S. V. Kirubaharan, France

The United Nations definition of ‘victims’ is as follows: “Victims” means persons who, individually or collectively, have suffered harm, including physical or mental injury, emotional suffering, economic loss or substantial impairment of their fundamental rights, through acts or omissions that are in violation of criminal laws operative within Member States, including those laws proscribing criminal abuse of power…..”

If this is the case, then who is not a victim in Sri Lanka? From top to bottom, I mean from so-called executive presidents to normal citizens everyone remains a victim. Here, I can quote several examples but to be brief – the President, the Chief Justice, members of civil society (human rights defenders, journalists, parliamentarians, lawyers, religious leaders, academics and others) are/were victimised in Sri Lanka.

A Tamil proverb says: “One will know the effect of a fever and headache only when he/she gets it”. (காய்சலும் தலை வலியும் அவர் அவருக்கு வந்தால் தான் அதன் தாக்கம் விளைவு தெரியும்!). In Sri Lanka, we have experienced the fact that victims have become horrendous violators of human rights and then again become victims.

In an earlier session of the UN Human Rights Council – UNHRC, I have listened to a representative of Sri Lanka as he related in meetings how at one time he had been in hiding in Sri Lanka because the security forces were looking for him. Unfortunately, later he was defending the state violations to the maximum in the same forum – the UNHRC.

This is to say that Sri Lanka should learn to take the grievances of victims seriously and with sincerity. Victims vary from the youth uprising to capture the whole of Sri Lanka, to the failure of thirty years of non-violent struggle to achieve political aspiration that consequently turned into an armed struggle. Today, where is Sri Lanka? It has become an international arena for super-powers, the regional super-power and peace-loving states and groups.

Socrates said, “Mankind is made of two kinds of people: wise people who know they’re fools and fools who think they are wise”. The stubborn, ego-centred attitude of politicians, under the pretext of patriotism, led Sri Lanka to today’s situation.

Impending resolution

Now let me discuss the impending resolution in the 51st session of the UNHRC in Geneva. The damning comprehensive report of the UN High Commissioner of Human Rights – UNHCHR was published. As part of the follow-up procedure, the member countries of the UNHRC are now working on a resolution on Sri Lanka. The first draft dated 12 September 2022 known as ‘zero’ draft, is in circulation. Well and good. This present draft is not very different to the last resolution (46/1).

For the victims who have waited since the independence of Sri Lanka or since the end of Mullivaigzhal in May 2009, this zero draft does not give any encouraging messages. For those who organised demonstrations against the government in various venues including in Galle Face Green and brought a change of government in Sri Lanka – this draft is not giving any good message either. Some of the demonstrators travelled to Geneva to find justice for their call and cause.

The zero draft has 23 preamble paragraphs (PPs) and 18 operational paragraphs (OPs). The Core group on Sri Lanka – (UK, USA, Canada, Germany, North Macedonia, Montenegro and Malawi) who drafted it, find it very difficult to accommodate every request by the government of Sri Lanka, their pied pipers and the victims. When drafting a resolution, countries have to consider many factors; otherwise it may end up in a disaster.

I still remember why neither the European Union countries nor Canada tabled a resolution on Sri Lanka, until the United States became a member of the UN HRC in 2012. I don’t want to elaborate more on this matter.

‘Informal consultation meetings’ on the zero draft, organised by the Core group, have taken place in the UN building on 16th Friday. These have been well attended by the concerned country Sri Lanka, several other countries and various members of civil society. Here I should say that not all members of civil society are working genuinely to strengthen this zero draft. We are finding it difficult to understand what they say and what is in their mind. The reason is that they have a deep link to any government in power in Sri Lanka. Therefore, their presence in the UN HRC is to observe what is happening there. In the UN, this style of work goes on, not only with Sri Lanka, but with many other countries. They are known as Government NGOs – or Gongos.

