The shipping industry vehemently oppose the government’s action to increase fees for select services from this month a move justified by Shipping lines and their agents but strongly opposed by importers.

A collective of business chambers and associations have made a joint representation to the Minister of Ports, Shipping and Aviation Nimal Siripala De Silva stating that these newly introduced provisions under the Extraordinary Gazette Notification No. 2304/24 violate the principles of market forces.

“This adversely impacts the cost of living and competitiveness of industry overall in terms of both imports and exports,” it was stressed.

The chambers and associations include the Joint Apparel Association Forum (JAAF), National Chamber of Exporters, Sri Lanka Association of Manufacturers and Exporters of Rubber Products, Sri Lanka Shippers’ Council, Tea Exporters’ Association, Sugar Importers’ Association and Essential Food Commodities Importers and Traders Association

The main concerns detailed in the letter to the Minister of these anti-competitive and non-transparent regulations are: Increased costs due to intervention by the authorities in price fixing; Removal of the negotiation capability of private parties as service providers and service receivers and Misinterpretation relating to freight and other costs.

The Cabinet Ministers approved to publish the amended Licensing of Shipping Agents Bill in the Government Gazette and to submit the same to Parliament for approval.

The tanker operators’ regulations were issued in the year 2005 subject to the provisions in Sections 8 to 10 of the Licensing of Shipping Agents Act No. 10 of 1972.

However, following the Judiciary’s decision to revise the 10th regulation of that Act, on 4 July, the Cabinet Ministers approved to introduce amendments required to the Licensing of Shipping Agents Act No. 10 of 1972 including the relevant revisions.

As per the Extraordinary Gazette dated 20 October 2022, the revisions are concerning the regulations in the Licensing of Shipping Agents, Freight Forwarders, Non-Vessel Operating Common Carriers and Container Operators Act No. 10 of 1972. Washing charges, De-stuffing charges and Transport cost have been included among cost recovery fees.

It has specified a new maximum Delivery Order (DO) fee for import shipments. For FCL import shipments – maximum DO fee that should be paid by an ultimate consignee/importer (except Freight Forwarder/Consolidator) is Rs. 18,000.

Accordingly, from Shipping Lines to freight forwarders and Shipping Lines to Consolidator, the maximum Liner DO Fee should be Rs. 14,800.

For LCL import shipments the maximum DO fee that should be paid by an ultimate consignee/importer is Rs. 20,500.

Accordingly, from Consolidators to freight forwarders – the maximum DO fee should be Rs. 16,500. The service provider shall charge from ultimate consignee equalling rupees per maximum of $ 8 per 1 CBM (cubic metre) as a cost recovery fee destination as applicable for the carriage of goods.

Shipping agents said service providers had asked for an increase along with soaring inflation and other cost increases and accordingly representations were made to Minister Nimal Siripala de Silva.

It was pointed out that the legislative changes were necessary to properly recover the actual cost.

However, shippers alleged the move is anti-competitive “price fixing” and manipulative and non-transparent. “Consumer will have to bear the additional cost when it comes to imports whilst exporters’ input cost will increase,” they said.

Shipping Industry up in arms over fees hike for select services

HNB offers working capital loans for MSMEs via ADB SMELoC Scheme

Sri Lanka’s Micro ,Small and Medium Scale Entrepreneurs are being given a sigh of relief following the selection of one of the leading private sector banks HNB PLC as a partner financial institution by the Asian Development Bank (ADB) to disburse a component of the US$ 13.5 million in funds allocated to the SME-Line of Credit (SMELoC) Emergency Response Scheme.

The ADB scheme aims to support and strengthen Sri Lankan MSMEs affected by the ongoing economic crisis with working capital credit facilities, with a special emphasis on agriculture, tourism and export sectors.

In working towards this goal, HNB looks to disburse funds to select businesses across its extensive MSME network.

HNB Head of Refinance and Special Lending Products, Bandara Rekogama said. “they are delighted to be a part of this powerful initiative from the ADB.

Given the unique strength and scale of HNB’s network of SME clients across the island, and our long-standing relationship with ADB, we believe that HNB is uniquely positioned to help uplift this sector, which even through our current challenges, continues to serve as the backbone of the Sri Lankan economy.

The Bank urged all eligible SME clients that are facing challenges in their working capital requirements to make use of this invaluable opportunity,”

SMEs that meet the eligibility criteria of a Rs. 750 million annual turnover will be offered a maximum facility of Rs. 10 million, with a repayment period of three years.

