The Bank of Ceylon has been able to report Rs. 21.8 billion of Profit Before Tax (PBT) during the first six months of the year amidst unprecedented challenges facing many headwinds due to never experienced turmoil in the economy,BOC chairman Kanchana Ratwatte said .

The net interest income of Rs. 80.8 billion was reported with 57% growth contributing 72% to total operating income of the Bank.

Interest income grew by 62% materializing the loans and investment growth reported in the previous year. Out of the total interest income of Rs. 197.5 billion, 67% was represented by the interest income from loans and advances and considerable contribution was delivered by income from Overdraft, Term loans and Retail loans.

The investment instruments which mainly comprises Government Treasury Bonds and Bills brought the major portion of interest income earned from the investment portfolio which stood at Rs. 63.8 billion..

Total net non-fund-based income of the Bank amounted to Rs. 31.5 billion. During the first six- month period ended 30 June 2022,.

Net fee and commission income of Rs. 7.8 billion was derived through the retail transactional level banking services and trade finance including card transactions and remittances.

Mark to market loss of Rs. 2.4 billion was resulted from the investment in unit trusts and equity shares due to adverse market price fluctuations.

Rs. 49.5 billion of impairment provision for loans and advances was charged to statement of income during the period.

The operating expenses of Rs. 21.5 billion consists of personnel costs, assets maintenance, deposit insurance and other overhead expenses. YoY increase of 14% has been reported in operating expenses due to increase in personnel expenses as the Bank ensures the safety and well-being of the employees in this trying times.

VAT on financial services which is charged based on the value addition made by the financial services has a direct relationship to the PBT and emoluments showed a marginal dip of 3%. Income tax expense for the period was accounted as Rs. 5.9 billion at an effective tax rate of 27%.

The Surcharge tax of Rs. 6.7 billion was deducted from the equity as per the Surcharge Tax Act No.14 of 2022 certified on 08th April 2022.

The Bank has already effected the payment of Rs. 3.4 billion for the 1st installment which was due on 20th April 2022 and the liability to pay the balance amount has been recognized under current tax liability as of end June 2022.

During the period the Bank’s total assets grew by 17% and reached Rs. 4.5 trillion, preserving its industry leadership.

The gross loans and advances showed a marginal growth of 7% during 1H-2022 and stood at Rs. 2.7 trillion due to low credit appetite in line with the sluggish movement in the economy. The lending to the private sector grew by 12% during the period and the Bank continued to extend its support towards business revival.

BOC continues resilience posting Profit Before Tax of Rs. 8 billion for 2Q-2022

SL Domestic debt restructuring raises fiscal sustainability issues

The Government is now considering the domestic debt restructuring as a part of a broader policy package to address massive debt vulnerability running up to trillions of rupees, finance ministry sources said.