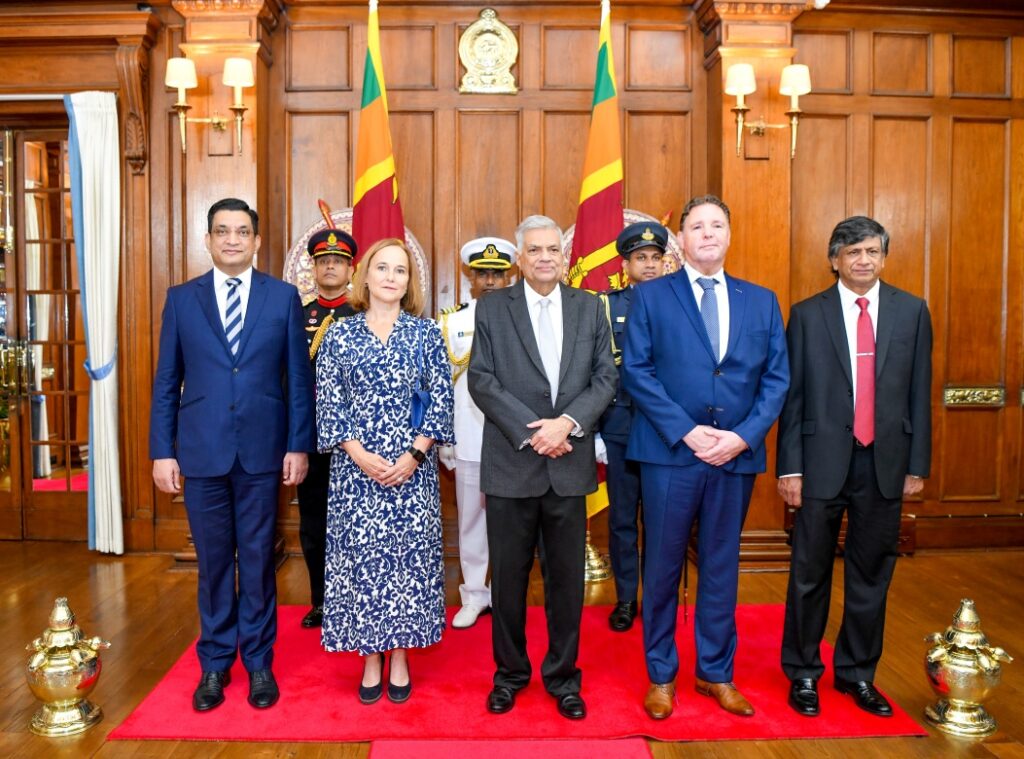

Leaving this never-ending Gongos business to one side, the world should know what has happened in the last two informal consultations. On the morning of Friday 16th, the first informal consultation regarding the zero draft took place. It focused mainly on the ‘Preamble paragraphs – PP1 to PP23’ and general comments. The UK representative, Mr. Bob Last, presided over the meeting on behalf of the Core Group and read out the zero draft. He said that it is based on the last resolution on Sri Lanka. Also, he made a note of the crisis in the country, demonstrations and change of government. The Sri Lankan representative then expressed the opinion of the concerned country.

So, the Sri Lankan representative read a statement which presumably was received from the Ministry of Foreign Affairs in Colombo. The statement said that Sri Lanka rejected the zero draft and Sri Lankan will not accept any resolution other than a resolution passed by consensus. This surprised everyone because even the resolutions passed in 2015, 2017 and 2019 by consensus in the UN HRC were not implemented.

The statement also said that the UN High Commissioner for Human Rights’ report goes beyond her mandate and that in the past two High Commissioners have visited Sri Lanka. Yes that’s true, but what happened to the reports that they published after their visit to Sri Lanka? The SL representative also said that the UNHRC is always moving the goalposts and requested the member countries to reject this resolution. This raises the serious question as to whether there is any ground in Sri Lanka to find justice – I mean are there any visible goalposts? However, the speech of the Sri Lankan representative is as usual like that of any other concerned country when facing a resolution addressing their human rights violations.

Attending UN H/R Forums for 32 years

Following this, many countries spoke generally about the zero draft. Some were supportive of the resolution and some were not. There were a few countries against the resolution, out of which only China, Cuba, Pakistan, Russia, Venezuela are current members of the UN HRC. At the same time, countries supportive of the resolution were mostly members of the council. This gives a clue to the eventual outcome of this resolution.

Before the closure of the morning session, some members of civil society had an opportunity to make their remarks. These people were mostly those who had come directly from Sri Lanka. They were – Mr Ameer Faaize, Attorney at Law; M. A Sumanthiran M.P. and Attorney at Law; Santhiya Elaniyagoda, spouse of missing journalist (2009) Prageeth Elaniyagoda and Bhavani Fonseka, researcher and Attorney at Law. Faaize touched on the issue of Muslim burials and displacement of Muslims.

M.A. Sumanthiran went into the history of the resolution on Sri Lanka in the UNHRC. He recalled how the present President then Prime Minister co-sponsored the resolution in 2015 and then Sri Lanka’s co-sponsorship was withdrawn in 2019. Sumanthiran reminded in the meeting that then Minister of Justice is the present Minister of Justice – so there shouldn’t be any problem in accepting this resolution. Sumanthiran also talked about the failure in implementing their own recommendations of the LLRC. He spoke further about the PTA, impunity and requested that this resolution be made stronger than it is at present.

Santhiya Eelaniyagoda’s speech was translated from Sinhala to English. She said that she has attended the UNHRC for the last ten years and she asked how many more years does she have to attend the UNHRC to find justice for her disappeared husband. Also she said that an international mechanism is the right solution for the situation in Sri Lanka.

In fact, when Santhiya was speaking about her ten years in the UNHRC, I was thinking about my thirty-two (32) years attending all UN Human Rights Forums – from UNHR Commission, Sub-Commission, Treaty bodies, Working Groups, UPR, all UN human rights conferences, seminars etc and I am still here without finding any justice for the victims. In fact, on many occasions I have become a victim myself, because of my active commitment to the promotion and protection of human rights in Sri Lanka.