All loans under the scheme must be utilized exclusively for working capital requirements, including recurring expenses such as salaries, overheads and raw material purchasing. Moreover, HNB will provide the attractive interest rates of 11.77% for the facility, significantly lower than the current market rates.

Notably, the bank has supported over 650 MSME customers with working capital and Capex facilities accounting for over Rs. 6.5 Bn through the ADB – SME LoC schemes. Established to support businesses affected by the COVID—19 pandemic, the Emergency Response Scheme initially disbursed USD 10 million to 280 local businesses as emergency working capital loans over the past two years.

Furthermore, HNB disbursed loans to the value of Rs. 600 million for approximately 132 women entrepreneurs with a grant of Rs. 100 million under the SME LoC – Wefi component.

With 254 customer centres across the country, HNB is one of Sri Lanka’s largest, most technologically-innovative banks, having won local and global recognition for its efforts to drive forward a new paradigm in digital banking. HNB has a national rating of AA- (lka) by Fitch Ratings (Lanka) Ltd.

The bank was also ranked among the World Top 1,000 Banks list compiled by the prestigious UK-based Banker Magazine for six consecutive years, and was also ranked as Sri Lanka’s Best Retail Bank for the 12th year at the prestigious International Excellence in Retail Financial Services Awards 2022 hosted by the Asian Banker Magazine.

India expresses concern over allowing mid-sea refueling of Chinese warships

India has expressed serious concerns to Colombo for allowing surreptitious refueling of Chinese military vessels on high seas with Sri Lankan tankers picking up fuel from Chinese leased Hambantota seaport, Indian media reported.

According to diplomats based in Colombo, New Delhi has asked Sri Lanka to come up with transparent standard operation procedures (SOPs) for refueling and docking of ships and not allow Chinese military vessels to either dock or refueled at Hambantota or Colombo ports.

It was noticed that Sri Lankan vessels were loading fuel from Hambantota port and refueling Chinese warships on high seas to bypass Indian and the larger US concerns.

It is understood that currently there are no Chinese ships in the Indian Ocean Region except for those plying in the name of anti-piracy task force off the coast of East Africa. “

The Chinese warships continue to ply off the coast of East Africa and the Gulf of Aden while there is hardly any pirate activity in the region. It was the anti-piracy pretext that China used to secure a base in Djibouti,” said a Beijing watcher.

Both US and India had clearly told Colombo not to allow docking of Chinese military vessels and strategic surveillance ships on its ports after the Ranil Wickremesinghe government allowed Chinese ballistic missile tracking ship Wang Yuan 5 to dock at Hambantota despite India red-flagging the move.

The ship stayed at Hambantota port for six days last August and then turned back to its home port in Shanghai after surveillance of Indian Ocean south of the Island nation.

The Biden administration raised strong objections to the docking of Wang Yuan 5 at Hambantota port, which was leased for 99 years by Wickremesinghe in 2017 to Beijing under the Rajapaksa regime. China has also been given tax incentives in the Colombo area for 40 years.

While Sri Lanka did not accede to Pakistani request to dock Chinese built frigate PNS Taimur at Trincomalee port, it gave permission to the warship to pay “goodwill” visit to Colombo port last August despite Indian objections.

It is understood that a senior Pakistan Navy official is visiting Colombo mid-November much to chagrin of India.

While a cash strapped Sri Lanka looks toward India for fuel, food and medicine supply to overcome ongoing economic crisis, it continues to play around with India’s main adversaries with impunity as the political leadership has accumulated IOUs from Beijing in the past.

Azur Air, Swiss and Air France resume flights to Sri Lanka

Three leading airlines of Russia, Switzerland and France have resumed their flights from Bandaranaike International Airport at Katunayake in Colombo suburbs as the island nation is gearing up to be part of the highly anticipated FIFA World Cup.

Sri Lanka yesterday officially launched FIFA Fan Zone 2022. FIFA Fan Zone 2022 is being set up in Negombo, Lewis Lane, where all hotels, restaurants and boutiques are currently receiving a facelift to give Qatar’s FIFA World Cup vibe.

Sri Lanka’s fan zone for the world cup spectators is endorsed by the FIFA management, the Sri Lanka Conventions Bureau (SLCB) said.

In the eve of this event ,Russia’s largest charter airline — Azur Air and the flag carrier of France -Air France, will resume flights to Sri Lanka starting from today , according to Sri Lanka’s Tourism Ministry.