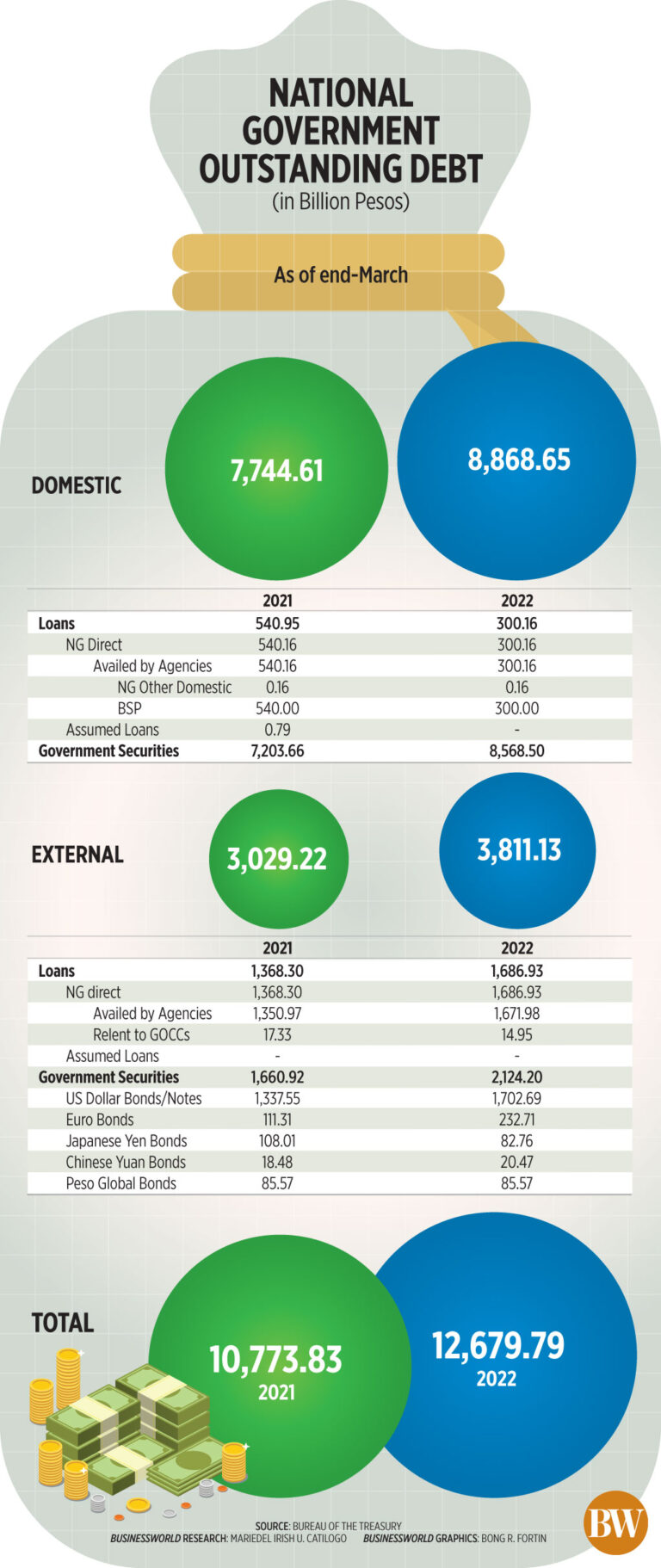

Total outstanding domestic debt was Rs. 12 trillion as at the end of March 2022 while the gross domestic borrowings of the Government surpassed Rs 1.6 trillion in the first four months of 2022, ministry data shows.

Around 60 percent of the domestic borrowing (over Rs. 1 trillion) was raised from Treasury bonds, 31 percent (Rs. 518.2 billion) from Treasury bills, and 4.4 percent (Rs 73.8 billion) through provisional advances from the Central Bank, and Rs 65.6 billion was raised from Sri Lanka development bonds.

In this context, President Ranil Wickremasinghe shocked the local debt market by saying domestic debt may have to be included in restructuring.

However domestic debt has already received upfront hair cut via over 60 percent inflation and inclusion debt restructure could cause financial instability, debt market sources warned.

According to Central Bank sources the restructuring of domestic debt would exert an adverse impact on domestic bank balance sheets.

In order to avoid the impact on the domestic financial system, measures should be taken to recapitalise some banks or replenish superannuation funds such as Employees Provident Fund (EPF) and Employees Trust Fund( ETF),CB sources said

A country’s debt is sustainable if it can repay it by borrowing from the market; this is known as ability to refinance, former Central Bank Deputy Governor and eminent economist Dr.W.A.Wijewardena claimed.

In the case of forex debt, if repayment has to be made by using reserves or borrowing from friendly countries it’s not sustainable and the domestic debt can be repaid by borrowing from Central Bank, then, it’s also not sustainable, he explained.

The Central Bank Governor tries hard to avoid this by increasing rates and borrowing everything from the market. But, there’s a liquidity crunch in the domestic financial system and so, he might one day run into problems, he claimed.

If this happens, it’s outside the control of local monetary authority and terms will be dictated by outside creditors and prospective lenders like International Monetary Fund (IMF) he said adding that in the case of IMF, it cannot lend to a member whose debt, either foreign or domestic, is not sustainable.

According to an IMF report, restructuring of heavy domestic debts could play a vital role in the resolution of future debt crisis by countries like Sri Lanka.

The government is now compelled to present a debt sustainability analysis (DSA), to the IMF and the country’s foreign creditors, finance ministry sources disclosed.

Therefore it has to consider potential restructuring of domestic debt in order to achieve debt sustainability, a senior finance ministry official said.

The authorities need to put in place measures that mitigate losses for banks, non-bank institutional investors, and that minimise spillovers, IMF report suggested.

