The public protest in Colombo has become very heated and the security forces of York Street area have started firing in the air to disperse the crowd.

All buses that have diesel will run today in support of the protests! (VIDEO)

Anjana Priyanjith, General Secretary of the All Ceylon Private Bus Owners’ Association said that today (09) all buses that have diesel will run in full support of the people’s protest and the government has no right to interfere with it.

Priyanjith said that people should support the struggle for the sake of the people at a time when the people are facing an economic and social crisis.

A so-called bus owner leader said that buses will not run today, but despite the delay in the morning, he said that all buses that have diesel will be run in the next few hours.

Sri Lanka’s Popular Brand “Hemas” is set to enter Omani Market

Sri Lanka’s 72 year old leading public quoted company Hemas Holding PLC is set to enter the Omani market.

Ambassador of Sri Lanka to the Sultanate of Oman Ameer Ajwad together with Hemas Senior Manager for International Business Promotion Kavindra Kasun Sigera met the Chairman of the Oman Chamber of Commerce and Industry (OCCI), Engr. Redha Juma Al Saleh, the sole representative of the entire Oman private sector, and introduced the Hemas brand. They also discussed ways and means to present Hemas products into the Omani market and the future scope for establishing a Hemas manufacturing facility in the Sultanate.

The Embassy of Sri Lanka in Muscat facilitated a series of B2B meetings between Hemas Senior Manager for International Business and their potential counterparts in Oman, including Muscat Pharmacy (FMCG Division), Concordia Group, Future Well Trading, LuLu Hypermarket, SPAR Supermarkets, etc. to establish business links.

The Senior Business Consultant of MS Holding (pvt) Ltd Dineshkumar Karthigesu, who coordinated the visit by Hemas Consumer Good to the Sultanate of Oman, accompanied the delegation.

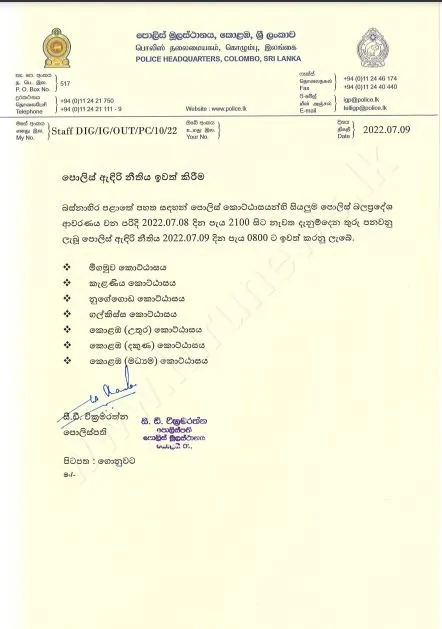

The police curfew imposed on Colombo lifted!

The police curfew imposed on several areas of Colombo from last night (08) has been lifted from 08.00 this morning (09).

UN urges the Govt to restraint from using police power to control protests

United Nations Office of the High Commissioner for Human Rights (OHCHR) has urged Sri Lankan authorities to show restraint in the policing of assemblies and ensure every necessary effort to prevent violence, ahead of what is expected to be a large demonstration in Colombo on Saturday (July 09).

At the same time, the OHCHR appealed to the organisers of the protests and their supporters to engage in peaceful means of protest and not to impede essential medical or humanitarian services.

In its statement, the OHCHR also called on the authorities to give clear instructions to the security forces that human rights defenders and journalists have a right to monitor and report on the demonstrations and therefore should be protected in the exercise of these functions and not obstructed in any way.

It also noted that all Sri Lankans have the right of freedom of expression, peaceful assembly and the right to participate in public affairs, which are particularly important in critical phases of the nation’s life.

Under applicable international law, gatherings can only be dispersed in exceptional cases, with use of force a last resort where absolutely necessary and proportionate, the OHCHR added.

“While we recognise the challenges that the police and armed forces face – including instances of attack on themselves – the Government needs to give strict instructions to the police and armed forces to desist from violence in dealing with the public and to act with utmost restraint.”