Azur Air will commence flights to Sri Lanka from today (November 03) while Air France is scheduled to resume flights from Friday (November 04).

It is scheduled to operate four flights per week initially with plans to operate additional flights from several cities depending on the demand.

Last month, the Russian flag carrier, Aeroflot also resumed flight operations to Sri Lanka.Aeroflot resumed flights after it suspended operations in June.

Meanwhile in a twitter message, Tourism Minister Harin Fernando announced that Switzerland’s national airline, Swiss International Air Lines, is now starting operations in Sri Lanka once again with weekly flights starting from November 10 to May2023.

He said this will further strengthen the European arrivals for the season. Russian airlines have not been flying to Sri Lanka since early June, when an A330-300 operated by Aeroflot was briefly detained due to a dispute with lessor AerCap‘s special purpose vehicle Celestial Aviation Trading Limited.

Even though the court quickly released the aircraft and the Sri Lankan government guaranteed that no further seizures would be made in the country, Russian airlines had been reluctant to return to the island.

However, Russia’s flagship carrier Aeroflot last month resumed flights between Moscow and Colombo after a lapse of 4 months.

Meanwhile Minister Fernando disclosed recently that French flag carrier Air France and Netherlands flag carrier KLM Royal Dutch Airlines will resume flights to Colombo from tomorrow, and the said airlines will operate four flights a week to Sri Lanka.

The increase in the number of flights operating to Colombo comes at a time when the government is hoping to attract more tourists from Europe during winter months.

Tourism Minister Fernando who has been staging road shows and events in recent weeks to encourage more people to visit Sri Lanka is expected to leave for Europe.

The Minister is of the view that Sri Lanka can attract more tourists due to the stable situation in Sri Lanka at present.

He is also hoping to open doors to football fans who will be traveling to Qatar for next month’s World Cup.

Meanwhile, the Sri Lanka Tourism Development Authority has announced that more than 42,000 tourists arrived in Sri Lanka in October. Accordingly, a total of 568,000 tourists have entered Sri Lanka thus far this year.

The SLTDA said, Sri Lanka which vastly depends on tourism as one of the main foreign exchange-generating avenues, hopes to attract at least one million tourists by the end of 2022.

The SLTDA said if the expected number of tourists arrives in the island, the government will generate revenue of USD 1.8 billion through the tourism sector.

The Fed stays the tightening course. Does the CBSL have another option?

The objective of this short article is to express a firm opinion that the CBSL has no option but to raise its policy rates further at the next policy meetings to suit the US Fed’s interest rate policy in view of the Fed’s policy decision and communication announced yesterday. The reason is because the CBSL also follows principles of the Fed’s monetary policy model and language for Sri Lankan economy.

However, the author’s view on the monetary policy model that should be adopted in terms of the Monetary Law Act to rescue the economy and general public from the present economic crisis that has been caused by the present monetary policy model is completely different as already has been highlighted in several articles released in this blog.

The Fed’s Policy Direction

As mostly predicted by market participants, the Fed yesterday raised its policy interest rates target corridor by another 75 bps to 3.75%-4.00% level although the US inflation peaked in July at 8.53%. The Fed’s key monetary policy tool is the policy interest rate that sets the target for overnight inter-bank interest rates for the purpose of driving inflation around a target of 2% in the long-term.

The rate hike announced yesterday is the 5th consecutive hike implemented from 4th April this year with a total hike so far being 3.50%.

The Fed’s Policy Communication Yesterday

The highlights of the monetary policy press release and Fed Chair’s press conference are given below. The market response immediately after the press release (before the press conference) was a slight increase in stock market prices and Treasury yields and a fall of the Dollar value. However, immediately after the Chair’s press conference, stock prices fell while the yields and Dollar value rose in response to further tightening course assured by the Fed Chair.

- Ongoing increases in policy rates will be appropriate for a stance of monetary policy sufficiently restrictive to return inflation to 2% over time.

- The Fed does not have a scientific way to decide whether inflation is entrenched.

- In determining the pace of future increases in policy rates, the cumulative tightening of monetary policy, the lagged impacts on economic activity and inflation and economic and financial developments would be considered (However, there are no benchmarks to assess these).

- Policy overtightening can be corrected easily by loosening. However, if the policy is too dovish, inflation will be embedded. Therefore, it is important to move expeditiously.

- The discussion on smaller rate hikes will come at the December meeting. The Fed thinks of positive real interest rates across the yield curve.