Sri Lanka’s former president tipped to return to crisis-hit nation next week

Colombo, Sri Lanka(CNN)Sri Lanka’s former president Gotabaya Rajapaksa, who fled the crisis-hit island nation last month amid mass protests, is expected to return to the country next week, according to a senior minister.

Foreign Minister Ali Sabry told CNN late Wednesday the Sri Lankan government had been told of Rajapaksa’s return “through diplomatic channels.”

“Officially we have no role in the return. He is a citizen of Sri Lanka and can travel as he wishes,” Sabry said.

Rajapaksa’s estranged cousin Udayanga Weeratunga, a former Sri Lankan Ambassador to Russia, told reporters Wednesday the former leader would return on August 24.

Rajapaksa is in Thailand after fleeing Sri Lanka in July on a military plane for Maldives, and then traveling to Singapore, days after angry protesters stormed his official residence and office.

He tendered his resignation from Singapore, while public anger grew over his alleged mismanagement of the economy.

The former leader’s hurried exit was a historic moment for the nation of 22 million, which members of the Rajapaksa family ruled with an iron fist for much of the past two decades.

Former Sri Lankan President Rajapaksa requests to travel to Thailand

Anger has been growing in Sri Lanka for months after the country’s foreign exchange reserves plummeted to record lows, with dollars running out to pay for essential imports including food, medicine and fuel.

Rajapaksa’s brother Mahinda Rajapaksa was forced to resign as prime minister in May as public fury grew over the crisis.

His departure came during a day of chaos and violence that culminated in police imposing a curfew across the country.

Sri Lankan President Ranil Wickremesinghe reportedly said in late July it was “not the right time” for Gotabaya Rajapaksa to return to the country as it could inflame political tensions.

CNN

A decisive meeting between Basil and Ranil this evening

A special meeting between Sri Lanka Podujana Peramuna National Organizer, former Finance Minister Basil Rajapaksa, and President Ranil Wickramasinghe is scheduled to be held this afternoon.

The main group that supported Ranil Wickramasinghe for the presidency is the pro-Basil group of the Podujana Peramuna and it is reported that the discussion will focus on the performance of the current government and the formation of an all-party government.

Meanwhile, political sources say that a cabinet reshuffle will take place next week. This meeting may be held to discuss the ministerial reshuffle.

Gotabaya applies for green card

Former President Gotabhaya Rajapaksa has decided to move to the United States of America permanently. It is reported that he has already applied for a green card.

Rajapaksa renounced his American citizenship in order to contest the presidential election in this country, but his wife, son and daughter-in-law are still American citizens. Because of this, Rajapaksa has the ability to regain American citizenship, his lawyers have said.

However, the American government has imposed strict restrictions on granting citizenship to a person who has renounced American citizenship.

Gotabhaya Rajapakse, who fled to Maldives on July 9th amidst to public protest, then left for Singapore. He left the presidency after that. Gotabaya Rajapakse left for Thailand due to the expiry of the period allowed to stay in Singapore and had decided to stay there until November.

However, Udayanga Weeratunga, a close relative of the Rajapaksa family, said yesterday that the former president will return to Sri Lanka on the 24th.

UK continues cooperation with SL opening its market for 80% of products

The United Kingdom opens its market for Sri Lanka to export 80 percent of its products with tariff concessions under new Developing Countries Trading Scheme (DCTS) while assuring continuous cooperation to tackle the present crisis.

British State Minister for South Asia, United Nations and the Commonwealth, Lord Tariq Ahmed assured that the government of the United Kingdom looks forward to working with the government of President Ranil Wickremesinghe and Prime Minister Dinesh Gunawardena to resolve economic and social issues faced by the island nation.

In a telephone conversation with Prime Minister Gunawardena on Tuesday 16 , he exchanged details on the issues faced by Sri Lanka.

Prime Minister Gunawardena briefed him about economic, social and political challenges and the government’s short, medium and long-term steps to solve them and bring relief to the people. Lord Ahmed assured UK’s support to the steps taken in those directions

Meanwhile Sri Lanka is included in the UK’s new Developing Countries Trading Scheme (DCTS) which replaces the UK’s Generalized Scheme of Preferences (GSP), accessing to the UK market for over 80% of Sri Lankan export products.