The OHCHR stressed that the military, as a general rule, should not be used to police assemblies. Where, in exceptional circumstances, members of the military carry out law enforcement functions they are bound by international norms and standards and must remain fully subordinate to civilian authorities and accountable under civilian law.

“The people of Sri Lanka are already suffering enormously and live in continuing uncertainty of how they can meet their basic needs including access to the right to food, health and education,” the OHCHR said further, adding that the people have a right to peacefully protest to demand a better life and an end to economic and social hardship.

“We also repeat the High Commissioner’s call for open and genuine dialogue to address the root causes of the crisis and grievances of the population.”

CEB introduces three new billing methods

Ceylon Electricity Board (CEB) has decided to introduce three new methods to issue electricity bills, instead of the existing method of pre-printed bills.

Accordingly, any consumer who wishes to receive a physical bill will be issued a bill printed using thermal paper during the monthly bill metre reading.

Consumers can also opt to receive the bill via SMS to the mobile phone number registered with the CEB. They can obtain the assistance of the CEB’s meter reader who visits their residence for the registration process. The consumers can register themselves by sending a text message to 1987 by typing “REG 10-digit account number”

Meanwhile, the CEBCare mobile application is also available for consumers to receive their electricity bills.

The three new methods of issuing electricity bills are introduced as an advance step of the “CEB Assist” programme, which aims to provide more effective customer service and digitalize state departments.

Necessary technical procedures are also being implemented to issue electricity bills via e-mail as the fourth method.

The CEB further stated that a decision was taken to initiate this scheme of issuing bills due to the difficulties in distributing pre-printed bills at the moment owing to the prevailing paper shortage.

The CEB is hopeful that the adoption of these new methods will not only increase efficiency but also contribute to saving more than Rs. 1 billion annually, against the backdrop of the rising cost of issuing printed electricity bills.

HRSCL reveals startling details of Police power used against Rambukkana protest

The investigation by the Human Rights Commission of Sri Lanka (HRCSL) into the Rambukkana Shooting revealed that the death of Chaminda Lakshan was the result of excessive use of force by Police Officers and cannot be legitimately justified by the Police, especially in the absence of any threat by the deceased to the police officers.

The report said that the gunshot injuries sustained by the people in the vicinity of the protest site, particularly whose shots have been sustained from back to front, indicate that the police officers used force excessively and longer than necessary.

The Committee of Experts investigation revealed the following findings:

i. Four Police Officers who used force at the protest site have been provided with T56 weapons which are lethal in nature, prior to their deployment at the protest site in Rambukkana.

ii. One out of the four Police Officers has received his weapon a day prior to the date of incident at hand, (18th April 2022) where there was no or very low

propensity for violence to erupt during the protests.

iii. Out of the four Police Officers who have been summoned for inquiries at the Commission, two of the Police Officers had very little knowledge on the operation of the lethal weapons they have thus received to be used as a means of crowd controlling and has also not received updated and adequate training on the use of such lethal weapons prior to deployment.

iv. Further, one Police Officer stated during the inquiry that he is too old to effectively handle a T56 weapon and is incompetent of shooting.

The Human Rights Commission of Sri Lanka recommends to immediately hold a disciplinary inquiry against SSP K.B Keerthirathne, who ordered

the police officers to shoot.

HRCSL issued strict guidelines and directives to Sri Lanka Police;

i. Abstain from providing police officers who are inadequately trained on the use of lethal weapons, with lethal weapons such as T56 firearms.

ii. Abstain from deploying police officers who lacks the required skills on using lethal weapons during a crowd dispersal operation, to disperse mass congregations of people engaged in protests.

iii. Frequently provide the necessary up to date trainings on the use of lethal weapons to Sri Lanka Police officers, as per the fundamental rights and the

international human rights obligations undertaken by Sri Lanka.

iv. Abstain from using excessive force on persons exercising their constitutionally guaranteed right to peaceful protest and ensure the police officers uphold basic

principles of respecting and protecting human rights, in their indispensable efforts to uphold rule of law.