- The terminal policy rate will be higher than initially envisaged (Market forecasts have increased from 3.0%-3.5% in April to 5.0%-6.0% immediately after yesterday’s policy communication)

- The economy has slowed significantly from last year’s rapid pace. Real GDP rose at 2.6% last quarter while modest growth of spending and production is seen this quarter.

- Growth in consumer spending has slowed from last year’s rapid pace due to lower real disposable income and tighter financial conditions. However, demand remains strong due to job gains and household savings.

- Despite the slowdown in growth of the economy, the labor market remains extremely tight, with the unemployment rate at a 50-year low (3.5% in September), job vacancies still very high and wage growth elevated. It is necessary to raise unemployment to get the demand down (In fact unemployment has fallen from 4% in January to 3.5% at present, despite the faster monetary tightening).

- Financial conditions have tightened significantly and the effects on demand in the most interest-rate-sensitive sectors of the economy such as housing are observed.

- The Fed does not have tools to directly affect prices such as energy prices but it tools will affect interest-rate sensitive demand sectors and help resolve demand and supply imbalances.

- Soft landing is still possible, but the window has narrowed.

Overall, given the persistence of high inflationary pressures envisaged across the world and strong economy, strong demand and tight labour market with unemployment at a 50-year low in the US, markets are observed to be pricing another rate hike of 75 bps in the Fed’s December meeting, despite inflation seems to have peaked.

The Policy Direction of the Bank of England and European Central Bank

The present policy direction of the Bank of England and European Central Bank whose currencies are reserve currencies next to the US Dollar is similar. The policy rates increase has been 1.15% to 1.25% by the Bank of England since December 2021 (six consecutive hikes) and 2.00% to 2.25% (Marginal lending rate) by the European Central Bank since July 2022 (three consecutive hikes). Further, their policy communications also are to stay the course of rates hiking as inflation does not show any sign of pivot.

The CBSL has no option but to follow the Fed

As interest rates of global reserve currencies led by US Dollar are being raised expeditiously with entrenched inflationary pressures (risen to 8% to 11%) amidst the effects of Russian-Ukraine war and China’s supply chain disruptions continued with the zero Corvid tolerance policy, central banks except in Japan and China are compelled to stay the continued tightening course. Central banks in emerging market economies generally follow suit primarily to keep their interest differentials in order to fight foreign capital outflow to developed market economies and to prevent currency crises.

The CBSL has raised policy rates so far by 9% to the corridor of 14.5%-15.5% and caused government securities yield rates rising to 30%-33%. However, inflation remains to be at hyper-levels around Y-o-Y 70% as compared to the CBSL monetary policy target of 4%-6%. Further, money printed to finance government budgetary operations has been fast rising without any sign of peaking, i.e., Treasury bill holding of the CBSL has risen from Rs. 725 bn at the end of December 2020 to Rs. 2,440 bn to-date (an increase of 237%).

Therefore, the CBSL which strictly follows principles of the Fed-styled monetary policy model with policy rate-based open market operations to control inflation as recommended by the IMF has no option but to stay the rate hiking course expeditiously and aggressively, given the exorbitant disparity between the inflation target of 4%-6%, continuously rising inflation around Y-o-Y 70% and IMF financial policy package being awaited.

Otherwise, the monetary policy rationale and consistency adopted by the CBSL as communicated in recent media reports and interviews will be questioned where concerns will be raised over possible policy irregularities and policy independence loss detrimental to the inflation control and price stability objective of the CBSL.

Therefore, if the CBSL announces a wait and see policy at the next policy meeting, it has to provide strong reasons for the policy deviation.

(This article is released in the interest of participating in the professional dialogue to find out solutions to present economic crisis confronted by the general public consequent to the global Corona pandemic, subsequent economic disruptions and shocks both local and global and policy failures.)

P Samarasiri

Former Deputy Governor, Central Bank of Sri Lanka

(Former Director of Bank Supervision, Assistant Governor, Secretary to the Monetary Board and Compliance Officer of the Central Bank, Former Chairman of the Sri Lanka Accounting and Auditing Standards Board and Credit Information Bureau, Former Chairman and Vice Chairman of the Institute of Bankers of Sri Lanka, Former Member of the Securities and Exchange Commission and Insurance Regulatory Commission and the Author of 10 Economics and Banking Books and a large number of articles published)

How a Lincolnshire oil refinery boosted couple’s secret $10bn oil empire

By Ellis Karran Local News Reporter

- An oil refinery in Lincolnshire, among the largest and most valuable in the whole country, has been a key fortune maker for a couple who have quietly amassed a $10 billion crude oil empire.