“The UK’s new Developing Countries Trading Scheme (DCTS) is one of the most generous sets of trading preferences of any country in the world and will benefit Sri Lanka by boosting the economy and supporting jobs,” British High Commissioner Sarah Hulton said.

She said that the DCTS will remove tariffs an over 150 additional products and also it will also simplify some seasonal tariffs, meaning additional and simpler access for Sri Lanka’s exports to the UK.

“The new scheme, which replaces UK GSP, will come into force in 2023 and the UK looks forward to future trading opportunities with Sri Lanka,” she said.

According to the UK’s Department for International Trade the new Trading Scheme applies to 65 countries, offering lower tariffs and simpler rules of origin requirements for exporting to the UK.

Britain has launched a scheme to extend tariff cuts to hundreds of products, such as clothes and food, from developing countries including Sri Lanka, part of London’s post-Brexit efforts to set up systems to replace those run by the European Union.

In June, British Prime Minister Boris Johnson said he wanted to start a new trade system to reduce costs and simplify rules for 65 developing countries to replace the EU’s Generalised System of Preferences, which applies import duties at reduced rates.

Trade minister Anne-Marie Trevelyan said the Developing Countries Trading scheme (DCTS) would extend tariff cuts to hundreds more products exported from developing countries, a system, she said, that goes further than the EU scheme.

““UK businesses can look forward to less red tape and lower costs, incentivising firms to import goods from developing countries.”

The DCTS covers 65 countries including Sri Lanka, simplifies rules such as rules of origin, which dictate what proportion of a product must be made in its country of origin, and removes some seasonal tariffs, such as making cucumbers tariff-free in the winter.

Products that are not widely produced in the UK, like olive oil and tomatoes, will also have lower or zero tariffs, making them cheaper to import.

The scheme also simplifies complex trade rules, including so-called rules of origin, making it easier for businesses in countries like Bangladesh to export clothes to the UK.

Duties will also be reduced by 14 per cent on bikes from the South Asian nation, 12 per cent on T-shirts for Cambodia, 12 per cent on baby clothes from Sri Lanka, eight per cent on roses from Ethiopia and eight 8 per cent on onions from Senegal.

Protestors will be prosecuted and compensation will be recovered – Minister Prasanna

Prasanna Ranatunga, Minister of Urban Development and Housing, says that legal action will be taken against the protesters to recover compensation for the damage caused to the land where the Galle Face protest took place.

He has stated that the protestors were removed from this land belonging to the Urban Development Authority according to the existing law of the country and that no one can take possession of state property by force.

The minister said that a group of activists has filed a lawsuit saying that they have rights to the land of struggle and said that he will recover compensation from them for the damage caused to the land.

The minister has further said that if the compensation is not recovered, the ministry officials will have to face problems in the future and that they will never appoint their officials to such a crisis.

Harsha thanks Nandalal for implementing a request he made last Friday(VIDEO)

Samagi Jana Balavegaya Member of Parliament Harsha De Silva says that Central Bank Governor Nandalal Weerasinghe has implemented the request he made in a press conference on Friday last week to stop the conversion of service export earnings into rupees by Tuesday this week.

Harsha de Silva said this while addressing a press conference held yesterday (17).

A cabinet paper to import coal until 2025? – Champika (VIDEO)

Member of Parliament Patali Champika Ranawaka says that a cabinet paper has been presented for one-time coal import until 2025 in a background where there are no dollars to import coal for a few months.

“They say that there is now a technical breakdown in the Norochchole power plant. In fact, one machine of the Norochchole power plant had to be shut down for triennial maintenance. However, if we do not arrange to import 2.5 million tons of coal from the end of September, we will have to face a power cut of 10 hours instead of 3 hours. Also, a cabinet paper has been placed to import coal till 2025. There are no dollars to even import coal for these few months. We have a question on what basis and process to import coal at once until 2025 is done. So if we don’t follow an open procurement process in this regard, we will have to face problems.”

Patali Champika Ranawaka said this while addressing a press conference held yesterday (17).

Chairmanship of the alliance of 9 small parties given to Wimal

The new alliance of 9 small parties that have left the government and become independent in the parliament is scheduled to be launched on September 4 at the Maharagama National Youth Service Council premises.

Member of Parliament Vasudeva Nanayakkara mentioned that the chairmanship of the alliance is given to the leader of the National Freedom Front, Wimal Weerawansa.