CB issues “broad guidance” to banks on concessions to crisis-hit borrowers

The Central Bank (CB) yesterday has provided the banking sector with a broad guidance” to grant concessions for the next six months to borrowers hit by the on-going economic crisis while a similar guidance is expected to be issued to non-banking financial institutions (NBFIs) shortly.

The CB has provided a broad guidance as to how to address loan repayments of borrowers who have come under financial strain including those who were under previously granted moratoria, especially in the SME and tourism sectors.

The banks have given the discretion to discuss with the borrowers in order to reach an agreement on a suitable repayment arrangement based on the new repayment capacity of each borrower,” CB Deputy Governor Yvette Fernando said.

Unlike the blanket moratoria implemented earlier, she highlighted that these concessions are to be considered on a case-by-case basis by banks, which are not limited to one particular sector or sectors.

In addition to the economic crisis, borrowers are also faced with rising finance costs following the significant monetary policy tightening measures of the CB.

Commenting on repeated requests from the tourism sector on extending the loan moratorium granted to the sector which expired last month, she pointed out that it would be unfair for others in particular for the SME sector to further extend the moratorium which has been originally granted following the Easter Sunday deadly bomb attacks in 2019.

According to the circular issued by the CB, banks have been encouraged to provide a six-month grace period on loan repayments, which could be on capital or both capital and interest payments of performing loans.

For non-performing loans, banks have been recommended to delay initiating the loan recovery process until the end of the year while rescheduling loan repayments over a longer stretch of time based on the borrowers’ repayment capacity.Banks are also advised to consider implementing these concessions through Covid-19 revival units already been set up.

Amid concerns of food security, the CB requested banks to suspend all recovery action against non-performing credit facilitates of paddy millers until the end of the year after coming up with a mutually agreed mechanism to divert sales proceeds of upcoming harvesting season to recover outstanding credit amounts.The CB has also imposed a maximum rate cap of 15.5 percent or contracted rate of interest (whichever is higher) during this concessionary period (including the recovery period), which is to be charged only on the amount considered for the concession.

In addition, banks have also been advised to not to reject new loan applications from borrowers solely based on adverse CRIB reports due to the on-going economic crisis.Borrowers are required to apply for these concessions on or before 31st of July. If the borrower and the bank fail to reach an agreement, Fernando noted that the borrower has an opportunity to appeal to CB’s Director of Financial Consumer Relation Department.

“..licenced banks shall inform the borrower the reasons of such rejections and shall advise the borrower by and through the same letter that there’s an opportunity for the borrower to appeal against such rejection to Director of Financial Consumer Relation Department,” the CB said..

The Central Bank (CB) yesterday has provided the banking sector with a broad guidance” to grant concessions for the next six months to borrowers hit by the on-going economic crisis while a similar guidance is expected to be issued to non-banking financial institutions (NBFIs) shortly.

The CB has provided a broad guidance as to how to address loan repayments of borrowers who have come under financial strain including those who were under previously granted moratoria, especially in the SME and tourism sectors.

The banks have given the discretion to discuss with the borrowers in order to reach an agreement on a suitable repayment arrangement based on the new repayment capacity of each borrower,” CB Deputy Governor Yvette Fernando said.

Unlike the blanket moratoria implemented earlier, she highlighted that these concessions are to be considered on a case-by-case basis by banks, which are not limited to one particular sector or sectors.

In addition to the economic crisis, borrowers are also faced with rising finance costs following the significant monetary policy tightening measures of the CB.

Commenting on repeated requests from the tourism sector on extending the loan moratorium granted to the sector which expired last month, she pointed out that it would be unfair for others in particular for the SME sector to further extend the moratorium which has been originally granted following the Easter Sunday deadly bomb attacks in 2019.