Winston and Arani Soosaipillai are among the wealthiest couples in the UK, having grown their company Prax from a flat in Surrey to a global juggernaut in the crude oil market.

The couple’s public image is almost blank, with the only trace of their presence being a brief bio of them both on the board of directors section on Prax’s website.

According to that directory, Winston, who goes by his middle names of Sanjeev Kumar, is down as chairman and chief executive officer at the company – while Arani serves as the chief of human resources and a corporate officer.

A report by The Times on Sunday looked into the limited public information on the history of the Soosaipillai’s, and how the acquisition of a Lincolnshire oil refinery grew their oil empire to almost immeasurable scales.

The Prax Lindsey Oil Refinery in Killingholme, North Lincolnshire. Photo: Google Street View

Prax employs 1,250 workers, has 11 offices across the world and a turnover of around $10 billion, which is the same as FTSE 100 giant JD Sports.

Initially specialising in blending diesel and then growing into gas oil, kerosene and petrol for jet engines, the company managed service stations for Shell and Total after acquiring an oil storage site in East London in 2005.

After Total looked to sell its stake in the Lindsey Oil Refinery in North Killingholme, Prax saw this as an opportunity to expand business at a pinnacle moment in the markets – with the coronavirus pandemic tanking margins.

Lindsey Oil Refinery processes up to 113,000 barrels of oil every single day, and spreads across 500 acres to supply oil for services across the world.

A deal was reached in 2021 for the Soosaipillais to buy the site, which is one of just six facilities in the UK that turns crude oil into petrol and diesel.

It has been reported that Prax paid some $167 million for the refinery in March 2021, and after a rebound of oil price following the relaxing of COVID-19 pandemic restrictions, the company logged a $500 million gain in a matter of months.

Earlier this year, The Guardian reported that the company’s profits have soared almost tenfold between 2010 and 2020, with a further astronomical boost from the acquiring of Lindsey.

The UK’s competition watchdog launched an investigation into profit margins within the largest oil refiners in the country, of which Prax Lindsey was mentioned.

In August 2022, the company revealed that its Lindsey refinery was one of 20 government-selected projects to develop carbon-capture technology, with the aid of taxpayer funds.

The firm now operates 183 service stations, owning half of them, and supplies crude oil and fuel across the planet, buying its first two tanker ships this year.

It is alleged that with large profits have come at a borrowing cost, however. The Times says Prax’s borrowing facility has expanded to £739 million as a buffer against high oil and gas prices in an uncertain market.

Information on how this flat-based business grew into the colossus it is today is somewhat sparse, prompting questions over whether a closer scrutiny is required for sales of large and important national infrastructure assets.

Lincolnshire

The President decides to appoint the cabinet before the 14th!

It is reported that President Ranil Wickremesinghe has decided to appoint the new cabinet before November 14.

After Ranil Wickramasinghe assumed the presidency, the last cabinet under Mr. Gotabaya Rajapaksa was reappointed with minor changes on a temporary basis. Dates were fixed on several occasions for the appointment of a permanent cabinet, but it could not be achieved due to the inability to reach an agreement with the Sri Lanka Podujana Peramuna.

In particular, in the list of names given by Pohottuwa, MPs Johnston Fernando, Rohitha Abeygunawardena, Mahindananda Aluthgamage and Namal Rajapaksa were also proposed for cabinet ministerial positions, but the president had flatly refused to give them ministerial positions.

Requests were repeatedly made to the President about this on several occasions, but the President had not changed his decision.

Accordingly, it is stated that the national organizer of Pohottuwa Basil Rajapaksa has also agreed with the President’s decision.

Sources further stated that President Ranil Wickremesinghe is scheduled to leave for Egypt this weekend to attend the World Conference on Climate Change and the new cabinet will be appointed soon after the visit.

Sajith’s response at protest yesterday the most suitable for his position!

Yesterday (02) the protest march held jointly by the opposition political parties, trade unions and mass organizations was interrupted by the Police in the Pettah area and the Police stopped the protest by not allowing the march to go in front of the Fort railway station as it had been organized.

There, the Opposition Leader Sajith Premadasa had decided to leave the place after being unable to reach a solution after discussing with the police officers about not allowing the peaceful march.

