s visit was the signing of a Memorandum of Understanding between the Ceylon Chamber of Commerce and the Gujarat Chamber of Commerce and Industry. Colonne said the agreement could mark the beginning of a “robust, forward-looking partnership” that would benefit both economies.

The MoU was formalised during an interactive session hosted by the Gujarat Chamber of Commerce and Industry, with business leaders from both sides expressing optimism about new commercial avenues that may open in the months ahead.