When Bhavani Fonseka spoke, she reminded those present that even after thirteen years since of the end of the war, there is no credible justice, no political solution, no abolishment of the executive Presidency, impunity prevails and there are economic crises. With their interventions, the morning session on general comments and discussion on preamble paragraphs was brought to an end.

Hypocrisy about the PTA

In the afternoon, the informal discussion started on ‘Operative Paragraphs’ OPs from 1 to 18. As usual, the Sri Lankan representative who rejected the resolution started to make comments on every paragraph. The main countries supporting Sri Lanka: China, Pakistan, Russia and Venezuela also gave their input on every paragraph. If we put all their interventions together, the message is to delete the whole resolution. One by one Sri Lanka, China, Pakistan, Russia and Venezuela wanted different operative paragraphs to be deleted.

The usual pattern in the UN is that even though the concerned countries do not agree with the resolution, they prefer to contribute to the discussion.

What was surprising was Russia said in this meeting that “this is interfering in the affairs of other counties”. I think Russia has forgotten what they are doing in Ukraine. Also, China seems to have forgotten that they are part of the present problem in Sri Lanka, when the representative said: “not to interfere in any internal affairs”.

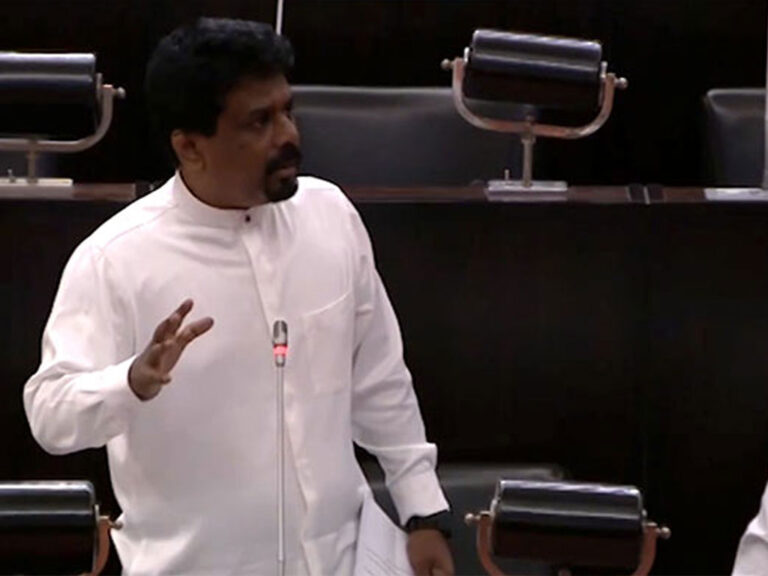

During the first week of the 51st session, a meeting took place outside the UN. It was about the PTA. In this meeting, two speakers who justified the PTA when they were the Minister of Justice and a Sri Lankan representative to the UN in Geneva, now spoke about the difficulties and dangers of the PTA. This is called hypocrisy. Shame on them.

If Sri Lanka ruled the country according to the constitution, there would be no need for any resolution by the UNHRC. Sri Lanka complains that the UNHRC resolutions are against their constitution. Many issues/affairs in the constitution for decades have never been implemented by Sri Lanka.

When they talk about external involvement being against the constitution, how about the appointment of the International Independent Group of Eminent Persons (IIGEP) by President Mahinda Rajapaksa and led by former Indian Chief Justice P.N. Bhagawati? Also regarding foreign judges, what about the Commission of Inquiry appointed by Sirimavo Bandaranaike in 1963 to inquire into the political aspects of the Bandaranaike assassination? Two out of the three judges were foreign. They were Justice Abdel Younis from Egypt and Justice G.C. Mills-Odich from Ghana.

In the same case, the first and the second accused: Buddharakitha Thero and H.P. Jayawardene, were represented in the Supreme Court by Phineas Quass, QC from the United Kingdom. Was this against Sri Lanka’s constitution? Come on… Please look at the grievances of the victims in a polite, decent and cultured way rather than all the time rejecting them blindly.

In conclusion, victims seriously wonder why Sri Lanka should be given two (2) year period as an extension by the Core group, knowing very well that for the last many years – Sri Lanka has not implemented and is not going to implement the resolution. The operating paragraph (PP18) reads as follows:

“Requests the Office of the High Commissioner to enhance its monitoring and reporting on the situation of human rights in Sri Lanka, including on progress in reconciliation and accountability, and on the human rights impact of the economic crisis and corruption, and to present oral updates to the Human Rights Council at its fifty-third session (June 2023) and fifty-fifths sessions (March 2024), and a written update at its fifty-fourth session (September 2023) and a comprehensive report that includes further options for advancing accountability at its fifty-seventh session (March 2025), both to be discussed in the context of an interactive dialogue. (46/1 OP16)”.

Those who understand the rulers in Sri Lanka well, will understand that Sri Lanka will do wonders in the North and East for the demography of those regions. Do wake up!

Once the Core group finalises the draft, they will table it by the third week of the session (26-28 September). During the fourth week of the session (4-6 October) voting on the resolution will take place. (End)

S.V.Kirubaharan

France

19/09/2022