According to the circular issued by the CB, banks have been encouraged to provide a six-month grace period on loan repayments, which could be on capital or both capital and interest payments of performing loans.

For non-performing loans, banks have been recommended to delay initiating the loan recovery process until the end of the year while rescheduling loan repayments over a longer stretch of time based on the borrowers’ repayment capacity.Banks are also advised to consider implementing these concessions through Covid-19 revival units already been set up.

Amid concerns of food security, the CB requested banks to suspend all recovery action against non-performing credit facilitates of paddy millers until the end of the year after coming up with a mutually agreed mechanism to divert sales proceeds of upcoming harvesting season to recover outstanding credit amounts.The CB has also imposed a maximum rate cap of 15.5 percent or contracted rate of interest (whichever is higher) during this concessionary period (including the recovery period), which is to be charged only on the amount considered for the concession.

In addition, banks have also been advised to not to reject new loan applications from borrowers solely based on adverse CRIB reports due to the on-going economic crisis.Borrowers are required to apply for these concessions on or before 31st of July. If the borrower and the bank fail to reach an agreement, Fernando noted that the borrower has an opportunity to appeal to CB’s Director of Financial Consumer Relation Department.

“..licenced banks shall inform the borrower the reasons of such rejections and shall advise the borrower by and through the same letter that there’s an opportunity for the borrower to appeal against such rejection to Director of Financial Consumer Relation Department,” the CB said.

FUTA condemns the decision of the government to declare a police curfew to suppress the legitimate right to protest

The Federation of University Teachers’ Associations (FUTA) vehemently condemns the illegal move by the government to impose a so-called police curfew with the intention of obstructing the peaceful protests organized by the general public. The curfew notice, transmitted to the public through a press statement by the Inspector General of Police, clearly aims to prevent people from taking part in the citizens’ demonstration which is scheduled to be held tomorrow (July 9th) in Colombo. The demonstration, convened by various citizen groups, is organized to protest the unaccountable conduct of the government that has taken the country into ruins due to mismanagement of the economy and rampant corruption.

Freedom of expression and peaceful assembly are fundamental rights of all citizens recognized by the constitution of the country. The Inspector-General of Police has no legitimate authority to declare a curfew through a press statement. This decision is a blatant violation of the fundamental rights of the citizenry. It is regretful to see that the government, which has failed the nation by dragging the country into the most severe economic crisis in its history — and has unheeded the call of the people demanding accountability — has resorted to repressive measures denying the most basic rights of citizens.

FUTA has always been at the forefront of the people’s struggle, demanding the resignation of the incumbent president and the government that has neglected the concerns of the masses in the most callous manner. While condemning the decision to declare a curfew unlawfully, we demand that this declaration be withdrawn with immediate effect. Furthermore, we urge all the law-abiding citizens in the country to come forward to protest the anti-democratic conduct of the government.–

Rohan Laksiri

General Secretary

Federation of University Teachers’ Associations (FUTA).

~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~

Govt to present new budget to meet IMF expectations

The Government is preparing a new budget taking into account the measures proposed by the International Monetary Fund (IMF) to restore debt sustainability in Sri Lanka.

Foreign Minister, Prof. G.L. Peiris said this during talks with the United Nations Resident Coordinator Hanna Singer-Hamdy at the Ministry of Foreign Affairs.

During the discussion, Minister Peiris briefed the Resident Coordinator on the current situation in the country, particularly with regard to fuel, food and pharmaceutical shortage.

He expressed deep appreciation for the humanitarian assistance being received from bilateral and multilateral donors.

The Resident Coordinator explained the current status of the humanitarian assistance from the United Nations and its agencies.

She stated that the immediate assistance extended by the UN for Sri Lanka includes urea for the Maha season, pharmaceuticals, seeds and a school feeding programme, in addition to other on-going assistance programmes.

Minister Peiris also elaborated on the progress of the IMF talks and stated that the Government is in process of preparing a new budget, taking into account the measures proposed by the IMF to restore debt sustainability in Sri Lanka.