At that time, there was some opposition to Premadasa from a small group of people present at that place and media organizations backing the current regime published the news about it. Supporters of the Sri Lanka Podujana Peramuna (SLPP), the United National Party (UNP) and even the Janata Vimukthi Peramuna (JVP) shared the story and videos with great enthusiasm on Social Media.

The Leader of the Opposition in a country is the leader of the entire Opposition representing political mainstream and is the alternate head of state of any democratic establishment. The Police had also sent a letter to the Opposition Leader saying that the protest would not be allowed, and he had participated in the protest despite it.

Also, when the Police prevented the protest, it was the right step taken by Sajith Premadasa as the country’s Leader of the Opposition to move out from the place peacefully without putting on a show.

The country’s Opposition Leader is not there to fight with the Police on streets. If he had done such a thing, it would have set a very wrong precedent for the people. Accordingly, the Leader of the Opposition did a very wise thing by not going to such a situation and leaving the place to save the protesters from making any unwise action and to avoid the anger of the people.

Saving a country from an economic crisis is not a task that can be done by acting like some cape crusader in a Hollywood movie. Accordingly, Premadasa’s response yesterday is the most suitable for his position and personal image.

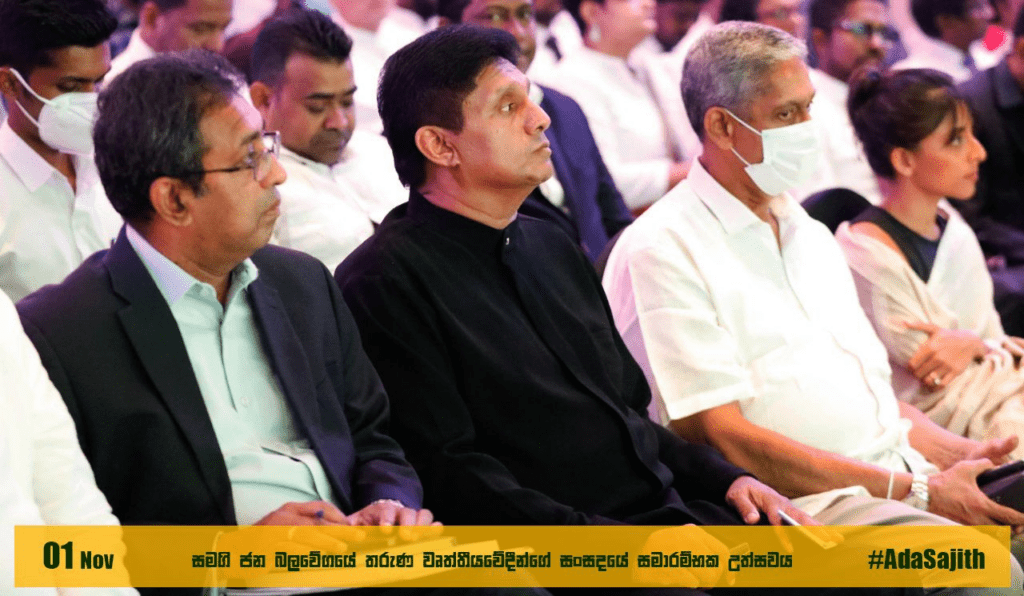

Young Professionals’ Organization of the SJB inaugurated

The inauguration of Young Professionals’ Organization took place yesterday (01st November) in Colombo headed by Hon. Sajith Premadasa M.P. the leader of the Samagi Jana Balawegaye and the leader of the opposition.

The event was organized by the Chairperson of the Young Professionals’ Organization Hon. Harshana Rajakaruna M.P. which was followed by a panel discussion with Leader of the opposition Hon. Sajith Premadasa M.P., Hon. Dr. Harsha de Silva M.P. and researcher and author Ms. Sarah Kabir.

Instructions to solve the problems of Samurdhi Development Officers

A discussion on the problems of Samurdhi Development Officers and possible solutions was held yesterday (02) at the President’s Office under the chairmanship of President’s Secretary Saman Ekanayake.

The problems faced by the Samurdhi Development Officers including their salary, pension, promotion procedure and permanent appointments were discussed at length and many related proposals were also presented.

The President’s Secretary has given instructions to the officials to pay priority attention to these problems and take immediate measures to solve them.

Minister of State for Social Empowerment Anupa Paskuval, Member of Parliament Jagath Kumara and a group of senior officials from line agencies including the Ministry of Social Empowerment and the Samurdhi Department attended the discussion.